It was one of the biggest bubbles in the history of the stock market.

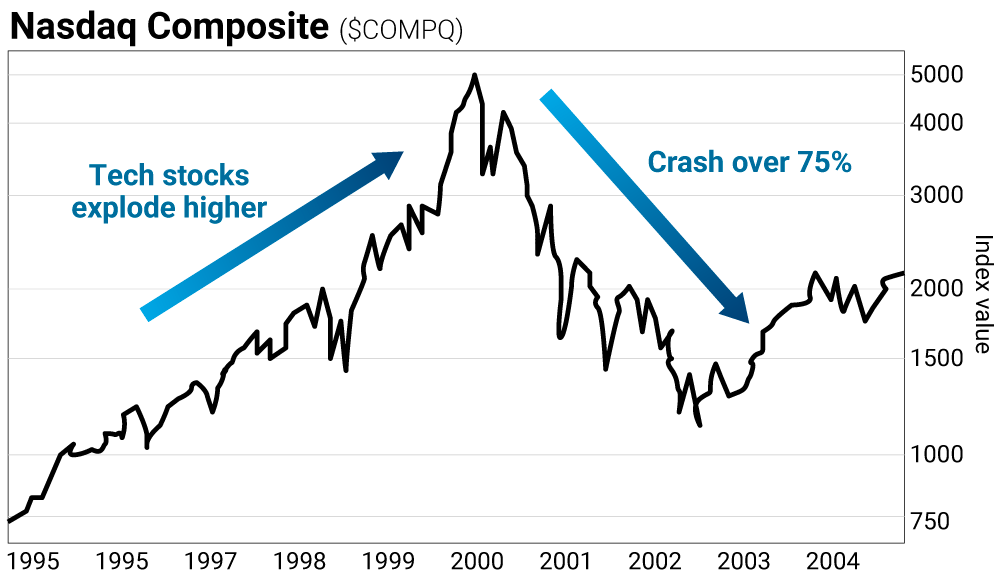

From 1995 to 2000, the Nasdaq surged by more than 400%. Driven by the internet boom, tech stocks (which mainly trade on the Nasdaq) sometimes rose hundreds of percent in days.

The momentum was so strong… and euphoria so high… any company with a dot-com name shot higher.

The average Nasdaq company was trading at more than 60 times (60x) forward earnings. That’s about three times higher than the Nasdaq average today.

Many of the dot-coms that went public later in the growth cycle (1998/1999) didn’t generate earnings or sales. Yet they traded at billion-dollar valuations.

You know what happened next…

Capital began to dry up. Money stopped flowing into the sector. And investors sprinted to the exits. When all was said and done… the Nasdaq lost over 75% of its value… and tons of dot-com companies filed for bankruptcy.

When a sector crashes, all stocks (including the best companies) get sold off. When there’s panic, investor emotions take control and fundamentals are an afterthought.

But there’s a bright side to this…

Crashes give you a chance to buy great companies at lower prices. If you had purchased Amazon, eBay, or Booking Holdings (formerly Priceline) in late 2001 or 2002—that is, even before the Nasdaq bottomed—you’d be sitting on a small fortune today. (Amazon and Bookings are up over 1,000%.)

There are always booms and busts. It’s the nature of investing. But buying in a bust and riding the boom is how smart investors make fortunes.

And right now, there’s another industry coming off a terrible crash…

| Recommended Link | ||

| ||

| – |

From July 2005 to July 2007, the price of uranium shot up over 300%. Geologists called the uranium sector the “new gold rush.”

Just like the tech bubble, companies changed their names to ride the momentum higher. Yukon Resources changed its name to Uranium Star Corp… Tonogold Resources changed its name to Prospect Uranium… and Birchpoint Capital changed its name to Ucor Uranium.

Companies with no shot at actually mining uranium moved higher with the entire industry. (A bull market has the same gravitational pull as a bear market—even the bad companies move higher.)

Then the bottom fell out. The recession of 2008 hit everything hard. To make matters worse, in 2011 a massive tsunami hit Japan and the country’s Fukushima nuclear plant was significantly damaged.

