Chris MacIntosh, founder of Capitalist Exploits and the Asymmetric Opportunities Fund, sees major changes coming down the pipeline…

With market valuations stretched and markets hitting all-time highs, Chris gives a macro view of the global financial system… explains why he’s preparing for a commodities supercycle… and shares the sectors that will explode higher as commodities break out.

Chris also breaks down the risks he sees for bitcoin… and why investors need to pay attention to the crypto investing cycle. [28:40]

Then, Daniel and I discuss earnings season and some feuds between billionaire CEOs. We also break down some major changes coming from the Biden Administration… and stocks that will benefit from rising inflation and reopening economies. [01:15:41]

Today’s episode of Wall Street Unplugged is sponsored by Blockchain.com… one of the most trusted cryptocurrency platforms in the world, with over 70 million wallets… and over $800 billion in transactions since 2011.

Not only can you trade your favorite cryptos… you can earn up to 13% interest annually.

To start your account, visit Blockchain.com.

Frank Curzio

Ep. 771: Prepare for runaway inflation

Wall Street Unplugged | 771

Prepare for runaway inflation

Announcer: Wall Street Unplugged looks beyond the regular headlines, heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street, right to you on main street.

Frank Curzio: What’s going on out there? It’s April 28th. I’m Frank Curzio, host of the Wall Street Unplugged podcast, where I breakdown headlines and tell you what’s really moving these markets. I spent some time with the family this weekend, went to St. Augustine. Nice outlets over there, about an hour away from our house. Get to drive to Jacksonville to get there. I go every four or five months, buy clothes and stuff with family and everything, kind of like a routine. I was surprised. We called ahead, and they said they’re open until 9:00, which we kind of expected. It was Saturday night. When we got there, and we got there kind of late, more half the stores were closed before 7:00 PM, which is weird. Usually they all have to stay open at the same amount of time, especially if you’re at a mall, kiosks or whatever you operate within that, they usually have the same hours as every other store. And many use those and explain why they were closed.

Frank Curzio: I was looking to see if they were still in business, but these are good brands, stone business, doing well. They’re just closed. And few others had signs saying that they were short-staffed. So, we were shopping for about two hours. Driving back home, about a half an hour to get to Jacksonville before we go a little bit 30 minutes north to Amelia Island. There’s another big center over there, and everything kind of closed at 10. We got there 9:30, so we’re hungry. So, I go, ah, let’s stop. I love going to Chipotle. Love it. Get that probably, maybe, twice a month. It’s supposed to close at 10 o’clock. Get to the door, there’s a sign on it saying that they closed at 8:00 PM. I was like, okay, great. Nothing on. Just, hey, we closed early. We closed at 8:00 PM.

Frank Curzio: So, there’s one of the place that’s open after 10, or maybe one or two of them over there. There’s a lot of different restaurants that supposedly close at 10. Buffalo Wild Wings, they’re open ’till 12. Been there plenty of times. I’m like, okay, we’ll go to Buffalo Wild Wings with the family, hang out, watch some sports TV, play trivia, whatever. So, before we do that, let’s just hit a store because it is an area. And one of the stores happened to be open till midnight, which is Burlington Coat Factory, which… Holy cow, it’s ducks on fire. And you could see why, if you go there. They just have better brands for cheaper prices than TJ Maxx, Marshall’s. Seriously, you guys should go. It’s pretty cool. So, we’ll go there for an hour, and then, we’ll go eat. Okay, fine. So now, it’s 10:30, 10:45.

Frank Curzio: Stay with me here. So, we go to Buffalo Wild Wings, which is in the same area. And they have a sign on the store saying that they’re closed. They’re closed because they’re short-staffed, and it would close it 8 PM. And they said, if you come in after 4:00 PM, which is another sign, it said you can’t come in with parties more than five. We just don’t have enough people to accommodate you. Remember, this is Saturday night, guys. This is Saturday night, right? Big day for all restaurants, all bars, everything is supposed to be open. So, we tried another restaurant, supposed to be open until 11. They also closed around 8:00, 9:00 PM.

Frank Curzio: Every one, just about every one of these stores, the reason why they were closed is because of short staff. They can’t find people to work. Got to think about that for a minute, because at one restaurant that was open ’till 12:00 AM in the area, we drove to. It’s across the street. There was a line out the door. So, I call and say, hey, how long is the wait? You have seats available? They said, it’s more than an hour wait. They’re open ’till 12. We’re there probably around 11:10. So basically, an hour wait, and they close in 50 minutes, which was interesting. Good for them. Good for them. They stayed open. They have people working for them. They’re doing great business. You see, most aren’t. I’m curious to hear from you, frank@curzioresearch.com.

Frank Curzio: The scene is everywhere right now. McDonald’s was also closing Jacksonville’s, supposed to be open 24 hours. So, we had no choice to eat the very healthy and awesome Arby’s. I can’t believe Arby’s is still open, actually. So, it took 25 minutes to go through the drive-thru. Mozzarella sticks, chicken sandwiches, it’s all we could get. Well, we’re starving. Now, I’ve been getting lots of emails from you, and this is important because the reason why we will see COVID early, the reason why we get into trends early, a lot of it is because of you. This is a network. This isn’t about me. I say the whole time, what I learned from everyone out there who’s in these specific industries is amazing. And so many of viewers. I can’t tell you the number of doctors that email me for COVID that listened to this. And it’s not just business owners, it’s students and telling me about different trends, Facebook buying Instagram and everybody thought Zuckerberg was nuts.

Frank Curzio: These kids are like, this is the greatest thing ever. It’s awesome. I remember they wanted to get his head on a platter, just get rid of him. Pay $2 billion for him. What is he worth, $50 billion or something? 40, 50 billon dollars. People just didn’t get it. He got it. And the only reason why I got it and understood and looked more into it was because I had a lot of young investors email me, telling me this. You don’t know everything, no matter what you think. You might be a professional in your field, but when it comes to every, you don’t know. So, when it comes to this network, that’s the power of this podcast. That’s why we do so well in the portfolio, we’re able to get into things earlier. They see the risk coming, and that’s from you. It’s not a bias. If you say, hey, this is bad across the board. I’m getting 90% of those emails, then I’m going to come out and say, hey guys, be careful here.

Frank Curzio: Or vice-versa, when everyone thought the market was going to crash for the last four or five years, I’m getting emails saying businesses have never been this great in our history, orders through the roof. I’m telling you, Pendleton and metal stocks can go higher. Recent emails you would send to me, I’m not going to bore you and read every single one of them, but I am going to read one of them to you. So, this one’s from my buddy, Steve. He goes, so my wife and I were down in Logan, Ohio this past weekend, a vacation rental in Hocking Hills region. We’re looking for a new couch for our place. Stopped into a local family owned furniture business that carries a pretty nice line. And this is right smack in the middle of rural Ohio. Logan is super small, and these are sort of salt-of-the-earth people.

Frank Curzio: At the start a discussion with Neese, the owners of the store, she proceeded to completely outline and explain what’s been going on within the entire supply chain economy. She explained that anything we order will take eight to 10 months to be delivered. She explained how this is not a direct result of supply demand issues, but employment issues. They can’t find any workers, entire supply chain can’t find workers. She explained that every aspect for the companies that make the foam all the way down in Texas, to the lumber companies that supply the wood, to the companies that make the fabrics to furniture, supply shipping, they can’t hire people. This completely bottlenecked the supply chain of taking prices considerably higher with furniture. She actually said to us that she would not be working at our family-owned store if it wasn’t for a family, because she would be making more money if she were unemployed.

Frank Curzio: So, here’s middle-wall America… It’s still Steve talking… a small pocket being impacted by all this, and these people fully understand what is happening, the mechanics of it. They’ve done the math, they get it. And what’s interesting is that this inflation seems to be an artificial by-product of our government continuing to inject massive dollars into the system, not a supply issue because there’s a lack of more materials. They’ve got the stuff. They just don’t have the people. Anything wouldn’t work because they’re hooked on fiscal crack. PS: We ended up not ordering the couch. The price has doubled and we would have had to wait 10 months. Just another data point. I can’t say how many emails I get. I love getting emails like that. Okay, I didn’t mean to read it and just bore you, but this is happening everywhere. Now, let’s move on from this because a lot of this stuff has been happening in the past couple of weeks.

