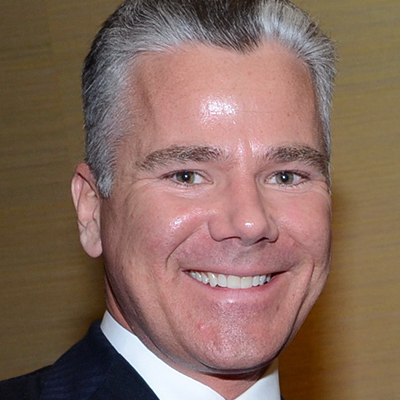

This week, global financial expert and U.S. Gold Corp. CEO Ed Karr joins me again live from Italy to discuss the current state of the markets and the coronavirus.

Ed shares an update on life under lockdown in Italy… his thoughts on the gold market… and his favorite ways to invest as the price of gold moves higher. [28:48]

Ed also discusses one of the biggest risks he sees today, and why you must pay attention to it. [36:17]

The markets are pricing in a return to normal by next year… and that’s just crazy. In today’s education segment, I break down why there’s still a lot of risk—and opportunity—in today’s market, and explain the key metrics to focus on when investing in growth companies. [1:02:24]

Frank Curzio

Ep. 721: If you think we’ll be back to normal in 2021... think again

Wall Street Unplugged | 721

If you think we'll be back to normal in 2021... think again

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on main street.

Frank Curzio: How’s it going out there? It’s May 13th. I’m Frank Curzio, host of the Wall Street Unplugged podcast where I break down the headlines and tell you what’s really moving these markets.

Frank Curzio: So, the lockdown in Florida is officially over. Not that we were really on lockdown anyway, and I live in Northern Florida, closer to Georgia Porter, South Palm Beach, different places.

Frank Curzio: Yes, they were on lockdown a little bit more than we were, but now restaurants are open. We can eat inside as long as you’re practicing social distancing, which they took out a lot of tables.

Frank Curzio: Hair salons opening up I think next week. It was supposed to open up this week. I think they pushed it to next week.

Frank Curzio: UFC, if you’re a sport fan, the only sports that are going on right now, I believe, outside of in China since on ESPN, you’re seeing highlights of baseball in China with nobody in the stands. It doesn’t get better than that. But UFC, UFC matches are being fought in Jacksonville.

Frank Curzio: But the lines around my neighborhood, they’re pretty long, especially for fast food. Things like Starbucks, anything with a drive-through, and beaches now open, people just dying to get outside.

Frank Curzio: I mean, in Florida, not dying to get back to work. This is Florida, remember, it’s different. And I called three different people to do work on my house over the past three weeks and all three of them didn’t show up. Three for three. It still surprises me. It still surprised… I can’t get over that. I can’t. It’s the way it is. You know when something is the way it is and you’re supposed to get used to it? I don’t know why I just can’t get used to it.

Frank Curzio: We could get the New York outta me, where people would fight for jobs like that, and these are big jobs. I mean, 700 to a thousand dollar jobs. I need my trees trimmed, which are terrible right now. It’s just landscaping, things on in the house and replacing the windows since they’re really old. It’s like big jobs. People are like, “Yeah, I’ll be there.” I don’t know, maybe it’s me. Maybe it’s me. I don’t know, it’s crazy.

Frank Curzio: Anyway, I say this all the time. If you have kids that hate to work, send them to Florida, best place to live. Anyway, looking at our lockdown, I have to say I wish the lockdown was still in place where I live. Right off the bat and I’m driving to work about, it’s only about a five-minute drive, and I usually stop at Starbucks and grab my tea. Yes, make fun of me. I’m a tea guy, I thank my mom for that. Not coffee, but I pull out of my complex and now there’s more people out and there’s a stop sign.

Frank Curzio: But you can’t see the road unless you pull in front of the stop sign. So, everybody stops at the stop sign and inches up. But there’s like a walkway there across the street. So, I’m inching up, inching up, inching up, and people are like, “You can’t see it,” because it’s like trees on both sides.

Frank Curzio: So, I’m inching up and then I finally seen my stop and it’s like a 70-year-old couple and they just stop right in front of my car and look at me and just shake their head. They just shake like, “What was I supposed to do? “I’m not gonna hit you. “I got to move up. “I got to see if cars are coming before I go.”

Frank Curzio: But right off the bat, it gets right back to normal. And this is just people walking by. And remember, I’m in my car for about five minutes, give it 10 minutes waiting on the Starbucks line because there’s a short stretch that I go on to that has two lanes. So, it has two lanes in each direction. Again, this is right a day after the lockdown. And some lady’s drive, completely cuts me off, and sometimes that happens, that’s fine. But of course, no blinker, no nothing. I mean, sometimes you’re in your blind spot, whatever, I get it. It happens to all of us. Now, completely cuts me. Doesn’t even know. Doesn’t even know, right?

Frank Curzio: So, then I pull up toward the light and I look at her and she’s on her phone talking, and she just looks over and she’s probably in her 60s. She just looks over and she shakes her head at me like, “What are you doing?” I’m just looking at her going, “Are you kidding me? “I mean, is this for real?”

Frank Curzio: And then as I’m pulling into Starbucks, of course, which again I do a lot, I like Starbucks, love it. But I pull into the drive-through and I’m about to just get on line and some guy rushes and cuts me off, like badly cuts me off. Not like you’re both coming in from different sides and it’s kind of even. The guy saw me and cut me off. I’m like, “Man.”

Frank Curzio: I have to tell ya, I’m losing patience here. I’m probably going to move. I just don’t like the environment for my kids. But man, people talk about New Yorkers and being mean. You’re crazy. I lived there all my life. People will help you, they’ll do anything for you. They’re impatient, yes, it’s fast paced, but here, man, just people are angry. I mean, it’s always been like that. Maybe it’s more because people have been home and they’re losing patience. I don’t know, but it is pretty crazy.

Frank Curzio: But I like to hear from you as well. I joke around about Florida, but it’s no joke. These are real stories. When my friends come here, they laugh, they listen to podcast and they’re like, “Oh, that’s a funny story.” And they’re here for a week. They’re like, “Oh my God. Everything you say is absolutely true.” I say, “I’m not kidding.” It’s weird here, but that’s here.

Frank Curzio: Now, states are opening up one by one slowly, which is good news for stocks until Tuesday. So, on Tuesday, the NASDAQ did something really, really, really unusual. It went down. I know it’s crazy. NASDAQ, technology sucks, they went down. And going up like every single day for five weeks. Outside of a few day periods, that’s it? But went down alongside the rest of the markets a little bit more than the markets. And that’s surprising these days considering on Friday after, not before, but after we reported the worst job number on record, 20 and a half million American workers lost their job.

Frank Curzio: Now, unemployment rate is close to 20%. Something we’ve seen almost ever since the 30s. It says 14 and a half. It’s not including furlough employees that may come back. I mean, there’s just so many different things that they’re trying to sugarcoat these numbers. They’re terrible. They’re terrible.

Frank Curzio: And now we look at an earning season where we’re halfway through. So, a lot of big names are gonna report this week, next week, but the new consensus, since they report, in the new consensus earnings for 2020 for the S&P 500, they’re in and that number is $127.

Frank Curzio: Now, what does that mean? It means all the earnings combined, the S&P 500, we combine them all, all of them, forward earnings for the year for 2020 altogether, they expect to generate $127. That number was $175 in January. So that’s a decline of close to 30%, and that may be conservative because half the company or 50% of the S&P 500 right now, and you still have a lot of companies to report, have removed their guidance. Removed their guidance.

Frank Curzio: So, analysts was speculating, “Oh, right, “maybe we’ll see based on what you reported this quarter, “what you said about next quarter, Q2, “we’ll figure out, okay, maybe a 10% decline.” No, this is with the 30% decline. That’s what they’re expecting.

Frank Curzio: So, based on that number, the S&P 500 is trading at 24 times forward earnings. 20 year average is 16 and a half. I would say it should be trading more like, I’d say 18, 18 and a half, because the 20-year average does not include low interest rates, favorable tax structure. You got to throw that in, right?

