For as long as I can remember, financial advisers touted the “60/40 portfolio”—60% equities and 40% bonds—as the surest way to ride out any market storm.

There was solid logic behind this target. Stocks would provide the upside potential… while bonds provide safety and income.

And years of empirical data and academic research supported this simple recipe as one of the best ways to generate superior risk-adjusted returns.

That is, until the pandemic… when the Federal Reserve cut interest rates to zero.

The Fed’s actions brought Treasury yields down to levels that made them useless as income investments.

And low rates created another big problem for the 60/40 portfolio—inflation.

When inflation is low, stocks and bonds tend to be negatively correlated (they move in opposite directions). As a result, bonds provide a solid hedge against a falling stock market.

But as inflation ramps up, the correlation turns positive. That’s why—as inflation soared to 40-year highs last year—bonds declined in unison with stocks during the 2022 bear market.

Today, the Fed has reversed its zero-rate policy and started hiking interest rates. But that hasn’t helped bonds, whose prices remain under pressure thanks to their inverse relationship to rates.

The Vanguard Total Bond Market ETF (BND)—a proxy for the entire bond market—is still down 14% from the start of 2022… having gone nowhere in 2023.

In short, just as I predicted two and a half years ago, the 60/40 portfolio is dead.

While stocks are still the best way to make long-term profits, bonds are no longer a safe, profitable counterbalance to stock market volatility.

Fortunately, there’s a better alternative to replace a portion of the bond position in a classic 60/40 portfolio.

A better alternative to bonds

Gold is widely recognized as a safe haven for good reason…

It has a long history of outperforming the stock market—and suffering much less volatility—during times of turmoil.

In fact, gold can generate massive profits when everything else fails. And it tends to rise when most financial assets are under stress.

In short, there’s simply no substitute for gold in a portfolio when market volatility kills stock returns.

For proof, let’s look at the three most recent bear markets.

During the bear market of 2022, gold beat both stocks and bonds hands down—and was the only asset among the three to generate a positive return for investors.

As you can see from the chart below, gold is still beating the S&P 500 by double digits since the start of the 2022 bear market. Better yet, the yellow metal achieved this return with much less volatility than stocks. While the S&P 500 fell more than 25% at its worst point, gold was only down 10%.

And we can see a similar picture for the other two bear markets of the past 20 years.

During the short (but painful) pandemic crash of 2020, the S&P lost almost 31% at its worst point. Meanwhile, gold barely budged. And despite a big recovery in stocks, gold still beat the S&P 500 by 8.6% in 2020 (as you can see from the chart below).

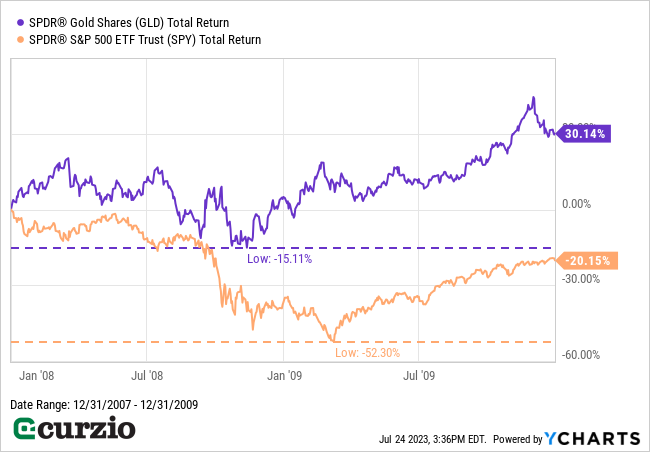

And during the Great Recession—the longest bear market in recent memory—gold gained 30% while the S&P 500 lost 20% (including dividends). It was also notably less volatile (as you can see below).

In short, gold has done extremely well during all recent bear markets.

More importantly, it has provided safety and acted as a counterbalance to stocks—advantages that bonds no longer offer.

And it’s super easy to get exposure to this asset class—without needing to own coins or bullion…

The SPDR Gold Shares ETF (GLD) is the oldest and best-known precious metals ETF. Constructed as a trust, it holds gold bullion as its sole asset. And its price closely tracks the spot price of gold.

This ETF is a great way to get direct exposure to gold without having to worry about storing or insuring the hard physical asset. Plus, buying and selling GLD is as easy as trading a stock.

Next time, I’ll give you more reasons why gold is set to play a big role in the coming bull market in commodities… and share some more ways to invest in precious metals.