Everyone is talking about inflation. Heck, we’re all feeling it.

I’m sure you’ve noticed the rising prices for everything from groceries to gas, and plenty of other stuff.

The latest data from the U.S. Bureau of Labor Statistics (BLS) confirms the inflation trend. Over the past 12 months, its “all items” index is up 6.2%. That’s the biggest 12-month increase since November 1990!

So, inflation will just keep going up, right?

Maybe not.

Keep in mind, inflation can be tricky to predict. Companies will raise prices when consumers are willing to pay more. But if they raise prices too high, they risk losing sales to competitors.

In short, no one knows what inflation will look like in 2022.

But there’s a good chance we’ve seen the worst of it… and the inflation numbers will settle down next year.

In other words, I think we’re at “peak inflation” right now… meaning inflation has already hit its height and is set to slow over the coming months.

If that’s the case, there’s one sector I want to bet against…

What’s driving inflation

Energy prices are one of the main contributors to the inflation we’re seeing. Looking at the latest BLS inflation numbers above, the energy index was up 4.8%… and gasoline prices increased 6.1%

In short, everyone is feeling the pinch at the pump. Less than two weeks ago, The Washington Post noted:

A main driver of the wave of inflation besetting the country is the price of energy—all forms of energy. Gasoline, diesel fuel, heating oil, natural gas, electricity, and coal all cost more—in some cases much more—than they did a year ago.

President Biden recognizes the situation. Earlier this month, he said reversing the trend is a “top priority” and asked the National Economic Council and Federal Trade Commission for help on reducing energy prices (with an eye towards decreasing inflation).

So, is it possible inflation will calm down in the coming weeks and months? I believe so.

And I’m not alone, according to the latest Big Money data…

The energy sector is slumping

If peak inflation is here, then energy prices are one of the most logical targets to bet on a fall. And if energy prices decline, we should expect a pullback for energy stocks too.

My research shows deterioration in energy stocks. While the major indices like the S&P 500 kept pushing higher this year, institutional investors have (generally) avoided buying energy stocks over the past few weeks. That’s after the group saw monster buying earlier this year.

We can check the situation by looking at the Big Money chart for the Energy Select Sector SPDR Fund (XLE).

More than 43% percent of this fund’s holdings are devoted to two stocks: Exxon Mobil (XOM) and Chevron (CVX). The fund holds positions in 21 leading companies in the energy sector, including ConocoPhillips (COP) and Marathon Petroleum (MPC). It’s the best way to track the sector.