Frank Curzio: And three weeks ago, we saw the tenure coming down. GDP is kind of just at state level. Three weeks ago, the Fed coming out today saying, oh, you have nothing to worry about or whatever. It would’ve been okay. But the past three weeks has been nuts. Three weeks. Now, look at the companies who just reported earnings this week. I want you to listen to these numbers. Please pay attention because this is amazing. So, Google reported quarterly earnings of $26.29 cents. That was over $10 better than consensus estimates, which is $15.64 cents. Revenue rose 34% year over year to $55 billion. 55… That’s for the quarter. That’s for the quarter. $55 billion. Revenues, 34% year over year. Yeah, nice being the biggest company in the greatest secular growth trend in history, which is digital advertising.

Frank Curzio: And then, to put a cherry on top, Google announced we’re going to do a $50 billion buyback. I can imagine what was going on at the board, right? They’re like, ah, let’s have buybacks of 20 billion. No, I listed 30 billion. Ah, let’s go 50 billion. That’s fine. 50 billion. $50 billion, guys. You know how much money that is? And put that in perspective, that’s higher than the market cap of 350 and the 500 companies, the S&P 500. This is a buyback, a buyback. We have nothing else that we have so much money, we’re just going to buy back our stock. And by the way, with those earnings, you’re going to do it definitely the cheapest of all the fangs, even though it’s up the most over the past seven months. It’s surged higher than the market, outperformed every one of the fangs by a mile. And it’s cheaper than all of them if they continue earning $26 plus every single quarter.

Frank Curzio: But a $50 billion buyback, are you kidding me? Blowing out estimates. Microsoft, saw on Tuesday, put a 41 billion in sales for the quarter. That was 18% better than expected, 20% year over year growth. Yeah, the stock came down a little bit because of run-up incredibly hard. Not talking about the stock prices because a lot of these companies have run up tremendously, so they’re going to take a breather like Microsoft. And I get it, a lot of it is computer sales and surface sales. And I don’t know if you got to see the impact from that going forward, break it down later with Daniel. Did you see A&D’s numbers put in earnings of $0.52 a share, blowing up the estimates. Revenues rose 92%, year over year.

Frank Curzio: These are mature companies. These aren’t small businesses that, oh, it’s easy to grow revenue. 100%, 200%, 300%, 400%. No, these are mature companies doubling their revenue year over year. And this quarter is comparable to pre-COVID. This isn’t, well, COVID numbers are really bad. No, this is pre-COVID, right? This is the quarter pre-COVID. This is the three months prior to COVID. You think they issued upside guidance? Said revenue is going to grow at least another 50% next year. The sheet numbers from UPS, $2.77 cents per share. Again, I don’t just throw a number at you and not put it in perspective. It was over a dollar better than estimates. That number was more than a hundred percent higher than last year. Revenue rose 27% year over year. $22 billion, much, much higher than estimates. You know what it was driven by? A 14% increase in volume from a year early. Huge, massive demand.

Frank Curzio: They also said market demands are based on industry supply. This is why you have to listen to conference calls, guys. Really, I’m getting to a bigger point here, but listen to conference. Don’t listen to UPS because you don’t have to listen. You can get the transcripts for free, anyways. Just go to Google transcripts UPS. But they give you a UPS, a GE, infrastructure companies. They’re going to give you a perspective of so many different areas, so many different industries, these conglomerates. So, you want to listen to them because you probably get so many different ideas listening to these conference calls. And I’ll listen to UPS because you want to buy UPS. You want to sell UPS. No, listen to it, because trust me, it’ll give you 15, 20 different ideas because they’ve got a course in market and demands are based on industry supply. No kidding.

Frank Curzio: But UPS says this dynamic, they expect it to continue for the foreseeable future. The key economic indicators continue to support the recovery in 2021. No kidding. You got a couple of firms, upgrade UPS. One of them upgrade, I won’t make fun of them. From a sell to a hold, probably a smart move. Probably. A little late on that, but probably a smart move with those numbers, UPS, because no one’s going to go higher, higher, and higher. Lots of money out there. Early this month, what did we see? This month, GM Ford idling their plans because there’s not enough chips to put in these cars because of crazy demand. You say, oh, this is the game. No, they’re not coming back online. It’s still several… Ford said that Chicago place, there’s still idle. They’re still having trouble. I’m reading Steve’s email. This isn’t like, hey, just a supply issue, either. It’s going to be a labor issue.

Frank Curzio: What else are we seeing? Again, copper, ten-year highs, close to its all-time high of $4.69 cents a pound. What is it, around $4.40 today? Lumber. Everybody knows about lumber now. It’s up 325% over the past 12 months, 325%. Corn, likely going to hit an all-time. Wages are starting to surge, which is why so difficult to find help. People want more and more money, plus people are still making money or more money staying home right now, which is insane. I mean, look, it’s everywhere. It’s being reported everywhere. Democrats, Republicans talking about a 1.5 trillion infrastructure package on the way on top of the 10.5 trillion in monetary and fiscal stimulus, which was already injected into this economy.

Frank Curzio: Household wealth, this number is awesome. Guys, household wealth all-time high is at $138 trillion. Household wealth is if you own assets, your home price is going up. That’s your household wealth, $138 trillion. That’s up 25% over the past five quarters, a little over a year. The average existing home price up 17% year over year. Usually, we see, what, historically, dating back 30, 40 years, 2% to 3% annual rise. 17% year over year. But interesting, home sales dropped in February, and home sales dropped in March again. Mortgage rates have come back lower. You know why? Because there’s no homes for sale. There’s 1 million homes for sale at the end of March. That represents a 2.1 month supply. To put that in perspective, that’s down 65% from the average, which is just over six months, usually six months. It’s two months. There’s no houses. That’s why the housing numbers are dropping, the home sales.

Frank Curzio: Food prices, looking at Bloomberg Ag Spot Index. Just Google it. You can look it up any place. Searched the most in nine years, recently. Have you listened to some of these calls? People reporting now, almost every food and beverage company said they’re raising prices. Proctor and Gamble, Coca Cola, Pepsi, Kimberly Clark, General Mills, Mondelez, Hershey’s, James, all of them. All of them, all of them raising prices. Freight companies are raising prices. Logistic companies are raising prices, which is now showing up in key indicators. We had Goldman come out today. I don’t know if you saw the note. A lot going on with the Fed, Biden’s plan. All this stuff said oil is going to $80 in six months. It’s 30% higher than it is now, so see, huge demand. You’re seeing all of this, but now, those key indicators that the Fed looks, input prices and the CPI, I mentioned this last week, core report prices went up 8.6%. It’s going to compound on your… 8.6%. You know how much that is? It’s insane. And sound like a lot; it’s a ton.

Frank Curzio: So, CPI just reported that’s the Fed’s most-watched gauge when it comes to inflation. It gets manipulated, but does this during the Reagan years to make it look like, hey it’s just rentals and stuff, to keep inflation as low as possible, to not show up when everybody knows is inflation. And even that, based on Kager, it’s at over 4%. We have almost every single asset. Think about this guys. Some of you other, you own your own house. You own your… Every single asset, collectibles, home stocks, cars.

Frank Curzio: You know what would probably… If I had to guess around 50% capacity in terms of every state opening every store and having no more masks, lifting restrictions totally, should tell you that to get the vaccine, you need to get the vaccine, but you still have to wear a mask. Why? Because you might affect other people, so that’s fact. That’s what we’re being told. Why get the vaccine if you still have to wear a mask? You have no worries, right? Why? Why? It’s crazy. Anyway, nobody cares. All that stuff’s going away, right? You have no choice. That’s today. It’s going to start opening up. My point? All these numbers are about to get even crazier when everything opened it up and everybody’s spending money. So, bringing it all together, I have a question. Just one question, and it’s pretty simple.

