The world’s biggest oil producers are cutting back… and that spells serious trouble for the stock market.

Last week, the Organization of the Petroleum Exporting Countries and allies (OPEC+) met to discuss production quotas for the year ahead.

As I’ll explain, the results from the meeting will have wide-reaching effects on the global economy and future inflation readings.

It’s especially critical after last month’s huge stock market rally… And sets the stage for a reversal soon.

But first, let’s take a closer look at what happened last week…

Lower oil production means higher prices ahead

Following last week’s OPEC+ meeting, the oil cartel announced they’d agreed to voluntary output cuts of up to 2.2 million barrels per day over the next few months.

These new cuts are in addition to the 3.66 million bpd reduction agreed on earlier this year… which represents about 5% of global oil demand.

Saudi Arabia is taking production cuts particularly seriously. It slashed production by one million barrels per day back in July—and plans to extend these cuts through the first quarter of 2024.

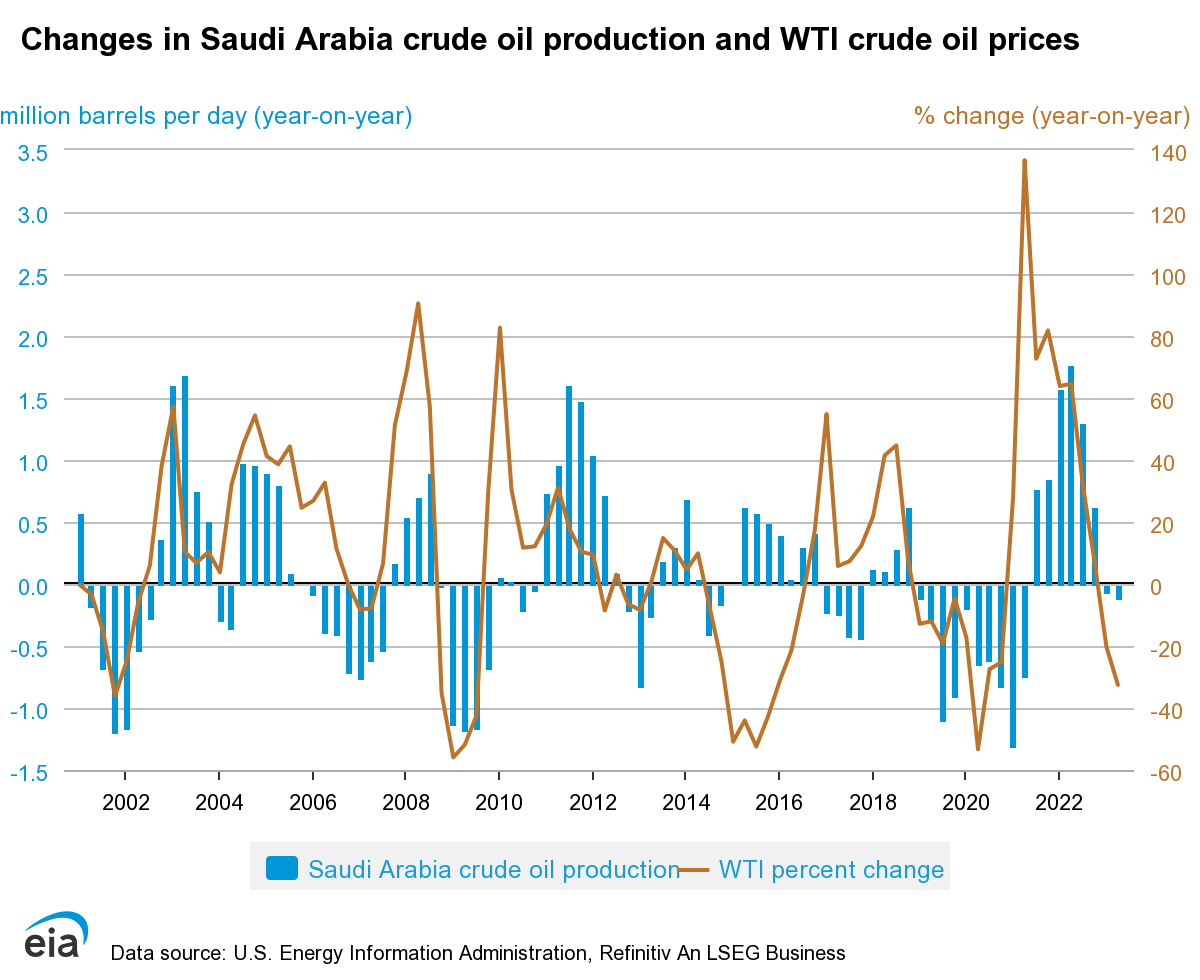

As OPEC’s largest producer, Saudi Arabia holds a lot of sway over the oil market: As you can see on the chart below, when the kingdom increases its output, oil prices soon decline. And when it cuts output, oil prices tend to rebound.