Frank Curzio: You got to see earnings much higher because they’re paying lower corporate taxes and also you have more debt being issued, especially this week, holy cow, Disney, everybody. I’ve seen more secondary offerings than debt offering just in the last couple of days than I’ve seen, right? The stock prices are higher. Hey, smart. Role of value, this is the time to do it. This is when you want to raise money, when you stocks are over-valued, right? You want to issue more shares. Who cares what the stock does after that? You just raised all that money at your share price a lot higher, and you’re seeing that like crazy. But the valuation right now is close to a 20-year high, 24 times forward earnings.

Frank Curzio: Now, what does that mean? It means we have a market surging higher while earnings are crashing. Hey, you guys, I’m hoping that you’ve learned as much from me as I’ve learned from you since I’ve been doing this podcast for 12 years. Can you send me research on any other time you’ve seen that? Ever? A market surging while earnings are crashing? Think about that.

Frank Curzio: I mean, earnings really started coming down in 2007 before 2008 crash. We saw earnings coming down for everything. If you go back to the tech bubble, earnings and sales were growing. We got crazy expensive into March, 2000 before the dot-com crash. Earnings were growing. They should’ve been growing much, much faster to justify those valuations.

Frank Curzio: But earnings were growing, sales were growing. Usership, people using the internet were growing while stock prices were ramping high before it crashed. Today is not the case. I mean, at that 125 earnings number for the S&P 500, again, this is assuming a 30% decline and it could be optimistic. It could be optimistic because a lot of these companies are pulling their guidance and everyone’s expecting things to be okay by year end.

Frank Curzio: They threw away the V-shape. I don’t know if it’s gonna be V-shape, W, whatever, pick whatever, whatever you want. Now they’re like, “I don’t think anybody believes.” I heard that on CNBC, someone said, “I don’t think anybody believes “that there’s gonna be a V-shape recovery.” Well, that’s what everybody’s been saying for the past three months since it’s happened. The V-shape’s come right back. It’s come right back. The numbers don’t suggest that. Companies are telling you that it’s not gonna happen. Yet the market, is it that forward looking?

Frank Curzio: Let’s talk about that for a minute. Because I’m just talking about the S&P 500 here, The S&P 500 trading at 24 times forward earnings. That’s nothing. Nothing compared to the NASDAQ 100, the largest technology companies in the world, which is now trading pretty close to 30 times forward earnings. And to put that in perspective, it’s been close to 20 years since we’ve seen this type of valuation on tech stocks and the tech bubble.

Frank Curzio: But, at 29 times forward earnings, that’s based on 2020 estimates, right? And I get it. 2020 is a throwaway where I’ll jump on that bandwagon, whatever. 2020 is a wash. All CEOs when they’re reporting should say, “Look, we’re removing guidance. We have no idea what’s going on, and we’re all going on vacation and your stocks are gonna go higher right now.” That’s the market we’re in, can’t control it. It doesn’t matter.

Frank Curzio: They report one positive thing and everything else is a disaster. Remove guidance. We don’t know what’s going on. Stocks are going up because 2020 is nothing because this is gonna go back to normal in 2021, right? So, none of this stuff exists. Pretend 2020 never even existed, okay?

Frank Curzio: I just beat that to death, I know, but there’s a reason why. Because when we look at 2021 and let’s look at that for a minute. So, it is 29 times forward earnings, which you are today, which NASDAQ 100 is trading at 22 times forward earnings mid-February, pre-coronavirus, when things were great before all this stuff really, really started spreading in the US.

Frank Curzio: But let’s take a closer look at basically the largest member in NASDAQ 100 depending on what day. Sometimes it’s Microsoft, but it’s Apple. And I’ve talked about Apple before. I’m not trashing Apple here at all. I just want to explain something to you, why this is important. Because right now, we’re trading at levels that 2020 doesn’t exist and 2021 is gonna be fine. There’s no one that could disagree with that. That’s what we’re trading at. That’s what everybody believes. That’s where the market is.

Frank Curzio: If you listen to CBC, you listen to consensus, you listen to analysts, that’s what they believe. Forget about what you believe. Forget about what I believe. Forget about main street. That’s the consensus. That’s what they believe. 2021 is gonna be great. Not just great, it’s gonna be better than pre-coronavirus ’cause that’s where we’re trading at. We’re trading at high evaluations.

Frank Curzio: So, when I look at Apple, in January, pre-coronavirus, stick with me. I’m just gonna give you a couple of numbers and this is important. I’m taking Apple on purpose ’cause it’s the biggest company. So, pre-coronavirus, Apple’s estimates, they’re expected to earn $14.60 this year, 2020, and $16.25 in 2021. So solid growth expected.

Frank Curzio: Again, pre-coronavirus, 5G phone coming out. Service revenue starting to really ramp up. I get it. Today, today Apple is projected to earn $12.20 for 2020. Again, that’s down from 14.60. Throw that out. Let’s throw that out, right? 2020 doesn’t exist, but in 2021, you know what the consensus estimate is? It’s $14.50. So, pre-coronavirus, it was $16.25. Now it’s 14.50.

Frank Curzio: Let’s throw this in perspective. Put all this in perspective here. Since everyone believes 2021 things are gonna go back to normal, right? But in January, Apple traded at $300 a share and was projected to generate $16.25 in earnings for 2021. Today, Apple is trading at $315 a share, 5% higher, just 3% off its all-time high. Yet earnings for 2021, again, not 2020, it’s a wash, are only expected to come in at 14.50.

Frank Curzio: So, we have a stock price that’s surging while earnings growth is slowing considerably. So, the market is trading right now based on valuation. I mean, even if it was trading at 21, 22 times earnings, the NASDAQ 100 at 30 times and the market at 24 times, it’s assuming that Apple should be generating not just 16.25 a share, which was your pre-January numbers, that it should be closer to $17 a share in 2021. That’s what we’re trading today, and it’s not the case.

Frank Curzio: And I’m taking the biggest stock on purpose. I’m not telling you to sell Apple, I’m not telling you to go crazy, whatever. I mean, tech stocks are going higher. There’s a bid on the room, there’s money just being pushed into that sector.

Frank Curzio: But at these valuations where you’re seeing earnings growth, it’s not gonna return back to where it was pre-coronavirus until after 2021, and that is definitely not factored in. If you’re looking at it, I know I’m throwing a lot of numbers, what you need to know if the numbers are hard to follow. I get it. Just understand that the market is trading as 2021 is gonna be business as usual.

Frank Curzio: Yet earnings for all of these companies, almost none of them are expected to be… I won’t say none of them, but probably about 80% even in technology companies, those earnings are not gonna be much higher than they were in 2019 pre-coronavirus. Some of them, but not all of them. And that’s pretty crazy when you think about it. Again, earnings drive stock prices usually. Usually, not in today’s market. It doesn’t matter. You remove guidance, you got stocks going higher, it’s better for you, but eventually, that’s going to matter.

Frank Curzio: And now the concern suddenly is really coming in and you’re looking at 2021 with these analysts estimates and how low they are. I mean, Apple is trading at 22 times 2021 estimates, one of its highest valuations ever, and we’re throwing away 2020 now. That’s how crazy the market is. I mean, it’s unbelievable.

Frank Curzio: I said two weeks ago, this is the most dangerous market I’ve seen in my career, which is my career is probably half as long as Stanley Druckenmiller who just said, he’s a legendary billionaire hedge fund manager. He was speaking at the Economic Club in New York. There’s an event this week, I think it was virtual. But he said the risk-reward for equities is maybe as bad as I’ve ever seen it in my career. And the V-shape recovery is a fantasy. This follows legends like Paul Tudor Jones, Jeffrey Gundlach, Paul Singer. These are the best of the best. These guys aren’t like Ackman that are UCV for their own benefit and just, I won’t say pretend to cry or whatever. What a joke because for his position, these are not the same guys.

Frank Curzio: And he’s a legend saying, “Guys, watch out “where they’re not gonna do as well if the market does come down.” They’re fully invested in this stuff. And I’m like, “Go short and just let me go on TV.” No, these guys don’t care. They’re billionaires, they’re rich. Ackman doesn’t, and some others will use the media but not these guys. These guys are like, “Look, risk-reward.” Buffett sitting in a hundred billion in cash, is it? Can’t find any ideas. How’s that possible with this market?

Frank Curzio: You’re looking at, I understand technology. I understand you’re looking at the S&P 500. You look at the NASDAQ, that’s up. The NASDAQ’s up this year. But look at industrials, look at energy, look at banks, look at airlines, travel, and Buffett’s saying none of that is worth my time right now. And Buffett’s looking out 10 years. He’s not saying, “Wow, this is a great opportunity. Let’s buy it right now. We can leverage this and sell it two years from now like private equity.” No.

