Many investors get gun-shy when stocks pull back. It’s natural. I see it a lot.

Here’s how it usually plays out…

First, stocks rally to unbelievable heights, catching the crowd by surprise. This is when many market-timers decide to wait for a pullback before buying.

The classic saying, “Buy low, sell high,” rings loud and clear in everyone’s minds.

But when stocks head lower, the mental acrobatics begin. Most investors freeze during a rout. Common sense goes right out the window… fast.

As fear takes over, the mental voices quickly change their tune. The thinking changes to, “I’ll wait for stocks to go lower.”

Eventually, the headlines get bearish. The latest news confirms investors’ fear. They forget their original plan to buy their favorite stocks. Instead, those awful words come to mind: “This time it’s different.”

Sitting tight feels like the safest play.

Then comes the finale. Stocks start to lift, but most investors are stuck in defensive mode. They’re skeptical about the rally’s merits. As the rally continues, they’re frozen. The lows are in. Stocks keep jumping…

Sound familiar? That’s how the mind works when emotions take over. Believe me, I’ve made countless boneheaded decisions over the years.

Emotions are the enemy. That’s why I’ve learned to follow the data.

And for many weeks it’s been pointing to lower prices…

Right now, a lot of folks are asking when the tech rout will be over. The answer is simple: when the selling stops.

But for now, the signs point to further downside ahead.

Let’s check the numbers…

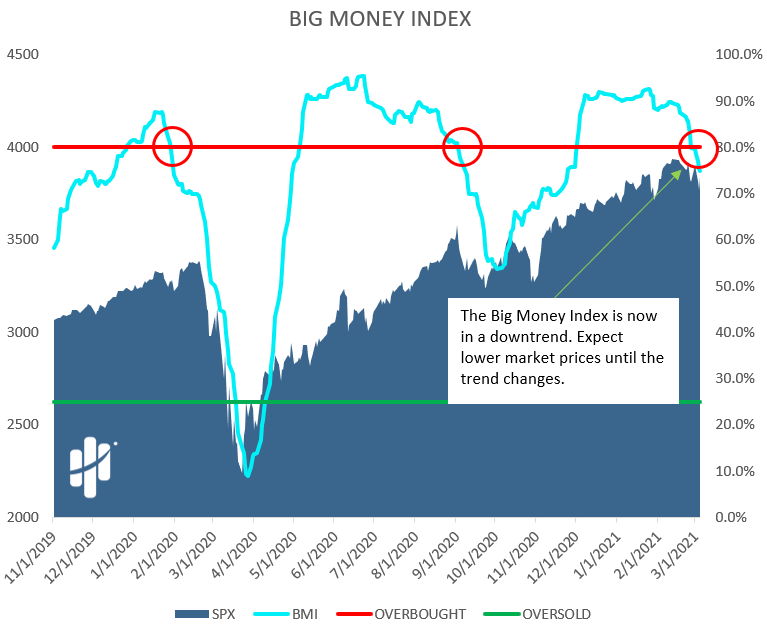

The Big Money Index is in a downtrend

Last week, I discussed how 3 charts are pointing to lower stock prices ahead. And that theme is still in play.

The Big Money Index (BMI)—which measures Big Money buying and selling in stocks—is falling:

Now, keep in mind certain groups are falling… while others are ramping. With an economy set to reopen, certain groups benefit more than others. The “reopen” groups are strong, but growth stocks are weak.

“Reopen” areas include sectors like financials, energy, and industrials. We can track these areas by looking at their respective sector funds. The Financial Select Sector SPDR Fund (XLF) jumped more than 4% last week. The energy sector fund (XLE) soared 10%. And industrials (XLI) were up more than 3% last week.

These gains happened as the tech sector—home to many momentum (“momo”) stocks—fell 1.33%. That’s last week’s performance for XLK, the tech sector ETF.

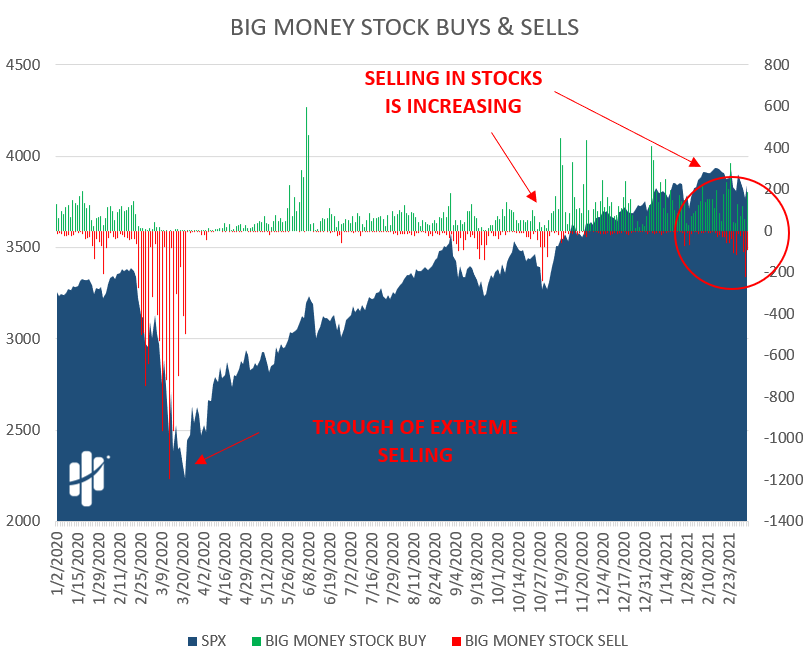

You can see that dichotomy by looking at the Big Money Stock Buys & Sells chart. It plots the daily totals of buys and sells for stocks. I’ve circled the important part…

In short, there’s a “tug of war” going on in stocks.

While some stocks made new highs last week, others broke down. That’s what’s causing the BMI (the blue line in the first chart) to fall.

It’s not a broad-based pullback. The most likely explanation for this tech pullback is due to “positioning.” That means institutional managers are reducing their exposure to tech. They’re selling and moving their money into “reopen” stocks.

The result is simple: The technology stocks that led the rally over the past year are finally taking a breather.

And based on the above charts, there’s likely more selling ahead. That means there’s an opportunity approaching… for patient investors.

You see, when we’re in a big bull market like the current one, pullbacks tend to be short-lived.

In my experience, the best strategy is to use times like these to build a buy list. Be patient… but don’t get caught in the mental acrobatics I mentioned earlier.

The bottom line is this: Selling is picking up in certain growth-oriented stocks. The numbers indicate more downside ahead. I’m keeping my guard up until they say otherwise.

While most people ask when the tech rout will be over… I’m using the Big Money data to help with my decision-making. Once the numbers start to turn higher, I’ll be buying.

It’s important to keep a long-term mindset. Short-term pullbacks are inevitable. But over the long run, great stocks keep going up.

This too shall pass.

Editor’s note:

While most folks were struggling through 2020, members of Frank’s Curzio Research Advisory were quietly collecting major gains on pandemic plays. I’m talking about profits like 60% in consumer goods… 95% in digital assets… 84% in construction… and much, MUCH more.

The best part is… for a limited time, you can try this product—risk-free—for 50% off!

Find out what makes Curzio Research Advisory one of the most valuable services on the market… and lock in your discount today.