Editor’s note: In honor of MLK Day, we’re updating a Curzio Classic from August 2020. Luke Downey reveals a timeless lesson from one of history’s greatest investors… and applies it to the current market environment.

I get asked all the time about my favorite investing books.

And while I have a short list that’s made a huge impression on me, at the top is Reminiscences of a Stock Operator by Edwin Lefèvre. If you haven’t read it, you’re missing out.

Originally published in 1923, it tells the tales of the great traders.

The lessons are timeless… especially the story of Jesse Livermore.

Back then, most stock trading was done by a deep-pocketed few. And Livermore was one of the biggest speculators of them all.

He was known for testing market liquidity by placing small orders and seeing how the stock handled it. Once he got a whiff of where the true liquidity for a stock sat, he’d pounce.

You could say he was the Michael Burry (of The Big Short fame) of his day. Burry made a fortune during the 2008 financial crisis by seeing what others were missing—and shorting derivatives linked to real estate.

Livermore made $100 million by shorting the crash of 1929. That was serious money back then… the equivalent of $1.5 billion in today’s dollars.

His angle: Follow the Big Money.

As regular readers know, I learned to do the same during my years on Wall Street.

Livermore summed it up best: “It never was my thinking that made the big money for me. It always was my sitting.”

What Livermore meant is that most investors fear loss and complicate investing by overtrading. You should keep it simple: Follow what the Big Money is doing.

This message rings louder today than ever before. Markets have gone parabolic since the pandemic broke out in March 2020… And fighting that trend has been a losing game.

For years, “sitting” has been the way to win big… because the Big Money has been pouring into stocks. And that’s where the Big Money Index (BMI) comes in…

The Big Money Index could be telling us something

For years, my partner and I handled monster-sized stock order flows from big Wall Street hedge funds and pension funds.

We took this experience and created a unique way of tracking it at our firm, MAPsignals—the BMI.

The way it works is very simple. If the BMI is rising, stocks should head higher. If it’s falling, stocks should head lower.

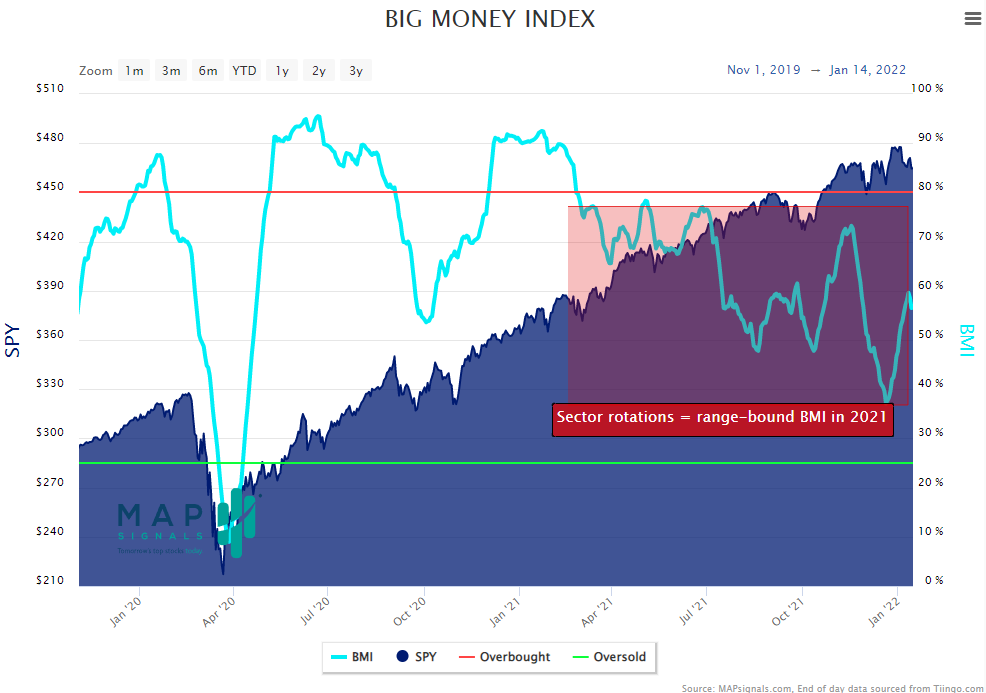

In 2021, we saw powerful rotations. In other words, big investors have been indecisive… moving money in and out of different areas. For example, early in 2021 they were buying “reopening” plays set to benefit as COVID faded… then they shifted into growth stocks… and lately they’ve been buying cyclical sectors like energy and financials.

That’s why the BMI has been pulling back from overbought levels since February. Notice how choppy the action has been in the chart below. I’ve highlighted the important area to focus on: the past nine months. While the broad market generated a 20%-plus gain in 2021, the big sector rotations have kept the market from getting overheated. This has kept the BMI from reaching extreme points (overbought/oversold) for nearly a year.

If Jesse Livermore were around today, I imagine he’d tell us now is a good time to be patient and watch for decisive buying in stocks. That’s usually when the easiest money is to be made.

Eventually this trendless market will shift to a “risk-on” environment (where institutional investors feel more comfortable with the outlook on things like inflation and interest rates). Once that happens, their buying will power the stock market higher.

Remember, patience gets rewarded. I’m a long-term bull… And I’ve learned to use sector pullbacks as opportunities.

But, in the end, “the waiting” is where investors can make the most bang for their buck. Here’s an example…

NVIDIA is a Big Money outlier

There are some stocks that are a cut above the rest—the ones with incredible fundamentals and technicals, which dominate their fields. We call these “outliers.”

When you marry those characteristics with Big Money buying, you can make serious returns.

A clear case of this is NVIDIA (NVDA). The stock has seen relentless buying since 2015.

Below, you can see Big Money has made 67 buy signals over the years. Since the first signal on February 17, 2015, the stock is up over 4,900%!

Anyone who rode that wave and held is sitting pretty.

That’s the secret of investing Livermore knew: Don’t overthink it. Just be on the right side of the smart money, whether it’s stocks or the overall market trend.

If you’ve missed out on some of the monster stocks over the years, start making your list of the ones you want to own now.

Pullbacks are gifts to the patient investor. Eventually, you’ll get an opportunity to buy… and sit.

P.S. I have my own secret when it comes to winning the stock market…

And it’s so simple, anyone can do it…

All you have to do is buy certain stocks… at certain times.