Frank Curzio: He’s saying, even if I buy right now, 10 years from now, I don’t see the value in this. I mean, to say there’s gonna be a V-shape recovery, I take Disney, for example. Disney just raised more debt today. You guys know how I feel about Disney. It’s probably gonna continue to go higher even though more leveraged than ever, crazy because you have Broadway just said they’re not opening up until after Labor Day. That’s September. That’s September.

Frank Curzio: But you look at Disney, which their whole business is based on crowds and families. I mean, they opened up Shanghai 30% capacity. Great, they sold out right away. That’s awesome. Disney will never have its parks at a hundred percent capacity again. They can’t, they don’t have the room because you’re gonna have to practice social distancing for at least three years, maybe more. People are still going to be kind of paranoid about stuff like this. And I’m just saying if the coronavirus goes away this year, we don’t see it spread again with states opening up. But you’re creating more separation between lines, whether it’s three feet in Asia, or six feet here.

Frank Curzio: So, you’re gonna have fewer people in that park. That means if I had a guess for Disney for their parks, they have to be at least at 70% capacity before they make money with expenses, employees, all this electricity. I mean, just leases. The amount of money it cost to run that park and then everything over 70% is gravy. Well, you’re never gonna get back to a hundred percent today, which is a fact because you’re cutting back. You’re creating more space in between people, which means you’re gonna have a capacity. Debt limit is gonna come down.

Frank Curzio: If it was a million people that go into parks, there’s probably gonna be like 800,000 that can go in now with social distancing. Otherwise, everyone’s gonna be on top of each other. Does that mean things are gonna go back to normal? Look in Los Angeles, Hollywood. Los Angeles said that they extended its stay-at-home orders for another three months. Basically, three months through July. Holy cow.

Frank Curzio: And Disney is very tied to Hollywood and their movies. Again, I’m just using Disney as an example. So, I get it. I get 2020 is a wash, but earnings projections for 2021, not 2020, 2021 are lower than they were in January pre-coronavirus. I don’t get that because we’re trading as not as everything’s gonna get back to normal, which we know is not, that things are gonna be much, much better. Much, much better.

Frank Curzio: Now, what factors? I’m drawing in the Fed printing, over four trillion already. Yeah, Pelosi and another five trillion stimulus that she’s ready to send to the Senate. Maybe it goes to four trillion or whatever before it passes. What’s five trillion? Nothing. I love these people.

Frank Curzio: It must be great to be a politician ’cause it doesn’t matter. You don’t have checks and balances. You don’t have to make sure it doesn’t, in my business, if we don’t generate money and I can’t pay employees, we go bankrupt, right? It’s just constant money where we could spend on whatever. That’s why they crave the power so much because I mean, even if it doesn’t work out for you, if you get elected and you’re horrible, you’re making a million dollars as soon as you come out just from your connections on Wall Street.

Frank Curzio: Wall Street will hire you, right? Look at all the Fed guns, best Fed chairmen, they’re all freaking making three to $10 million a year working for the PIMCOs and whatever, right? Bond company, whatever. Consulting, they make a fortune. Becoming a politician is awesome because you could spend as much money as you want. Debt money is gonna be used to bail the Post office. It was five billion. It’s probably gonna be seven to 10 billion, 12 billion. Don’t worry, just keep it open. Forget about trying to figure it out and run it like a business. Forget about that. Just throw money at it, we’ll be fine. It’s okay.

Frank Curzio: Another five trillion. Five trillion, guys. We’re talking about close to $10 trillion. I mean, a trillion’s not gonna be enough to bail out the states. The states are all bankrupt. There’s no revenue coming in and they’re spending money and supplies and everything and there’s no money coming in for the states right now because nobody is working. With the tax dollars, nothing’s coming in.

Frank Curzio: Yeah, some people are still getting paid, but still, most of the money, these companies are just bankrupt. I mean, the companies with the states, these states are bankrupt. A trillion dollars you think is gonna be good enough for them? Are you crazy?

Frank Curzio: In New York, it’s gonna take half of that at least by itself. So, you have to factor in trillions coming to this market. The government’s gonna stop buying high-yielding debt securities or ETFs. But you have to remember, some of the negatives, guys, is buybacks are gone. That was a huge driver of the market for the last six years. At least six years. And you look at the numbers. They’re going from 800 billion, 900. It’s supposed to be a trillion dollars in buybacks.

Frank Curzio: This was the main reason of buybacks. That’s why banks are getting crushed. I mean, I recommended Citi, but we did fantastic on it. Sold it before coronavirus, but my thesis was based on they were buying back 30% of their float over three years, and they were gonna increase their dividend. It was like 12, 15, $20 billion, I think. It was 20 billion over the next year, 30 billion in total that it was just for shareholders. I think Citi doesn’t have to do anything and the stocks will go higher based on that. And it did, it started going higher, but now banks aren’t allowed to issue dividends and buybacks are gone.

Frank Curzio: There’s a reason why they’re getting destroyed. And they make a lot of money when interest rates are higher, and interest rates are low. M&A activity for investment banks is kind of shut down. Yeah, you see Grubhub and a couple here and there, but not many.

Frank Curzio: So, buybacks, a big fuel for these stocks, is gone. It’s the reason why Apple made their quarter so many times. They’re just buying back tons of stock, good for them. They have the best balance sheet in the world, but that’s gone. I mean, Apple is gonna continue to buy. Do you want them to buy 22 times, 23 times forward earnings? 2021 earnings? Not really.

Frank Curzio: I think that 50 billion, you could do a lot more with that. We’re also seeing consumer demand shrink. Record unemployment, GDP is gonna be down 25%, 30%, numbers we haven’t seen since 1930. So very, very rare, guys, very, very rare. If ever have we seen stocks surge in the face of a monumental collapse in earnings. Are there good ideas out there? Of course, this sector is still getting destroyed. I mean, most of this is a tech boom. But most stocks are overvalued.

Frank Curzio: Now, I don’t know when this market’s gonna come down. It could be next month. I don’t know, seller may go away, who knows? It could be three months, 12 months, but this can’t be sustained the way it is. I mean, you want to buy technology stocks at these insane valuations when their earnings estimates are going to be lower in 2021 than they were projected to be pre-coronavirus? ‘Cause I was under the impression 2021 was gonna go back to normal. Everything’s gonna be great.

Frank Curzio: Do you want to buy these in the face of zero growth from Europe? Europe accounts for lots of profits for these companies. The growth engine, a lot of companies in the US, 30% of earnings come from overseas. You have a massive slowdown in growth in China, which was seeing a slowdown in China already. Now with possible trade wars heating up again, which this time it’s for real, it’s not just back and forth and who’s got the bigger, you know what? No, this is for real now. This is gonna hurt growth.

Frank Curzio: So, I’m not including any of those risks at all. And I’m not even including the coronavirus, where we could see it start spreading again as each state opens up their economies. I’m not even counting that risk. So, from a risk-reward perspective, man, you have to be careful. You have to be willing to change your thesis or get out of stocks when things start turning. Because when they turn, it’s gonna get very, very bad.

Frank Curzio: And you’re looking to analyze Home Depot. Home Depot’s stock in our portfolio up 20% on. It has 30 analysts that cover the stock, really quick. 30 analysts that cover the stock, 18 have a buy rating they report on Monday. Out of those 18, 14 have a buy rating, right? The 18 have a buy, but 14 of those that have the buy rating have a target price that’s lower than what Home Depot is currently trading.

Frank Curzio: Explain that to me. You have a buy rating on a stock with a target that’s lower. All right, fine. Maybe earnings come out good, but what’s the upside on Home Depot? For me, I’m struggling, what is it? 5, 10% of things don’t go well. It could come down a ton ’cause it’s trading at 22, 23 times forward earnings. Maybe these stocks go high, but the risk-reward has never been greater. I mean, you’re seeking returns and taking an enormous amount of risk to do it in most of these stocks. Not all of them.

Frank Curzio: Sorry for the gloomy outlook. Just tell you how they see it. I have no agenda here.

