On Wednesday, the Fed delivered a rate hike for the ages.

At 0.75%—or, more formally, at 75 basis points—it’s only the second such hike in the history of the Fed.

The only other time was in 1994.

The largest hike since then was 0.5%.

This new, higher-rate environment calls for an updated investment strategy.

Today, I’ll give you just that…

But first, let’s talk about the market’s reaction to the rate hike.

On Wednesday, the S&P and the Nasdaq shook off last week’s blues, rallying 1.5% and 2.5%, respectively.

You could say the market applauded the Fed’s move.

But truly, with inflation at its highest levels since the early 1980s… and the fed funds rate stuck under 1%… what choice did the Fed have?

It had been hoping inflation would go away on its own… which isn’t happening.

Faced with a never-before-seen disconnect between the rate of inflation (the orange line on the chart below)… and short-term interest rates (the purple line), the Fed made the right move—raising its target rate to 1.5–1.75%.

What’s more, the Fed has projected a 3.4% rate by the end of 2022. And the estimate for year-end 2023 is 3.8%.

The market’s sharp rally on Wednesday suggests some traders didn’t believe the Fed is serious about hiking rates all the way to 3.8%…

But as the reality of higher rates sunk in… the market sold off again.

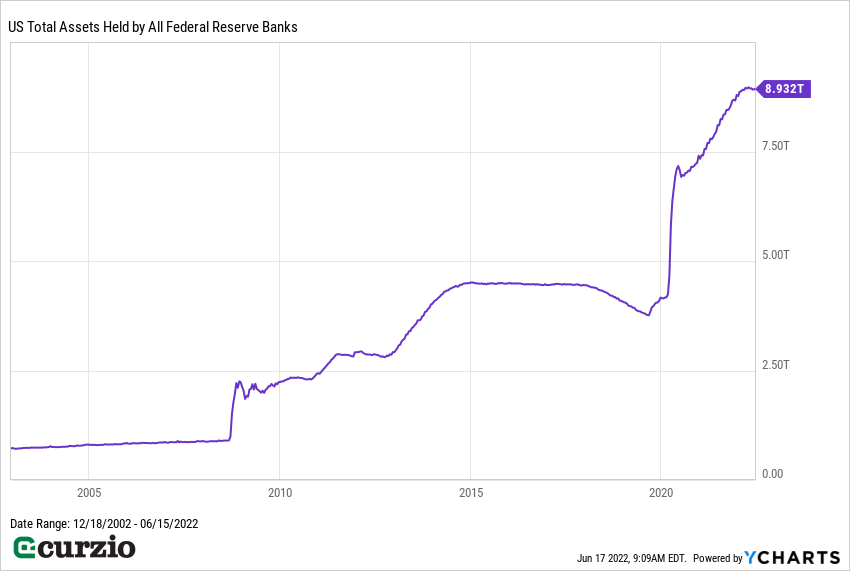

And here’s another reason for concern: The Fed reiterated its plans to shrink its balance sheet by $47.5 billion a month—a move known as quantitative tightening (QT). And starting in September, that number will increase to $95 billion.

While moves of this size will ultimately reduce liquidity in the market, we still have plenty of it for now.

That’s because, after more than doubling since the start of the 2020 pandemic, the Fed’s balance sheet sits at a massive $8.9 trillion (as you can see in the chart below)… It will take many months at the current QT pace for the balance sheet to shrink significantly.

In other words, much of the liquidity from the recent monetary easing is still floating around in the economy… and that’s good news for the market.

The other good news has to do with longer-dated interest rates…

The sharp jump in long-term Treasury rates this year (and the resulting selloff in bonds) has spooked the market.

I warned you just three months ago that bonds have been violently reacting to inflation.

The selloff has accelerated since then in anticipation of higher yields. (Remember: The higher the yield, the lower the bond price, and vice versa.)

The 10-year Treasury rate, one of the most important rates in the economy, has more than doubled since the start of the year, surging from 1.6% to 3.3%.

And this pales in comparison with the move in shorter-term Treasurys. The two-year rate has jumped more than fourfold in 2022… from 0.78% to 3.2%.

Compare that to the 0.75% hike the Fed just instituted.

The U.S. Treasury market has clearly anticipated the Fed’s hike… and more.

But, even though the two- and 10-year Treasury yields are much higher than they were a few months ago… they’re still low by historical standards, as you can see in the chart below.

And remember, bonds don’t offer any protection against inflation: Their payments will never adjust higher to account for the rising prices for goods and services.

With the Fed firmly on the hiking path, the great bull market in bonds is over. Treasurys might be safer (and higher-yielding) today than they were six months ago… But until inflation is truly tamed, bonds still hold downside risk (unless you plan to hold to maturity).

There’s no substitute for equities when it comes to fighting inflation. Stocks are the only asset that can grow profits over time… and have the potential to outpace inflation.

But stick to companies that can actually grow… and avoid stocks in deteriorating businesses.

Stocks that can grow revenues and profits—like the ones favored by the investment legend Warren Buffett—tend to hold their value better than their no-growth or no-profit peers during times of economic and market stress.

And be careful with interest-sensitive sectors, like REITs, utilities, telecoms, and consumer staples.

These companies often have high debt loads… and their operations often require massive borrowing. Higher interest rates equal higher borrowing costs. Consider companies that are more moderately leveraged or lighter on assets.

But don’t forego the group entirely. Rather, focus on companies that have been growing faster than their peers.

Better yet, invest in stocks that have the potential to grow their dividends… and then reinvest those payments. This simple strategy will allow you to turn market selloffs to your advantage.

You might also consider building portfolio insurance to protect yourself from the downside.

Most importantly, don’t panic. Develop a long-term plan and stick to it. Your portfolio will thank you later.

P.S. For my favorite high-yielding, inflation-ready stocks…

Join us at Unlimited Income—risk-free.

These carefully selected assets have consistently returned double-digit gains…

And right now, many are trading at bargain prices.