Imagine 6,500 Olympic swimming pools, all filled with oil. That’s how much crude the world uses every single day.

And that enormous consumption keeps rising.

Worldwide oil demand is set to increase by 2.4% this year… and reach 102.3 million barrels per day (bpd)—a new record.

There’s a simple reason for the rising prices. Global demand has already exceeded the previous all-time monthly high set in 2019, before the pandemic.

You don’t need to be an oil expert to see that oil prices (and the price of gas at the pump) keep moving higher.

Put simply, oil demand is at levels we’ve never seen before. And because this demand isn’t being met by a corresponding increase in supply, the price of oil is rising again (up 26% since late June).

Today, I’ll show you why this trend is sustainable… and how smart investors can profit from the situation.

The current supply/demand imbalance in the oil patch

Like any commodity, oil prices are all about supply and demand.

You don’t need to be an economist to understand that oil prices rise when demand exceeds supply (and vice versa).

On the demand side, the most recent International Energy Agency (IEA) analysis predicts global oil demand will keep increasing for at least the next five years.

The problem is that supply isn’t keeping up with this demand.

The main reason is that major producers aren’t eager to pump more. They’re happy with the current (higher) prices for oil. In fact, some of them have cut back on production. For example, in July, Saudi Arabia cut production by a massive 1 million bpd… and is extending this cut for yet another month—at the minimum…

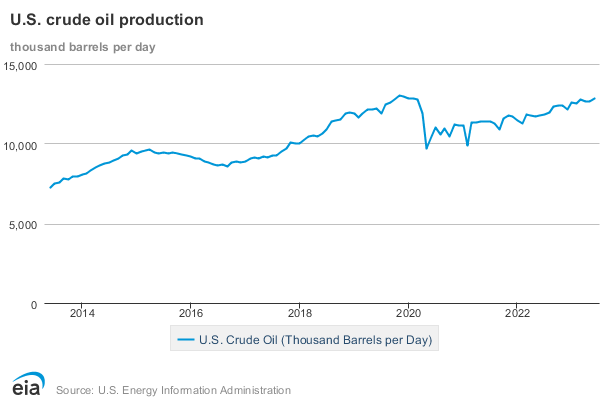

And as you can see below, U.S. production hasn’t recovered to 2019 levels.

To make matters worse, oil companies have been hoarding their cash instead of spending it on finding and developing new oil fields. They’ve been underinvesting for years as new oil has become scarcer and harder to find… And they’re even warier after the 2020 lockdowns destroyed oil demand.

There are also political factors worth mentioning. In 2021, the IEA specifically told Big Oil not to invest in new oil, gas, or coal projects… thanks to the expected transition to green energy.

Put simply, years of underinvestment in exploration and production (E&P) have kept oil supplies low.

And now that the pandemic is behind us… and the green transition has been slow to materialize… new oil supplies are running significantly behind the growth in demand.

The bottom line: The world desperately needs oil right now… even more than before the pandemic.

The easiest way to profit is by investing in companies that have oil… and can produce more of it.

And because the entire oil sector benefits from higher prices, you don’t need to pick and choose between individual stocks. You can buy an exchange-traded fund (ETF) to get exposure to dozens of winners.

Here are two of my favorite ETFs to play the uptrend…

Energy Select Sector ETF (XLE)

This ETF gives investors massive exposure to the two biggest U.S. energy companies—ExxonMobil (XOM) and Chevron (CVX). Together, these two stocks account for almost 40% of the fund.

In addition to these two giants, XLE invests in smaller oil & gas producers (49% of the fund’s total assets) and energy equipment and services industries (11%). In short, the ETF is well diversified among various energy businesses.

All companies in the ETF benefit from the higher energy prices: Producers can sell their output at a higher rate… their profits skyrocket… and share prices follow. Plus, there’s more money left over to pay for various oil services.

It’s also worth noting that XLE yields 3.6%, more than double the 1.5% offered by the S&P 500.

In short, for exposure to the entire energy sector, from Big Oil to smaller producers to oil service companies, XLE is the perfect choice.

SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

XOP is a great choice if you already have Exxon or Chevron in your portfolio… or you want a more direct play on rising oil prices.

This fund invests mostly in smaller, independent oil & gas producers, with minimal exposure to “midstream” and “downstream” stuff like chemicals, refining, and transportation.

Because XOP’s holdings focus on production, the fund directly benefits from higher oil & gas prices.

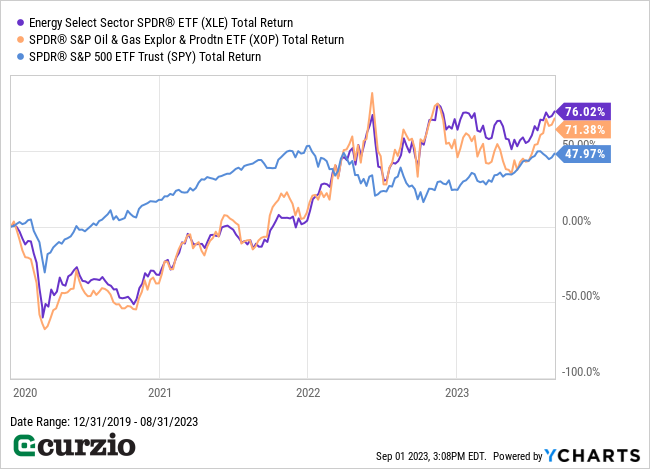

It’s worth noting that the last time oil demand hit a record high… it set off a major multi-year bull run in both ETFs.

As you can see below, the Energy Select Sector ETF (XLE) has outperformed the S&P 500 by about 28% since the start of 2020 through the end of August… and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has outperformed the market by more than 23% during the same time. And they achieved these gains despite a massive drop during the pandemic.

In fact, energy stocks were the only major sector of the market to deliver positive returns during the bear market of 2022.

Today, with oil demand at a new all-time high—and production falling behind demand—oil & gas companies are gearing up for another market-beating run. And the two ETFs above are gearing up for a major move higher.