Frank Curzio: Now, this week’s guest is going to give you an amazing perspective and it’s gonna come from Italy because that’s where I’m interviewing him. Should be familiar with this name now. This person has come on my podcast, this was in mid-March on lockdown Italy, and he’s still on lockdown. Italy is finally easing restrictions, very, very slowly, but they are. And his name is Ed Karr.

Frank Curzio: As the CEO of US Gold Corp, he’s founded several investment management firms, investment banking firms in Europe, active in the natural resource industry for years. 2004, Future Magazine named Karr one of the world’s top traders. He worked for Prudential. He’s been in the financial service industry for over 25 years. He knows about economics. He travels the world. Very smart individual.

Frank Curzio: And last time he was on, he gave us a great picture of what was taking place in Italy since they went on lockdown two weeks ahead of us. Funny, because we’re ending our lockdown in most states. Well, Italy is still being cautious. Italy is still being cautious. They were on lockdown before us, and they’re still on lockdown. We’re opening up, and let me tell you something, you’re gonna hear this in a minute, Italy’s lockdown, it’s a real lockdown.

Frank Curzio: Europe, China, those are real lockdowns. When the government says something, you do it. Here, the government says it and you’ve got reporters just yelling at the president, and everybody’s smarter than everybody else here. Everybody’s a teacher, a doctor, the US. Freedom is really cool, but sometimes you’re like, “Wow, I just wish some person said, ‘This is what you have to do,’ and you do it.” Because everybody’s kind of doing what they want right now. Which isn’t a bad thing, but if you’re looking at every place else, they’re locked down. And when they went on lockdown, they really went on lockdown. They weren’t out of their houses at all. Here, everybody’s out, and we’re going back. It’s a greater chance for it to spread in the US than it is for these other countries.

Frank Curzio: So, it’s a great follow-up interview. Please listen carefully. It’s going say a lot of great stuff that you could use and that I’m using to the point where you can see what’s happening in Italy and what’s potentially going to happen in the US.

Frank Curzio: So, I look at Ed Karr, it’s because contacts like this, which I have all around the world, thanks to you guys listening to this podcast. Incredibly smart, decades of experience, finance, economics, have zero bias. It’s helped me bring into news ahead of mainstream media, and this video, it’s going to be a little echoey, which, of course, we’re doing it through Skype, but you’re gonna be able to hear everything. Usually, it’s better quality, but trust me, it’ll be fantastic, and let’s get the interview with my buddy Ed Karr right now.

Frank Curzio: Ed Karr, thanks so much for joining us on Wall Street Unplugged.

Ed Karr: Hey Frank, great to be back. Thanks for having me.

Frank Curzio: No, it’s great, it’s great. So, the last time we did this, right, I interviewed you and it was mid-March. This was when you were on lockdown. I think it was since March 9th. We were not on lockdown yet. New York officially went on lockdown on the 20th, but the rest of the country hasn’t really been on lockdown like Italy.

Frank Curzio: It’s two months later and you’re starting to open up your economies. You’re seeing rates finally come down. We’re seeing them come down a little bit. You’ve seen them come down a lot when it comes to infections and also deaths. Talk about the environment there, what’s going on right now, now that you’re just starting to open up?

Ed Karr: Sure. So, as you know, Frank, I’m in Florence, Italy, in Tuscany. The hardest hit area of Italy was more to north around Milan and Lombardi. But the reason why Italy locked down so strongly and countrywide I think as we discussed in the last time was the country was really on the verge of a healthcare industry collapse. No more ICU beds available. Literally, no hospital beds available. A number of new cases spiking up, deaths spiking.

Ed Karr: So, they had to lock everyone down, and that was successful. Here we are, and I don’t know, but if we’re even on week eight or nine of lockdown, they kind of all meld together after a while. I think we’re on week nine now.

Ed Karr: So, the lockdown has actually controlled the amount of new cases. The transmission has declined precipitously. We’re seeing very, very good news. There hasn’t been a lot of new cases. The curve is really declining and the amount of deaths is really declining as well. So that’s very positive. Now, the Italian government here in mid-May is starting to ease up just a little bit on that lockdown. So, they’re starting with industrial factories. We all know that the economic implications of this lockdown have been catastrophic.

Ed Karr: And for Italy, the economy was weaker than the United States going into this pandemic. The lockdown has just been like a nuclear bomb going off. So, they need to get the factories open. They’re starting with a little bit of construction workers, but everything else is still pretty locked down. You know, it’s very selective on restaurants, cafes, take-out only.

Ed Karr: Now, you can actually leave your property. You have to have a mask on, and you can go visit some relatives, go get some exercise. So, this is all new, but you can’t just travel. You can’t go to the beach. You’re definitely not going to a soccer game any time soon.

Frank Curzio: Now, talk about the lockdown in terms of the restrictions that you had, because I want to compare it to what we have in the US. Because of US, as you know, yes, the free country of the world, but it also results in everybody thinks they’re a doctor, everybody thinks they’re a teacher, everybody knows more than everybody else. Sometimes it’s nice to be someone telling you, “This is what you have to do.” We don’t really have that. We kind of do whatever we want here even though things are on lockdown.

Frank Curzio: New York was the toughest lockdown. I mean, that was as close to a lockdown as you can get. But even at New York, when I look at Italy, could you talk about the restrictions in place? Were there military industry not to the point where were scary, but just enforcing this? Do you see people with masks when you went to grocery stores, where they take your temperature? What was included in that lockdown? I just want to compare it to what’s included in ours, because we’re opening up our economy even faster than yours, and our lockdown started later than you, which is a little scary.

Ed Karr: Right, and the answer, Frank, is yes, all of the above. It was a real lockdown here in Italy.

Ed Karr: So, everyone was confined to quarters. You were not supposed to leave your property unless to go to the supermarket for food shopping, the pharmacy, or a medical emergency. Once you left your property, you had to have a mask. Most people put on gloves as well. You had to respect two meters, six feet, social distancing. And it was rigorously enforced. There were a lot of police officers out. There was military out.

Ed Karr: A lot of the teenagers think they’re Superman and invincible. So, they might take a little music, go to the park, and have an impromptu techno party. And they all were fined very severely. €500 fines. The cops were out all the time.

Ed Karr: I went out and walked my dog on our street, which is almost a countryside street. The cops pulled me over, they asked me where I lived, where I was going. I had a dog, so I had an official reason why I could go be outside my property.

Ed Karr: But yeah, they were pretty stringent here. Really, really trying to keep everyone inside. And ultimately, Italy was on the verge of that healthcare system collapsing. So, it was a real national emergency.

Frank Curzio: So, healthcare, you’re looking at healthcare system almost collapsing. You’re looking at also Italy itself was a disaster pretty much pre-coronavirus. So not just Italy, a lot of Europe was close to a recession, whatever. So, trade caused negative GDP. I mean, the top five economies were growing basically at like 0.2, 0.1, even negative 0.1. So, it was kind of like recession already.

Frank Curzio: How was Italy on the stimulus side dealing with this? And is it gonna be enough because we were coming from a base where we were much stronger, and now you’re seeing all market come back to, we’ll get to in a minute?

Frank Curzio: But with Italy, things were pretty bad going in. Banks were not fully capitalized. What are you seeing now? How are they going to stimulate the economy in terms of us, we spend trillions of dollars like you’re taking a dollar out of your pocket. What is Italy doing to stimulate their economy?

Ed Karr: Well, Frank, you’re exactly right. The economy of Italy has basically been flat-line GDP since 2009, the great financial recession. So, no growth since 2009. So, they were in a weaker position going into this pandemic, had a stronger lockdown.

Ed Karr: Now, recently, they’ve approved a €740 billion stimulus package from the Italian state government. But it’s going via the Italian banks. And this is a country of a lot of bureaucracy. You know, Italy changes the government like most people change their underwear. So, every six months, they get a new government year since World War II. A lot of bureaucracy. It has not been as smooth and as easy as the United States.

Ed Karr: You go get the SBA or the PPP loans, and a lot of people can apply through their local banks and United States with good technology, bang, in a week, your loan is approved. Here in Italy, it’s not like that at all.

Ed Karr: So, I’ll tell you, Frank, a lot of people are hurting and hurting badly. Let’s take, for example, Florence, the town that I live in. This is a tourist town. Well, we don’t have any tourists. There are tens of thousands of restaurants, cafes, bars, museums, hotels, Airbnb. That entire industry downtown has been gutted.

