I get asked all the time about my favorite investing books.

And while I have a short list that’s made a huge impression on me, at the top is Reminiscences of a Stock Operator by Edwin Lefevre. If you haven’t read it, you’re missing out.

Originally published in 1923, it tells the tales of the great traders.

The lessons are timeless… especially the story of Jesse Livermore.

Back then, most stock trading was done by a deep-pocketed few. And Livermore was one of the biggest speculators of them all.

He was known for testing market liquidity by placing small orders and seeing how the stock handled it. Once he got a whiff of where the true liquidity for a stock sat, he’d pounce.

You could say he was the Michael Burry (of The Big Short fame) of his day…

Livermore made $100 million by shorting the crash of 1929. That was serious money back then… the equivalent of $1.5 billion in today’s dollars.

His angle: To follow the Big Money.

As regular readers know, I learned to do the same during my years on Wall Street.

Livermore summed it up best: “It never was my thinking that made the big money for me. It always was my sitting.”

What Livermore meant is that most investors fear loss and complicate investing by overtrading. You should keep it simple: Follow what the Big Money is doing.

This message rings louder today than ever before. Markets have gone parabolic… And fighting that trend has been a losing game.

Over the last five months, “sitting” has been the way to win big. But that won’t always be the case. That’s where the Big Money Index comes in…

The Big Money Index could be telling us something

For years, my partner and I handled monster-sized stock order flows from big Wall Street hedge funds and pension funds.

We took this experience and created a unique way of tracking it at our firm, MAPsignals.

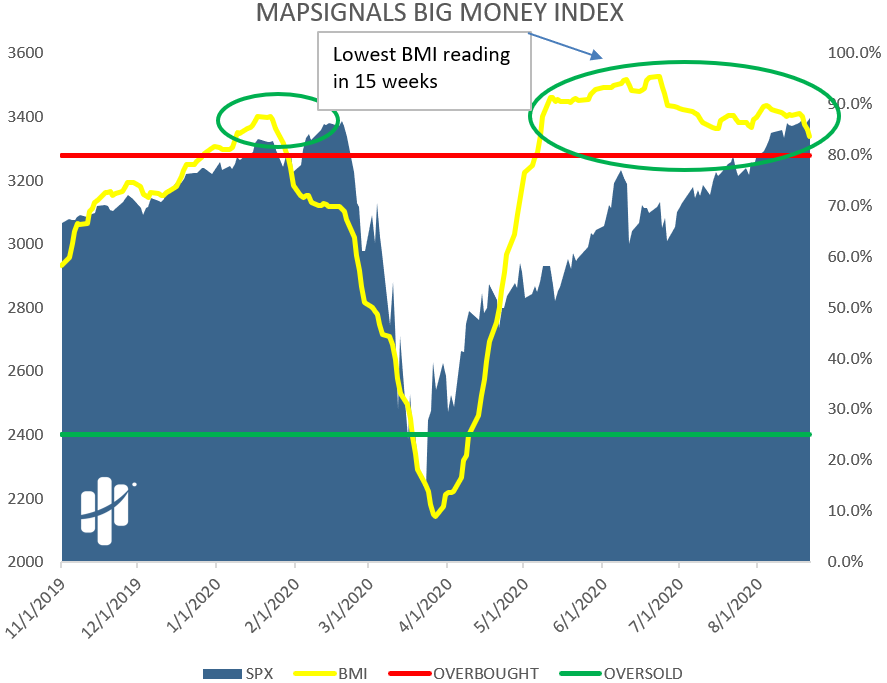

Our tracking system, shown below, is called the Big Money Index (BMI).

The way it works is very simple. If the BMI is rising, stocks should head higher. If it’s falling, stocks should head lower.

In 2020, we’ve seen the most prolonged overbought period in my firm’s 30-year dataset: 15 weeks. But recently, the BMI has started to pull back:

I’ve circled what’s important: Once the BMI begins to fall, it could spell trouble for the market. It’s falling because fewer and fewer stocks are going up with Big Money buying.

If this trend continues, it could be a great setup. I’m a long-term bull, and I use pullbacks as opportunities.

But, in the end, “the waiting” is where investors can make the most bang for their buck. Here’s an example…

NVIDIA is a Big Money outlier

There are some stocks that are a cut above the rest—the ones that have incredible fundamentals and technicals. We call these “outliers.”

And they dominate their field, too.

When you marry those characteristics with Big Money buying, you can make serious returns.

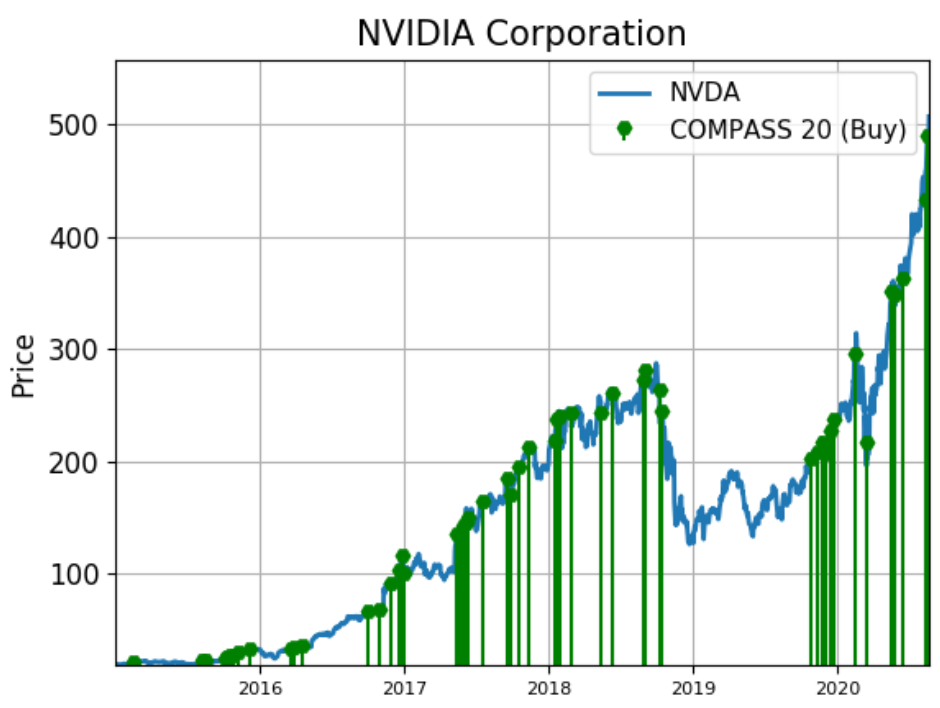

A clear case of this is NVIDIA (NVDA). The stock has seen relentless buying since 2015.

Below, you can see the Big Money signals it’s made.

That’s 51 Big Money signals. Since the first signal on February 17, 2015, the stock is up over 2,253%! Anyone who rode that wave and held would be sitting pretty.

That’s the secret of investing Livermore knew: Don’t overthink it. Just be on the right side of the smart money, whether it’s stocks or the overall market trend.

If you’ve missed out on some of the monster stocks over the years, start making your list of the ones you want to own now.

Pullbacks are gifts to the patient investor. Eventually, you’ll get an opportunity to buy… and sit.

Editor’s note: Not sure what to put on your buy list? The Minneapolis PD (along with 150 other police departments in America) is now testing an incredible new device that could be the future of policing. Make sure your portfolio is positioned before this tiny tech firm takes off…