Back in the 1990s, a rumor began circulating about a recent episode of The Phil Donahue Show…

Allegedly, Procter & Gamble’s CEO had appeared as a guest to announce his allegiance to the Church of Satan… and that he was paying tithe with “a large portion” of his company’s profits.

The story took on different iterations throughout the ’90s. Some say they heard it on The Sally Show… or The Jenny Jones Show… or Oprah.

Anyone who follows Procter & Gamble (PG) knows how ridiculous this story is. The company has never been anything like a satanic cult. And the rumor is remarkably easy to debunk. Snopes wrote a whole article about it…

PG even went to court over the issue. It successfully sued distributors of then-competitor Amway for spreading the rumor via company voice messages in the 1990s.

Still, the rumor lingered for years.

Amazingly, however, it hasn’t mattered…

PG remains a beloved provider of consumer staples. In fact, during the “Satanic panic” from 1987 to 1999—the rumor’s peak—its revenue grew 120%.

The fact that PG has been unfazed by the long-running rumors goes to show the power of its brands.

The benefits of strong brands during inflation

Brands have huge power over consumers.

If you trust the brand, you’re much more likely to choose it over similar, even cheaper, products. Some brands even foster a level of personal attachment. We all know the meaning of “brand loyalty.”

The power of a brand goes hand in hand with a company’s pricing power… its ability to raise prices without destroying demand for its product. It’s a critical advantage when inflation is running hot.

The best companies have enough pricing power to pass their rising costs on to their customers… without hurting sales.

These are the businesses you want to own during inflation… and even during a recession.

Thanks to its brands, Procter & Gamble has massive pricing power.

Last week, the company reported its latest quarterly results. Organic sales (total sales excluding the impact of the stronger dollar) rose 7% (to around $20 billion)… despite a 3% decline in volumes.

In other words, the company pulled in 7% more money… while selling 3% less stuff.

The reason: A 9% increase in pricing.

It’s not easy to raise prices by 9% and not lose any customers…

One of the best sectors for a recession

Of course, there’s more to PG’s success than just owning strong brands—especially in the current inflationary environment. For instance, you might love a certain brand of car—but that doesn’t mean you’re going to buy a new one when prices—and interest rates—are soaring.

With consumers looking to stretch their dollars further, the best brands are the ones that represent necessities… the items folks will keep buying, no matter how tight their budgets get.

That’s exactly what PG offers. It owns dozens of the world’s most recognizable consumer staples brands, including Tide, Pantene, Bounty, Olay, Oral-B, Braun, and Pampers…

In fact, many of PG’s brands deliver more than $1 billion in annual sales alone. And because these brands represent necessities, they virtually guarantee consistent sales for PG… regardless of the economy.

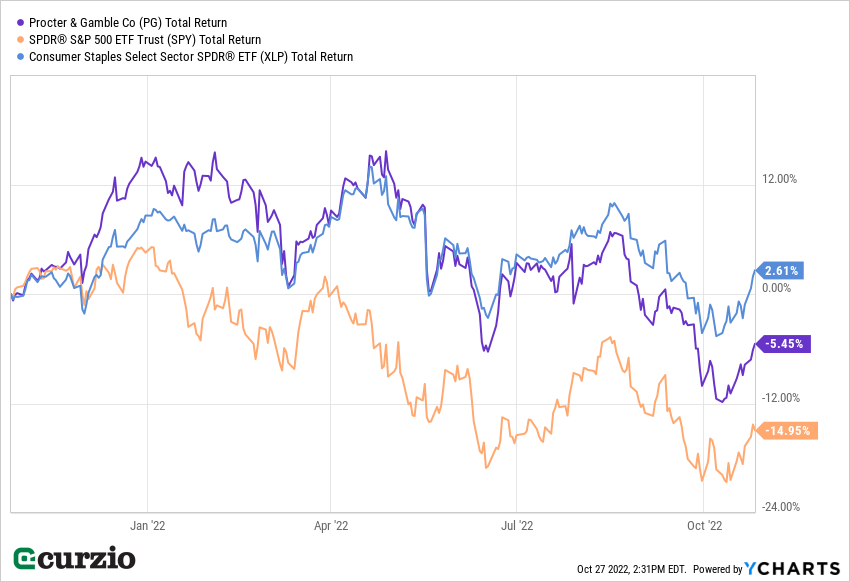

Below, you can see just how well the consumer staples sector—represented by the Consumer Staples Select Sector ETF (XLP)—has performed over the past year…

Consumer staples stocks are known for their market-beating dividends, and PG is no exception: It pays a 2.7% yield vs. the S&P’s 1.8%… and has increased its quarterly payout by more than 22% over the past three years. (For more of my favorite dividend-paying stocks for this economy, join us at Unlimited Income.)

The bottom line: Investors can sleep more soundly at night by owning companies that check two simple boxes: They own strong brands and sell essential products that everyone buys on a regular basis. These businesses generate steady profits… and usually come with less risk.

Whatever the economy, people always need staples like toothbrushes, diapers, soap, and paper goods. (Remember the great toilet paper shortage of 2020?)

PG owns many of the most trusted brands in these spaces. And thanks to the power of its brands, the company can weather the rising costs of raw materials by passing them on to consumers.

After all, we all know we’ll pay a little more for the brands we love.