Over the past three weeks, I’ve explained why a recession is inevitable… and how to invest during the downturn.

To make matters worse, a full-blown banking crisis has gripped the nation following the collapse of Silicon Valley Bank on March 10.

The Fed is now stuck between two awful choices: Either keep hiking interest rates, which could cause the crisis to spiral even further… or end its rate hikes, which would give inflation free rein.

Surprisingly, with the exception of the banking indices, the market has been relatively resilient since Silicon Valley Bank was seized by regulators: Over the past three weeks, the S&P 500 fell just 2%… while the tech-heavy Nasdaq rallied about 3%.

That said, we can’t rely on this resilience to last.

Historically—and logically—recessions lead to market declines. And the recent bank failures are another troubling sign for the economy ahead.

In short, we need to be prepared for more downturns. Fortunately, there’s a simple way to outsmart the market… and build a strong, profitable portfolio that can handle all conditions.

What is dollar-cost averaging?

Dollar-cost averaging (DCA) is a simple strategy: You buy selected assets (stocks, ETFs, or mutual funds) on a set schedule .

In a nutshell, you invest a little bit annually, quarterly, or monthly… gradually and consistently contributing to your nest egg—regardless of what’s going on in the markets.

This probably sounds familiar if you have a 401(k), where a percentage of each paycheck is automatically invested into a handful of pre-selected assets.

While the dollar amount stays the same, the number of shares you buy changes… depending on the price.

So when the price of an asset is down, it means you automatically pick up more shares… And when the price is higher, you purchase fewer. This fixed-contribution process helps you avoid over-investing near a market peak… and underinvesting near the bottom.

Put simply, DCA takes advantage of a declining market—or even a choppy, fluctuating one—to set you up for long-term profit.

Plus, investing on a set schedule forces you to stay disciplined, which can protect you from the emotional impulse to run to the sidelines when the market is falling.

If you’re investing in a single stock or sector, be sure to do your homework and stay up to date on any important news and results.

In short, you need to make sure your thesis remains intact. If it’s not, you should stop putting new money into it… and rededicate your DCA funds somewhere else. The same goes for a position that’s working out in your favor… and becoming too big compared to the rest of your portfolio.

But if nothing has fundamentally changed about your selection, DCA prevents you from reacting to short-term market movements—and allows you to benefit from the investment’s upside over the long term.

Let’s take a look at a few examples of how DCA can benefit your portfolio…

How dollar-cost averaging works in different markets

Let’s say, after doing your homework on a stock called ACME, you decide to build a position. But you don’t know where the market is going near-term… so you plan to use DCA by breaking your $5,000 planned investment into five $1,000 purchases.

Let’s look at the three basic scenarios for how the process would work: in a falling… rising… and fluctuating market.

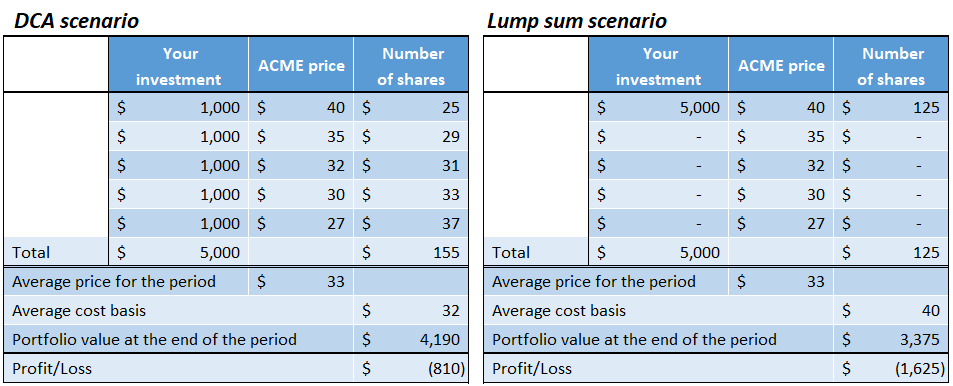

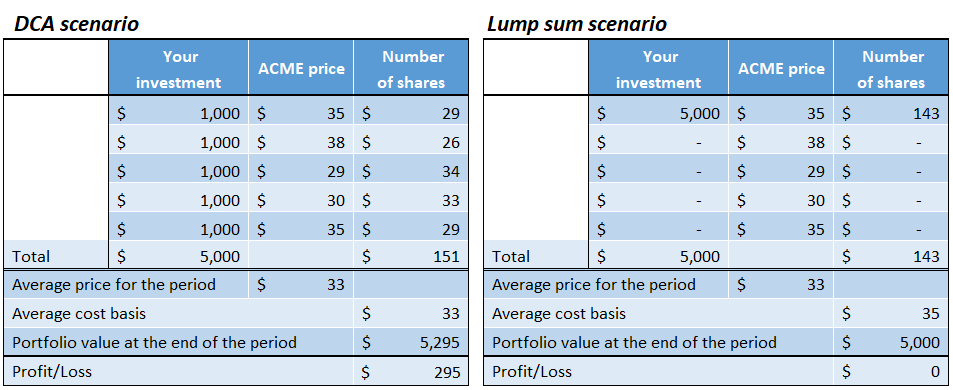

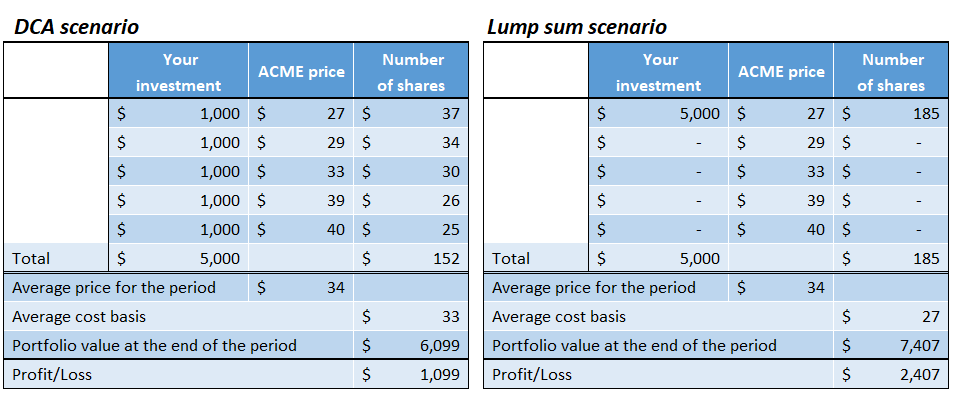

Each example includes two tables. Both show the same stock price path. But the one on the left estimates the potential profits from using DCA… while the one on the right shows what would happen if you invested the entire $5,000 upfront.

Declining market

As you can see, in a steadily declining market, your investment will lose value in both scenarios.

But by using DCA, you’ll end up buying more shares at a lower cost basis compared to the lump-sum purchase.

As a result, you’ll end up with a smaller loss by using the DCA method.

Choppy market

By using DCA in a choppy market, you’ll end up owning more shares at a lower cost basis than you would have if you’d invested a lump sum at the start. (Note that the end result would depend on the actual path the market takes.)

Rising market

Of course, a steadily rising market would favor a lump-sum method versus DCA: When the market is rallying, you end up getting a lower purchase price by buying early.

But that’s the only scenario where a lump-sum purchase outperforms the DCA strategy.

Conclusion

DCA helps turn a declining or volatile market to your advantage. And given the high likelihood that this dangerous market will continue in 2023, setting up a dollar-cost averaging investment plan could be one of the best decisions you make for your long-term wealth.