On June 21, 2018, in the 5-to-4 South Dakota v. Wayfair ruling, the Supreme Court made a decision that would have a massive impact on ecommerce…

The decision overturned 1992’s Quill v. North Dakota, which exempted remote sellers from state sales taxes… unless they had a physical presence in those states.

Quill v. North Dakota helped pave the way for massive ecommerce growth (think Amazon)… and led to the death of many brick and mortar retailers.

But today, thanks to South Dakota v. Wayfair, no longer does a company have to be physically present in the state for sales taxes to be required.

No longer can out-of-state (and online) retailers enjoy a tax advantage over local businesses.

And because sales-tax rules vary significantly from state to state and from jurisdiction to jurisdiction, following them can be complicated for ecommerce businesses.

Fortunately, one company has taken the lead in helping a variety of businesses adapt to this new world…

It’s a company that specializes in helping businesses collect sales tax. It has 12,000 tax jurisdictions… and near-zero competition.

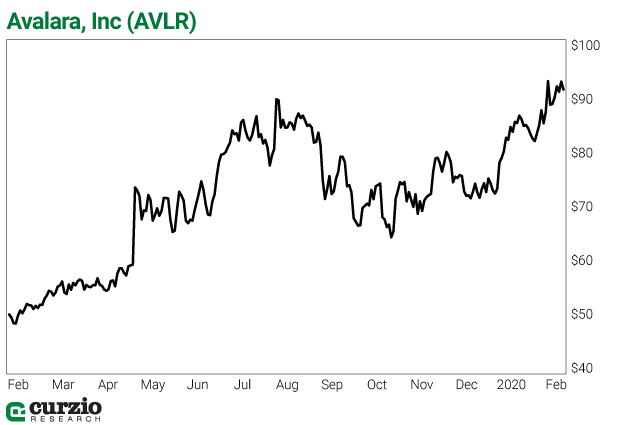

My Moneyflow Trader subscribers collected nearly 30% on this company in just three weeks. And as I’ll show you today, it’s time for another round of gains…

Avalara (AVLR) was founded at a kitchen table by current CEO Scott McFarlane with Rory Rawlins and Jared Vogt. In 2015, Bill Ingram joined the leadership team as a chief financial officer (CFO).

But it’s not a kitchen table anymore… The Seattle cloud-based tax calculation and compliance company went public in June 2018. It has over 1,500 employees and offices on four continents.

In 2017—before Avalara went public—the global tax software market was already significant. Valued at $5.7 billion at the time, it’s expected to grow as large as $11.8 billion by 2026.

That’s because tax compliance is a complicated issue. Programs like TurboTax make it cheaper and easier for an individual or family to file their taxes. But for businesses and vendors dealing with an ever-changing sales tax nexus, it’s not that simple. The data and real-time updates required to maintain accurate accounting records for every tax jurisdiction aren’t things you can just download from Intuit or pick up at Best Buy.

That’s where AVLR comes in… The company maintains and updates its cloud-based sales tax software and database for companies, making it easier for companies to comply with the variety of regulations and jurisdictions. Sellers report their tax numbers, and Avalara does all the heavy lifting, calculations, and necessary software updates.

Eventually, any company that reports sales tax—in any business or country—could become a customer for AVLR.

Plus, AVLR is far more than just a tax software company…

Thanks to its 2019 acquisition of Compli, a provider of compliance services, technology, and software to the U.S. alcoholic beverage industry, AVLR has expanded beyond sales tax compliance.

Avalara has also expanded into artificial intelligence (AI) and data automation… In February 2019, it bought Indix, a Seattle AI technology startup. It was a major step toward automating and enhancing Avalara’s services beyond its core tax compliance business.

I recommended an AVLR call option trade (a bullish strategy) to my Moneyflow Trader subscribers in December. We booked nearly 30% gains in less than a month.

And while it may take longer to see such gains buying the stock outright, it still has tremendous near-term—and long-term—upside potential.

The company’s latest financial results were outstanding.

Reported just a few days ago (February 12), the fourth quarter (Q4) was the third quarter in a row of 40% or better revenue growth. AVLR has also been adding new customers at a brisk pace, too, with 720 net new customers.

The 20%-plus revenue guidance for 2020 also looks easily achievable.

Avalara isn’t profitable yet, but this isn’t a red flag. It’s rather typical for tech today. Most young companies go public years before reaching profitability. They earn the investing public’s support by growing consistently faster than the rest of the market.

Moreover, AVLR already generates positive free cash flow; if everything goes well, it will break even in 2021.

As a growth company in a promising industry, and thanks to the 2018 U.S. Supreme Court ruling—AVLR’s future growth is almost a certainty. The market will reward the company if it stays on this path or, better yet, accelerates it.

And it’s possible the coronavirus scare could help accelerate it…

Because of the highly contagious nature of the virus, anything that can be done remotely, including shopping on the internet, can get an extra boost. Ecommerce businesses are shaping up to be major beneficiaries of the coronavirus scare, and AVLR will ride this growth trend, too.

The biggest risk, therefore, is growth disappointment.

Here’s a rundown of the positives and the risks of going long AVLR…

The good:

- Long-term, high-growth opportunity with short-term growth tailwinds

- Expanding market reach and growth in existing customers

- Strong share-price momentum and analysts upgrades

- A small percentage of short shares is a healthy sign

- Its four main competitors mostly focus on large (Fortune 2000) businesses; in Avalara’s mid-market space, there’s very little competition

- It can easily become an acquisition target for a number of tax-focused businesses, like Intuit or H&R Block (HRB)

- Its cloud-based sales-tax service is resistant to—and may benefit from—a coronavirus selloff

The bad:

- At more than 18 times (18x) trailing sales, the stock is expensive. This valuation, however, is justified by its growth prospects: Based on projected 2020 sales, the stock trades at a price-to-sale multiple of just under 15

And the potentially ugly:

- If the market sees a big selloff, Avalara could fall victim to indiscriminate selling

With the positives outweighing the negatives, I expect this growing company to continue outperforming the market.