Frank Curzio: Why is the Fed not pulling back? The Fed achieved that objective. They wanted to create inflation. It’s here. It’s now. It’s running wild. So why are we not looking to raise rates? Really talk about raising rates later this year? But the Fed usually does. They usually get ahead of things and say, this is what we’re going to do. So you sugarcoat it and expectations are met, but you’re really still talking about this is going to happen in 2023? We’re not going to raise the… Are you insane? Why is it the Fed still buying government bonds? Why are we still injecting trillions into this market?

Frank Curzio: Listen to Biden today in his speech. You’re going to see much, much more money is going to be injected into this market. Why? Are you crazy? Now, we’re starting to see some pretty smart people talk about inflation a little bit. In fact, if you look at the S&P 500 companies that reported already, they’ve cited the term inflation is based on fact state data, which I love these guys. So, you cited the term inflation on their earnings, calls for Q1. And through this point in time in their earning season, it’s the highest that they’ve done this in more than 10 years. They’ve seen that word inflation creep up. Okay, we haven’t seen inflation in 10 years, 20 years, 30 years. But the most in 10 years, companies have mentioned the word inflation in their quality presentations, copies are already reported. But those inflation worries, those mentions, they’re just concerned a little bit. We’re talking about 2%, 3% of the CPI. You’re looking at inflation expectations, which is a gauge. I think this is Evercore here, rose at 2.4%, 3%. The highest since 2013.

Frank Curzio: So economists, even though it’s a highest since 2013, are only expecting 2.5% percent inflation, which is insane. We’re already over 4% on a CPI. We’re not talking about 10% inflation, which you could easily make an argument for. I know that number sounds crazy, but this is exactly where we’re headed unless the Fed puts the brakes on right now. Right now. If you invest in stocks, it’s going to ramp higher for the next few months, maybe a quarter or two. The Fed doesn’t put the brakes on, or at least just talks about it. We’re taping this a little bit before the Fed meeting, but you should release a statement. They said, eh, they’re really not going to talk about raising rates yet. Let’s see, maybe that changes over the next hour or so.

Frank Curzio: They don’t have to put on the brakes, and we’re going to see inflation beyond belief. It’s here right now, everywhere you look, every asset class is surging, and you, just average retail folks know it. You’re going to know more than the economists looking at these stupid bell curve charts, locking themselves in a room talking to rich people. They get it so much later. They wait three months to report some of these statistics, and then they revise them three times after that over the next three months. You’re seeing it. You’re seeing it with your neighbors. You’re seeing it in everything you buy, tuition, electricity. You’re seeing it everywhere. And it’s going to get even crazier because the whole U.S. is about to open up, and everybody has a lot of money. But everywhere you look, every asset class is surging.

Frank Curzio: And you know what? I don’t trust the Fed. And I definitely don’t trust the politicians to do the right thing here. You know what, billionaire bond king Jeff Gundlach doesn’t either. Yesterday, he came out. So, he thinks the Fed is sweeping aside the growing risk of one rate inflation, and says the Central Bank is just guessing at this point. This is the guy, Jeffrey Gundlach. Billionaire bond king, this guy knows inflation, everything, much, much more than I do. This is his job, 40, 50 years he’s been doing this. And he’s extremely worried saying the Fed is sweeping aside the growing risk of runaway inflation. Runaway inflation. Doesn’t mean he’s going to be shouting on the rooftops and looking at us. No, this is coming out now. Mark Zandi’s economist said the same thing. You got to start pulling back. And I don’t know if they’re going to do it.

Frank Curzio: Okay, I’m not predicting a huge market crash or anything like that, but you have to start hedging yourself. You have to protect yourself. Take a little bit off the table. Goodbye, long data ports. That’s not shorting because the market can surge from here. We saw that with numerous stocks that you thought were going to come down a lot, and they didn’t. And these things usually go a lot higher before they go lower. You can hedge 5%, 10% of your portfolio just to be safe. You can’t go all in here. There’s no way you can go all in. And it’s not about evaluations. They’re going to continue to skyrocket low interest rates. You can’t look at a stock based on evaluation. You have to remain long here, but you’ll get we’re inflating the market’s profits are going to be… The average company, as we found, which was being prompted by 30%. That’s unheard of in history of the… Tracking this for what, 20 years?

Frank Curzio: You can buy inverse ETFs, a little bit easier. I mean, don’t go higher than the 2X ones. If you like getting the 3X ones, because again, if you’re wrong, you’re really going to be wrong, but you only lose the money you put into those. Okay, we go a lot higher before we go lower. But when it comes to inflation… And I just said this last week. I’m not going to repeat it. But when it comes to inflation, it’s the one problem the Fed can’t stop immediately. It takes many, many, many years, even decades to stop runaway inflation. You just look at the ’60s and ’70s and ’80s. And you could print money to capitalize banks. You could print money when long-term credit mag where people F up. I won’t curse. You can capitalize failing institutions, could bail out businesses.

Frank Curzio: You can pray as much, but look at COVID. COVID crushed the markets. You know how long? For 45 days before the Fed… And I had no idea if I was going to do it this way. Otherwise, I would’ve been buying right away through April. It took me to a day to realize, holy cow, they’re throwing out trillions. They said trillions of dollars. They’re going to hand to people checks and businesses and loans that they don’t have to pay back. You had to get bullish again. How quick did we recover? Almost send me yearly. Pretty simple. Just print 10.5 trillion dollars. We’re good. Why 10.5? We’ll do 15. We’ll do 20 trillion, and I just keep printing until we’re okay. And keep rates at zero.

Frank Curzio: With inflation, you have to take money out of the system. Instead of buying treasuries, the Fed has to sell them. You have to raise rates. You have to take away the punchbowl. No more stimulus. Nobody wants to do that because we’re addicted to it. And we’ve never seen the consequences of this because we haven’t had inflation while we have interest rates low, almost forever, since the credit crisis. Those are the only ways to control inflation. And the worse it gets, the higher inflation gets, the more difficult and the longer it’s going to take to control.

Frank Curzio: So, I don’t know what the Fed is going to do. I know what our politicians are going to do. They’re going to continue to spend money, give free money to everything, colleges, everything for free, right? Buy votes, whatever they want to do. That’s fine. But enough is enough because when you see these people making enough money where they’re not going to care, they’re not going to work. They don’t need to work. We’re seeing in stores everywhere. Again, frank@curzioresearch.com, I want to hear from you. Let me know what you’re seeing in your neighborhood because I’m seeing this all over the country.

Frank Curzio: I don’t care what the Fed does. I don’t care what politicians do. What I care about is you, and you need to protect yourself right now. You’re doing this across all your portfolios. Just maybe take a little off the table. Lose your subscribers to Moneyflow Trader, which focuses on buying long-term data ports, hedging yourself. Pay close attention to Genia’s advice, because she’s going to kill it. I’d say, you don’t have to wait for a market crash for that to happen. We’re seeing a lot of individual stocks down 20%, 30%, 40% from their high… Look at those ESG names, a few marijuana names. Lot of these just crazy stocks that ran up tremendously in the last three months. Look at the Russell. There’s a lot of stocks down 20% plus, see about 30% of the Russell. A lot of these names are getting crushed. And if they’re in the wrong industries, that they had inflated valuations, money’s rotating out of them.

Frank Curzio: I wonder if I’ll trade. It takes those individual names along data points. And those gains like we saw during COVID when the market did come down tremendously, our 3X, 4X, 5X, 6X. That’s why if you had your portfolio just a little bit with these things, and you’re right, yeah, the rest of your portfolio would come down to long positions. But that part of your portfolio, if you had your 10% could become 30%, 40% of your portfolio. That’s how much money you would make off of this. And if you’re wrong, doesn’t matter because the rest of the stocks are going to go higher. It’s a big deal. Your hedge 10, 5%, of your portfolio, whatever it is. Pay close attention to advice because she is by far the best I know when it comes to hedging. And that’s why I hire. I’m glad she’s at Curzio Research.

