Not long ago, Snowflake (SNOW) was a high-flying tech darling…

But—despite its efforts to pivot alongside the AI revolution—it’s struggling to keep up.

Frank has been pounding the table on why investors should steer clear of Snowflake… and the recent numbers prove he was right.

Today, we’ll examine how Snowflake is fighting a losing battle against artificial intelligence… and a better way for investors to play the AI growth trend.

Snowflake is waving some major red flags

Founded in 2012 and headquartered in Bozeman, Montana, Snowflake was a darling of the data and cloud business—and deservedly so. For years, its data analytics platform was top-tier, and it partnered with the likes of Amazon, Google, and Microsoft.

Then, AI hit the forefront of the tech landscape.

Snowflake has since tried to reposition itself to an AI-centric business model… calling it the “AI data cloud”…

But a look under the hood paints a picture of a company struggling to adapt.

For one thing, the company has missed earnings expectations for three consecutive quarters. In fact, Q1 2024 was one of the worst quarters in the company’s history and triggered a 24% decline in the stock price.

What’s more, after reporting its terrible Q1 numbers back in February, Snowflake’s superstar CEO abruptly resigned, raising red flags about what was going on behind the scenes.

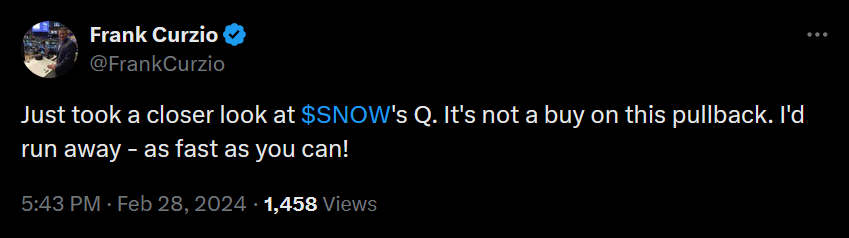

(Of note, after its Q1 earnings, Frank tweeted that investors should run away from this stock.)

And it’s only getting worse, as the company’s Q2 2024 sent the stock down 13% last week.

Put simply, the company’s margins—a critical metric for high-growth tech companies—have been getting weaker, showing that Snowflake is struggling to maintain profitability. Remember, when you’re developing AI, it should send your margins shooting higher—but that’s not what’s happening with Snowflake.

And one of the most alarming moves: The company reduced its capital expenditures (CapEx). When a growth company stops spending on innovation and expansion, it’s a seriously concerning sign—especially when that stock trades at 180x forward earnings. If the company stops innovating, it’s hard to justify such an insane valuation.

Finally, the company just announced a $2.5 billion stock buyback program. While buybacks are typically good for stocks, that’s not always the case—and this one rings alarm bells.

For one thing, Snowflake has a history of losing money on its buybacks by purchasing its shares at premium prices.

For another, this isn’t exactly a new buyback plan; instead, Snowflake is extending/adding to its current buyback. Without getting too into the weeds, it looks like a desperate move to manipulate the stock price.

Why AI is a threat—not an opportunity—for Snowflake

So, what exactly is happening with Snowflake’s business?

Put simply, despite management’s claims that the company is benefitting from artificial intelligence… it seems that AI is creating more of a threat for Snowflake than an opportunity.

You see, AI is capable of doing everything that Snowflake specializes in—specifically, data warehousing and cloud-based analytics—but more efficiently, accurately, and at a significantly lower cost.

For example, AI algorithms can predict supply chain disruptions and optimize logistics operations, areas where traditional data solutions like Snowflake’s are struggling to keep up. And since AI doesn’t require code to offer these services, it doesn’t require coders, nor do customers have to pay the massive fees that traditional software companies charge.

The bottom line: Snowflake is facing significant headwinds as AI reshapes the software landscape.

Until the company can demonstrate a clear path to sustainable growth and profitability in this new environment, investors should avoid this stock at all costs. Instead, focus on stocks that benefit from the AI revolution—like those in the Curzio AI portfolio.