Ed Karr: I estimate, Frank, that at least 50% of those bars, restaurant, hotels, Airbnb will all go bankrupt. You know, they’re not gonna get the loans out to the people in time. This is a liquidity cashflow issue. When you have a pizzeria, a restaurant, your rent does not stop. Even though you’ve laid off your employees, you still have to pay the rent. You still have to pay the electricity. And if you can’t get these loans, at some point, you have to throw up your hands and say, “Pasta.” Sorry, bankruptcy. So, I think it’s gonna be devastating for the Italian economy.

Frank Curzio: Now, what are you seeing from the people perspective? Is their civil unrest? Again, for us small business loans. It’s crazy to the point where almost anyone can get them no matter what business. I mean, Harvard was getting them, Shake Shack was getting them. Then they gave them back for all the backlash and stuff.

Frank Curzio: I mean, here, it’s a little different because the unemployment benefits, they’re making more money than when they worked, which is insane when you think about it. But what do you see with yours? Because even from our side, we’re seeing frustration from people, frustration for small business owners.

Frank Curzio: And we’ll get to the US economy in a second. But I’m curious to see with those small businesses really struggling. Here, you could say, “Well, we’re not gonna pay rent.” The government will probably take care of you and pay that fee at some time. Or the REITs or whatever it filters down to. But what are you seeing on that side? Are people angry? Are you seeing more and more people worried? You know, I’m just curious to see that part of the environment, the people part of the environment.

Ed Karr: Yeah, and I tell you, Frank, it’s a great point. Great observation. Civil unrest is definitely increasing. And personally, that’s one of my biggest worries because the people that are watching your show, your podcast, subscribe to your newsletters, they have some net worth around the financial markets. They probably own stocks and bonds and have some cash.

Ed Karr: As we all know, this pandemic hit the lower economic income of the population the worst. So, it’s the people that live paycheck to paycheck. You know, the waitress at a restaurant that lost her job who’s a single mom. Now she has no job, can’t pay the rent, can barely put food on the table.

Ed Karr: And in Italy, this has always been a country where people have been very kind, courteous, civil, very Catholic-oriented country, homogenous. We’ve seen a lot of anger down South when you start getting down towards Napoli. Definitely in Sicily, there has been organized riots by some of the Italian mafia really trying to stir people up. In fact, they went with iron bars, and they broke into a Carrefour Supermarket because the people didn’t have enough food.

Ed Karr: And a lot of people in the South of Italy, they’re all working black. So, they’re not paying taxes. All these jobs are gone, and they can’t even get unemployment benefits ’cause they were never declared in the first place. So, we’re definitely seeing civil unrest starting to increase. And I think, Frank, that’s one of our biggest black swans, and it’s gonna increase even more in the future.

Frank Curzio: See, those are the stories we’re not reading here. Riots, and organized riots and stuff. We’re not hearing that at all, which is pretty crazy.

Frank Curzio: But let’s move to the United States now. You have 25 years background investment banking and the financial services, US Gold Corp present CEO. So, you understand our markets and you travel the world. You have to see what’s going on in our economy where there’s such a major disconnect.

Frank Curzio: We’re seeing GDP numbers, unemployment numbers not seen since the great depression. And people say, “Well, it’s temporary. “Everything’s gonna go back to normal soon,” which it’s not gonna go back to normal soon. I mean, it really isn’t. Well, you’re telling people that you can’t be next to each other. It’s going to have big consequences. It’s gonna take a lot longer than expected.

Frank Curzio: But with that said, we’re seeing a stock market that has jumped incredibly to the point where the NASDAQ’s actually up this year. From your experience, how do you explain that disconnect?

Ed Karr: It’s absolutely mind boggling, Frank. You know, it really is. And when we look at it, you’re exactly right. I mean, I think when they write the history books, when we’re sitting down with our future grandchildren, you know, when Jesus Christ was born, we have BC timescale, Before Christ. But then AD, basically After Christ. We’re gonna have BC and AC, Before Corona, After Corona.

Ed Karr: Now, I don’t think we ever go back to normal. Normal is gonna be the stories we tell our grandchildren that, “Yeah, we used to ride the subway in New York City and we used to go to Times Square for New Year’s Eve with millions of other people. We’d go to a Yankees game and eat a hot dog, and then we jump on the plane, and we’d fly down to Miami for the weekend.” And our grandchildren will look at us like, “What?”

Ed Karr: It’s never going back to that, Frank. You know, it’s just not.

Frank Curzio: I say the same stories with my kids today that we used to smoke in hospitals and planes, and nobody wore a seatbelt when I was a kid. you just jump in the backseat. It’s kind of crazy, but yeah, yeah, yup.

Ed Karr: So, it’s never going back. And there’ll be this new normal. The world will get used to it. We’ll persevere, we’ll overcome, and we will get through this. You know, ultimately, I’m bullish on the spirit of the human race. However, the market, Frank, is way ahead of itself. I mean, it’s absolutely insane that we bounce back up and now the NASDAQ’s positive for the year.

Ed Karr: We have the highest unemployment rates ever and that only went through mid-April of 14.4%. We’re probably gonna go 20 to 25% unemployment, maybe 30 before the thing’s all done. You know, it will be probably a 20% hit to GDP. And a lot of these jobs, Frank, are not coming back.

Ed Karr: And I’ll tell you why. Crowd psychology changes. Just ask yourself, Frank, would you take your family right now to a ballgame with 50,000 other people? I wouldn’t, I just won’t take the risk, you know? Are you gonna go, I mean, on the subway right now in New York City if you could afford to take an Uber? I probably wouldn’t, you know? I wouldn’t take mass transit if I could avoid it. So, am I gonna go into a crowded restaurant when maybe I could get Uber Eats? So, there’ll certainly be winners and losers. But I think a lot of these jobs, take New York City alone, probably half the restaurants there are gonna go bankrupt. They really will.

Ed Karr: So, with this economic Armageddon of bad information, why is the stock market rallying so much? Well, two words, federal reserve. They’re on the bid. They’re buying everything through all the stimulus. The Fed actually, today, Frank, is gonna start through BlackRock buying junk bonds. The first time in the history of the United States, the Fed usually buys investment grade or even government bonds.

Ed Karr: Now, they’re buying junk bonds, and they’re going across the board. They’re buying ETFs. When they buy an ETF, a rising tide lifts all boats. So, this massive amount, this tsunami of stimulus money has plowed its way into the capital markets.

Ed Karr: And I think the Fed and the government wants this because you have this psychological wealth effect when people look at their 401k IRA statement and they see that, “Hey, I’m actually positive or a flat for the year. It’s not that bad. Maybe we should get that new car or go to Walt Disney World.” If you look at your 401k statement and you’re down 30, 40%, oh, you’ll hold off on making any big purchase. So, I think that they’re trying to stimulate the markets, but personally, I think it’s way ahead of itself, and it’s probably gonna have another leg down.

Frank Curzio: And what’s gonna trigger that leg down? So, we’re gonna get to the Fed, which is something that you predicted, and I want to get to it, but what’s the trigger here? Because when I see as money flows and I see the government, and we’ll get to it now.

Frank Curzio: In fact, because you said last time, I was on that, and this has been March, that the Fed needs to do everything to backstop this economy, right? I’m not gonna put words in your mouth. For me, I was agreeing and saying, “Okay, we definitely have to backstop some of these industries.” I didn’t think it’d be in the tune of three trillion plus with more on the way. And you said that before the two trillion was announced, before you had the small business loan, which was 500 million and another 250 right after that, like a week later, right? It went so fast.

Frank Curzio: Did you think it’d be this excessive? And that could lead to the other question I was gonna ask you. You know, what’s the trigger for the sell-off since the government just said whatever it takes, and they’re not going away anytime soon?

Ed Karr: Yeah, I did think it’d be this excessive. In fact, I think it’ll be even more excessive. You know, between the Fed and Congress right now, Frank, they’ve probably pumped in about 5.5 trillion. So that’s a big number. However, if we have a 20% contraction to GDP, you know, they’re gonna have to spend 10 trillion just to get us back to zero.

Ed Karr: So already, Larry Kudlow said the White House is debating the third stimulus bill, and it’s gonna be like Rocky IV, Rocky V, Rocky VI, Stimulus 23. Like you say, they’ll just keep going. At the end of the day, you can’t fight the Fed. All that money coming in. However, I really believe there will be a point when the normal economics, the earnings releases out of companies start to bring a little sanity to whether it’s big hedge funds or other investors out there.