Frank Curzio: Anyway, just be careful out there guys. I know that was a lot of statistics I threw at you. I know everyone likes to be entertained and stories and stuff like that. To me, this is really important. We’ve done incredibly well in the markets for a long time. It doesn’t help me by telling you to protect yourself, right? Bold markets are probably great for financial newsletters because everybody wants to buy everything. It’s easy to sell. So, it’s not my best interest to come out here and tell you what I’m telling you, but I’m doing that because I care, because I’ve run this business for 20 years of Curzio Research. And there’s times to be super bullish, which we’ve been for a very long time, and there’s times to just be cautious. And now’s the time to be cautious, because again, I don’t trust the Fed, and I definitely, definitely, don’t trust our politicians.

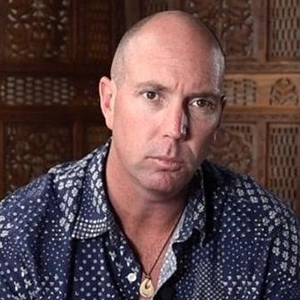

Frank Curzio: I had a great interview today which is being sponsored by blockchain.com. Those trusted cryptocurrency platforms in the world are over 70 million wallets, over $800 billion in transactions since 2011. And only you can treat your favorite crypto is on blockchain.com, but you can earn up to 13% interest annually on your crypto. That includes Bitcoin, Ethereum, stable coins, USD tether. More information to start your account, go to blockchain.com. That’s blockchain.com. Yes, I use them as well. And my guest this week is a one and only Chris MacIntosh, founder of Capitalist Exploits, also manages money. Highly controversial, says exactly what’s on his mind. You would notice if you follow him on Twitter, very entertaining. Chris has been coming on these podcasts, I’d say, for about six years. Incredibly smart. He’s right a lot more than he’s wrong, has given you tons of amazing ideas. Clean Bitcoin, and he was buying it 400 Bitcoin, 400.

Frank Curzio: It was back to 55,000 around there? Buy junior miners in 2017, position his portfolio that way. Most recently, about nine months ago, he told you to buy oil stocks. The amount of homework that this guy does, just behind every one of his investments, his ideas, it’s what separates him from so many other so-called analysts out there. And I’ve seen a research firsthand. He’s made me money personally firsthand by following his idea. Yes, I listen to the guys that I interview on the podcast as well as you should too. I vet these guys and make sure I bring great guys in front of you. Chris is one of those great guys.

Frank Curzio: So enough of the buildup, here’s my interview with Chris MacIntosh. Chris MacIntosh. Thanks so much for coming on Wall Street Unplugged.

Chris MacIntosh: Thanks for having me, Frank. It’s good to be back.

Frank Curzio: Well, I have to say, good to be back. I mean, we’ve been doing this probably for about three to four years, having you on. And some of your investments have been absolutely incredible. I would actually put you right at the top of the list in terms of getting into Bitcoin super early, getting into oil which I didn’t really agree with your thesis when you came on. I think it was about nine months to a year ago and you turned out to be right and I was wrong. I just thought it was a little early, but just find that those assets at a mispriced fable risk/rewards asymmetric investing is really cool, but I want to start off with this. So, when are you planning on getting the vaccine so you could travel?

Chris MacIntosh: Well, at the moment I’m just sitting here waiting for my overlords to tell me when I can take some experimental DNA enhancing vaccine, and I eagerly await them plunging it into my arm on a continuous basis because getting it once will not be enough. So, I’m just waiting really.

Frank Curzio: It’s funny and it’s not funny, right? Because this is probably going to happen where we’re going to have to get vaccinated and have to carry a card around to actually… I know there’s some states that are just saying this, so you don’t have to do that in Florida but other states I think are going to mandate it and especially other countries like Canada, I could see that which I travel a lot to for mining and stuff.

Frank Curzio: But more to the point, we all have our personal feelings of whether we agree or disagree, but this also creates different opportunities, investment opportunities. What are some of the things that you’re seeing? Because I saw you comment, and guys you’ve got to follow Chris on Twitter, it’s very entertaining capital exploits. I saw you mentioned how Ark and Cathie Wood continue to invest in these growth stocks and playing for deflation, but you have to get to take the opposite end of that coin. What are some of the things that are opening up because of you’re seeing, with the vaccine gets distributed, travel industry. Again, it’s creating opportunities and I want to put politics and personal feelings aside, but how are you using that to find investment opportunities?

Chris MacIntosh: Well, I think if we just go on a 40,000 foot view, what we’re experiencing is a breakdown of the international rules-based system that has existed post Britain wars. There’s a number of components to that, de-globalization is one of them. Another one is a shift of political, economic and human capital, intellectual capital from the west to the east. This has been taking place at an increasing trend, it’s been an increasing trend for the last 10-15 years. And it’s one of the reasons we moved out to this sort of region of the world, but it’s now going in through an absolute acceleration phase.

Chris MacIntosh: So, that’s kind of the global setup that we find ourselves in. And what it’s providing us is, we’re at a pivotal point where a lot of the trends and a lot of the investments that have succeeded over the last, I would say even 40 years, but certainly over the last 10-15 years that had reached astronomical levels are changing, the dynamics behind them are changing. So, for example, talk about Cathie Wood. So, Cathie has gotten into all of these growth equities. She’s throwing out numbers like $3,000 for Tesla per share. And none of the companies or many of the companies that she’s investing in make any money, profitability doesn’t matter anymore.

Chris MacIntosh: Now, I come at this from actually having seen a lot of what is transpiring in that space, but earlier on in the cycle. If you remember, I built a venture capital firm for the very reason that I’d figured out what I believed at the time that we were going to have an enormous amount of capital shift into risk growth, quote unquote, growth assets. The furthest end of the risk curve is venture capital and that’s where I went to. That became really, really stupid in 2016, 2017. I sold the business in mid-2016, it got even worse. And we will remember we work in the elevating the world’s consciousness and all this kind of nonsense, when really all it was, was a Regis, just subleased bloody buildings, there’s nothing fantastic about it. It’s a low margin business, it’s an okay business, but it’s nothing that’s elevating anybody’s bloody consciousness, but people bought into that nonsense and we had these ridiculous valuations that all collapsed.

Chris MacIntosh: So, that whole private equity venture capital space has come under a lot of pressure, but we’re seeing this tail end of that speculative mania. And we’re seeing it in listed equities, much of that is driven by both algos and essential sending, which is passive investment capital. So we’ve had this extraordinary amount of capital, it’s shifted into non-managed or passively managed indices. And there’s a feedback loop there whereby the more capital that goes in, the more it sucks in more capital.

Chris MacIntosh: In other words, for example, you can run an algo and the algos will be saying, you know what, if this part of the index goes up by 2%, allocate another 2% of capital to it. And by virtue of allocating another 2% of your capital AUM to that particular sector, it causes the sector to rise more, which then says, hey, if it’s now increased by 4% add another 1% or whatever the case might be. You have this kind of feedback loop which is why today we have the top five companies in the S&P account for roughly 25% of the index. We’ve never, ever had such extraordinary concentration. If you go back and you remember in the GFC, it’s similar dynamics but it wasn’t anywhere near as high as 25% and that was enough to tip the whole cart over.

Chris MacIntosh: The point is, we don’t know when that tip happens, but we do know that it’s extraordinary. We do know that it doesn’t make any sense. We do know that the valuations that are being paid for a lot of these companies are mathematically impossible for them to actually… Unless every other company sort of goes away on the earth and they end up capturing not just their own segment of the market but many other markets, they don’t make any sense. And so the probability of these things working out in the medium to long-term for investors is super problematic. While, all of this is taking place we’re having this extraordinary supply destruction. And you’ve got supply destruction in critical goods, while at the same time you have monetary expansion fiscal policies that are coming in, both of which are extraordinarily destructive to the value of currency. And so, I believe we’ve already seen the first innings of this shift.

Chris MacIntosh: If you look when we last spoke, we talked about oil. Okay, so oil is one of the components behind this, but you’ve got the amount of capital that is now going into value or value stocks as opposed to growth. That turning point, we believe it’s been hit. It’s going to be bumpy and can come back down again, but we are confident that that secular and cyclical changes taking place and where people are missing this is that looking in a second, ah, in order for us to have capital go back into value and to go back into commodities, we have to see growth because the last time we’ve ever experienced bull markets in commodities, for example, has been as a consequence of growth that’s been emerging, market growth. It’s been the rise of Asia, it’s the bricks, et cetera. This time that’s not happening, but this time we’re going to have an extraordinary bull market in the east as a consequence of supply and destruction, not as a consequence of demand-led growth.

