In 1972, shares of Taco Bell were going through a major correction…

But legendary investor Peter Lynch saw an opportunity.

In just a short time, the stock price had been cut in half—from $14 to $7—despite no obvious issues with the business. Lynch began scooping up shares.

But the correction wasn’t over…

Shares kept sinking, eventually hitting $1—an 85% pullback from the $7 level where Lynch started buying the stock.

But rather than chalk it up to a loss… Lynch kept buying Taco Bell.

You see, Lynch knew the real story: The company had no debt and continued to see strong growth… which meant the pullback in the stock’s price was a great opportunity for patient investors.

As we now know, Lynch was absolutely right…

Once the dust settled, Taco Bell was acquired by PepsiCo (PEP) for $42 per share—making it a 5-bagger from Lynch’s original buy price. Meanwhile, a stock going from $1 to $42 is a 4,100% gain!

That’s the stuff of legend. In fact, it turned into Lynch’s best investment ever.

The moral of the story: Don’t give up on businesses you understand.

Remember… This amazing gain was only possible because of the wicked drawdown in the stock.

It’s a critical lesson for today’s investors.

Right now, many stocks and ETFs are down huge from their 52-week highs. NVIDIA Corporation (NVDA) is off nearly 20%. Another hard-hit stock, PayPal Holdings (PYPL), is down more than 60% from its highs last year. And the ARK Innovation ETF (ARKK) is down more than 50%.

I bet many investors are tossing in the towel right now.

The 2022 bear market has hit the major indices, too. The Nasdaq has been down 20% at certain points this month. And a few weeks ago, we saw the biggest day of stock selling since the pandemic lows.

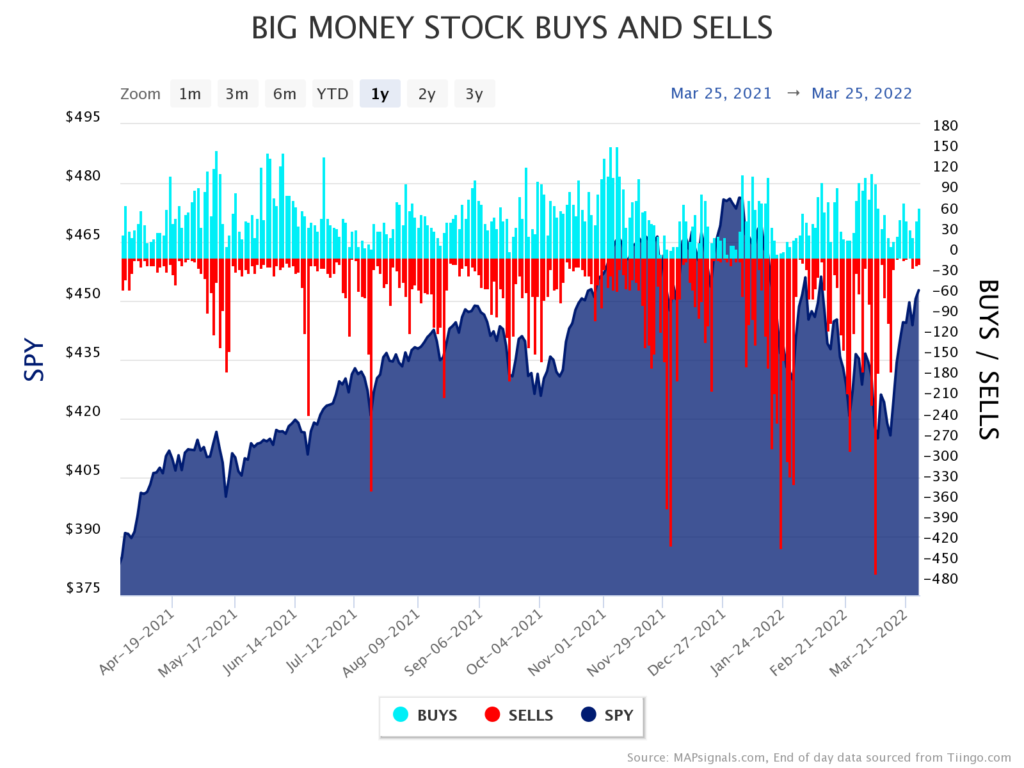

During a market-wide selloff, all stocks get dragged down—the good, the bad, and the barely listable. Below, I’ve included a chart that shows how tons of stocks have been brutally sold recently. Each big red bar represents a day of major selling in the stock market. Notice how the S&P 500 Index (SPY) drops when the amount of selling surges. And notice how there’s hardly any buying on big sell days:

As you can see, there’s been plenty of selling over the past few months. But if you apply Lynch’s mindset, the current bear market is an opportunity…

Some great stocks are feeling the heat… and pulling back sharply. So, my question to you is this: What would Peter Lynch do?

As the Taco Bell story illustrates, Lynch focuses on the long-term trajectory of a business. When you’re confident in a company and its fundamentals, yet the stock price has fallen heavily, it’s an incredible opportunity. But you need to have the right mindset. Giving up because of price action can lead to regret down the road. These pullbacks are part of the game. Take advantage of them!

Lynch has also said if one of your stocks fall 50% and you’re unwilling to buy more shares, you don’t understand the business. Think about that. If a wonderful business (that you’ve done your homework on) gets cheaper… Why would a lower price change your attitude? The answer is: It shouldn’t.

Lynch’s edge was his ability to not be swayed by near-term price action. More importantly, he bought when most investors couldn’t stomach the pain.

It’s why his greatest investment came because of a monster pullback. Had the stock marched higher from the get-go, this amazing story wouldn’t have happened.

This story teaches us why now is a great time to look around the investing landscape. There are undoubtedly some jewels in the rough after the recent bear market…

What do you think? Do you see a Taco Bell-like opportunity? I’d love to hear from you, so send me your thoughts here.

Note: I personally own shares of PayPal Holdings (PYPL) in personal and managed accounts.

Editor’s note:

For some of the best ideas from Wall Street legends, check out The Dollar Stock Club.

This fully-vetted portfolio from Frank’s Rolodex of Wall Street insiders is full of beaten-down stocks set to soar as the market rebounds.