Talk about a wild year for stocks!

We saw rotation after rotation. What was a favorite one month was a dud the next.

And yet, despite the ups and downs, the bulls still ran. As of this writing, the S&P 500 is up about 23% so far in 2021.

Some of the volatility was unexpected, like with the Omicron variant. And yet, investors knew there would be some rocky days, too (as there are every year).

But now it’s time to look forward…and backward. Today, I’ll:

- Revisit my 2021 investing game plan to see how it did

- Share which sectors I’m betting on for 2022

My report card for 2021

One theme I liked in 2021 was technology—specifically best-in-class ecommerce and digital media stocks. I mentioned a way to play this theme was with the iShares Evolved U.S. Media and Entertainment ETF (IEME).

While it took off like a rocket this year, reaching a 25% return in March, it’s since succumbed to gravity: So far in 2021, it’s down about 4%.

IEME could be a candidate for a rebound because of the quality stocks it holds—like Netflix (NFLX) and Disney (DIS) (I own both in personal and managed accounts). But in terms of 2021 performance, this pick was lacking.

The other tech subsector I liked for 2021 was semiconductors. I suggested the VanEck Semiconductor ETF (SMH) as a play. SMH’s top holdings include some of the best names in semis, including Taiwan Semiconductor Manufacturing (TSM) and NVIDIA (NVDA).

I’m happy to report this one is anything but a dud—it’s up more than 35% so far this year!

My third 2021 play focused on high-quality economic reopening stocks. These were the names that got battered during COVID lockdowns… but were positioned to thrive once economic activity picked up.

The play I highlighted was the iShares Evolved U.S. Discretionary Spending ETF (IEDI). It holds consumer-facing giants like Amazon (AMZN), Home Depot (HD), Costco (COST), and more (I own HD and COST in personal & managed accounts).

So far this year, IEDI is up more than 16%… and based on the strength of its holdings, it could fly even higher next year.

All in all, a minor loss, a big gain, and a respectable (though market-trailing) gain isn’t such a bad scenario.

I’d give myself a B.

Predictions for 2022

I foresee the markets being less rotational in 2022 than they were this year.

Why? I’m just a positive person. I envision a world where COVID-19 concerns are more predictable, and countries are more prepared.

Should that happen, economic activity will flourish and supply chain pressures will ease.

Because of this, I’m particularly bullish on semiconductors (again) for 2022. All-star companies like NVDA and AMD will continue to crank up as growth opportunities for semis grow. Remember: Semiconductor chips are a part of nearly every electronic device, from your smartphone to your car.

So, I’m going to double down and suggest SMH as a solid play again this year.

Below you can see that SMH had zero Big Money sell signals last year:

Next, I’m betting on a sector that’s hated right now: small caps.

Everyone’s calling for continued pain in these stocks… but not me. I predict small caps will rise in 2022.

These names lagged their large-cap counterparts in 2021. This kind of underperformance usually leads to value hunting (as institutional investors look for bargains). Plus, smaller companies will be the biggest beneficiaries as the effects of COVID continue to fade in 2022.

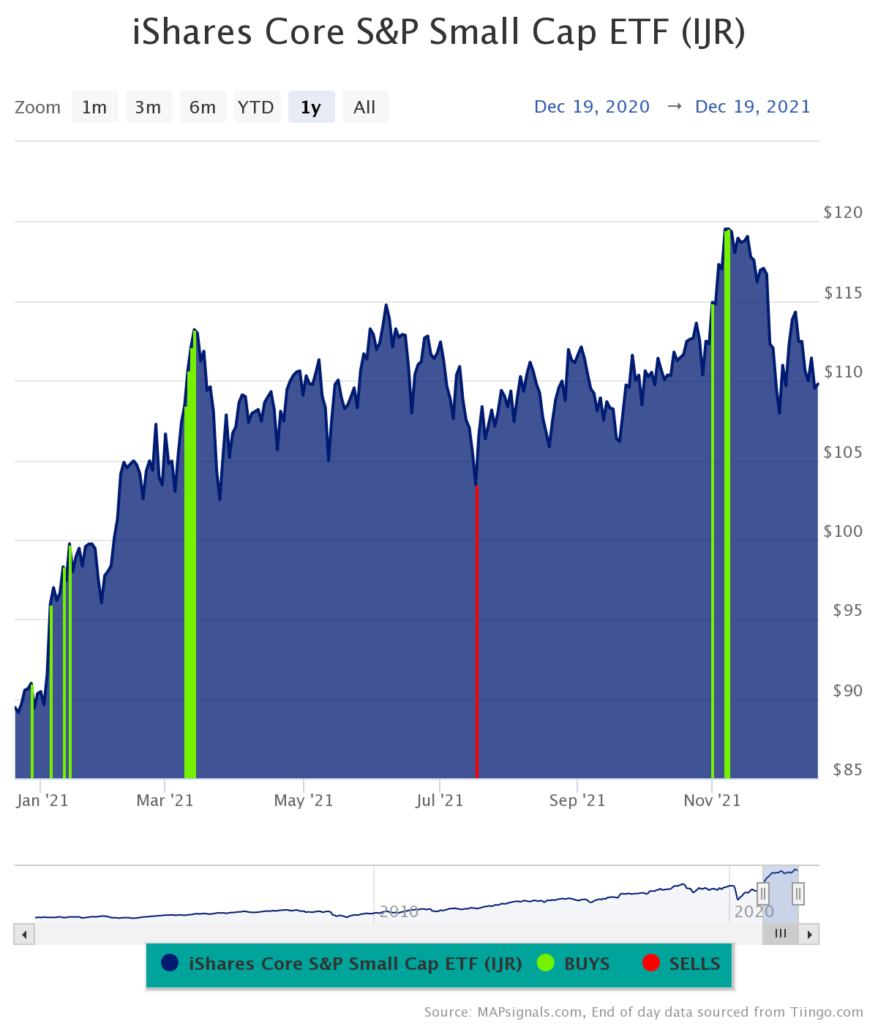

For a play on small stocks, look no further than the iShares Core S&P Small Cap ETF (IJR). This ETF holds several quality names, including winners like Omnicell (OMCL), Kulicke and Soffa Industries (KLIC), and more.

It trades at a forward P/E ratio of 20.6. This is cheaper than the S&P 500’s forward P/E of 21.84.

Below you can see how IJR has been in a relative uptrend all year… I want to keep betting on that strength:

Here’s the bottom line: 2021 was a roller coaster for investors. All things considered, I’m pretty pleased with gains of 35% and 16% next to a small 4% loss on my 2021 picks.

Looking ahead to 2022, I’m sticking with one of my favorite groups: semiconductors… and SMH is an easy way to get exposure to this growth sector. In addition, I want to own small-cap value stocks (via IJR) in 2022. These two funds make an excellent core investment to build the rest of your portfolio around.

Happy holidays, everyone!

P.S. Tomorrow I’m revealing my latest Big Money Report pick—a high-quality retailer I predict will become one of the biggest winners of a reopening economy…

Better yet, thanks to the recent volatility, we have the chance to get into this stock at an incredible discount.

Be one of the first to get access to this stock—along with a portfolio full of Big Money growth picks—by signing up for The Big Money Report today.