Chris MacIntosh: And so everyone’s looking at the growth and going, oh, well, the world’s shut down and many people are going out of business, it’s less growth. I get it, I get all of that. But what you’ve had is more supply destruction than you have of growth. And it’s all taking place at the very tail end of what was a pretty bloody brutal commodity bear market. So, that sets us up for a phenomenal next decade, I would say. And so that’s kind of… I’m just rabbiting on. That’s the broad-

Frank Curzio: No. I love it. I love the explanation. I love the explanation of that. So, let’s get into the commodity part and also, we’ll throw Bitcoin in there as well. I want to share something and maybe we can start with Bitcoin before we get into gold and oil and different commodities and stuff, which I know you’ve been invested in and doing very well on, but on your website here, capital exploits, guys, just scroll down here to your blog and you have something interesting. So, 13 reasons bulls are wrong. Now, I want to bring everyone in here before I say anything. No, no, no, but you are not a permabull or permabears, one of the things I love about you, because when the facts change, you change. We don’t see that a lot. We don’t see it often, especially with gold bugs, it’s buy gold no matter what the market is.

Frank Curzio: You were one of the early adopters of Bitcoin. You still own Bitcoin now. I mean, you talk about 2014 and I don’t think you’ve sold any if I read that correctly. So, you’re just pointing out, hey, why Bitcoin could go to a hundred thousand, but here’s some serious risks because when you see things at all-time highs, people kind of forget the risks. And you’re a guy that always looks at the risks. I believe you look at the risks first and making sure that they’re manageable and that reward is going to be that much greater, right? Risk-reward and ace in investing but talk about that story and Bitcoin. And I don’t want it to be where, hey, you’re going to get hate email because you are, you’ve been right, you’ve been bullish on this and you still own it. But to me, I read this piece as someone that really knows this industry, that’s saying, Hey, just be careful here, it’s getting a little crazy.

Chris MacIntosh: So, Bitcoin’s been one of those things. Look, it’s easily been the most asymmetrical investment I’ve had, and I’ve had a bunch. So, we ran an event where we got investors into it. I was still really trying to figure it out, but we had sufficient information at the time that led us to believe that it was a decent risk-reward bet. And it was about 450 bucks. So, we treated it like you would treat any other venture capital type of investment where you’re saying, you know what, there’s a good probability this thing goes to zero and it doesn’t work out. So, I’m going to risk. My weight at investment is going to be risk adjusted for that probability event.

Chris MacIntosh: And then as things transpired, well we know where we’re at now. And the main thing that I’ve been waiting for, because like I rode it all the way up to 20, I let it crash back down and I didn’t sell, I didn’t do anything. I added more, a little bit more when it dropped down to like four and then at about six and a half, I added some more. But anyway, the long and short of it is most markets go through cycles. In terms of new technologies, if you will.

Chris MacIntosh: Ordinarily, what happens is capital will go into a sector via our family and friends. And it’s a bunch of kids in hoodies, drinking beer in their garage, making whatever it is that they make. And so they ask mom and dad for some money and then friends come in and you kind of slowly build this up until you got until you have something. And then you have, angel groups will come in and invest into that technology or that sector. And then once you get more traction, often liquidity events in that, larger companies will buy out these smaller companies in whatever the new technology is.

Chris MacIntosh: And now you have some liquidity events, you kind of have traction, you can see the runway, that’s when the venture capitalists start coming in. So, the VC firms will come, and they start putting money in. And then you get a few liquidity events, either in the VC world without selling them to other funds and or where they’re actually getting listed and they’re actually becoming public. And then as soon as you get some of them going public, now you have the brokers come in and the brokers go, okay cool, I can start selling those to my retail client base, or if it’s IPO’s and they’ll sell it to their creditor client base. So, now you kind of got broker participation and the bull builds and builds and the sort of tail end of that is when the investment bankers look at them and go, “hey, we’ve got a whole new asset class here, it’s a whole new sector, let’s go and make some money,” because at the end of the day they’ll sell anything and I think that they should.

Chris MacIntosh: So, now they’ll take this new asset class and they’ll package it up, right? And that’s when you’ll get indices or you’ll get ETFs, right? So, you’ll have a new ETF that’s listed and it’s for solar or it’s for whatever. Okay, and what they’re doing now is they’re just making it super easy for the retail investor to come in and go, I want that, I’ve seen that, that’s done really well over the last 10-15 years or whatever it is, this is clearly that I have to be involved. Here’s has an easy way for me, click of a button on my Robinhood account, and I can buy it. That is often the tail end of that particular bull, because who else is there to sell to? So, that whole transition takes place regularly in all sorts of things.

Chris MacIntosh: Now with Bitcoin, what we actually had was we missed the entire corporate component in the last… When it ran to 20,000, the reason I didn’t sell and I remained bullish. I mean, I looked at it, I was like, I understand chance, I’m like this is nuts, I expected volatility and I actually didn’t expect it to crash as much as it did, but hey, whatever. I was like this is a massively volatile asset class but what I wanted to see was I wanted to see institutional participation because we didn’t have it yet. We had retail participation, but predominantly actually from like a select niche group. It wasn’t broad retail participation. Everyone was like, I mean, after it ran to 20,000, a lot of people were like, oh, well, every joker and shoemaker is buying Bitcoin and that’s bullshit it wasn’t actually that extensive. Part of it is it was just the free float of Bitcoin is so tiny. So, you had a lot of retail participation, but not broad retail guys with a Robinhood account participation.

Chris MacIntosh: So, that whole retail component had not taken place and commercial or institutional participation hadn’t taken place at all. So that’s now happened and that’s what we were waiting for. That can easily run a bunch. And I mean, can it go 10X from now? Possibly. But the points that I made in that blog post, I think are all relevant. There is this, while that’s taking place, central banks have a huge issue. They have to resolve their debt, which is unsustainable, unplayable and they are increasingly owning much, much more of the bond market. We’ve seen this. Japan basically owns all the bond market. There is no functioning bond market in Japan.

Chris MacIntosh: Europe is increasingly in the not functioning bond market in Europe because a hundred percent of all secondary issuance is bought by the central bank and about 85% of first issuance. So, that’s not a participating market. So, their reflective interest rates are incorrect, they’re completely mispriced. They are going to have to keep doing that to the extent where they’re just going to own the entire bond market. And this is Peter paying Paul. It’s a nonsense story. So, they realize that that’s not going to get them anywhere and ultimately the mispricing of real interest rates, the market starts pricing them anyway. I mean, for example, you look at ECB rates, if you look at the German bonds or anything else, and you go out and you want to borrow money to start your business, you’re not paying those rates, you’re not paying anything near those rates. So, the disconnect gets broader and worse.

Chris MacIntosh: So, the answer for these pointy shoe bureaucrats is to actually repudiate that debt and to issue or usher in a new central bank digital currency. When that happens, they will not want to have any conduits to get out. In other words, because what it is essentially Frank, is capital controls. If you think about how we have capital controls in the third world. They shut down the borders, right? They won’t let you cross the border with a bag of money. That’s their liberal capital control. They don’t need to do that anymore, everything’s digital. So, they’ve got to do the same thing in the digital world.

Chris MacIntosh: So, in the digital world, they don’t want you to have an ability to escape their new system. And Bitcoin is an escape valve, which makes it come as a metric because as they start, as they look to bringing that in, it would conceivably be a lot of people would go, holy shit, I don’t trust this new central bank digital currency that’s being issued. I don’t want my cash being converted into that thing and I’m out. And so, I’m going to choose other avenues. And there could be many avenues, it could be buying gold, it could be buying oil or whatever. But one of those avenues certainly is Bitcoin. And I don’t think it’s reasonable to expect them to allow that.

Chris MacIntosh: And so, while I’m aware that you can’t ban it per se, you can easily ban people using it. And if you think that people are going to repudiate that and say, well no, I’m going to do it anyway. Then you haven’t been looking at the world over the last year because they just told you to lock yourself under your pillow for what clearly, evidently now is not much worse than a seasonal flu. To wear double masks, to take experimental drugs into your body and people are doing it.

