We’ve probably all heard this acronym before.

KISS: Keep it simple, stupid.

And if you haven’t… well, there you go.

The concept originated back in 1960 with the U.S. Navy. The KISS principle says that systems work best if they are uncomplicated.

If only I’d had this advice when I started investing…

Initially, I’d envisioned my journey to riches something like this: I would be wearing a wizard hat, staring down 10 computer screens, and whipping stocks around day in and out.

It’s actually hilarious when I think back. I’d bought into the idea that investing was highly complicated.

But it isn’t.

I quickly learned that my personality isn’t drawn to high-pressure situations. For me, emotional decision-making was a huge time and money waster. Eventually I learned that only a handful of stocks were responsible for most of the stock market’s gains (I call these stocks outliers).

Here’s my KISS system…

Follow the Big Money into the best stocks.

See? Simple.

The top two Big Money stocks

The best thing that ever happened in my trading career was when I got a job on Wall Street. Landing my dream job on a trading desk changed how I see the world of investing.

For years, my job was to move big investors in and out of stocks. Sometimes I could do it in an instant, while other times it took weeks.

The lesson I learned from that experience was insanely simple: When big investors pile into a stock, it goes higher. That’s supply and demand 101.

At my firm, MAPsignals, we marry that Big Money knowledge with amazing companies—the ones that grow sales and earnings year after year. This process yields outliers.

To keep things simple, these are the top two stocks with Big Money activity over the first half of 2020:

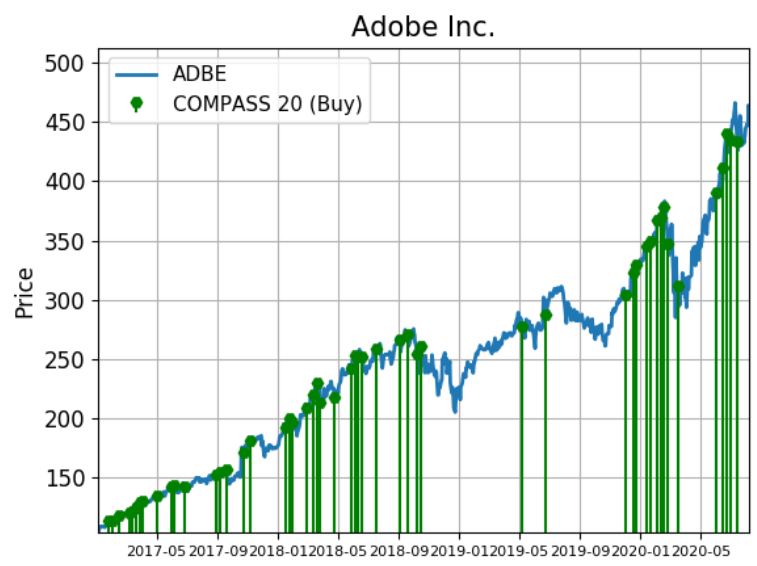

First up is Adobe, Inc. (ABDE). MAPSignals has been following this name for years.

It’s a top stock for two reasons:

- It has tons of Big Money signals (green bars in the chart below)

- It makes tons of cash—i.e., big profits.

This has been a top stock for a long time—a mega outlier. You can see this below, in a chart going back to 2017.

But just since the first Big Money signal in 2020, the stock is up 30.45%.

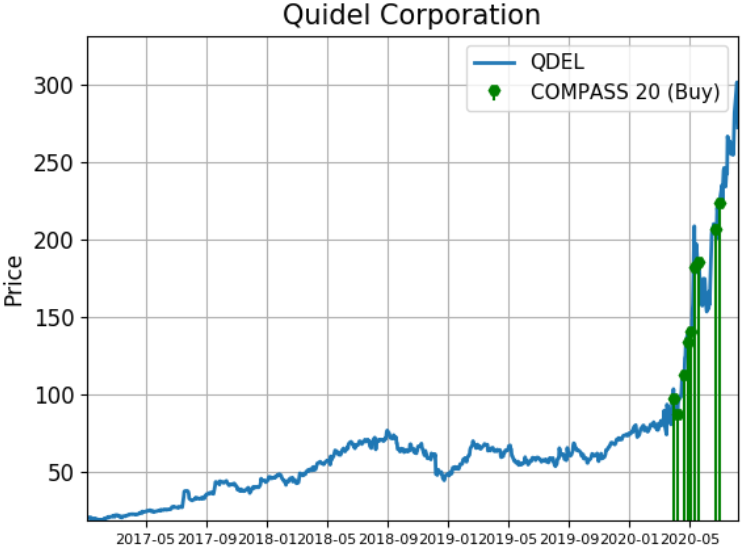

The No. 2 stock is a new one for the firm: Quidel Corp. (QDEL). Check out the chart below, beginning in 2017.

Look at how Big Money ramped things up beginning in 2020. Our belief is that a large investor got involved.

In other words, this stock was a “no-touch” until Big Money came to play. It’s up 263% year to date, and 176% since the first Big Money signal in 2020:

My KISS process is to follow the Big Money.

Year after year, the best stocks trounce the markets. I found a way to keep it simple and so should you.

Editor’s note: Many financial experts—Frank included—are predicting a historic “emergency” announcement by the Fed… one it hasn’t made in 80 years.

If the experts are right, it will result in a huge transfer of funds into one subgroup of stocks that could easily climb 5x, 10x… even more.

The announcement could be made in a matter of days… so the time to get in is NOW. Frank is urging investors to listen to this short video… and use this once-in-a-century event to build real, generational wealth.