Over 300,000 people had to leave their homes. Countries like France, Germany, and Italy cut back on nuclear power for electricity generation. And many cancelled plans to build new reactors.

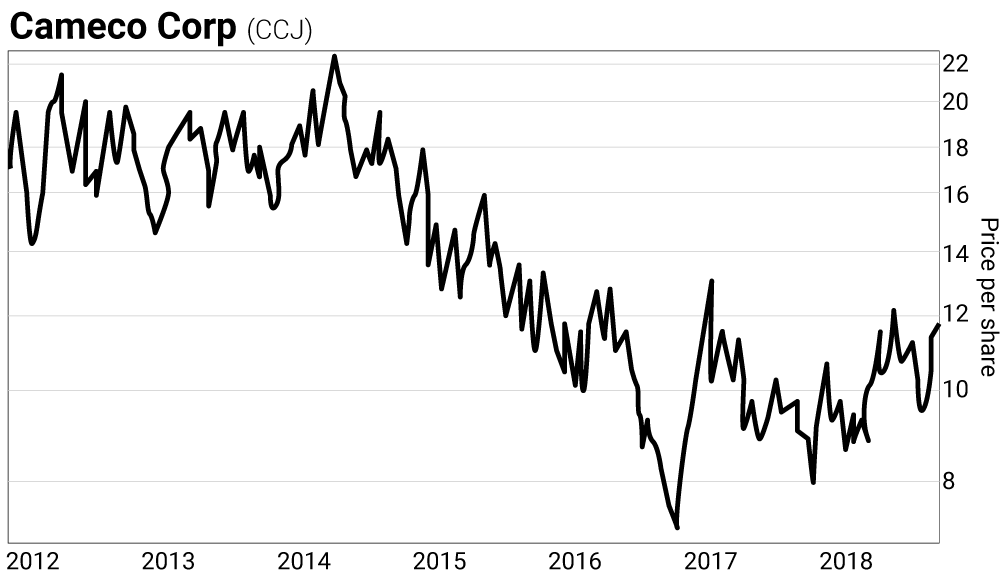

These events caused the price of uranium to fall for six straight years. Uranium fell over 80% from its highs of $130 to under $20 per pound. Take a look at Cameco (CCJ), one of the biggest—and best—uranium producers in the world.

I don’t have a crystal ball. But I can tell you we’re close to the end of this bear market. Since most uranium companies’ breakeven is about $45 per pound (about 50% higher than the current price)… prices NEED to move higher.

In fact, that trend is already happening. Uranium prices are up close to 40% ($27 per pound) over the past few months.

Just like during the dot-com boom, or any boom, when the cycle turns, you can see companies rise several hundred percent. Cameco rocketed over 200% higher from 2005 through the middle of 2007.

The internet wasn’t going away because of a market crash. And neither is uranium. Countries are starting to bring reactors back online after the Fukushima scare… and moving forward with building new reactors.

During this bear market, uranium producers have cut back on production and closed certain operations. But now demand is expected to rise. Countries like Japan, China, and the U.S. need reliable, affordable, clean energy. Pollution is a problem all over the world. Nuclear power is clean energy, which cuts down on smog. And places like China desperately need help with that. All this is a recipe for higher prices.

Now’s the time to gain some exposure to uranium.

Buy the big survivors, like Cameco. Cameco is an easy way to gain exposure to uranium. Its market cap is about $4.5 billion. And it’s one of the few in the sector that have made it through the crisis. (Hundreds of companies have filed for bankruptcy or changed their focus to other commodities.)

Cameco survived because of its incredible uranium deposits. At the peak of the uranium bull market, there were around 500 uranium companies. Today, only about 50 remain.

As you can see, Cameco’s been hammered during this bear market. But the company will pull out of it.

Buying Cameco (CCJ) around $12 gives you huge upside with little risk. In a couple of years, we’ll look back at this just like the Nasdaq crash…

Buying the survivors leads to huge returns.

Note: Owning big producers can lead to big gains when resource cycles turn… But if you’re looking to generate life-changing gains, you want exposure to strong small players too. Junior miners are higher risk… but the potential payoff is incredible.

To learn how to access high reward opportunities in the small cap space—including the uranium sector—click here.