Chris MacIntosh: So, to think that people wouldn’t turn around and say, no, I’m going to actually use Bitcoin and the whole view, I think flies in the face of the evidence of what we’ve seen over the last year. So, that actually has made me far more bearish. If we’d seen a different response to these tyrannical, draconian measures being taken, then one could think that humanity actually has some senses and we could have a way forward with some. It doesn’t even need to be Bitcoin, but any other sort of free decentralized monetary system. But at this point in time, that doesn’t unfortunately tie in with what’s taking place.

Frank Curzio: No, that makes a lot of sense. And I love that because everyone right now is really bullish on Bitcoin. And it’s just nice to see someone who’s been bullish on it and saying, hey, there’s things to worry about here and just the government and things like that. That there are definitely risks to it. Everyone’s just like it’s going to a hundred thousand more institutional adoption. But one of the areas that has, I don’t know if it’s because people choose between Bitcoin or gold, but I would think from your standpoint in a market where you’re seeing inflating evaluations almost in every single sector, right? Even the so-called value growth, transition from growth into value and all these reopen trades, where the cruisers are trading at higher valuations than they were pre-COVID and they still don’t have any ships in the water, the three biggest ones. I would think gold here.

Frank Curzio: I remember you coming on the podcast, I think it was 2017. And you said, look, we’re investing heavily for credit investors in junior miners and they surge off their lows but over the past year, they significantly underperformed on the market. Not just the juniors, but we look at even the majors in gold. So, is this up your alley where, to me, when I look at gold, I like buying things that are hated. Everybody hates gold. Nobody wants to talk about it. You can’t sell anything gold related, but I think people don’t understand that last year, 2020, they reported record profits. So, you’re seeing growth.

Frank Curzio: We’re not just buying value and hopefully growth is going to… You’re seeing it. I mean, the margins that they have, the growth that they have, is incredible. Yet, it still seems like this is an industry that’s relatively cheap, especially from the majors and the producers. But is this something that you’re looking to invest in? Does this check off all your boxes in terms of your investment style? Which is, hey, we need to see massive rewards here while taking on as little risk as possible.

Chris MacIntosh: Yeah. I mean, look, everything goes through… Again, we’re at the first innings of this major super cycle in commodities. And so it’s not going to be linear, don’t expect it to be linear. And the smart thing to do is actually just to be very patient, not get overly excited with anything, build a portfolio that has multiple positions across multiple sectors and literally be right and sit tight. Now, I know that’s boring for most people. Much of what we do, my positioning for the last 12 months, two years, hasn’t changed a whole lot. It’s changed a little bit, but broadly we don’t change our portfolio very much. We don’t dive in and out of things. You be right, just sit tight. You keep analyzing what you hold. If you don’t, you keep holding it and it doesn’t make sense to hold them any longer, you get rid of it. And you either replace it with something that’s a better asset or you reallocate into another sector that might have more asymmetry, but by and large, you don’t do a hell of a lot.

Chris MacIntosh: With respect to gold, we’re having a bit of a pull back and look, we could have a short-term liquidity event. This is the biggest risk. And a lot of clients will come to me and say, oh, I’m really worried about the markets. Yeah. Should I wait and maybe we dive in after some sort of crash? And my response to that is always the same. What is the crash? If we get a crash and it’s not given that we will, what does it look like? Is it a crash in bonds? Is it a crash in bonds and equities? Like, what is it a crash in? Because remember when something’s crashing out, it’s got to crash against something else. In other words, an equity market crash is actually just a bull market in the dollar or vice versa, right? Or some other currency because what’s crashing it in? So, it’s crushing against currency.

Chris MacIntosh: So then, I would ask the question, if you’re worried about a crash in the equity markets… And again, this is a broad equities, like we’re not into the broad equity market. We don’t own the S&P, we don’t own the NASDAQ. We’re very selective on what we do own, but if you’re that guy and you’ve got broad mutual fund exposures to a bunch of the indices, you’re looking at it, and you say, okay, I’m scared of a crash. Well, here’s the second question, if you want to get out and go into cash, how long are you going to own the cash for? Because we’ve just had roughly 4 trillion just in the United States alone, that’s a stimulus package, which is roughly 40% of the existing Fed’s balance sheet. Would you want to own cash when that’s taking place? That doesn’t inspire me with confidence to want to own dollars or to want to own bonds, which is ordinarily in some crash, you would own bonds because they would outperform your equity positions.

Chris MacIntosh: So, when you look at what you can invest in, there’s a huge problem here. Our timeframe is five-ten years. What happens in the next six months? I don’t know and I don’t really care too much. But I look out five years, it’s much more clear and much more evident to me where we’re going and I need to be positioned for that because that’s critical for me. It’s critical for me. It’s critical for my family. It’s critical for my clients. So when I look at that, I’m like, I don’t want to own dollars, I don’t want to own Euro, I don’t want to own any of this garbage. It doesn’t make any sense to me.

Chris MacIntosh: Aside from the fact that the Euro looks like it’s going to be replaced with some digital central bank currency and almost certainly what they’ll do is what they did when they introduced the Euro. And a bunch of other countries actually just got closed. If you were in Portugal and you suddenly went to the Euro, you found that a lot of the things that you were going to go and buy on the street, actually gets more expensive because they actually just did a semi-Nixon on you. In any event, you don’t want to own cash. You don’t want to own bonds when we’re at 5,000 year lows in interest rates, the highest debt levels the world has ever seen. Buying into that makes no sense to me. So you say, well, broad equity is not on that either, because you’ve got, again, the S&P, 25% of the S&P is a bunch of companies, top-take companies which are running evaluations that make blood want to shoot from our eyes.

Chris MacIntosh: So, running evaluations that are blood on the sheet from ours. So it actually becomes quite easy for me to look in say well, the stuff that I want to own is actually all this deep value, cheap stuff. And incidentally, it happens to be the very goods and services that are pretty much critical to humanity. Whether it be copper, nickel, natural gas, coal, and from the precious metal sides of things, gold, silver, all of those fit into a broad portfolio. You ask specifically about gold stocks, I’m not worried about them. I expect that they’ll have some volatility, but I’m going to hold them for the next probably 5, 10 years. We’ll see, how that cycle goes. So, don’t hold me to that. But broadly, that’s what I’m thinking at this point in time.

Chris MacIntosh: And there’s some exceptional value out there because… again, we’re coming out of a bear market in commodities and you and I both know this, this is a super capital-intensive business. It’s also predicated a lot on investor emotions and in those investor emotions for the last 10 years or in 2012, was kind of the end of our cycle. Nobody’s wanted to go near this stuff. Now, that’s changed in the last 2 years, it slowly started changing. 2019, 2020, you’re now at a point where if you’re getting into, for example, into private placements, you’ve got to fight. You got to fight a bit to get placements. Two years ago, you could name your price, you could do whatever the hell you pleased because these poor guys could not get financing at all. So again, there were first endings in this phase, but there’s no broad participation. And again, forget about retail because they don’t matter that much, but we’re going to get institutional ownership coming in, they’re just going to build these things up in this and there’s so few assets left.

Frank Curzio: So, one asset that you didn’t mention, which I know that you’ve liked for a while is Uranium. All of a sudden, Uranium has been the trade. Everybody loves it, right? They hated it when, when it was really cheap, a lot of these stocks, but now you’re seeing supply demand, balances, things that you cited, things like Michael Alkin cited some of the brilliant minds in this industry. Now, you’re seeing some of these stocks move incredibly higher, and I still feel like it’s under the radar.

Frank Curzio: You’re not hearing uranium mentioned at all in a financial media, right? You see it on social media from Uranium bugs and stuff like that. Where are your thoughts on this? And could we still continue to see a lot of these stocks move higher, where the surprise for me and what we saw at oil, right? Oil prices rose incredibly, right? So, that’s an influence in those stock prices and eventually profits with those end up producing, but prices haven’t really been moving higher in uranium. Does that make you nervous? Or you think, hey, that’s got to come based on a supply demand and balanced by so many countries and so many companies just cutting off production and with demand really coming online now for alternative energies and green fuel, especially international. I want to get your thoughts right now today, as someone who’s done very well in uranium market, do you still think this trend has likes?

