Back in the early 2000s, the entire country was enthralled by the success of Ken Jennings—who was in the midst of a record-breaking winning streak on Jeopardy. Jennings would finish with a run of 74 consecutive wins—which remains the longest winning streak in the show’s history.

It took 75 games for a human opponent to take down Jennings.

But it only took one game for a supercomputer to do the same.

In 2011, Jennings and Brad Rutter (another of the show’s most successful contestants) faced off against IBM’s state-of-the-art artificial intelligence (AI) program—Watson.

Watson decisively won.

Unfortunately for IBM, it was a little too early to the AI party… While Watson represented an exciting breakthrough, IBM’s customers and investors struggled to find practical applications for the new tech.

Still, Watson gave us a glimpse of the possibilities that come with AI… and paved the way for the hottest tech trend since the dot-com era.

And despite Watson’s commercial flop, IBM is still in the AI race.

Today, I’ll explain how AI will contribute to IBM’s future success… and why its growth potential makes the stock downright cheap at current levels.

Let’s start with a look at the updated Watson…

There’s room for more than one AI

Watson (rebranded as watsonx) has come a long way since its days beating Jeopardy champs…

Today, its expanded capabilities include tax preparation… cybersecurity… and customer assistance.

IBM is positioning watsonx as the go-to solution for businesses to make sense of their proprietary data… and create useful, AI-based applications. In other words, IBM aims to use watsonx to help turn its customers’ data into valuable solutions/products.

Watsonx is the perfect AI for these applications because of its statistical processing capabilities—which set it apart from “deep learning” AIs like ChatGPT.

I don’t want to get too deep into the weeds here, but the short version is that ChatGPT’s software is great for imitating human interaction and answering questions… whereas watsonx’s more “scripted,” predictable processes are better at managing data and streamlining/automating workflows for applications where you don’t necessarily want surprising, “off-the-cuff” responses.

(It’s worth noting that watsonx also has some “deep learning” capabilities—but it’s not the focus of the software. It’s also worth noting that there’s room in the AI space for both types of operations to succeed, as they each have their own particular benefits.)

The bottom line: IBM quietly continues to carve out a slice of the AI pie, which will be a huge growth driver for the company over the next several years.

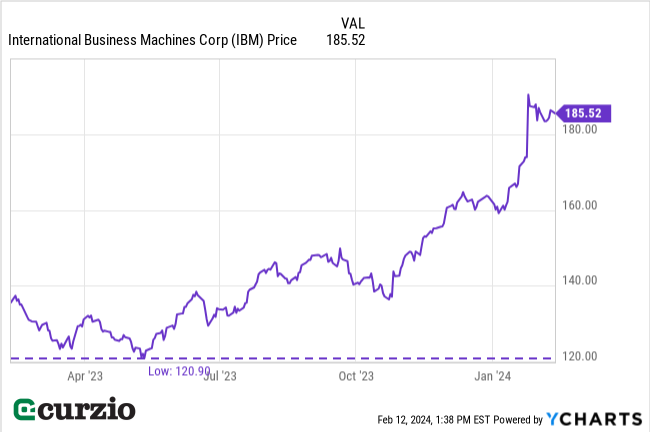

As a result, IBM is trading near a new 11-year high.

But it’s not too late to invest in this century-old company.

Here’s why…

AI exposure without the hype

Unlike other AI-related companies, there’s no market frenzy surrounding IBM.

For one, unlike other rallying tech names, it has no direct stake in ChatGPT.

As I mentioned above, IBM isn’t planning to compete with ChatGPT. The company’s AI systems are business-oriented as opposed to public-facing. In other words, the public has no access to IBM’s AI, which means we can’t test it like ChatGPT… and most folks know little about it.

To add to the mystery surrounding IBM’s AI, it hasn’t released a specific revenue or profit number for investors to hang their hat on. This makes it harder to create excitement around the company’s AI potential.

Meanwhile, investors haven’t forgotten the hoopla surrounding the original version of Watson… and how IBM couldn’t bring it to the next level. In short, investor expectations are low.

As a result, IBM has stayed firmly outside the AI bubble.

And this creates an opportunity for the company to blow investors’ expectations out of the water…

In fact, it’s already happening…

IBM had a solid 2023—particularly the second half…

In the third quarter (Q3) alone, its generative AI business raked in “the low hundreds of millions,” according to CEO Arvind Krishna. By Q4, this demand roughly doubled. While the number is vague (and might seem low for this multibillion-dollar tech behemoth), the doubling in just one quarter is huge news.

And according to its Q4 earnings report, the company expects revenue growth of mid-single digits for 2024—much better than the 3% analysts were calling for.

Excited investors see the potential and have been bidding up the stock.

As you can see from the chart below, the stock has rallied 52% in eight months.

And the stock price has way more upside as IBM captures its portion of the AI market.

Here’s the best part: Despite the recent rally, the stock remains quite cheap.

Today, it’s selling at just 18.4 times (18.4x) next year’s expected earnings—vs. 22.5x for the S&P 500 and 30x for the tech-heavy Nasdaq 100 (not to mention Nvidia’s 35.5x or Microsoft’s 35.9x).

Put simply, IBM offers exposure to the AI megatrend… without the sky-high premiums attached to the market’s leading AI stocks. And investors will collect a 3.6% dividend (vs. the market’s 1.4%) as they wait for more upside.