Many investors are baffled by the market’s recent surge.

After all, we’re living in one of the most difficult economies ever: Unemployment not seen since the 1930s… double-digit economic contraction… fearful consumers and ongoing trade wars. This combination of circumstances doesn’t seem to agree with the stock market action.

The surging market of late has one large underpinning: unlimited quantitative easing (QE) by the U.S. Fed—a policy that essentially translates to unlimited money-printing.

Interest rates are on a downtrend. Short-term rates are already at zero, thanks to the Fed emergency rate cut executed this March.

Naturally, Treasury bond rates for all maturities have declined sharply.

While we started the year with the benchmark 10-year Treasury note yielding 1.88%, it closed yesterday at just 0.64% yield. In normal economic conditions, this would be considered extremely low, even for the shortest-term government borrowings.

As a result, Treasury prices are rallying. (Remember: Bond prices and yields move in the opposite direction.)

The Fed’s policies have been a boon to the stock market—where free money is everything.

But unlimited QE is not a panacea for our economic woes… We’re only beginning to understand the enormous effects the coronavirus is having on the world economy.

As Frank and Ed Karr discussed on this week’s Wall Street Unplugged, the market is pricing in fundamentals companies cannot predict. Most are waving earnings guidance for the next quarter—and for the remainder of 2020.

In other words, there’s still more downside risk to the market. And it’s important to own portfolio hedges.

Today, I’ll show you a simple hedge that takes advantage of the decline in interest rates. This trend is likely to accelerate… as central banks continue to cut rates in hopes of staving off economic disaster.

We can’t beat central banks.

So my advice is to join them…

With the Vanguard Extended Duration Treasury ETF (EDV). It has all the hallmarks of a good investment and a strong hedge against market risk.

EDV isn’t your typical treasury. It’s an exchange-traded fund (ETF) composed of long-dated, zero-coupon Treasury bonds.

EDV deals with Treasury STRIPS, which stands for “separate trading of registered interest and principal of securities.”

With STRIPS, the principal and the coupons trade separately (the coupon is the actual interest payment on a bond).

Since the principal—called the zero-coupon bond—is stripped of its coupons, it doesn’t deliver any payments over the course of its lifetime. So it typically trades at a large discount to its face value—that is, until the time of maturity… when the entire face value of the bond is recouped.

As with any bond, the price of a zero bond moves in the opposite direction of interest rates.

But since zero bonds don’t pay any interest, they tend to be impacted much more significantly by interest rate fluctuations than do coupon-bearing bonds. That means if interest rates continue to fall… zero bonds will increase more sharply than coupon bonds.

This makes zero bonds more leveraged than coupon bonds, and thus a better market hedge.

For instance, with long-term rates sharply lower (and negative interest rates—as defence against the falling economy—not completely off the table), EDV has significant upside.

Historically, too, EDV has rallied during sharp market declines.

We all know past performance isn’t a guarantee of future success…

But take a look at the chart below. It plots the price action for EDV vs. the market during and shortly after the Great Recession.

In 2008–2009, the stock market was crashing—down more than 50% before rebounding. During the same time frame, EDV rallied as much as 55.6%.

As the market kept falling, EDV kept rallying, peaking in December 2008—three months before the market bottomed out.

The two investments ended up almost even at the end of this three-year period.

What’s the explanation?

Just like today, the U.S. Fed was busy cutting interest rates. And like today, investors were looking for a place to hide from the volatility of the stock market… Long-term treasurys were their ultimate safe haven.

Of course, as you can also see from the chart above, investing in EDV isn’t a riskless proposition.

Timing can be everything—as it was with EDV back in 2007–2008.

Just like with any investment, had you bought at the top (in or near December 2008), you would’ve lost money.

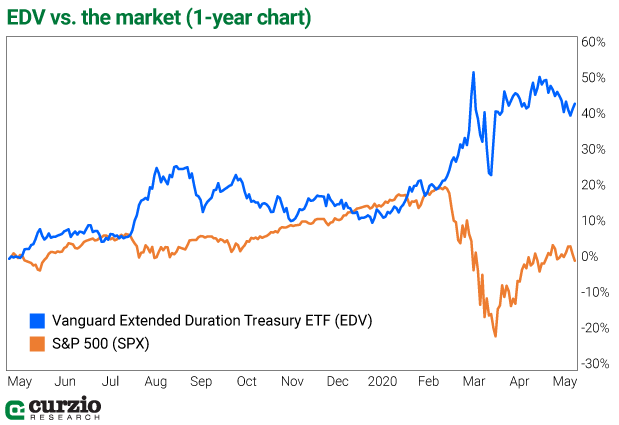

But take a look at what’s happened to EDV since the market began to slide this February.

As you can see, thanks to the 2020 rally, EDV is now up more than 40% over the last 12 months vs. the market… which is essentially flat.

But it’s not too late to buy this hedge, even at today’s levels.

Consider that going forward, two factors will remain in play…

On the one hand, treasuries’ traditional safe haven role is reinforced by the worldwide economic contraction… as well as the reserve currency role of the U.S. dollar. This creates demand… and drives prices up.

On the other hand, the U.S. is on a borrowing spree, including the recently announced $3 trillion debt issuance.

This excessive supply is a factor in Treasury prices moving lower.

If the economy contracts more than expected, or if the market sells off again, the former factor will likely prevail… with Treasury prices moving higher as a result.

Remember, EDV isn’t a typical treasury ETF… since it’s composed of Treasury STRIPS, it’s more leveraged than straight bonds to the overall level of interest rates and to the economic environment.

This means EDV will outperform its long-dated Treasury peers on the way up… although it will underperform them on the way down.

It also makes EDV an instrument uniquely suited to serve as a hedge against a market decline.

In sum, the Vanguard Extended Duration Treasury ETF (EDV) is a great way to protect your portfolio AND profit… with a single trade.

Editor’s note: In today’s issue of The Dollar Stock Club, Ed Karr recommended another fantastic way to hedge against market uncertainty… one you want to take advantage of immediately.

If you’re not familiar with The Dollar Stock Club, members get a thoroughly vetted stock pick every week from Frank’s Rolodex of industry experts.

It’s one of the easiest ways to stay diversified in a volatile market… and at $1 a week, this club is a no-brainer.