Ed Karr: And they start looking at this and saying, “Hey, wow, you know what? Disney World who has streaming, but also has theme parks, their earnings look pretty bad.” “Wow, look at how bad these other companies are.” “Wow, did you see that some big major oil companies really slashed their dividend?” “Does everyone realize how bad the energy patch is right now?” So, I think the economics and the fundamentals, you just can’t stop them.

Ed Karr: And all this enthusiasm of the market, the NASDAQ going up, being positive on the year, ultimately, my own thesis, Frank, is that it’s a reelection year, as we all know, so it becomes political. President Trump wants to open the economy tomorrow so he can get jobs back. The economy starts ripping a little bit into November. People feel better, and he gets the votes.

Ed Karr: The Democrats want the economy locked down as long as possible. So, Joe Biden can go out and say it was Trump, he was the bad guy, he didn’t handle this situation well, look at all these jobs that are destroyed. So, you got a real political struggle.

Ed Karr: I personally think that governors and local areas will want to get the economy going. I don’t think they’re gonna manage it well because, personally, what I think they should do is keep the vulnerable people, the old people, or if you have preexisting conditions, keep those people at home, you know? But guys like me that are 50 years old in good shape, guess what, Frank? I can get back to work. You know, I’m fine. I’m not really that worried. If I get it, it might even be mild. So, I’d like to get back to work myself.

Ed Karr: But, if we have this haphazard reopening, which is happening right now in the United States, there could be a second wave. You know, in the Spanish flu in 1918 and 1920, there were actually three waves. The second wave was the most deadly. That could happen now. June, July, August, with this reopening. You get this spike and a second wave. And then, we get a third wave maybe November, December when it starts getting cold, and flu season comes back in.

Ed Karr: So, if you start getting these open, close, open, close, I think that could be really, really catastrophic for the markets overall, ’cause the markets hate uncertainty.

Frank Curzio: They do, they hate uncertainty. And right now, it’s funny because the S&P 500 is even going, NASDAQ is going up. And the companies, around 75% have removed guidance. They’re telling you, “We have no idea what’s going on. Just buy, buy, buy.” And I get it, with the Fed, they’re behind it.

Frank Curzio: But, when we compare this market to say, we want to compare it to something… Last time, it was the Spanish, 2008, 2009, and people say, “Don’t fight the Fed.” And they were right, and I was one of those people.

Frank Curzio: But earnings were, S&P was trading at 11 times forward earnings. It’s a big difference today, where we’re trading at 22, 23 times forward earnings. So, it’s interesting. Maybe that is a new norm, maybe it’s not. But like you said, I guess it is hard to fight, but it’s just everything that you learn traditionally, especially for me in 25 years. Buying a company at 23, 25 times forward earnings, a company like Disney, 40 times forward earnings, that’s not growing now and not growing next year, and this is gonna significantly impact this company going forward.

Frank Curzio: I mean, as someone who was a finance guy and understands money management, how as a money manager do you go in and buy these stocks at these levels where highest valuations you’ve ever seen? Yet, they’re not gonna grow over the next 12 months, and their earnings even for 2021 are gonna be less than what they were pre-coronavirus.

Ed Karr: Yeah, absolutely, Frank. And I think any fundamental analyst that looks at this and runs the numbers realizes the market’s getting way ahead of itself.

Ed Karr: But what really brought the markets off the low of 2008, 2009, and even now, is all these computerized algorithmic trading. And a lot of these guys are just short-term trend followers, flash traders. And as the Fed goes in and starts buying all these ETFs, all of these algorithmic trading signals go onto buys, bang, and it just builds a self-perpetuating up cycle. So, it’ll carry on until it doesn’t.

Ed Karr: But there’s entire industries that are gonna be wiped out. I mean, who wants to go on a cruise? You know, do you really want to take a plane flight before there’s a vaccine unless you have to? Again, major league sport stadiums, shopping malls, anything with large crowds, I think crowd psychology, people are gonna be genuinely cautious, and all those industries are gonna be horrific going forward. It’s not gonna be a V shape recovery. You know, we’re looking at either a U or probably an L for certain industries.

Ed Karr: Okay, guys like Amazon and Netflix might be able to capitalize. But you’re talking to a very small segment of the market overall, you know? So, I think we’re way ahead of ourselves, and we probably will have that next leg down. And guess what? You know, Frank, everyone knows the old saying and the markets, “Sell in May and go away.” This is a perfect year for it, in my opinion.

Frank Curzio: Yeah, the markets have run up incredibly here. So, what are the best plays here? We know the Fed’s not gonna stop spending, right? They’re gonna continue to back. They said whatever it takes, that’s their words. Whatever it takes, and we’re seeing whatever it takes, it doesn’t matter.

Frank Curzio: And they have the banks in Congress’s ear saying, not like last time where AIG was surprised. We had no idea they were backstopping everything. We had no idea how deep this was synthetic, asynthetic, or synthetic CDOs, the leverage.

Frank Curzio: Now, we have the banks in the ear saying, as soon as they’re seeing the risk, they’re telling the president. They’re telling Congress, “Okay, high yield, high yield.” For me, CLO loans was a massive risk, and the banks actually went out there. They had to backstop that industry. Not that they had to, but it really would have collapsed the whole market, it’s a massive industry.

Frank Curzio: So, my question is, with the Fed spending, people are saying buy gold, buy Bitcoin. You’re familiar with both of them, obviously, president, CEO of US Gold Corp, a US based company. What are your thoughts on gold? Is it a lay up here is Bitcoin, a lay up here say as a three to five year investment? Because it’s not just here with spending money, but it seems like this trend’s not gonna stop globally.

Ed Karr: Yeah, exactly. That’s a good point. You know, number one, this is not just a US phenomenon. This is international. You know, ECB, Bank of England, Bank of China, Bank of Japan, they are all just full throttle on the monetary stimulus. So, the whole world.

Ed Karr: And they have to, Frank. They have to, or else we will have real civil unrest. You know, if half of the people in the world, four billion of the eight billion people can’t afford food, it’s not gonna be a nice planet to live on. So, they’ve got to continue. They are locked in this trade.

Ed Karr: So, what do we look at? I’m very, very bullish going forward on gold, Bitcoin, and any hard physical assets because ultimately, all central bankers and politicians can do is inflate. They hate deflation. They don’t want to write off tens of debts. So, they will inflate, inflate. They will print, they will print, they will print. They’re gonna continue to run the printing presses ad infinitum, which ultimately, one day, will debase the currencies. Now, that could take much longer than we think. It could take years and years and years for reserve currency like the US dollar.

Ed Karr: But at some point, it will come, and when it comes, you could see something like gold go from current $1,700 an ounce on a super spike to thousands and thousands of dollars an ounce. And now, Frank, we’ve got real credible people.

Ed Karr: You probably saw it just last week or the week before, Bank of America. Their analyst came out with a $3,000 gold price target. This is Bank of America. This isn’t conspiracytheory.com. This is a major credible bank with a $3,000 price target. So, a lot of people are realizing that.

Ed Karr: If you look at Zimbabwe, you look at Argentina, you look at Venezuela, countries that in the last 20 years have really run the printing presses, none of it ends well. It’s a massive train wreck, and that’s what’s coming for us in the future.

Frank Curzio: Let’s end with this because I think everybody is in agreement, which may be a contrarian indicator, which is a negative, but gold makes sense here. Talk about what gold does for a company like US Gold, because we know, obviously, the producers, the majors who all merge just like the Exxons and the Mobils merge.

Frank Curzio: I mean, they’re giants now. A lot of their mining is coming back on production and they’ve shut down with coronavirus, but they’re gonna generate huge profits when prices go high.

Frank Curzio: Talk about projects like in junior miners that don’t generate revenue, but you have projects and these studies like your own have been done on much lower gold prices and now everything’s kind of getting re-rated where a lot of projects, not yours, but other projects between with junior miners were uneconomical, and now suddenly, they’re economical, is 1,700. So, what does higher prices do for you particularly as a junior miner in gold?

Ed Karr: Yeah, you have tremendous leverage as a junior miner to the price of gold. If you go out and you buy just the physical metal itself, and gold goes from 1,700 to 2,500, okay, you doubled your money. You made a hundred percent return.

