The pain at the pump is real—and it just keeps getting worse.

Gas prices are up 18% since the start of the year… including a 10.6% jump in August, according to the latest Consumer Price Index (CPI) data.

In fact, rising prices at the pump were responsible for more than half of the CPI’s increase last month.

And, as I’ll explain, gas prices have a lot more room to run.

But there’s good news: While you might be feeling the hit to your wallet every time you fill up… you can earn that cash back—and more—by investing in the companies set to profit from rising gas prices.

Today, I’ll show you one of my favorite ways to play the situation.

But first, let’s look at why gas prices have skyrocketed… and why they’re set to keep rising from here.

2 reasons for rising gas prices (that won’t disappear anytime soon)

At $3.94 per gallon, the current average price for gas is nearly 35% above the average over the past decade. As you can see in the chart below, prices are actually down vs. a year ago… but the overall trend is up.

There are a couple of reasons for this situation.

The first is obvious: crude oil prices are rallying.

After bottoming in late June, oil prices have surged more than 30% over the past three months. This jump shouldn’t surprise anyone who read my commentary from early July.

And, as I pointed out two weeks ago, there’s simply no way for supply to catch up with demand anytime soon. As long as global oil production keeps lagging behind demand, prices will keep climbing.

The second factor behind rising gas prices is less obvious… but it’s also likely to be an ongoing problem…

The U.S. is losing refining capacity.

As you probably know, crude oil needs to be refined in order to create gasoline and other fuels.

Shockingly, the U.S. hasn’t built a new large-scale refinery since 1977. While a few smaller refineries have come online in recent years, they haven’t replaced the capacity lost as older refineries have shut down. For example, five U.S. refineries shut down for good in 2020… as the pandemic decimated fuel demand.

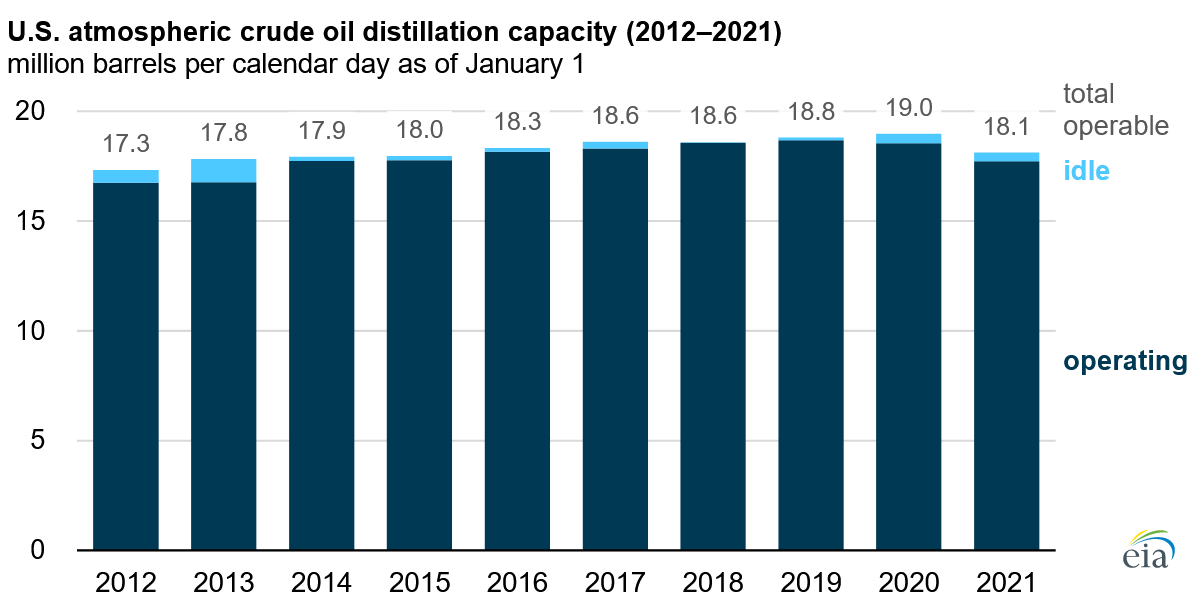

By the beginning of 2021, U.S. refining capacity was down 4.5% in a year… and sitting at a six-year low, as you can see below.

Unfortunately, the situation hasn’t changed much over the past two years. U.S. refining capacity has basically flatlined around 18 million barrels per day.

That’s a problem… especially now that gasoline demand has rebounded sharply since the pandemic, with folks driving to work and traveling again.

Of course, when rising demand meets lower supply… prices inevitably rise.

Bottom line: Gasoline prices will keep rising thanks to two major tailwinds on the “supply” side. Oil production isn’t keeping up with demand… and U.S. refining capacity isn’t rising to meet the rebound on gasoline demand since the pandemic.

This situation is great for refining businesses, which profit as gasoline demand keeps rising and supply remains tight. And as their profits grow, their share price will follow.

Here’s my favorite way to play the situation…

A one-click way to own the world’s biggest refiners

The VanEck Oil Refiners ETF (CRAK) is an exchange-traded fund (ETF) that invests in the world’s leading oil refiners—companies that produce a range of petrochemicals, including gasoline, diesel, jet fuel, fuel oil, naphtha, and more.

CRAK gives investors an easy way to own dozens of major refining companies. Its top holdings include Marathon Petroleum (MPC), Phillips 66 (PSX), and Valero (VLO).

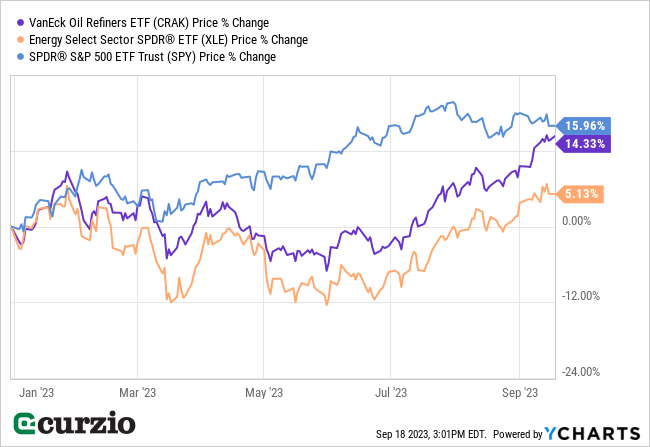

CRAK is already benefiting from the rise in gasoline prices. It’s up 14% since the start of 2023. Even better, the fund has outperformed the Energy Select Sector SPDR ETF (XLE) by almost 10%—and has nearly caught up to the S&P 500, as you can see below.

Thanks to its stake in dozens of refining companies, CRAK is poised to soar as the industry’s profits keep rising.

It’s also worth noting that CRAK is a solid income play, as many of its holdings pay generous dividends. Currently, the ETF pays a dividend yield of 2.7% (well above the S&P 500’s 1.6% yield).

The bottom line: With its market-beating yield and upside potential, CRAK is a “no-brainer” way for investors to capitalize on rising gas prices.