Chris MacIntosh: We’re still alone, first innings… I mean, the dynamics of that market, if we strip out the green wishing, which is what I call it, because renewable green energy is both, when you look at the dynamics of it, is neither green nor is it renewable, for the most part. That aside, we’re going to still play this game. Politicians are still going to pertain that it is what it isn’t and we’re still going to have an extraordinary boom. That dynamic did not exist in the previous bull market in Uranium. So, there wasn’t a precious towards a green economy and yet, we saw multiples of what we’ve already seen. So, our positions were up about, I think it was about 800% something like that. If you go and you have a look for market adjusted, so market cap adjusted, the companies that we’ve got on our portfolio that you can take pretty much any, you’re just going to get a string of uranium companies and track them on a market cap adjusted basis.

Chris MacIntosh: And you’ll see, we’ve hardly moved in this. We really have hardly moved. The reason that you can go up the up 800% and really actually hardly move is because they were absolutely decimated. We’d got roughly 90% of the companies that existed in the previous bull, went away. They’re gone. So, the supply side got crushed. And again, this time around, we’ve actually got a demand side that is really extraordinary because it’s being led by this green initiative, renewable energy bollix. And so that’s going to push a lot more capital into the uranium space. That’s just one component. Then the other component that you’ve got is actually within Asia in particular, India and China as well, the amount of capital that’s going in and the amount of reactors being built and everything else, dwarfs anything that we’ve seen before. So, I do think that we have an extraordinary setup. I mean, the best time, was to invest 18 months ago when it was still… In fact, best time to invest was in March when we had that initial selloff with corona… the corona selloff and…

Frank Curzio: An ETF up here that I’m showing while you’re talking, just overall ETF, but just to show the huge growth again.

Chris MacIntosh: Is that URNM?

Frank Curzio: This is just URA, so I just brought up some just to see a broad range of how good this trade has been, especially over the past year, which again, not too many people talking about right, Chris?

Chris MacIntosh: Well, just on that night, cause that’s a garbage ETF. That’s a horrible thing. There’s another one that’s been listed called URNM that I would suggest listeners go and have a look at. What happened with URA was they… And this is interesting to watch with cycles, look, ETF providers make money based on volume and they make money based on assets under management in that ETF, and then clip the ticket. So, you pay it out on a 50 basis points or 28 basis points, whatever it is, depending on the ETF structure. The bottom line is, they need to have a lot of capital into that structure. So, the individual equities that got hammered in what was URA, your amount of your capitalization was so small, so these guys weren’t making much money. What they did was they went and changed the structure of URN and they started throwing in a bunch of companies, which actually aren’t really uranium companies, but they had larger market caps.

Chris MacIntosh: So, you could chuck in something like Mitsubishi because it has some fricking R&D department, that’s got some uranium component or whatever. So, I sort of threw in a whole lot of stuff that was not really specifically uranium related, but allowed the market cap to be greater. And so they could earn more fees. So, you’ve got to be careful with that, but that’s actually a really good indicator of what you get at the bottom of the cycle, right? When they either de-list an ETF, because it just doesn’t make sense for them to own it anymore, like they did with ECA, which is shipping, another one of our sectors, they de-listed that. I got that, no one’s interested in shipping. We’re not going to need chips anymore. And so they just de-listed the thing. So now, you actually can’t get exposure to shipping without going in and buying individual equities.

Chris MacIntosh: That’s great. That’s a good thing. It just means that there’s less participants there. Anyway, back to Uranium. So, with uranium, that whole ETF is garbage. There’s a new one that just got listed called URNM, which is a better proxy for uranium, if investors desire to go after it. But you will see the same sort of thing. I mean, you’re not going to get the price history on URNM because it’s only just been listed, but I mean look, you can just take Chemico. Chemico attracts uranium spot relatively well. So, if you are kind of trying to get your head around from a 40,000 foot view, what does the uranium market look like? I’d use Chemico as a proxy and then if you want to exposure and you don’t have the skills or don’t want to go and pick individual equities, I would go for URNM, as opposed to URA. But no, I think the sector is going to continue to do well for all of the reasons that the entire base commodity sector is going to do a lot.

Chris MacIntosh: But especially as a consequence of green funds, if you want to call them that, that are going to come out and they’re going to invest into the space. And now what you’re seeing is some other companies are going out and buying a head in the spot market because they’re realizing holy shit, we don’t have supply. And so that’s a done-r. That’s an interesting change. I think right about last week or the week before in one of our nights to clients. But yeah, we’re long, we remain long. I anticipate we’ll be long for a few years. We’ll watch and keep our eye on it.

Frank Curzio: Now Chris, when you say you’re long, is it through North Shore Global Uranium? Is it through individual companies? Is it through private placements? Is it Chemico? Is it next gen UEC? Uranium Royalty, which is a new royalty company in Uranium. I mean, when you say long, is there any specific ideas that you could share? And if you can’t, I understand a hundred percent, but just for some of our listeners out there, when you say a little, what are some of the good investments out there? Is it you’re long just a price of Uranium and maybe play it that way through options market? But I’m just curious, where do you see-

Chris MacIntosh: Sure. Yeah. Look for starters, we don’t use leverage. Very, very rarely do we use leverage. So, no options. We’d never do futures contracts. If you think, and this goes back to, I mean, look, we’re deep value investors, but if you go and you look at long-term cycles, sure your futures traders can do well, but for your average Joe, the best thing that you can do is just bang. You hit that sector and you just hold on for the ride, and you want to get at least 80% of that, right? You want to get the meat of it. And when things get nutty, start sort of taping off and realize, I’m not really good at this, but realize that things are going to get even more stupid than you think they will. So, when you’re looking at stuff and it doesn’t make any sense, it can easily double or triple from the risk behind it, of course, you need to be cognizant of risk.

Chris MacIntosh: So anyway, and to a certain extent, that’s what I feel like Bitcoin’s a little bit like now, right? I mean, we’re up in an astonishing amount, but let’s say we weren’t, let’s say we got in at, I don’t know, 6,000, which is not that long ago, right? You’re still up like 10 times, right? So, you’ve got to look at it and go, okay, if I took that capital now, where can I get a 10 times return? Is it in Bitcoin, or would I go and buy nickel miners where we’re going to need, by all accounts, at least, at the very minimum 4 times global supply to meet the initiatives of many Western governments in terms of their 20, 30 protocols of green energy.

Chris MacIntosh: So, everything’s looked… Kind of looking at it as a broad perspective and going don’t look at them in isolation and I think that’s one of the problems that you have with gold bugs or Bitcoin bugs or whatever is they kind of live in their little own isolated world and they get fixated on that one thing. It’s like a teenager with a girlfriend, and he can only see that girlfriend, she’s probably a pain in the arse, but it’s like, those other girls are happy, I want to go out. But anyway, on uranium, the way that we go about this, Frank, is quite simple. We want to get exposure to a sector. The problem is that you can pick the base company, but things can go wrong.

Chris MacIntosh: Remember, Chemico’s cigar light flooding? I mean, this is a good company. Could you have foreseen that? No. Even the guys that were working on the bloody project didn’t foresee it, obviously, right? And so there’s all sorts of things that can take place. It could be geopolitical risks, you could have a war breaking out, you could have government regulations that come in, there’s a lot of different things that can, that can upset what would ordinarily be a very, very good investment. And so, we like to have a broad diversification. We basically look at that and we’d say, okay, let’s break that down, let’s take our uranium sector allocation. We want to have roughly 50% of that in companies that we don’t think are going to go away, right? So, these are your Chemico’s or the ETF that I mentioned, URNM, kind of gives you poor exposure.

Chris MacIntosh: And then the balance of that, we will go and look and say, okay, what else did we put in here? And we’ll get geographically diversified, and we might take risk, in that we’ll go into companies which might have a resource that is not yet developed, right? So, it’s in ground resource. We know the resources there, maybe they’ve got three years of cash in the balance sheet, we go, okay. But where that resource with them comes into the money is now very valuable and the share price would reflect it. So, you can have something that goes from 10 cents to like 5 bucks, but you’re taking risks.