Ed Karr: Take our company, US Gold Corp. I mean, we have a project in Wyoming called Copper King. It’s a gold copper deposit not in mine yet. It’s being pushed towards production. So that project, we have a PEA, preliminary economic assessment, and 1275 gold, it has $178 million net present value. It’s about 1.8 million gold equivalent ounces, but it’s $1,600 gold that we updated recently. That net present value jumps all the way to 321 million. So, for every hundred dollar rise in the ounce of the gold, we get about $44 million more for our NPV.

Ed Karr: In fact, Frank, we ran the numbers on that at $3,000 gold and that Bank of America call, the NPV of Copper King at $3,000 gold is a billion dollars. I mean, our market cap today on the company is $15 million. It’s very out of whack. But what will ultimately happen as that metals price, the gold price increases, these projects become more and more economically attractive and viable. Probably at some point, a major or a mid-tier comes in to either take over a project or a company like us because it’s just so economic.

Frank Curzio: Yeah, I’m seeing that across the board. So, especially in gold and junior miners across the board where their projects, as you know even with biotech, the biggest gains go from something that is just a clinical test at the phase one, you get approved phase one. It’s a massive gain. So, you’re turning an asset from nothing into something. That’s when you see, with your stock price, it goes up tremendously. And that’s what we’re seeing.

Frank Curzio: So, just well-positioned, and it’s great for you guys, US Gold. Now, I guess I’ll ask this last question. The S&P 500, very hard to predict to the point where you ask for a target, right? Because it’s so heavily weighted towards the FAANGs. If you throw a Microsoft in there, it’s 25, 27% of the whole index and money continues to flow in these guys and rightly so. Often, we’re doing well and well-positioned for this than industrials or banks.

Frank Curzio: Where do you see this happening? Because I’m in agreement with you, we’re overvalued. For me, I’m playing it long-term conservative put options, but I don’t know what’s gonna happen next month, three months, six months. But I know a year from now, this market is gonna make sense where these companies are gonna have to put up the numbers to justify these valuations. And I just don’t see that happening with a lot of companies.

Frank Curzio: But what are your thoughts on a market a year from now? Where do you see us?

Ed Karr: Yeah, look, I think it’s gonna continue to be choppy. We’ve seen volatility increase since the beginning of the COVID pandemic outbreak. Thousand point swings on the DOW. I personally think we’re probably getting towards a short-term peak, maybe mid- to end of May. We’ll probably go into the summertime doldrums, and I really think test those lows, those March initial lows.

Ed Karr: I think we’re gonna test those in the historic seasonal lows. September, October, markets tend to bottom in October. And then, I think you’ll see even more stimulus out of Congress, more stimulus out of the Fed, that will juice the market back up in a year from now.

Ed Karr: And, let’s assume that we get through this. They get ultimately a vaccination for COVID, and we can move towards some normality, I think the US markets will be pretty buoyant. They’ll probably be back up towards these levels a year from now. But you’re gonna have some big volatility, in my opinion, going into that. So, it’ll be a pretty good market for traders over the next 12 months.

Frank Curzio: No, it definitely makes sense.

Frank Curzio: Well, Ed, thanks so much for the follow-up. I mean, the information you’re providing us, US, my listeners from Italy, you’re doing this, you are on lockdown just to see your economy. I wanted to compare it to our economy. You’re on a much more stringent lockdown. They really took it seriously. We weren’t. It’s just amazing to me. I’m a person who believes the economy should open up, and they should try, and we have to open up eventually, and see it’s gonna result in more cases, obviously, letting everyone out of the cage.

Frank Curzio: But just to see where Italy was and learning from you where you were on lockdown before us, almost two weeks before, and you’re still kind of on lockdown, and we were not really on lockdown. For us to be going back so fast and you guys are still holding up, it tells a crazy story, doesn’t it?

Ed Karr: Yeah, no, it really does. And the whole world right now, Frank, is a forward-looking statement because no one knows what’s gonna happen next week, next month, or next year.

Ed Karr: But we got to watch the situation closely. How this plays out over the next several weeks and months. And if there’s another big super spike of cases, I don’t think the market’s gonna like that at all.

Frank Curzio: Hey, well, listen, you, your family, we’re friends. I know you for a long time. I really appreciate you coming on. Hopefully, you guys are staying safe, you stay safe. Then if you ever need anything, just feel free to give me a shout. I appreciate you coming on, buddy.

Ed Karr: Appreciate that, Frank. We look forward to seeing you in-person in the not too distant future, and you too. All the best, stay safe. Stay healthy for you and all the viewers.

Frank Curzio: Great, thanks, man. Great stuff, from Ed. Love having him on, great contact. Very, very smart. Tells it like it is.

Frank Curzio: And it was funny because we ended the interview, we spoke for about 15 minutes after the catch up. And he was like, “Man, Italy is F,” right? The curse word, that’s what he said. Just as you were talking to one of your friends or whatever, he’s like, “Italy is,” and dead serious. He’s like, “Civil arrests is here.” He’s like, “The mafia is planning coordinated riots in the lower income areas.” And he was saying he hopes that doesn’t happen in the US, which I’m not sure it won’t happen.

Frank Curzio: But it’s kind of like, I wish we could take that version. I think there’ll be a huge demand for people to just talk as you’re talking to your friend, like, “Holy shit, this thing is effing crazy.” But just to see that where you always behave yourself while you’re on TV, you’re on media, you’re not cursing. I hate that they say cussing. I don’t know when cursing turned into cussing.

Frank Curzio: Anyway, I don’t want people to curse. But you see the reaction from him, someone who has this experience, and he’s like, “I mean, this is crazy. I mean, there’s a big disparity where, of course, people in the stock market are gonna be doing better, and these are people who have assets.”

Frank Curzio: But you’re looking, let’s go to the US. I mean, Wall Street doing great again with stocks going higher, asset prices are starting to go higher. The stock market is surging from its lows while main street is getting decimated right now. I’m sure some of you out there don’t have jobs that are listening to this. I know a lot of you, almost every one of you know people who are having trouble. I know tons of people who are having trouble right now.

Frank Curzio: If you’re in those industries I mentioned earlier, whether it’s industrials, energy, travel, I mean, a lot of these companies, just laying off employees and yeah, they’re furloughed. Are they gonna bring them back? How long could they pay employees? It’s gonna be tough. A lot of these jobs are not gonna come back, and maybe some of them do, but I’m hoping. I wish every job came back, but it’s not gonna be the case.

Frank Curzio: Look at unemployment closing at all-time highs. We’re talking about more than 50% of the population struggling right now. Easily struggling. And probably more than that, that lives paycheck to paycheck and some of them keeping their jobs, but still. Yeah, not everyone’s in the technology sector and in cloud and works for Zoom and works for Amazon or Walmart, which are hiring. Some of these jobs, I don’t know if they’re gonna come back. I mean, restaurants, bars, it’s crazy.

Frank Curzio: So yes, this could certainly lead to violence, right? And it’s not factored into stocks, these crazy levels. We’ve seen it come close to Wall Street and all these movements. I was there, I worked on Wall Street when we had the credit crisis. I worked literally on Wall Street right across New York stock Exchange. And it was pretty crazy. People carrying their boxes, getting fired, groups, and just… I mean, it was crazy. It was crazy, right? Every corner, it was like just people shouting and holding up signs going, “Wall Street.”

Frank Curzio: Yeah, and now we’ve come a long way since that, but this looks like it’s gonna be even worse. Yeah, we give them money and people have checks and stuff like that, but man, you can’t discount that. I mean, when people really rise up and say, “Enough is enough. I mean, we’re broke, we can’t pay our bills. You’re telling us, you’re forcing us to stay home. And now these companies that said were gonna hire us back, they’re not gonna hire us back.” Man, it’s a little scary.

Frank Curzio: I hope it won’t get to that. I never said anything like that. There’s people out there, “It’s gonna be riots. The dollar is gonna crash, end the world.” They’ve been saying it since, you know, 80-year-old since they woke up, and they’ve been 12 and saying it the whole time. It’s never happened. But man, it’s a possibility. I’m a common sense person. It’s possibility. Main street is getting decimated out there. It’s pretty crazy.

