For the last 38 years, Byron Wien—currently vice chair of private equity giant Blackstone—has been publishing his annual list of “10 surprises” for the market.

He’s gathered a loyal following, thanks to his ability to correctly predict what’s coming down the pipeline.

In January 2000—near the top of the dot-com bubble—he predicted a decline in the S&P 500… and an even sharper drop in the internet sector. The market ended the year down 10%… while the internet-heavy Nasdaq 100 lost more than 36%.

In 2008, he predicted the first economic recession in the U.S. since 2001, along with high inflation, and a big spike in oil prices.

For 2020, Wien called for market volatility and significant interest rate cuts.

And a year ago, he said value stocks would outperform a weak market.

As we now know, he was right on the money.

Last month, I reviewed a few of his 2022 predictions… and promised to share my take on his most important surprises for 2023 as soon as they were published.

Well, the list was just released. And of his latest predictions, three surprises stand out to me.

Let’s break them down…

1. Wien’s surprising stance on a Fed pivot

Wien and coauthor Joe Zidle, chief investment strategist of Blackstone’s private wealth solutions group, expect the Fed to “[put] the word ‘pivot’ on the shelf alongside the word ‘transitory.’”

With all eyes on the Fed and inflation, this is the most important prediction on the list.

Put simply, the market consensus is that the Fed will begin to “pivot”—i.e., cut interest rates—in the second half of 2023… But Wien and Zidle don’t believe this will happen.

Rather, they predict the Fed’s benchmark rate—the fed funds rate—will rise above the Personal Consumption Expenditures Price Index (PCE)—the Fed’s favorite measure of inflation.

This is a bold prediction…

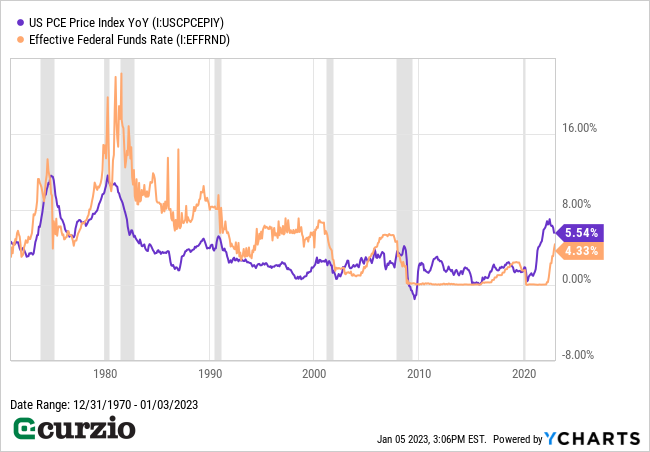

Right now, the effective fed funds rate sits at 4.3%… while the PCE is at 5.5%. Over the last decade, the former has only risen above the latter during periods of (relatively) modest inflation. In other words, we’ve rarely seen interest jump above the PCE over the past 20 years… and it’s never happened during periods of high inflation. Below, you can see that the fed funds rate only crept above the PCE once since 2008.

But Wien and Zidle’s prediction makes sense. Historically, the Fed has only ever been able to overcome persistent inflation by raising the fed funds rate above the PCE. As you can see in the chart above, the fed funds rate far exceeded the PCE during the highly inflationary 1970s and ‘80s.

If the Fed goes that route again, the market won’t like it…

And investors need to be ready for such a possibility.

The easiest way to prepare is by owning inverse ETFs and put options that can make you money when the market declines. Get access to some of my favorites by joining us at Moneyflow Trader. This is the perfect strategy to prepare for a painful 2023.

2. A spin on the recession outlook

Wien expects the Fed to eventually win its fight against inflation… but it will go too far with its restrictive monetary policies, which will squeeze companies’ profit margins and cause a recession.

This might not sound shocking… Most market pros (including those of us at Curzio Research) have been predicting a recession in 2023.

The “surprise” is that Wien believes the recession will be mild.

It goes without saying that a mild recession would be a pleasant surprise.

The simplest way to profit from a mild downturn is by holding onto your core positions… buying quality dividend-growth stocks (which will pay you a steady stream of cash)… and looking to scoop up any bear market bargains that will quickly turn into money-makers when the economy recovers.

I just recommended one of my favorite stocks in yesterday’s Unlimited Income issue. It’s a beloved retailer with a history of rewarding shareholders… and it’s trading at a rare discount thanks to last year’s market-wide selloff. Access it by joining us—risk-free.

But even if Byron Wien is wrong and the recession turns out to be deeper than he’s anticipating, dividend-growth stocks will do well when the economy turns for the better—which it always does.

3. A “surprise” recovery that would be truly shocking

Finally, another positive prediction: “Despite Fed tightening, the market reaches a bottom by mid-year and begins a recovery comparable to 2009.”

In other words, Wien expects the market will stage a massive rally after bottoming out this summer.

Much like the prediction above, this is only a slight “surprise.” Plenty of Wall Street analysts expect the market to rise in 2023… with an average 6%-higher year-end target for the S&P 500 vs. 2022.

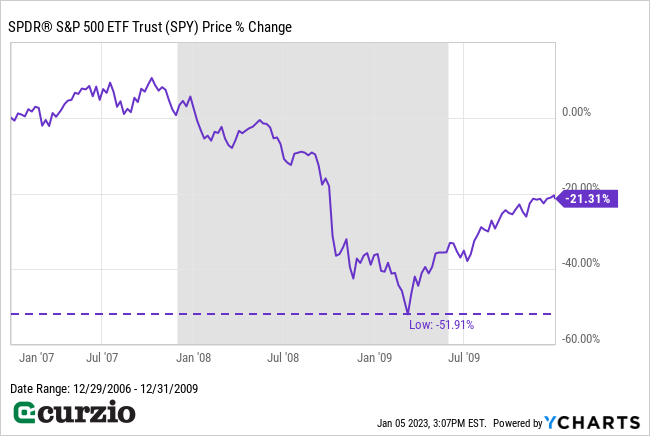

What’s surprising is Wien’s forecast of a 2009-like recovery.

In fact, the idea is somewhat alarming…

The 2007–09 bear market was the worst in recent memory. At its March 2009 bottom, the S&P 500 lost more than 50% of its value before rallying 62% by year-end.

The bottom line: While a 62% rally might sound good… big rallies like that tend to follow big crashes.

A more recent example is from the COVID crash in 2020. After crashing 32% in a matter of weeks, the stock market rallied 68% off the bottom through the end of the year.

And as painful as 2022 might have felt, the S&P 500 fell by just 20%—well short of the COVID crash… and less than half the decline investors suffered in 2008-09.

If I had a choice, I’d take more moderate declines… and a slower recovery rally.

Of course, we don’t have a choice in the matter…

But not many—myself included—anticipate a big recovery in 2023… not with the Fed staying put on interest rates (as Wien himself predicts).

Still, it’s best to be prepared for all eventualities.

A combination of the two strategies I discussed above—owning quality dividend-growth stocks, as well as some inverse ETFs and put options—is the best (and safest) way to profit from whatever 2023 brings.

The good news is that overall, Byron Wien believes 2023 will turn out well for investors.

Better yet, most market strategists agree.

It’s extremely rare for the market to be down two years in a row… and, based on that fact alone, 2023 should ultimately be better than 2022.

No matter what happens this year, the two strategies I discussed above will help you weather the volatility… generate income from your portfolio… and position you for massive long-term profits.