Chris MacIntosh: So, we kind of break that down. Ordinarily, we won’t take any one position. We’re often 1% of AUM on an individual position. So, it’s not so much about what, I mean, it is what you pick, but it’s about risk management. It’s about portfolio management. That’s what people need to do better, I think. But I mean, I could throw out all sorts of names, energy fuels, I think is a good one, which goes triple u, I think it’s 4 u’s, anyway.

Frank Curzio: I think it is 4 u’s.

Chris MacIntosh: I got mixed up. Yeah, because u, u, u. I mean, we own Bannerman. Bannerman’s probably got the best management team that I can think of great, great CEO. Their resources is not amazing, but I’ve seen amazing resources run by shitty management teams and they don’t work, and I’m seeing average resources run by amazing management teams and their work is great. What else? Peloton, we own Boss. Boss resources. But look again, if you’re just trying to get broad exposure, that new ETF Uranium, I think there’s some decent room too, to get into that space, there’s some other ones that we own that you can have a look at.

Frank Curzio: That’s great. Thank you so much. Thanks so much for sharing those ideas too. So, I know you’ve been early in that trend, just like a lot of other trends. I know you made my investors a lot of money, so I really appreciate you coming on the podcast. If someone wants to learn more about you, go to your website or follow you on Twitter? How could they do that?

Chris MacIntosh: I’m less active on Twitter these days than I have been in the past, the hell with the Silicon Valley overlords. I’ve gone off Facebook. I’ve of de-Googled everything, and Twitter sort of still hangs out there. But I mean, direct on my website, capitalistexploits.at, and occasionally, you’re right, probably write a bit less than I used to on the free blog. Just very, very busy these days. There, or Praetorian Capital, but that’s just for accredited investors, that’s to personally manage their accounts for people, but which is actually just our portfolio. So, that’s how you can find me.

Frank Curzio: That’s great stuff, Chris. And again, I really appreciate you coming on from New Zealand. Like I said, I don’t know exactly if you’re always a New Zealand when we do these, but I know there’s a big time difference in terms of it’s a different day. So sometimes, we get a little confused with timing and stuff, but I really appreciate you doing this and you’ve done a hell of a job for my investors. You always come on, you always bring it. And I really, really appreciate that man, more than you know, so thank you so much for coming on and giving these guys ideas and more important, giving them where they make money on them because that’s what this podcast is about. So, I appreciate it, buddy.

Chris MacIntosh: You’re welcome. It was good to see you and good to chat and you know, it’d be awesome to actually do one of these in person.

Frank Curzio: Hopefully soon.

Chris MacIntosh: That’s looking like it’s a problematic scenario ahead of us. So, we’ll have to just see how that one pans out.

Frank Curzio: Absolutely. Absolutely. So, all right. Thank you again for coming on, and we’ll talk soon.

Chris MacIntosh: Take care, man. See you.

Frank Curzio: Great stuff from Chris. Make sure to go to Curzio Research YouTube page to watch that video for this interview and all my podcasts, I mean, it’s really, really cool, I’ve put up some charts and figures and stuff like that. So, everything is done in video format at our studio. A lot of work goes behind it, but getting very, very positive reviews. Again, that’s absolutely for free just to watch it on the iTunes, which I know some of you to work out to listen to this, it’s perfectly fine. But if you like to watch it, Curzio Research YouTube page, be sure to go there and subscribe.

Frank Curzio: But Chris always full of good ideas. And he has a system, right? Asymmetric, he’s buying things that are hated that he expects that will re-rate in the future. It’s the reason I’m talking to him, great ideas all the time, and very, very smart. I know he’s made you guys a lot of money, he’s made me money and I love having him on. But this podcast is about you, not about me. Let me know what you thought, frank@curzioresearch.com. That’s frank@curzioresearch.com. Now, let’s bring in Daniel Creech, senior analyst at Curzio Research. Daniel, what’s going on, buddy?

Daniel Creech: Frank, happy Wednesday, lots to go over today. It’s exciting, earning season’s kicking off. So yeah, it’s going to be a lot of fun.

Frank Curzio: I love earning season because after earning season’s over, it’s like, there’s no news. And then they just have, if you watch CNBC, Fox, whenever you watch, they have to inflate some story to make you watch it. But earnings is actually really cool news going on, and that’s where I find the most ideas too, because it’s not just the companies that are reporting right there. It’s just what they’re saying in the conference calls, which I mentioned earlier that are huge, that can lead to more and more ideas.

Daniel Creech: Yeah, absolutely. I mean like UPS, I mean, even though they didn’t give guidance again, but they basically just said, hey, we expect a demand to be huge for the foreseeable future. It’s like, oh okay, huge stock pops what, 7, 11%? Right after earnings? You know them and FedEx, I don’t know how much you touched on it in the past, but we were talking off camera, what, yesterday, day before?

Daniel Creech: You talk about a follow-through from COVID and people adjusting, a lot of things will go back to normal, things are opening up. Hopefully, people get comfortable with going back and saying hello to one another, but there’s certain things you’re going to do and order online that you may not go back to the old way and that’s going to benefit them. I know Amazon’s getting in the shipping business, but hard materials like that in your everyday needs and necessities are great. Waste management reported strong earnings. They’re going to grow, everybody needs their trash taken out and they’re going to grow what, 12 and a half to 13% give or take over the next year? Steady. I mean, Staples are going to be great, man.

Frank Curzio: Yeah. You mentioned too that we did talk offline about this, where you have the stay-at-home stocks. Now a lot of them did fantastic. You look at Peloton and Peloton, I think a lot of people are going to be cancelling that membership, you’re seeing the stock come down a little bit. There’s some, whatever problems with their treadmill or where the safety concerns, I’m not worried about that. I just think a lot of people are going to be like, okay, now I can go outside. I don’t have to pay 40 bucks a month for their service, especially when apple has a similar service where you could pay, I think, $9.

Frank Curzio: Zoom as well is another company as others is stay at home. You know, you’re going to see business so down as the economy opens, but with UPS, what you mentioned is interesting because they’re not going to see a slowdown, because there’s a large percent, I think it was 8% of people spend money on digital advertising, right? It’s like 8% of the market, not digital advertising, but through the internet, that’s how much they spend, right? In retail. That went up tremendously, right, with COVID, because you need to get everything delivered now. People never used Amazon for that. People, familiar with Amazon? Yes, they have it. They never really used it to the point where, I need to get my paper towels delivered and get toilet paper delivered every month, constant. And now that you’re on that plane, you’re not going to come off it because it’s so easy, right?

Frank Curzio: So, you’re looking at Amazon, it’s going to continue to be a beneficiary. And I think you’re going to see that come out of their estimates, and I don’t think you’re going to see a slowdown at all from the reopening trade, which you’re going to see in some of these companies. I think it’s going to benefit UPS tremendously.

Daniel Creech: Yeah. Like I said, that’s hard to argue. Obviously, they just posted a great quarter, stocks reacting well. The funny thing on Amazon, Amazon is a league of their own, they can come out and say whatever they want. They could probably come out and say, they’re going to get out of the online shopping business and the stock will go up. I mean, they’re just doing everything right. They can infiltrate any market they want. It’s incredible. You know, they’re actually playing this politically correctness and fun game in the stock market.

Daniel Creech: Because, you know, the rumor is when they announced earnings coming up, it might be Thursday, I should know that, that’s my fault, unprofessional, but there’s rumors out there they’re going to announce a stock split. And the stock has been moving higher towards 3,500 a share on the news that hey, because why? Because people mentally like to buy cheaper quote unquote smaller dollar amount stocks, so if it goes from 3,500 to say under 1,000 or even a couple hundred or whatever, you’re going to see retail investors bid it up because it’s cheaper all of a sudden mentally. And that’s okay, that’s good for Curzio Research Advisory. That’s a big holding for us, but it’s just kind of funny to see Bezos step away and then them kind of announce this and you know, nothing’s a coincidence in the stock market just like politics.