We investors are a worrying bunch.

We worry when the markets are falling… And we worry when the markets are rallying…

This is human—it’s hard to watch gains disappear. And it’s difficult not to anticipate when they might…

For some investors, it’s challenging to stay the course after a strong rally.

After all, we might reason, this bull market’s been going since 2009, and it can’t have much power left.

It’s already the longest bull market on record. The second-longest was the 1990s bull market. That one lasted 113 months (a little less than 9 1/2 years), while delivering a nearly 420% rally.

It’s quite possible that this bull market—which has returned about 350% to date—still has a lot of room to go.

But can you stay invested and still be protected?

One time-tested way to build portfolio defense is with options—securities that give you a right, but not an obligation, to buy or sell a specific stock at a predetermined (“strike”) price before a certain date.

Contrary to a popular opinion, option investing—when done right—isn’t that risky.

In fact, there’s a kind of option trade that acts as portfolio insurance: the protective put.

Just like life insurance, portfolio insurance protects an investor against an adverse event. And just like life insurance, it costs money.

The protective put technique is based on buying put options.

A put option gives you the right, but not the obligation, to sell a specific stock at a strike price before a predetermined date.

The value of a put option goes higher (all else equal) when a stock price moves lower.

A protective put involves buying a stock together with an equal number of put options to protect yourself from a share price decline. If, for whatever reason, the stock price declines before the day of the put’s expiration date, the put would provide price protection if your stock declines below the strike price.

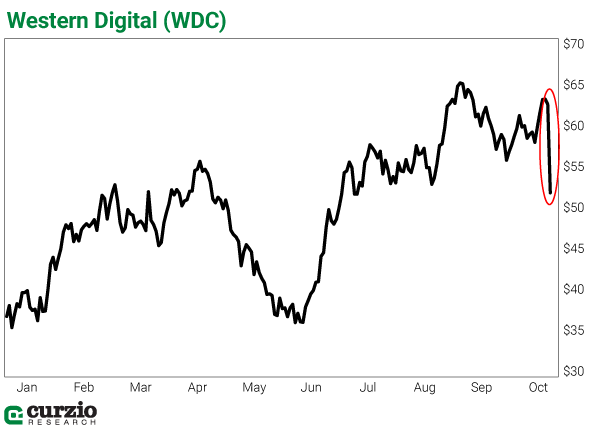

Let’s say last January, you bought data storage manufacturer Western Digital (WDC) as a long-term way to play the growing data storage trend…

At just under $37 per share by year-end 2018, the stock was trading near its 52-week lows and at a fraction of its three-year high. Plus, its annual dividend yield was 5.2%—very tempting in a world of low interest rates.

But what about volatility?

Western Digital is notorious for it. Over the past three years, the stock traded as low as $35 and as high as $102. That’s a lot of price movement in a relatively short period of time.

This also makes WDC just the type of stock protective puts were made for.

Let’s say by mid-October you became nervous and decided to protect your WDC position by buying one January 2020 put contract for $3.85 a share with a strike price of $60. (An option contract is for 100 shares, so this contract would have cost you $385.)

The contract would have given you the right to sell WDC at $60 per share any time before the January 17, 2020 expiration (option contracts typically expire on the third Friday of every month).

If the stock drops under $60, you could sell your shares of WDC at $60—thanks to the put option you own which gives you that right—and pocket the difference in the share price.

Or, you could sell only your put option contract—which would have appreciated as the stock fell—for a profit, and hold on to your WDC position for its dividends (and for future gains).

In sum, buying this particular put would have created three months of protection for your long WDC position.

And that protection would have been useful just last week…

On October 31, WDC had a very bad day.

The company reported disappointing first quarter (Q1) 2020 results, announcing lower-than-expected Q2 earnings guidance and the upcoming retirement of the company’s CEO. WDC lost 16.9% on the news.

This translates to a one-day decline of $10.51 per share.

The value of the put option, on the other hand, has gone up. At the end of the trading day, you could have sold your protective put for $9.80 per share—a gain of $5.95.

That simple action would have reduced the per-share daily loss to $4.56 ($10.51 – $5.95) or 7.3%—a much better result.

The WDC protective put would have done exactly what it was supposed to do: limit your losses.

In theory, a protective put works best if you own it together with a long position on the stock. It’s a great way to hedge risk if you’re bullish on the market or a stock—but also anticipate more volatility.

In practice, though, investors often buy a protective put prior to a significant event (like WDC’s earnings report)—and sell it if the event results in a share price decline.

(Buying a put without an accompanying long position is a bearish trade, which we’ll talk about in another letter.)

Profit potential on a protective put position is theoretically unlimited (after subtracting the cost of the put plus commissions). Had WDC moved higher post-earnings, you would still have benefited, thanks to your long position.

Again, think about the protective put strategy as portfolio insurance.

Buying a protective put option costs money like any insurance policy. And, like insurance, the best-case scenario is that you don’t have to use it…

But it’s always good to be prepared.

| Genia Turanova Analyst, Curzio Research |