Changes in Saudi Arabia crude oil production can affect oil prices

And basic economics tells us that when supply is reduced… prices MUST rise (if demand stays the same or increases).

In short, OPEC’s production cuts mean we’re likely to soon see oil prices rally.

Now, you might think this is only relevant to energy investors—but that’s not the case…

A rally in oil prices could soon undercut the entire stock market… and eradicate its recent gains.

Why an oil rally would upend the stock market

Inflation is finally declining—causing investors to celebrate.

Following last month’s surprisingly positive inflation data, investors have turned ultra-bullish… sending the S&P 500 up more than 9% over the past month.

In short, a lot of folks think inflation is no longer a problem. As a result, they’re expecting the Fed to start cutting interest rates early in 2024… and pushing stocks higher.

This optimism is short-sighted.

While it’s true that inflation has come down, lower energy prices have helped a lot.

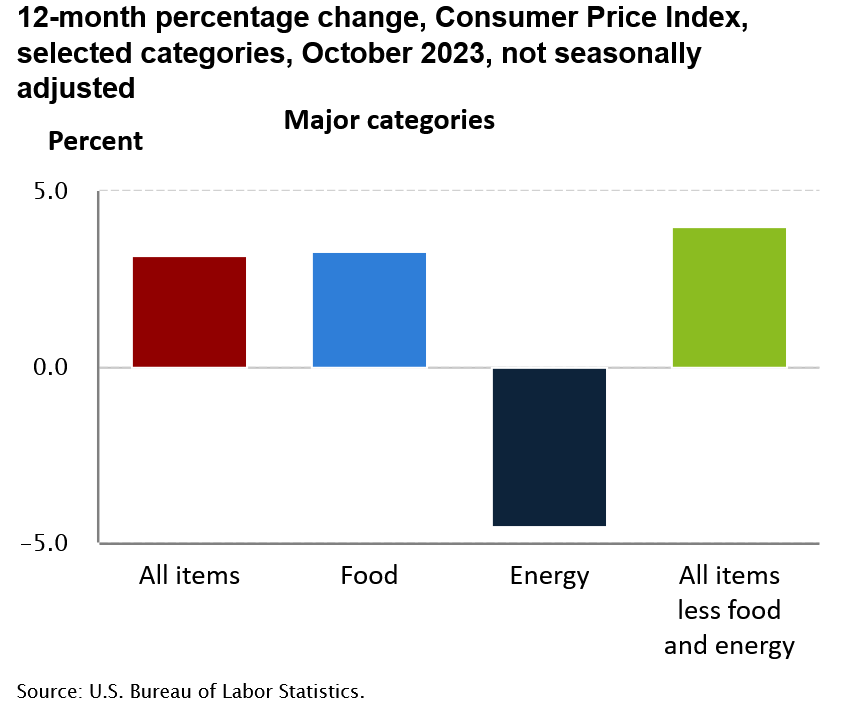

As you can see on the chart below, annual consumer inflation has now moderated to 3.2% (from its June 2022 peak of 9.1%).

But you can see that core CPI (the yellow line) is running well above total CPI (the purple line). In other words, if we exclude food and energy prices, inflation looks a lot worse.

