The market has finally caught up with the coronavirus pandemic.

As we all know by now, earlier this month—just a couple weeks after trading at all-time highs—the market crashed into bear territory. As nations continue struggling to contain the coronavirus, there’s no saying precisely when they’ll recover.

What we do know is that in hopes of cushioning the economic blow, governments around the world are injecting stimulus… contemplating bailouts… and lowering rates to practically 0%.

This begs the question: Where can investors go for income in a zero-rate world?

Dividends.

The unprecedented market conditions haven’t left any market sector unscathed—including dividend stocks. And because no company is immune to the economy, we can expect significant changes in the way income strategies are executed from this point on… and at least for the next couple of years.

For income investors, this market is a prime example of why safety comes first…

The recent crash in the price of oil has almost immediately resulted in Occidental Petroleum (OXY) cutting its quarterly dividend by 86% (from $0.79 to $0.11 per share)… and threatens dividends for more energy companies.

A temporary halt in car production has caused Ford (F) to suspend its dividend… hotel REIT DiamondRock Hospitality (DRH) suspended its dividend after a dramatic decline in reservations… Boeing (BA) is considering cutting its dividend… and the list goes on.

Just like everything else around us, income investing has become much more challenging.

More than any point in the past decade, safety matters. Stock selection matters. And, as always, your individual situation—your investment timeline, your overall liquidity, or your need for cash from your investments—also matters.

But even in the middle of a downturn, dividends remain a sound strategy…

And if you choose to reinvest those dividends, you’ll continue to build a bigger position buying at lower prices—and collecting even more dividends in the future.

Assuming the world doesn’t end here, investing won’t either. The best and the strongest will continue generating free cash flow and paying dividends, and many companies now being forced to cut or suspend dividends will restore them when economic conditions improve.

We don’t have many similar economic examples to fall back to, but we can learn some lessons from prior market crashes.

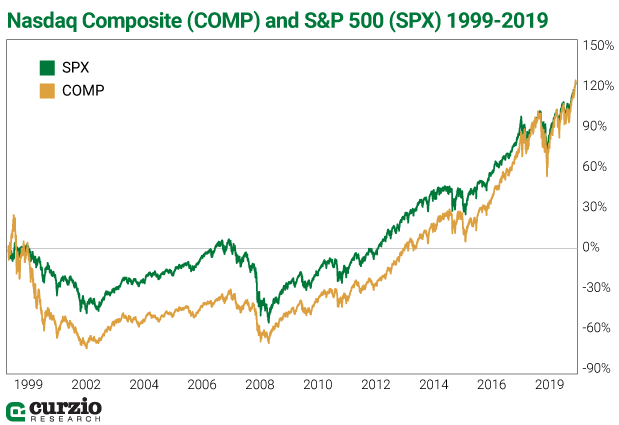

Let’s look at another recent historic market crash: The dot-com selloff.

The Nasdaq and the S&P 500 were both hit heavy by this market bust (although the Nasdaq bore the brunt).

In 20 years, the total value of corporate dividend payments jumped 3.5 times (3.5x)—from $373.5 billion in 1999 to $1,340.7 billion in 2019—much faster than the approximately 2.3x market appreciation over the same time.

More importantly, corporate dividends had exhibited much less volatility than the market.

From 1999 on, the only period the total amount of corporate dividends declined was during the Great Recession. As soon as the recession was over, dividends recovered—and then some. From $622 billion in 2009, they more than doubled by the end of 2019.

Over my 20-plus years studying the markets, I’ve learned trying to time market action with any real precision is an impossible task.

We can do our best to anticipate the market’s next move, but there will always be an element of unpredictability from one day to the next.

Over time, though, the market has always trended higher. And dividends contributed to a significant part of total returns.

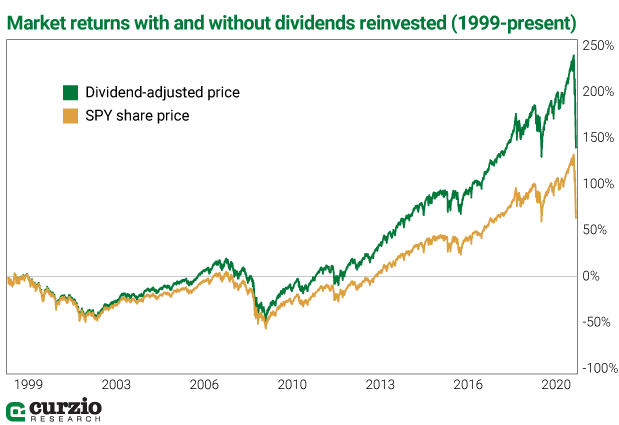

Take a look at the chart below. It covers the same 20-year period as the chart above…

Despite all the turbulence of these two decades and the past few weeks, had you invested $1,000 in an ETF representing the S&P 500 (I used the SPDR S&P 500 ETF [SPY] in the chart above) on December 31, 1999, you’d have more than $1,600 (a 63.8% gain) today.

With dividend reinvestment, you’d have $2,382… more than double your money at 138.2%.

That’s the undeniable power of dividends. Even in times of crisis, unpredictability, and 0% rates, a steady dividend income stream can make all the difference… and even beat the market.

P.S. In early February, my colleague Frank Curzio predicted stocks would crash. They did. He predicted the earnings of dozens of companies would be crushed. They have. He even predicted the government would cut rates and pass a stimulus to try to calm the markets. They did both. What’s happening next? That’s the focus of Frank’s new 5-minute video.

Warning: His predictions will probably shock you. [Facebook censored his last report.] Click here to watch it now.