Last week, we took a look at how inflation works… and why the Fed won’t do much about it under today’s extraordinary circumstances.

That means we have to prepare for even higher inflation down the road…

There are two main strategies for fighting inflation: investing and hedging.

But given the inflationary scare of the past few days, you’re likely questioning whether to stay in the market at all.

After all, it was a jump in consumer inflation that caused the market to sell off 2%-plus in just one day last week.

But don’t let the headlines sway your resolve: With all the choppiness of the past few weeks, the market is barely down in May… and up more than 10% for the year.

It’s important to stay invested: Stocks are the only asset with a long-term history of appreciation beyond the level of inflation.

But don’t ignore inflation either. There are ways to profit from it, if you invest much more selectively…

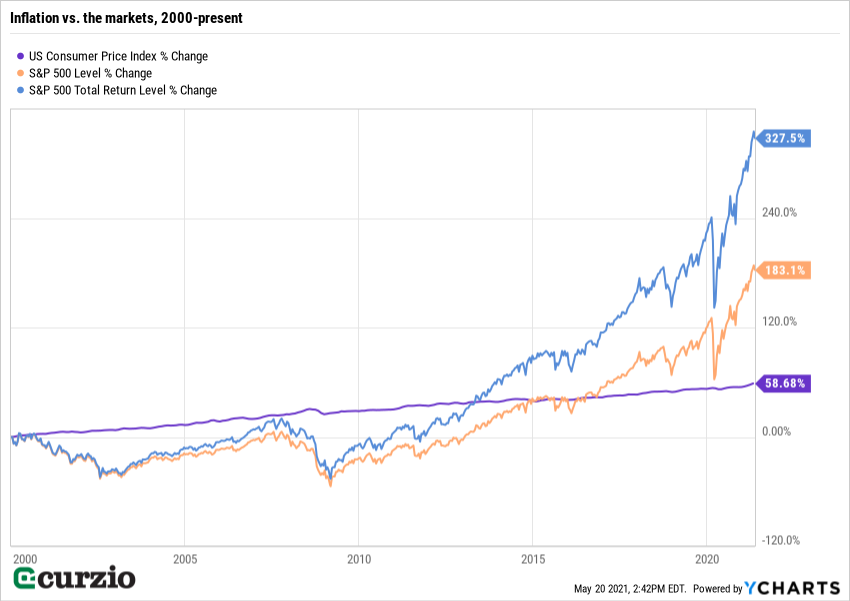

As you can see from the chart below, cumulative inflation over the past 21-plus years has approached 60%. In other words, you’d have to pay $1.60 today for something that cost $1 in 1999.

On the other hand, the market has nearly tripled (up 180%) over the same time—and more than quadrupled (up 327%) with dividends reinvested.

The period below includes three major bear markets…

Periodic declines—including bear markets—are par for the course.

But investing remains the only way to reliably grow your wealth over the years.

While we can’t predict the future, past experience tells us stocks tend to move higher together with the economy.

Even COVID didn’t derail the market.

A year after the S&P 500 set its 2020 low, the market was up more than 70%… the largest ever one-year gain for the index.

But it doesn’t mean the markets don’t periodically disappoint… or that higher-than-normal volatility won’t impact your returns.

The market tends to correct when there’s a disconnect between future outlook and stock prices.

And expensive stocks (today those are mostly smaller growth companies) are especially vulnerable to prospects of higher inflation and higher interest rates. That’s because they’re valued on the basis of profits far in the future… and the present value of these profits declines as interest rates move higher.

If you want to create and preserve wealth, the stock market is the most efficient way to counteract even modest inflation.

The best stocks for inflation

In the near term, profitable companies look more attractive… especially those with “pricing power,” or the ability to pass a price increase to the customer.

An added plus is the ability to pay and grow dividends—giving the stock owner an ever-increasing cash flow.

Take one more look at the chart above: Dividends nearly doubled the market’s return over the past two decades.

