Once a company is accused of fraud, it’s awfully difficult to restore its reputation… not to mention its profits.

Case in point: Wells Fargo (WFC), the fourth-largest U.S. bank by assets.

In 2016, authorities uncovered about two million fake accounts—from savings to credit cards—on Wells Fargo’s books. Records were falsified, and the unsuspecting “owners” were hit with a variety of fees. And this was going on for years… from 2002–2016.

The scandal was a major drag on the bank’s business… especially as the sheer size of the fraud became public.

This past February, Wells Fargo finally agreed to a $3 billion settlement with the DOJ and the SEC. But, as reported by Reuters, it’s estimated that even before the settlement, the bank had already paid out some $4 billion in various fees and penalties.

So it should come as no surprise that the stock has done nothing over the past decade.

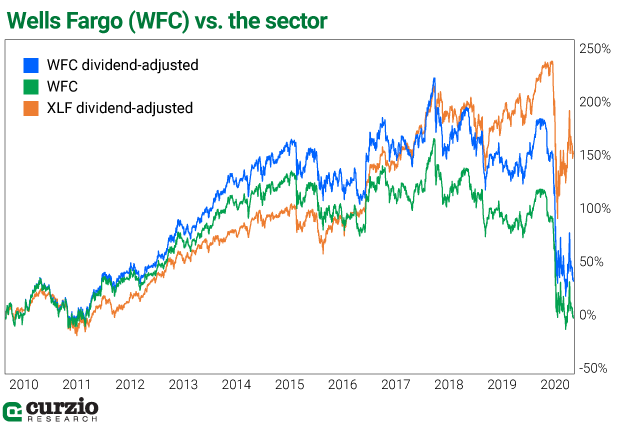

Literally nothing: WFC shares delivered a -0.4% return from July 1, 2010–July 1, 2020. And with reinvested dividends, Wells Fargo’s total performance is just under 33%.

In other words, all of WFC’s return over the past decade have come from dividends. And this week, the company announced a dividend cut… making it the first major U.S. bank to cut its payout since the financial crisis.

Today, I’ll tell you what this action signals for all big-bank shareholders…

Compared to WFC, the financial sector—represented on the chart below by the Financial Select SPDR ETF (XLF)—has managed to deliver almost 2.5x (150%) in total returns, with dividends reinvested over the last 10 years.

It’s truly been a lost decade for WFC and its shareholders.

Even Warren Buffett is losing faith in his favorite bank…

Buffett (via his holding company Berkshire Hathaway) has owned WFC shares since 1990… and largely held on to his position (around a 9% stake) through the 2016 scandal. But he’s since admitted he made a mistake.

In the fourth quarter (Q4) of 2019, Buffett cut his WFC position by some 55.2 million shares (or 14.6% of Berkshire’s 378.4 million share position).

The year before the scandal hit, in his 2015 letter to shareholders, Buffett praised Wells Fargo and its management as one of Berkshire’s “Big Four” investments (the other three were American Express, Coca-Cola, and IBM).

Buffett limits his exposure to individual names—and thus their potential troubles—and his portfolio is better for it.

But time never stands still… and even Buffett’s strategy has changed.

He’s since sold Berkshire’s entire stake in IBM… and his WFC position is smaller, too.

But it may get even smaller after this week’s news.

Wells Fargo said Monday it would cut its dividend. The exact size of the future payout will be announced on July 14, together with WFC’s Q2 earnings report.

The dividend cut was somewhat expected, thanks to the combination of the COVID-19 crisis, recent earnings decline, and the monetary settlements. Still, the stock tanked about 7% over the past week.

The dividend action on its own is remarkable.

First, as I mentioned above, Wells Fargo is the first major U.S. bank to cut its dividend since 2009.

Secondly, the announcement came just after the Fed’s “stress test”—its annual review of U.S. banks and their readiness to weather the crisis.

After this year’s stress test, the Fed limited the current and future dividends the 34 largest banks (29 domestic, five foreign with U.S. operations) could pay out, and requested a stop on banking sector share repurchases.

Thanks to this regulatory action, Q3 dividends are not allowed to increase compared to Q2 payouts… and future dividends are restricted by each bank’s profits from the previous year. Share buybacks are also not allowed—for now.

The good news is… the banking sector as a whole should be able to handle economic shocks, according to regulators.

After the stress test, the Fed did leave some wiggle room for less profitable banks to pay their shareholders: Banks falling slightly short of the Fed’s capital requirement goal can still pay dividends, but they’ll be capped at 60% of the latest four quarters average earnings.

But given the uniquely bad situation Wells Fargo found itself in (compared to its peers), I don’t expect significant dividend cuts from the sector in the near future.

If the Wells Fargo story teaches us anything, it’s that a dividend cut is a last-resort option for a bank—a business where reputation is everything.

Thanks to the Fed’s unlimited liquidity, banks should survive this COVID economy relatively unscathed.

But if big banks comprise a good portion of your portfolio holdings, you may want to consider additional sources of income. Banks’ profits and dividend growth, for the foreseeable future, are going to be limited.

Note from Frank:Genia’s shown that in this volatile market, having a solid hedge strategy can mean the difference between merely surviving—and thriving.

With recorded gains of up to 508%, just ONE of Genia’s Moneyflow Trader recommendations can rescue your overall portfolio from another downturn. That’s why I follow her advice with my own money…

Plus, for a limited time, Moneyflow Trader members get Genia’s upcoming income advisory—FREE.