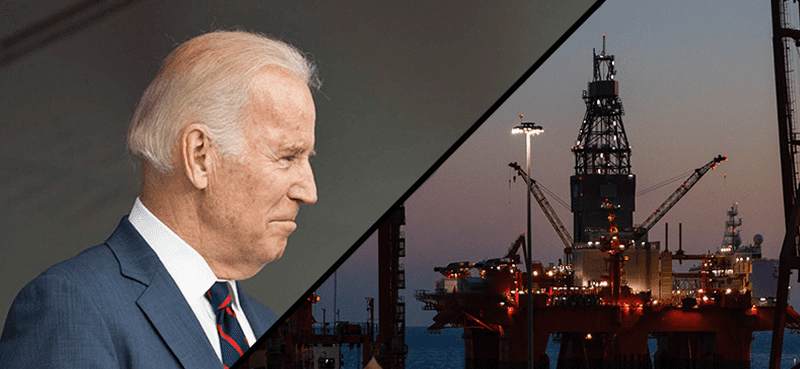

Is it time to buy oil stocks? The bulls vs. the bears

Why the Fed could stop raising interest rates sooner rather than later... What to look for this earnings season... Signs inflation is coming down... And the bull vs. bear cases for buying oil stocks today.