The extraordinary market action this past month has turned one of the most basic principles of investing on its head…

That is, the assumption that stocks and bonds move in opposition to one another.

Many stocks have been weak for a reason during the COVID-19 crisis: their businesses are harmed more than others. And while a slew of companies will exit this period stronger than before… some will cease to exist.

But what about bonds?

After all, while bankruptcy usually wipes out shareholders’ equity, debtholders can often recoup at least some of their investment.

This is why bonds are typically safer than stocks.

Moreover, over time, bonds and stocks have historically moved in different directions. The expectation that bonds will rise when stocks drop has served as the basis for diversifying among these asset classes.

But the massive market disruption over the last month means even this investment dogma is no longer reliable…

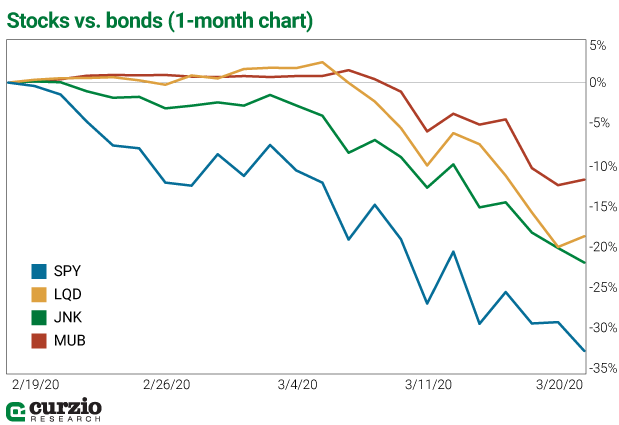

In just a month, from February 19–March 20, 2020, the S&P declined 32.4%.

But bonds declined as well… with several major bond categories all down by double digits.

Municipal bonds (munis)—represented on the chart by the iShares National Muni Bond ETF (MUB)—declined 11.7%.

Corporate debt declined much more… Junk bonds—the SPDR Bloomberg Barclays High Yield Bond ETF (JNK) on the chart—were down 21.7% in just over a month, and investment-grade bonds—the iShares Trust iBoxx Investment Grade Corporate Bond ETF (LQD)—lost 18.6% of their value.

Bonds exhibit an inverse relationship between yield and price: As the price of a bond declines, its yield moves higher—and vice versa. This is why a sharp decline in bond prices also indicates higher borrowing costs—not desirable in a contracting economy.

Moreover, they’re not called “junk” bonds for no reason. These are the lowest-rated debt obligations, issued by companies in trouble, overleveraged, or both. Again, lower prices mean higher yields on these bonds. This is normal in an environment of economic stress, where lenders must contend with higher risks of such companies.

But the similar decline on higher-rated, investment-grade bonds—those that represent quality borrowers—was troubling… a sign of an all-around panic. Just like during the Great Recession (2008/2009), investors—motivated by the need for cash—abandoned bonds and stocks alike.

And just like in the Great Recession, this indiscriminate selling is yet more proof of market stress.

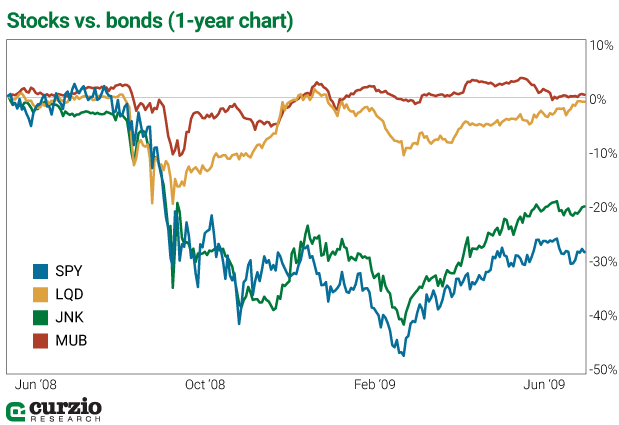

But this time, the action was even worse than 12 years ago. Even in the darkest days of the Great Recession, when the stock market lost more than 50% of its value, the decline in bonds wasn’t as sharp… or as uniform. Quality bonds—the investment-grade section of the market—as well as munis held their value much better than the junk bond group.

That’s why the Federal Reserve had to move quickly.

On Monday, the Fed announced an enormous $2 trillion liquidity package to inject stimulus into the economy. And buying bonds is part of that plan.

These bonds will include corporate debt, as well as the more typical U.S. treasuries and mortgage-backed bonds.

For the next six months (ending September 30), the Fed will be able to buy intermediate and short-term bonds directly from U.S. companies with investment-grade credit ratings… and lend to those companies directly.

The Fed can now buy corporate bonds outright… and exchange-traded funds (ETFs) that invest in such bonds.

This is drastically new—the Fed has never before had to buy corporate debt, let alone ETFs.

The exception is junk bonds—buying junk debt isn’t part of the Fed plan.

The Fed’s bold bond-buying action is already helping bonds recover…

In the first four trading days of this week, investment-grade debt recovered sharply—and outperformed its “junky” counterpart. LQD rallied as much as 14.8%, while JNK added about half as much, up 8.8%. Muni prices rose, too, adding 12.5% in just four days.

Congress’ economic rescue package will help all types of bonds. It includes about $500 billion dedicated to backing loans and assisting businesses… in addition to financial help to state and local governments.

Plus, the Fed is adding liquidity just when it’s so desperately needed. However, bond investors—especially retirees—can’t fully relax…

For one, if staying safe is your priority, you should steer clear of junk bonds.

While this low-rated debt offers higher yields, it remains very risky. Remember, the companies issuing low-rated bonds were under some duress even before this market rout started.

And even though investment-grade debt is now backstopped by the Fed, remember that deteriorating businesses typically result in debt downgrades. When this crisis is all said and done, many investment-grade companies will have been downgraded.

The Wall Street Journal reports that bond downgrades have already begun in earnest.

As of this Tuesday, Standard & Poor’s made more than 100 downgrades linked to the coronavirus… such as airlines (JetBlue and Spirit)… office-sharing company WeWork… and large mortgage bond-backed retail properties.

I still recommend diversifying in stocks and bonds. But to stay safe, invest in high-rated bonds… and don’t chase yield.

P.S. In early February, my colleague Frank Curzio predicted stocks would crash. They did. He predicted the earnings of dozens of companies would be crushed. They have. He even predicted the government would cut rates and pass a stimulus to try to calm the markets. They did both. What’s happening next? That’s the focus of Frank’s new 5-minute video.

Warning: His predictions will probably shock you. [Facebook censored his last report.] Click here to watch it now.