Last October, Ryan Petersen went viral.

On Twitter, he’d shared his idea for how to help resolve a major industry problem… one threatening our entire economic well-being.

Within hours, dozens, if not hundreds, of people began calling up California mayors—and even the governor—demanding changes to current regulations…

And in an unprecedented move… by the end of the same day, the politicians listened… accepting and implementing some of Ryan’s suggestions.

As you might remember, back in October, we were seeing extraordinary congestion at some of the busiest U.S. ports… creating a serious disruption to the supply chain.

Particularly, the ports of Long Beach and Los Angeles, the country’s two largest ports, were suffering from extreme bottlenecks.

So Petersen—the CEO of a logistics company—went to investigate the situation at the Port of Long Beach. What he saw was unlike anything he’d ever witnessed…

While the port had more ships and equipment than ever… the hustle and bustle of activity had essentially come to a complete standstill: Out of around 100 cranes, only 10 or so were actually operating. And dozens of ships sat motionless in the harbor, waiting to enter the port.

After looking around, Ryan noted that the real bottleneck was at the terminals. Simply put, the yards at the port were almost completely filled with containers (both empty and loaded).

You see, in the normal course of things, semi-trucks are an integral part of the flow in and out of the port. They return empty containers to their correct terminals and pick up new containers to deliver to their designated locations across the country.

But because the port was so congested, it was nearly impossible for semis to pick up new loads—there was nowhere to drop off their empty containers. The terminals were completely full… And unloading had come to a halt.

A solution, Ryan thought, would be to stack as many empty containers on top of each other as possible… and store them outside the port in the truckyards of Long Beach.

But there was one problem: The city didn’t allow stacking more than two containers in its truckyards (largely for aesthetic reasons).

So Ryan took the plan to Twitter…

And by the end of the day, the City of Long Beach temporarily suspended container-stacking regulations.

That meant the truckyards could use the space more efficiently… freeing up more semitrailer trucks… allowing more drivers to go to the port for a pickup… and, in turn, beginning to break up the bottleneck.

Obviously, this was a huge step in the right direction…

But, as you probably know, our supply chains are still far from running normally… even months later.

Just this week, my colleague Luke Downey shared 4 ways to capitalize on the supply chain bottlenecks.

Two of these—Global Ship Lease, Inc. (GSL) and Danaos Corporation (DAC)—are containership owners and operators.

That makes sense: Shippers of all kinds are the leading beneficiaries of the ongoing crisis: The supply chain issues mean rising demand across the entire shipping/transportation industry… and the containership owners are in a position to command higher prices, even as some goods (and ships) get delayed.

And this profit can then be shared with the owners of containers… which are irreplaceable in today’s shipping industry.

These containers are the reason that nearly 90% of all global trade is seaborne…

The simple boxy design has a lot of benefits: flexibility… stackability… and improved loading efficiency—which translates to lower labor costs.

The container shipping business is based on standardization—which makes it easy to mix and match containers and chassis… and leasing—which frees up capital and gives the shipper the ability to easily switch among a variety of loads.

This was a great business long before our current supply chain crisis…

But it’s all the more critical today.

Long story short, the container industry is primed for further growth…

Less than six years ago, there were two big names in the container leasing business: TAL International and Triton International. But in the summer of 2016, these two companies merged…

The resulting business, Triton International (TRTN)—which leases and sells containers and chassis to the shipping industry—immediately became the industry leader. The company is the No. 1 owner of dry containers, which generate the majority of its revenue… But it also holds the leading positions in refrigerated and specialty containers.

Plus, leasing from a well-established, geographically diverse company like TRTN allows shippers to pick up (and drop off) containers and other equipment in multiple places around the globe… making it cheaper to operate.

The ability to offer this variability and geographic spread is a must for leasing companies… but it’s no simple thing to do: There are high capital requirements and other significant barriers to entry.

That means fewer competitors entering the market… and lower price pressures in TRTN’s business—exactly what you want if you plan to own a stock for a long time.

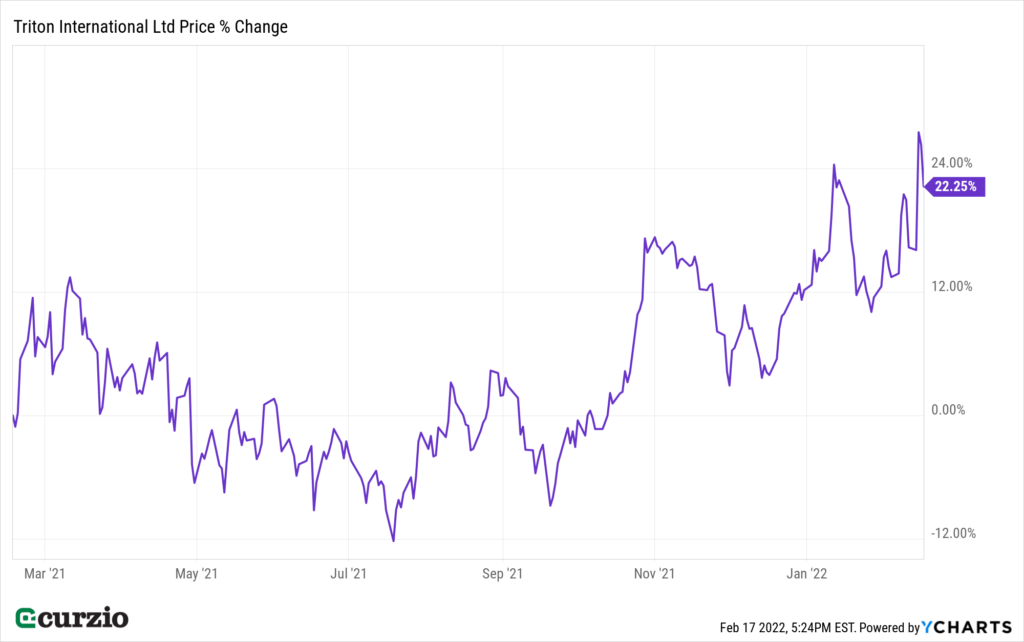

No wonder TRTN has outperformed the market… not only off the COVID lows, but on a longer-term basis, too.

And this outperformance doesn’t even include dividends… yet another reason I like TRTN in this market.

After hiking its quarterly dividend by 14% (to $0.65 per share) last December, TRTN now generates a truly outstanding 3.8% annual yield (vs. 1.4% for the S&P).

Bottom line: With its leading position in the container business, TRTN offers us a great (and relatively low-risk) way to play the supply chain crisis… while collecting a solid, market-beating dividend.

P.S. Earlier this week in Moneyflow Trader, I revealed 2 ways to profit from the fall of “story stocks”…

And just yesterday, I shared one more trade… A hedge that already generated triple-digit gains for us in just a few weeks… and is poised to do it again.

Join Moneyflow Trader to access these trades—while they’re still in play.