This week, shares of Tesla (TSLA) dropped by 66%—closing at $891.29 on Wednesday… and opening at $302.36 the very next day.

That might sound shocking if you’re not aware of what happened…

But not only was it expected… the price cut was planned well in advance.

You see, the drop in Tesla’s share price was due to a 3-for-1 stock split… a move approved by shareholders on August 4. This means that the stock price was cut by 2/3, and the shares outstanding tripled.

So anyone who owned 100 shares of TSLA on Wednesday (and didn’t buy or sell any) now owns 300 shares—each worth 1/3 of the Wednesday price (plus/minus market fluctuations).

If you own TSLA, like our Dollar Stock Club members, there’s no need to panic. By looking at the basic math, you’ll see the total value of your position has stayed the same.

Other than the additional stock liquidity that comes with the lower price, a stock split doesn’t change anything about the company’s story.

From a valuation perspective, the company will have the same price-to-earnings (P/E) ratio and other metrics after the split. Its market cap (the total value of the company) also remains the same.

In other words, a stock split does nothing to the stock’s fundamentals, its outlook, or the size of your position.

So what’s the point? Why does a company split its shares if nothing really changes?

Why stocks split

Traditionally, stock splits are a way to make a stock more attractive to investors of all kinds… and to make it more affordable to buy a “round lot” of shares (multiples of 100).

And because the market isn’t always 100% rational, there’s some psychology involved, too: The stock looks cheaper purely because its “price tag” is now lower.

As a result, many splits are treated as good news. In some cases, a stock receives an additional boost simply because of that change in perception.

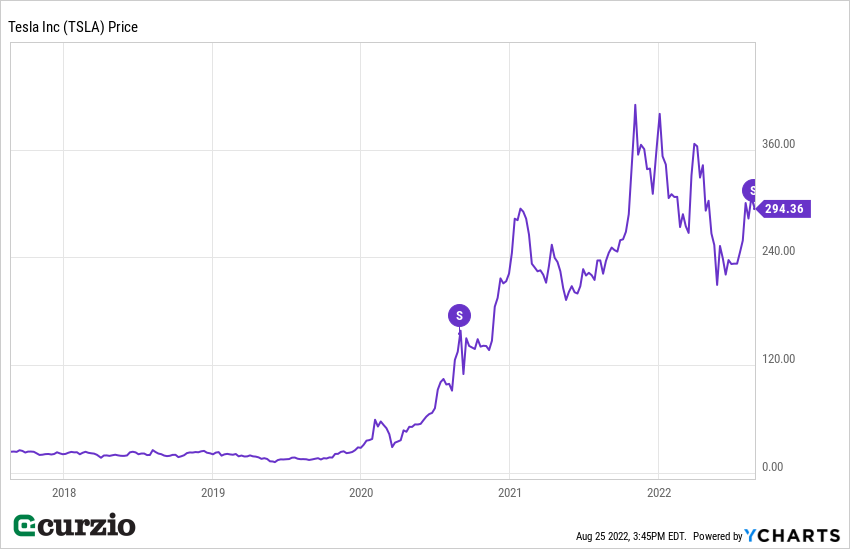

Our Dollar Stock Club members could soon see the benefits of a split… Tesla went through another split in 2020, and the stock price soon moved sharply higher.

Keep in mind, this kind of boost isn’t necessarily based on the fundamentals. And it doesn’t happen with every company or every single stock split.

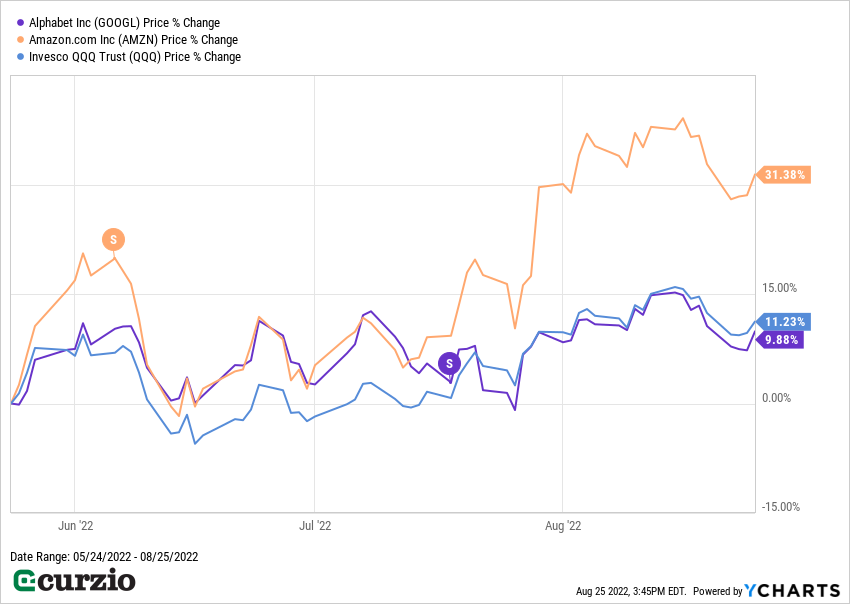

For example, while Amazon (AMZN) has outperformed the Nasdaq (represented by Invesco QQQ Trust on the chart below) since its 20-for-1 split earlier this summer, Alphabet (GOOGL) has lagged the index by about 5% since its own split 20-for-1 last month.

By itself, a split isn’t a bullish indicator. A stock’s long-term performance depends on whether the company can grow profits (or keep paying dividends)… not the “sticker price” of its shares.

That said, when a stock splits, it’s usually after a period of strong performance… pushing its shares too high for small accounts to buy in—hence, the decision to execute the split.

Positive post-split momentum is often just a continuation of the stock’s previous uptrend.

This split can be a “kiss of death”

By contrast, a reverse split raises a company’s share price—and it’s typically a sign that a company is in trouble.

In fact, it’s been called “the kiss of death.”

In most cases, a company does a reverse split because its shares have fallen sharply–a sign that its business is struggling. And while the higher share price (following the split) might look better… it doesn’t improve the company’s prospects. Often, a reverse split does nothing more than prolong a company’s inevitable demise.

Let’s say a stock is trading at $0.50 and executes a 1-for-10 reverse split. The move boosts the share price to $5… and reduces the shares outstanding to 1/10 the pre-split number. The total value of the shares outstanding remains the same… but the stock seems more attractive because it’s no longer a penny stock.

A reverse split can also be a last-ditch play to remain listed on a stock exchange. In many cases, a stock needs to trade over a certain threshold price… or else it will be delisted from the exchange.

Again, this helps the company solve a short-term problem… but doesn’t change anything about the direction the business is headed.

It boils down to this: While splits don’t change a company’s financial health, they attract investors’ attention… and can therefore confirm or even accelerate the stock’s recent market trends.

As always, do your homework on the individual stock in question—fundamentals will win in the long run.