In 1896, the discovery of gold in Canada’s Yukon territory launched an era now known as the Yukon-Klondike gold rush.

Over the next two years, 100,000 miners flooded into the area in search of the next big gold strike.

But it was far from easy…

The trek was treacherous… The competition was fierce… And the weather was glacial.

During the winter of 1896–1897, the water around Alaska’s ports froze solid, which forced shipping to shut down completely.

The result was a major food shortage—and skyrocketing prices for the little amount of available supplies.

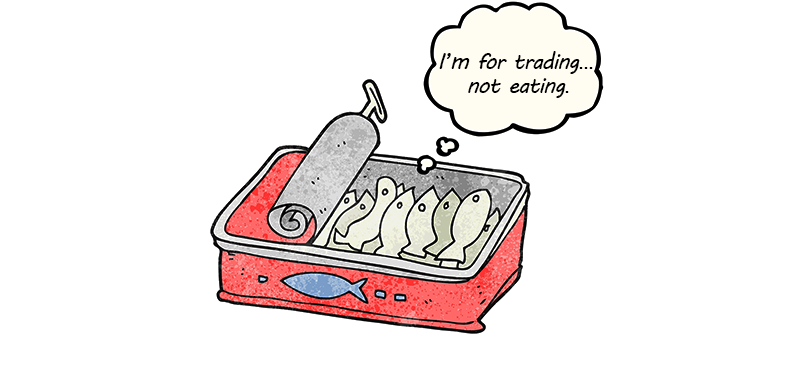

In the most isolated regions of Alaska, a single can of sardines—which cost $0.10 in New York—sold for many times that amount. And thanks to the demand from starving miners, the price kept rising.

Legend has it that one miner, desperate for a meal, bought a can for $100.

But when he went to open it, the fish was rotten.

He tracked down the seller, demanding his money back.

The seller was confused—asking the buyer why he would open the can in the first place.

He told the miner, “Those are trading sardines, not eating sardines.”

This piece of market lore is a commonly cited metaphor for speculative trading, where an asset can keep rising… and traders—suffering from FOMO (fear of missing out)—keep bidding the price higher. Meanwhile, the asset is—from a practical standpoint—worthless.

In the modern market, “trading sardines” are some of the market’s most popular stocks. Specifically, they’re unprofitable companies that fly high based on nothing but investor intrigue. Experienced investors know that you don’t want to own these stocks… they’re merely for trading.

Remember: There’s a difference between the value of a company (or any business for that matter) and its market price. And in a speculation-driven market, it can be easy to overpay for assets that offer little in long-term value.

There’s no shortage of examples throughout market history… and the story always plays out the same: Those who bought these overpriced assets eventually suffered massive losses.

Back in 1999, the rise of the internet caused a boom in the shares of companies like Pets.com, Boo.com, and CDNow. But there was little substance to their hyped-up business models. And once the boom turned into a bust, their investors ended up with nothing.

In the current post-COVID environment, “growth at any price” stocks that thrived during the free money era—like those in the portfolio of the ARK Innovation ETF (ARKK)—are the ultimate trading sardines.

This actively managed thematic fund invests in “disruptive innovation” companies, such as Tesla (TSLA), Roku (ROKU), and Zoom (ZM).

The fund’s view is that it doesn’t really matter how much you pay for these stocks. If a company can dominate its entire business, its growth is unlimited… and its current price will seem like a bargain down the road. But in reality, most of the companies in ARKK’s portfolio are unprofitable and overly expensive.

We saw how well this logic worked out in our sardines parable. When prices rise far beyond what an asset is actually worth… it’s a recipe for big losses. Zoom, for instance, might have been worth the risk at $65… but that was very much not the case at $500 per share.

And as you can see from the chart below, ARKK flourished at rock-bottom interest rates…

But the fund’s performance quickly turned negative in early 2021, as inflation soared… and the market started to anticipate the Fed’s restrictive money policies.

And the losses accelerated as the Fed started hiking rates a year ago: Since March 2022, ARKK has lost almost half of its value.

With the Fed gearing up for yet another hike later this week, investors need to understand how much the market environment has changed…

Put simply, rising interest rates are bad for growth stocks… especially those that trade at high valuations but can’t offer either profits or dividends. As money becomes more expensive, investors are more wary of stocks that don’t have a viable path to profitability.

The bottom line: The “growth at any price” heyday is behind us. In the new era of higher interest rates, the market is finally seeing these trading sardines for what they are: overpriced assets with little to no actual value. As long as rates remain elevated, be very careful with this group of stocks… chances are they’ll never return to their previous highs (and some will even go to zero).

As history has shown us, rotten fish are terrible long-term investments.

P.S. My Moneyflow Trader portfolio has made three winning trades for gains as high as 57% by betting against the ARK Innovation ETF.

And during the bear market of 2022, we locked in 18 winners for gains as high as 271%!

Learn why Moneyflow Trader is the perfect strategy for 2023.