The official start date for the Atlantic hurricane season was June 1, 2020.

Anyone who’s lived through a hurricane knows how devastating they can be. The wind and water destruction are unparalleled.

Thankfully, meteorologists have the tools to help predict when a storm is forming and where it’s likely headed. We can use these predictions to prepare by stocking up on supplies and securing our homes.

Markets have hurricanes from time to time, too… and the action in March was a Category 5.

Using my data like a weather radar, last week I warned to beware the extreme greed gaining momentum in the markets… that eventually this buying would boil over and become fear.

And boy, was that the right message.

Since then, two market benchmarks—the iShares Russell 2000 ETF (IWM) and the SPDR S&P 500 ETF (SPY)—have fallen nearly 10% and 6%, respectively.

As I’ve been saying for weeks, markets are extremely overbought and due for a pullback. Peak exuberance is here… but the best time to invest in stocks isn’t when people are clamoring to buy them—it’s when they’re dying to get out.

Thursday’s 6.75% pullback in SPY was like a sudden, nasty hurricane… And with it came the dangerously high waters that hurricanes often leave behind. FOMO buying may be the tide that lifts the market… but investor greed is the storm surge.

And just like high tides eventually recede, buying mania will eventually become a pullback…

The Big Money Index is falling

There’s one force that ultimately determines the market’s direction: supply and demand. After years of handling billions of dollars in Wall Street trades, I learned to pay attention to the buying and selling habits of large trading firms—the “Big Money” buyers and trends.

When Big Money is flowing in, stocks race higher. When it’s flowing out, stocks fall.

Right now, the Big Money stopped buying… and there’s a very good chance it means they’re prepping to get out of stocks.

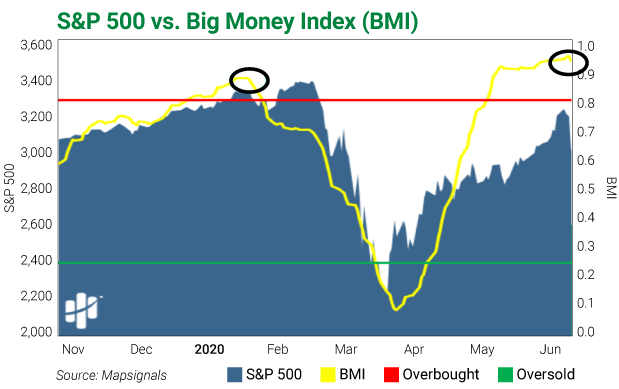

Below is the Mapsignals Big Money Index. It is a proprietary index that measures the estimated buying volumes of the Big Money players. All major U.S. indexes correlate to Big Money buying, so I use the well-known S&P 500 as a benchmark.

If the BMI is at or above the red line, then the market is overbought. As you can see, we’re extremely overbought right now… The market’s storm surge is high.

Right now, the BMI is the highest it’s been all year… But the BMI has just started to fall over the last two days. That’s the circle to the right. I’ve also circled early February—the last time we were overbought and the BMI fell.

As you can see, the BMI decline was well in advance of the pandemic pullback in the S&P 500 that occurred weeks later… And just like in early February, I fully expect the BMI to continue falling from here in the days and weeks ahead.

The phases of Big Money

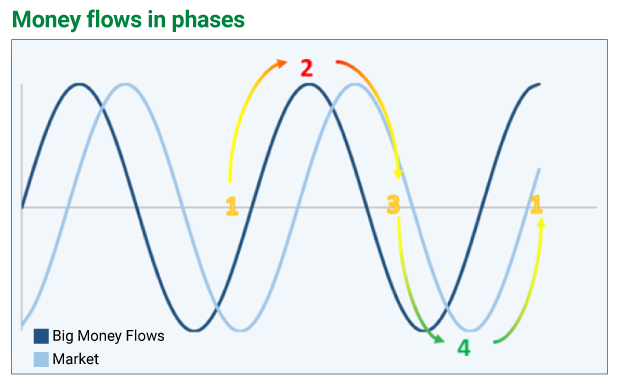

A simple way to visualize where we are in the stream of things is to look at the four phases of Big Money market flows. Like hurricane tides and much else in life, buying and selling moves in waves.

The four phases are:

- Liftoff: Big Money buying is huge, and selling is nearly zero.

- Market peaks: Big Money buying slows and selling begins.

- Fear begins: Big Money buying slows significantly and selling intensifies.

- Peak fear: Big Money buying is nearly zero, and selling is huge.

When buying slowed last week, we entered Phase 2. Sellers are now matching buyers, which is a huge change from the massive buying we’ve seen recently.

This is a warning.

Phase 2 is typically the near-term peak for the market… i.e., high-water levels. And since the beginning of market hurricane season in March, the buying has gotten out of control.

If you’re wondering what to do with your money in today’s market, now is the time to be on guard. The best time for bargains is when market fear rises and stocks pull back… Personally, I’m preparing by moving cash to my brokerage account and getting a buy list ready.

Right now, the market radar is predicting another hurricane. What you do with your money today could be the difference between being prepared… and being caught without toilet paper, batteries, or water when the waves come crashing in.

Editor’s note: When it comes to hedging your portfolio against market hurricanes, our Moneyflow Trader advisory has a proven track record in times of market crisis. It even returned triple-digit gains on 5 hedges during the recent downturn.

If you’re not already a subscriber, here’s how you can get started today.