“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

The above quote comes straight from Warren Buffett’s 1986 annual letter to Berkshire Hathaway shareholders. It’s one of his most timeless quotes… and one of the most important for investors in the current market.

Everyone is worried about inflation, rising interest rates, and a likely recession… The data shows the crowd is already panicking—and selling stocks in a big way.

You might be scared and tempted to sell, too.

But if Warren Buffett is right… that means now is actually a great time to buy stocks. In fact, the latest filings show he’s using the recent declines as a buying opportunity.

And as I’ll explain, the latest data agrees a big opportunity is here… and that the market is likely to zoom a lot higher over the next 12–24 months.

The massive selling in ETFs is sending a clear message

Exchange-traded funds (ETFs) are a great way to get exposure to a specific sector or the entire market.

As you probably know, an ETF is a basket of securities (similar to a mutual fund). When you buy an ETF, it’s like buying dozens—or even hundreds—of stocks instantly.

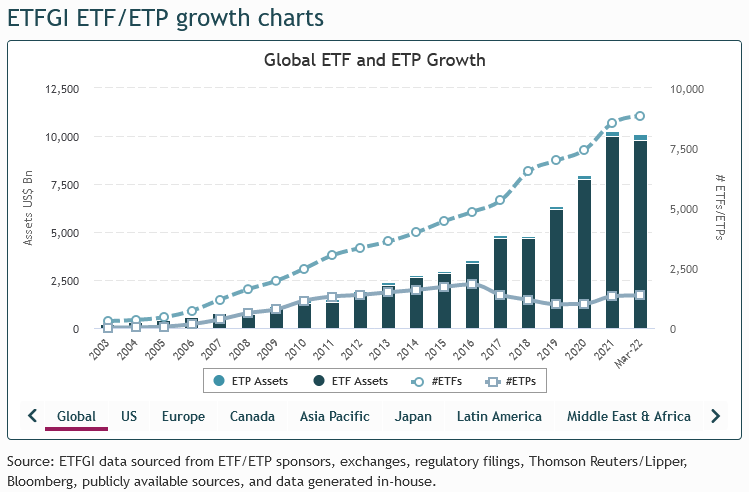

According to independent research firm ETFGI, there are more than 8,800 ETFs in the market today. Altogether, they hold almost $10 trillion in assets. As you can see in the chart below, ETFs have become a huge part of the market over the past decade:

And they can give us a valuable look at what investors are doing…

In today’s shaky environment, plenty of folks are selling their stocks and heading to the sidelines. In other words, they’re scared… and we can see that fear in the latest ETF action.