Frank Curzio: Anyway, let’s get to my educational segment real quick. Today’s podcast was pretty gloomy. I hate gloomy. I’m more an optimistic person, but I promise like always, I’m always gonna tell you how it is, no agenda. But a positive is that there are companies and sectors where the coronavirus is leading to surging profits. Whether it’s Amazon, whether it’s Zoom, whether it’s Walmart, a lot of technology companies, all the cloud companies seeing strong growth, software companies, and you look at the coronavirus and say, “Wow, these stocks are up tremendously off their lows. They took a dip and now they’re surging.”

Frank Curzio: But when you look at the coronavirus, a lot of this is going to be some of it, and maybe not a lot of it is gonna be temporary, right? So, you have to understand that some of the companies that you’re buying, like for example, I believe it’s 25 major companies that are searching for a vaccine, right? They’re researching for vaccine. There’s a coronavirus place, right? A lot of them have a premium.

Frank Curzio: Well, as soon as the first one finds that vaccine, it’s gonna be a massive distribution spread. The other 24 companies are gonna be left behind, right? You’re gonna lose that premium. Maybe they come up with other versions, I don’t know. I mean, do we have 25 different flu vaccines? No, but the first one that comes up with it, and it really works if it works. Again, the quickest we’ve seen a vaccine come to market’s four years. Everybody thinks it’s gonna come to market in six months. It’s not. It’s gonna be at least 2021.

Frank Curzio: If it’s before that, you’re nuts if you take it because it probably didn’t go through the process of safety. Have control groups, which you need, and biotech, these major companies, pharmaceuticals, they understand this. There’s a lot of optimism out there, but either way, once you come out with that vaccine, then the other companies are going to back to where they used to trade, based on earnings or whatever. Sales growth, whatever numbers. So, you have to be aware of that because when this risk subsides, and it will, a lot of these companies are gonna lose premium.

Frank Curzio: But what you want to look for is companies that are benefiting not just from the coronavirus, but they’re benefiting from the fundamental shift that we’re seeing in business, where more people are working from home than ever. And they’re not losing productivity. So, what does that mean? It’s less space in a commercial real estate and that’s gonna be least in major cities. I’m thinking about New York. Holy cow, I mean, the amount of money it costs to rent space in New York is incredible. Imagine if you can cut that in half. And a lot of these companies have operations in 40 different cities.

Frank Curzio: So, if you could find companies that are not just benefiting from the coronavirus, that are gonna benefit long-term, maybe like the Zooms, again, it’s trading at a crazy premium. I get it. But those are the companies you really want to focus on.

Frank Curzio: I’m sorry I identify a lot. In fact, one I just recommended for Curzio Research Advisory members, you should have got it already if you’re listening to this. And it’s a technology company that I’ve found. And what’s amazing about this company is that it’s trading at 30 times forward earnings just like the rest of the index, the NASDAQ 100.

Frank Curzio: However, unlike almost every other company in that index, this company is projected to grow earnings by 35% plus, and that’s 35% plus not just this year, but annually over the next two years. It’s seeing massive growth. Massive people sign up to the platform.

Frank Curzio: These are the companies you want to buy because 30 times forward earnings, when I say that, it’s crazy, crazy expensive if you just look at it on a standalone basis. And the reason why the market’s so expensive is because it’s okay to trade at 30 times forward earnings if you growing earnings considerably more than 15, 20%. That’s fine.

Frank Curzio: We’ve seen Apple, we’ve seen Netflix, we’ve seen Chipotle trading at these levels where they keep hitting highs because they’re growing, which scares the shit out of me with this market is earnings are not growing, and yet prices are going higher for a lot of these companies.

Frank Curzio: So, this is company I recommend, I’m not gonna give it away, but it’s not just the only company I’ve found. There’s like three or four of them that are really digging into, that are growing earnings considerably, which really got help from the coronavirus ’cause we’re in the technology sector, but they’re also gonna benefit from the permanent shift that we’re gonna see in people working from home.

Frank Curzio: And not only that, it’s older people. I mean, now older people or pregnant women or anyone who has respiratory diseases. I mean, they’re not gonna go, they could be working from home. How do you say if you’re their boss, “You got to come into work?” No way. If they die, man, that’s on you. Especially since all the technology we have, we have faster internet, access to everything, cloud. Get on anything you want.

Frank Curzio: My whole staff already is mobile, and we get it done. As we get bigger, I think we’re gonna have to really have a core office where we have our marketing team there and things like that, but we have calls a lot. We have Zoom calls, calls every week, talking to them a lot, and we make it work here. This was before coronavirus.

Frank Curzio: So, a lot of companies are starting to realize that where if we had everyone that they had to work in Northern Florida, I’d probably lose half of my staff ’cause I don’t think anybody really wants to live. A lot of people don’t like Florida. So, these are the companies that you want to look at that it’s okay if it’s trading at 25 times forward earnings. It’s more than 150 companies right now in the S&P 500 trading higher than 25 times forward earnings. And I have to say at all those companies, I would say about 75% of them are seeing earnings slow considerably. That’s dangerous.

Frank Curzio: If you have companies that are growing, you can trade at 40 times forward earnings, that’s fine. If you’re growing those earnings, projected growth earnings at 25%, 30%, that stock is actually cheap, and you have to understand, it took me a long time for having a fundamental background from my dad to understand that. That’s the education I got from Kramer, and it’s made my investors and me a lot of money over the years, because there’s value investors that would never touch any of the technology stocks, and look how high the FAANG companies are, and they were expensive forever. They’ve been expensive forever because they’re growing.

Frank Curzio: So, you want to look at companies that are growing. Make sure that if you’re gonna invest in companies that have expensive valuations, which is across the board right now, most companies, make sure that they’re growing earnings.

Frank Curzio: That’s the advice I’m gonna give in my educational segment. CRA members have that pick. Gets a very, very low price newsletter. If you want to subscribe, you can go to our website. If not, it’s okay. If you want to just listen to free stuff, that’s fine.

Frank Curzio: But this pick is definitely worth it. I like it a lot, and I think it’s an easy double inside 24 to 36 months, probably more like 24 months. And you’ll see why after you watch my video, which I provide a nice 20-minute awesome video for my subscribers. I’ll be doing video updates to get things out to you quicker for my newsletters, which I don’t think anyone’s doing. I still do updates, but this is a full issue. And also, we have the writeup of the stock, which we’re doing for both Curzio Research Advisory and Curzio Venture Opportunities to get picks out to you quicker because the market is more volatile than ever.

Frank Curzio: Okay, guys, a lot to digest in this podcast. Thank you, Ed Karr, for coming on. If you wanna find out more information from me, tweet me @FrankCurzio. I do live videos once a day, two, three-minute videos. Just updates on the market, pretty cool. But it is live, so have fun with it, and I can make mistakes or whatever, but they’re getting thousands of page views, which is awesome. Thank you so much.

Frank Curzio: And a lot of those get posted also to our Curzio Research YouTube page. If you want to subscribe, you should subscribe. You’re gonna get all of our content. It’s not just interviews, a lot of interviews I’m doing with video. But I am gonna be doing more media appearances. I just started. You’re gonna see all that. Even when I’m speaking at conferences, or everyone that runs these conferences tapes these things and everyone who speaks gets there, gets a little file. All this stuff’s gonna be posted. And every time we post something, it’s all automatically gonna be sent to you. It’s really good stuff. It’s not advertisements or anything. This is just pure research ideas, lots of fun stuff.

Frank Curzio: So, if you wanna go and look at my ugly face, you could do so instead of listening to the podcast. But you could do that at Curzio Research YouTube page.

Frank Curzio: Guys, thanks so much for listening. Be careful out there. It is a dangerous market. When navigating well, we do good in the portfolios, still be very, very careful, guys. A lot of risk out there. Really appreciate all your support. I’ll see you in seven days. Take care.

Announcer: The information presented on Wall Street Unplugged is the opinion of its hosts and guests. You should not base your investment decisions solely on this broadcast. Remember, it’s your money and your responsibility. Wall Street Unplugged produced by the Choose Yourself Podcast Network, the leader in podcasts produced to help you choose yourself.

Editor’s note: In an uncertain market, I’m giving readers a deep dive into the sectors that will—and won’t—thrive in the COVID-19 environment—and even into 2021. And I’m releasing this to Curzio Research Advisory members. It’s all in my special report, “How to prepare for what’s coming next.” To become a member—and one of the first people to access to my latest report—watch this short video.