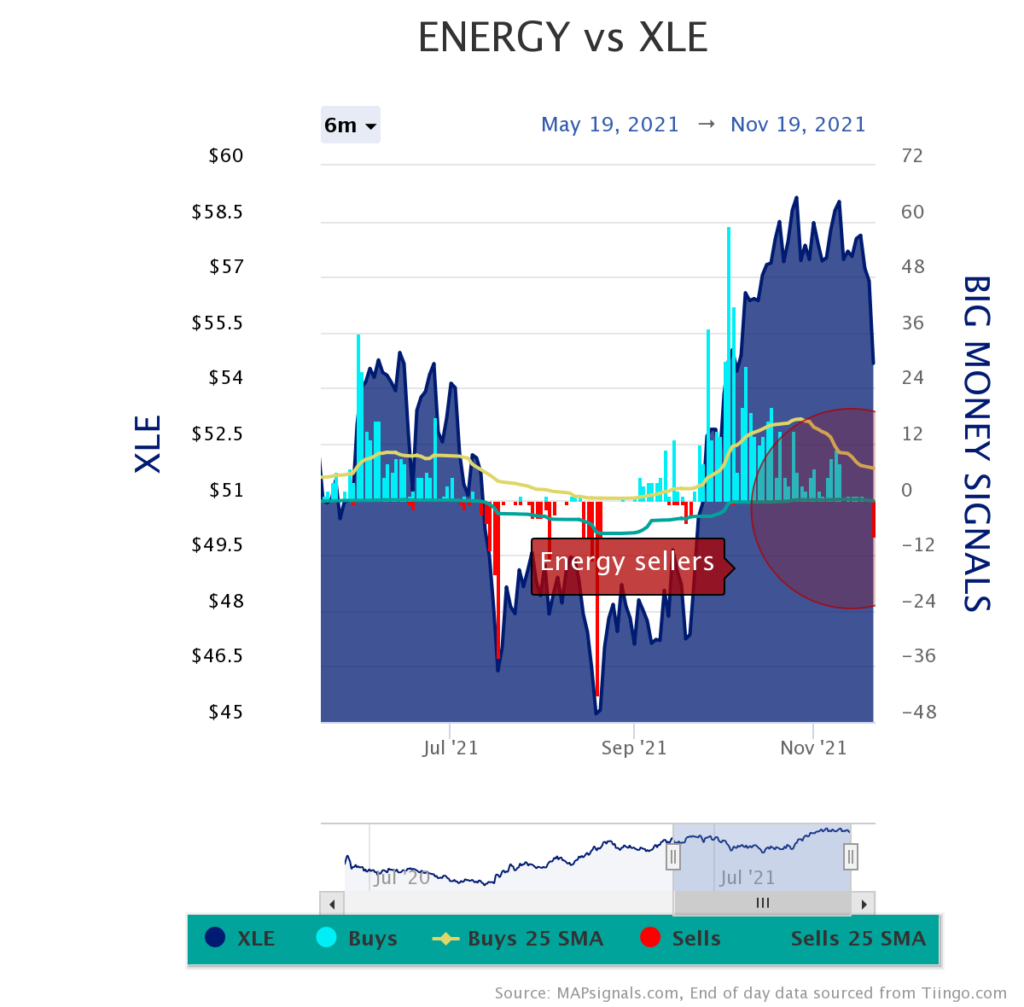

Below, I’ve overlayed the XLE chart with all the Big Money buy and sell signals for energy stocks over the past six months. The shaded blue area shows the fund’s performance… while the blue/red bars indicate the number of buy or sell signals in energy stocks on a given day.

I’ve circled the most interesting part: the decline in buying over the past month. As you can see, there was a big jump in Big Money buying during October (indicated by the spike in blue bars). But the buying has slowed way down in recent weeks… and could turn into selling if the trend continues.

The yellow line going across the chart shows the moving average of daily buying. As you can see, it peaked in October and has been sinking ever since.

This is critical to pay attention to… because when buying slows, it paves the way for sellers to take over. And last Friday, we saw the first selling in months. That’s what the lone red bar (off to the right) tells us.

Let’s dig a little deeper…

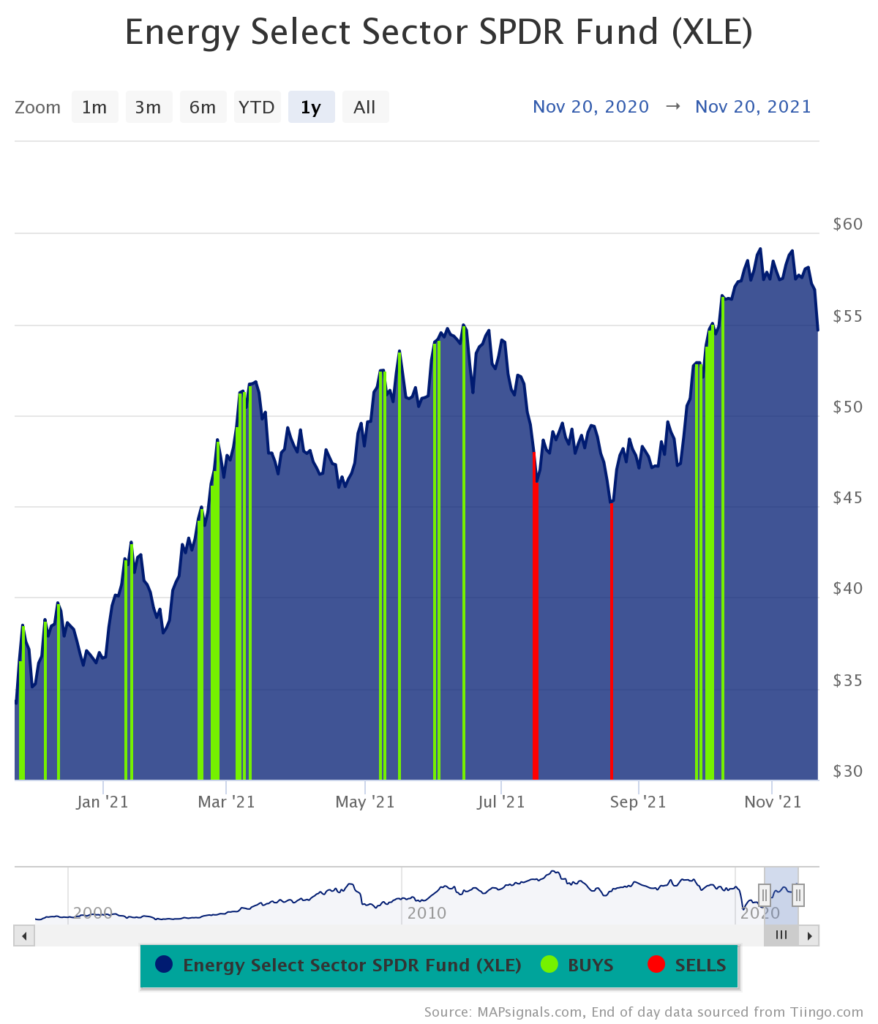

The chart below shows the Big Money action in XLE over the past 12 months. As you can see, there’s been way more buying than selling in 2021 (more than two dozen green bars vs. just a handful of red bars during the summer).

When I glance at this chart now… it looks like it wants to roll over, almost like a tired dog that’s been running all day. After the buying spiked in October, XLE has traded flat… and just touched a 6-week low on Friday.

This downside momentum could pick up if we’re at peak inflation… which means energy prices will trade flat or even decline over the next few months.

And based on the Big Money chart, I think it’s best to step away from energy stocks for now.

P.S. My new high-upside trading service, Big Money Trader, is finally here!

In this service, I’ll be sharing a strategy I’ve used to consistently identify triple- and quadruple-digit opportunities… with a 77% win rate.

Learn all about it—and claim your limited-time launch discount.