And if you look closer, you’ll see that energy prices are the ONLY thing holding inflation back. As you can see below, all other CPI categories are still up year over year.

And now that OPEC+ has announced a new round of production cuts… we could see a new spike in inflation over the coming months.

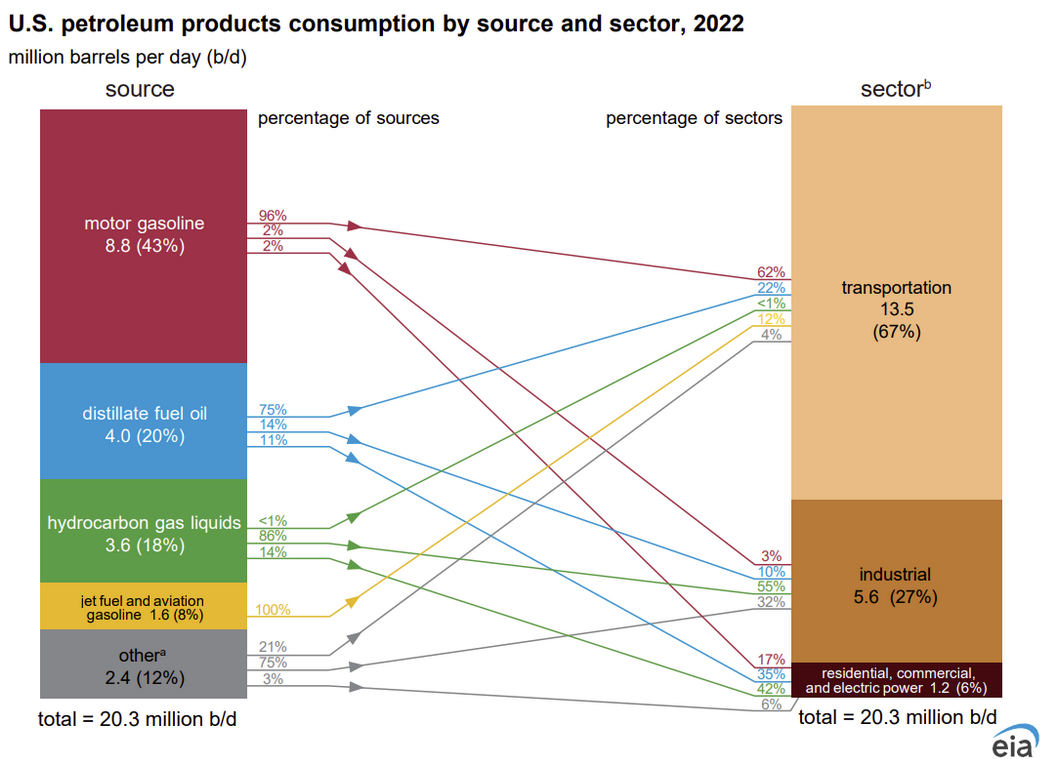

How oil prices drive inflationOil is used throughout the economy, from transportation to power generation (as you can see on the image below). And that means the price of oil directly impacts other costs throughout the economy. After all, if it suddenly costs more to produce or transport a particular product, it stands to reason that the price of that product will rise to maintain the producer’s profit margin.  In short, oil affects just about every product we spend money on—and as its price rises, the costs get passed to consumers via higher prices. In other words, oil prices have a massive effect on inflation. And because the U.S. uses more than 20% of the world’s petroleum output (4.7% more than the next-largest user, China), it’s uniquely vulnerable to rising prices. |

Put simply, a rebound in oil prices could have dire effects in 2024. Higher prices will trickle through the rest of the economy… and cause inflation to spike once again.

And given that lower inflation (and the expectation of rate cuts) is the main reason for last month’s rally, that could spell danger for the stock market.

To learn how to protect yourself—and profit—from the market’s coming decline, check out my Moneyflow Trader strategy. Frank calls it the “safest and most profitable way to ‘short’ this market.”