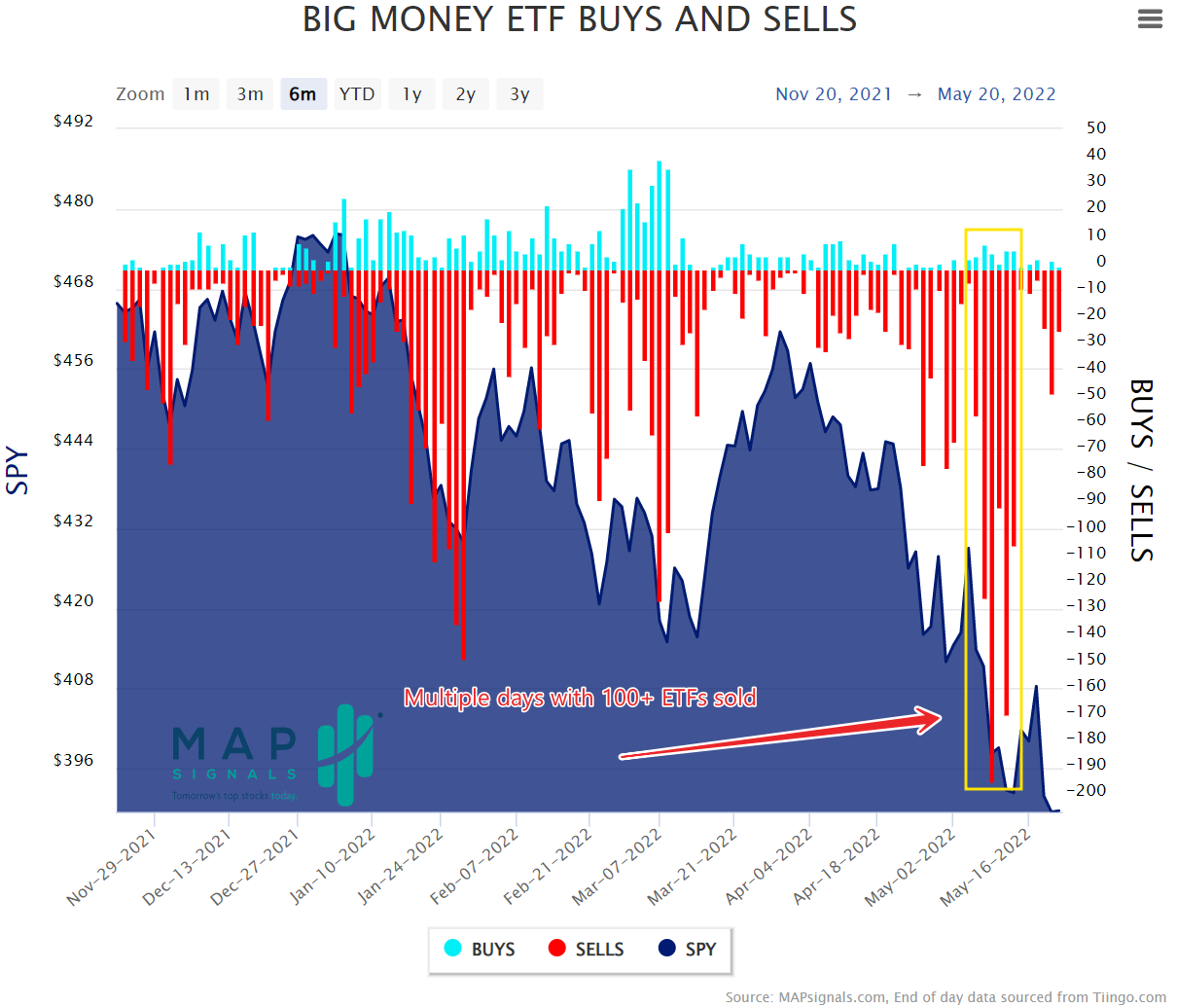

Below, I’ve included a chart of the daily buying and selling in ETFs over the past six months. Blue bars indicate the number of ETFs ramping higher on increasing volume (a sign of big buying). And the red bars tell us how many ETFs are being sold each day:

As you can see on the right side of the chart, there’s been huge selling in ETFs this month. Notice all the steep red bars (boxed off in yellow). Over the past couple of weeks, we’ve seen multiple occasions where 150 ETFs were sold in one day. That’s more selling than at any point over the past two years.

Put simply, the data shows folks are fearful. They’re scared of rising interest rates, 40-year high inflation, and a possible recession.

But if you’re a long-term investor, a bear market is typically a huge opportunity to generate above-average gains…

How big selling leads to big future profits

Extreme selling in ETFs doesn’t come around often. According to MAPsignals data, the amount of ETF selling in May is approaching pandemic levels.