If your portfolio lacks dividend-growing companies, or if you feel you need more, consider the Vanguard Dividend Appreciation ETF (VIG).

This fund invests in companies with a record of increasing dividends over time: Microsoft (MSFT), JPMorgan Chase (JPM), and Johnson & Johnson (JNJ) are its top three positions.

Altogether, you’ll own as many as 248 dividend growers… and will get about a 1.5% yield—all with just one trade…

But even the best stocks will be powerless during a sharply lower market.

This is when a variety of hedges can be useful.

To make money from inflation, consider this time-tested way to protect yourself: hard (physical) assets, like precious metals.

The best hedges for inflation

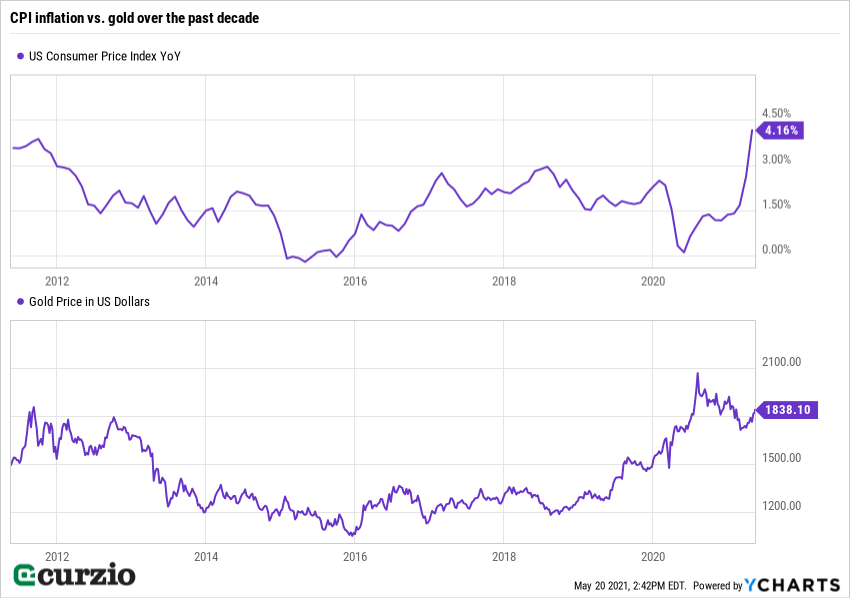

Gold and silver tend to fade during stable monetary conditions—when there’s no inflation or deflation.

But high inflation is typically favorable to precious metals. They act as a store of value. In other words, gold and silver become more and more valuable the higher inflation gets.

For example, gold went on a wild run during the inflationary 1970s. The shiny metal outperformed everything else in sight… by a wide margin.

But gold prices declined over the past decade as inflation stabilized. That is, until 2020, when the economic recession caused stock price declines and record-high gold prices.

I expect gold to reclaim its recent highs—and then some—as inflationary pressures continue to mount.

Silver, too, is well positioned to protect against inflation. Thanks to its industrial applications (including its role in solar energy), silver will continue to be in demand as economies reopen around the world. Tight supplies and rising demand should push silver prices higher—with inflation giving us another reason to own this precious metal.

Two popular ETFs give you easy and cost-efficient access to gold and silver are:

Both funds do a pretty good job of tracking the performance of precious metals… without the extra cost of buying and storing bars or coins.

As we discussed last week, a surging money supply and super low short-term interest rates are overheating the economy.

In this environment, our best bet is to own a combination of quality income equities and precious metals.

This universal combination works for many markets. But it works best in a moderate to high inflation scenario…

Editor’s note:

For easy access to the best high-income stocks in the market… check out Genia’s Unlimited Income advisory.

Over and over, Genia’s shown you don’t need to sacrifice growth to earn income. I’m talking about stocks that deliver market-beating dividends… AND triple-digit capital gains.

Join here to get immediate access to her research… for an incredible 66% OFF.