If you’re a value investor, rejoice.

Value stocks—the cheaper half of the market—have rallied sharply from their 2020 lows.

Including dividends, these stocks are up 16% this year alone.

And they have plenty more room to run…

Today, I’ll tell you my favorite way to play the value card to its fullest… not only to boost your income, but to inflation-proof your portfolio.

There’s no magic formula that defines value vs. growth.

Essentially, the market is split in half… and the cheaper half is “value.”

Value stocks are the ones with lower price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) metrics than their growth peers.

Accounting for half of the market, value is a large and diverse group.

Some value stocks are cheap because they’re in distress… a classic “value trap” situation.

But many are simply cheaper than growth.

Unlike growth companies, which sell for higher P/Es because of their accelerating profits, value stocks tend to be steady and less exciting.

But many value stocks are safer… Thanks to well-established businesses, stronger balance sheets, and more certain (albeit slower) growth.

Plus, value stocks tend to have higher levels of free cash flow (the cash left over after paying for capital expenses). This cash that can be used to make acquisitions, launch new products, and pay or raise dividends. And growing dividends can go a long way to safeguard your income with inflation.

And when the market is overvalued—like it is today—value is set to gain more fans.

That’s the first reason I like Canada: Its stock market is trading at a massive discount to the S&P 500 (SPX).

In fact, the TSX index, the leading Canadian benchmark, is trading at its cheapest valuation in years relative to the U.S. market: The S&P 500 trades at a forward P/E of almost 23 times (23x), while the TSX demands less than 16x expected earnings—a major bargain.

But it’s not going to last…

The main reason: Canada is a developed country blessed with abundant natural resources.

This makes it a great way to invest in rising commodity prices… with a higher level of safety.

And while a worldwide pandemic put a temporary damper on resource prices… in our post-COVID world, commodities are experiencing a resurgence.

Precious metals… oil… copper and a slew of other commodities are even more critical today than they were before. New industries—such as electronics, green energy, and electric cars—demand these resources.

Plus, precious metals are a natural beneficiary of currency debasing… and benefit from higher inflation.

In fact, during inflationary times, the entire commodity sector has traditionally fared well.

Historically, the TSX does well when the U.S. market is too expensive (like the dot-com era)… and when commodities rally (like in the years preceding the Great Recession).

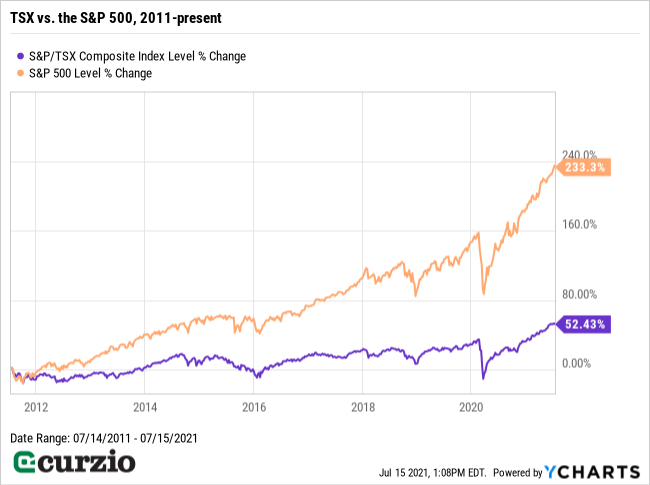

Over the past 10 years, however, the TSX has lost its edge, lagging the S&P by more than 180%.

To make sure we’re not getting caught in a value trap, let’s review the main reason for this decade-long underperformance: commodities.

Canada has plenty of them… and it’s one of the rare developed economies (along with Australia) leveraged to the commodity markets.

And commodities are in rally mode…

An accelerating pace of economic recovery, lower mine output during COVID, supply bottlenecks, the green energy transition, and massive U.S. infrastructure plans have all come together to create a new commodity rush. For many materials, supply deficits are meeting surging demand…

Canada is one of the richest countries in the world in terms of natural resources. It’s the largest crude oil power in North America, and it’s No. 3 in the world in terms of total oil reserves.

And it leads in many other resources, too.

Canada ranks in the top five producing countries for 13 major minerals and metals, including potash, nickel, and uranium.

Commodities are notoriously volatile… as are commodity stock prices.

Although Canada is a developed country, and only a quarter of the TSX is energy and materials stocks, these two sectors are vital to Canada’s overall economy… and have a big impact on the TSX.

Historically, the TSX has done much better when commodities have rallied… and underperformed when commodities were in a downtrend.

With commodities on the uptrend, I fully expect Canadian stocks (and indices) to benefit.

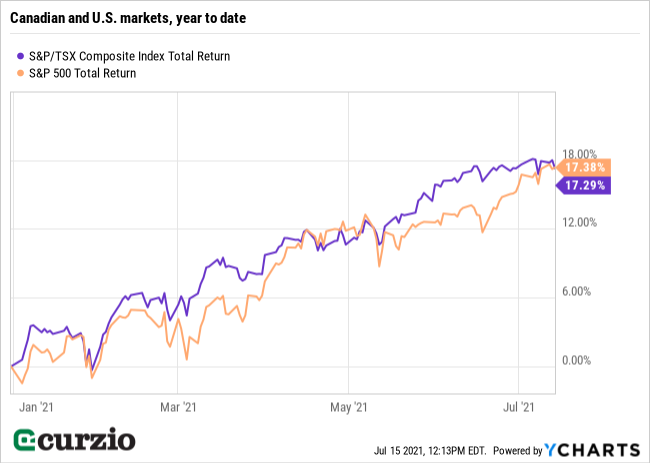

After years of trailing the S&P, Canadian stocks are performing in line with it so far in 2021…

It’s not too late to invest… but more and more investors are catching onto this idea.

That’s because Canada has the best of all worlds: companies leveraged to resource prices… and a relatively cheap, diversified stock market with a built-in level of safety.

Next week, I’ll talk about some easy ways to invest in the Canadian market to take advantage of its bargains.

Editor’s note:

Genia consistently gives fantastic actionable advice in these pages. But her Unlimited Income subscribers get her most profitable ideas first…

Earlier this week, she recommended a commodity stock that’s not only staging an incredible comeback on the rising price of oil… but its green energy initiatives will ensure growing profits for years to come.

With commodities set to soar, it’s the perfect time to become an Unlimited Income member.