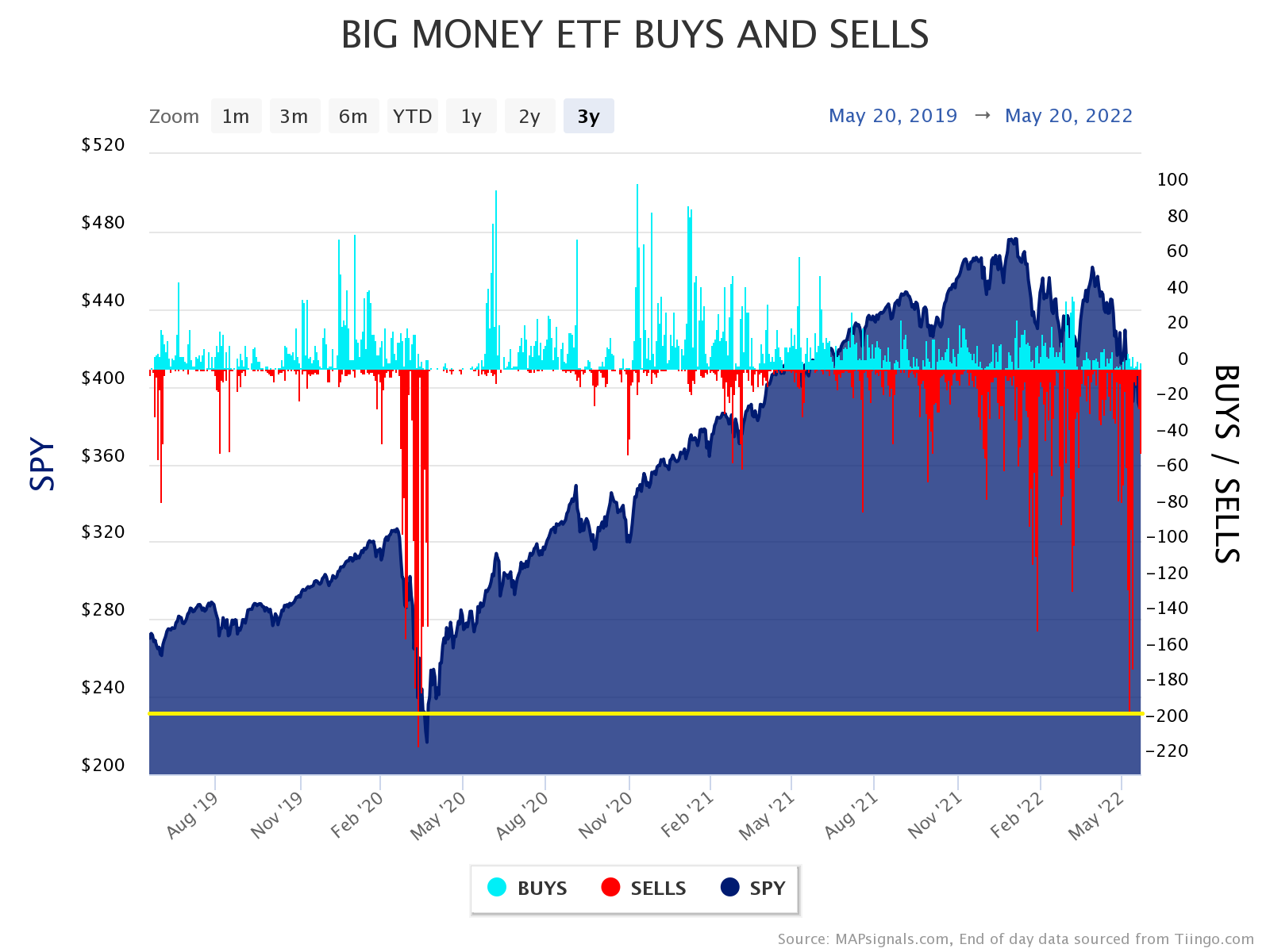

To put the recent selling into perspective, I’ve included another chart below. It’s similar to the previous one, but stretches back further so we can see the massive selling that happened when COVID hit in early 2020. On the right axis, you can see that nearly 200 ETFs generated sell signals last week:

Notice the yellow line that stretches across the bottom of the chart. It shows how ETF selling has almost hit the same levels we saw at the pandemic low in March 2020.

In the short term, the data is scary. It’s tough to hold steady as others are running away from stocks.

But the truth is: This kind of panic selling usually leads to double-digit gains over the next year.

That might sound crazy… but experienced investors are familiar with this phenomenon. It’s the key concept behind Warren Buffett’s quote above.

You see, once investors fully appreciate the negatives (like inflation and a likely recession)… it means those factors are already “priced in.” In other words, investors won’t be surprised if future numbers—like economic data, interest rate hikes, or inflation—are ugly.

Don’t take my word for it… Look at the data below.

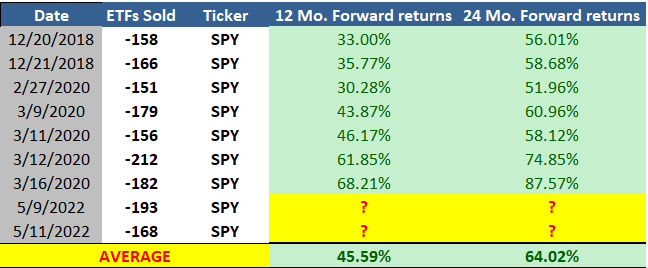

I’ve put together a table showing the seven times in ETF history that selling topped the 150 mark. (We hit 193 last week). This data goes back to 1993, but keep in mind that there’s been an explosion in the number of ETF listings over the last few years. So the 150 threshold has only been able to be triggered in recent years. Nonetheless, it’s a powerful bullish signal.

To show how the stock market performs after this extreme selling, I’ve included the one- and two-year performance for the S&P 500, represented by the SPDR S&P 500 ETF Trust (SPY):

As you can see, if you’d bought SPY every time the ETF data showed 150-plus sell signals, your average gain would have been over 45% in just 12 months. And if you’d held SPY for the next two years, your average gain would have been over 64%.

These results show why the current bear market is a major opportunity for long-term investors. When other investors are throwing in the towel, it’s likely the market is putting in a bottom… and sowing the seeds of the next bull market.

That means it’s time to be greedy, not fearful.

P.S. Later this week in The Big Money Report, I’ll reveal my latest recommendation…

A financial stock getting Big Money love in 2022—and poised for double-digit gains in the coming months.

To find out what it is as soon as it’s published—along with the names of other stocks I’m scooping up on this pullback—join The Big Money Report.