As you surely know by now, the Fed has been hiking interest rates as it tries to bring down inflation.

And even the banking crisis didn’t stop the central bankers from hiking in March. Altogether, the effective Fed Funds rate is now 4.8%—up from zero in March 2021.

The Fed’s hikes have pushed rates to levels not seen since 2007…

And one major side effect is in the bond market.

After years of yielding next to nothing, bonds have fallen far enough that investors can finally earn a decent income.

This is especially true for shorter-dated bonds.

Short-term Treasurys—those maturing within the next two years—currently offer yields ranging from 4% (for a 2-year Treasury note) to 4.96% (for a six-month bill). At the start of last year, these rates stood at 0.8% and 0.2% respectively.

These yields look especially juicy compared to longer-term bonds.

You see, the Fed’s interest rate hikes have resulted in an inverted yield curve—when short-term rates are higher than long-term rates.

Typically, longer-dated bonds will give you a higher payout. This makes sense, since investors need to be compensated for the risk of lending money over a longer period. But today, the normal relationship has reversed… resulting in higher yields for shorter-term bonds.

Better yet, shorter-term bonds are set to benefit as the yield curve returns to normal. Remember, bond rates and prices have an inverse relationship: When yields rise, prices fall, and vice versa. So when interest rates stop rising, new bond yields will fall… and the value of the bonds you hold will bounce.

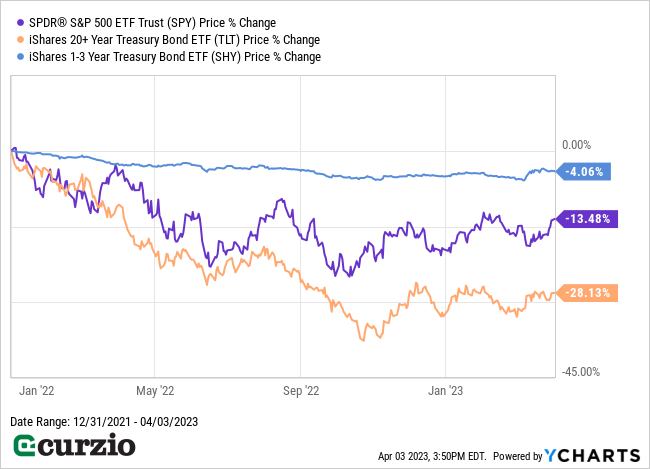

While long-term bonds, represented on the chart below by iShares 20+ Year Treasury Bond ETF (TLT), are down twice as much as the market since the end of 2021… short-term bonds—represented below by the iShares 1-3 Treasury Bond ETF (SHY)—are down just 4% over the same time.

As you can see, short-term bonds acted as a safe haven for investors over the past year. Meanwhile, long-term bonds took a beating.

That’s because the longer the bond’s lifespan, the more sensitive it is to changing interest rates. Since their payments are locked in (at lower levels) for a longer time frame, their value plunges when interest rates rise.

The above chart also shows how short-term bonds easily outperformed the S&P 500 over the past year… while exposing investors to much less risk. (Remember, stocks are inherently riskier than bonds.)

This outperformance isn’t a temporary phenomenon…

In the current high-interest-rate environment, short-term bond exchange-traded funds (ETFs) are poised to see their yields push higher over time…

You see, as older, lower-yielding bonds mature… bond ETFs will replace them with newer, higher-yielding bonds. And by owning these funds, you’ll get to collect a growing income stream as this process plays out (even if interest rates stop rising).

In short, while you might not think of bond funds as a source of growing income, they’re currently offering us the opportunity to benefit from high interest rates (via their high yields)… while taking less risk compared to long-term bonds.

One simple way to benefit from the situation is by buying short-term bond ETFs—such as the iShares 1-3 Year Treasury Bond ETF (SHY)… which currently yields 2.3%.

If you want an even higher yield, you can take on a bit of credit risk by buying an ETF that holds shorter-term corporate bonds, such as the iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB).

IGSB owns more than 3,000 corporate bonds with remaining maturities between one and five years—all with investment-grade credit ratings. In other words, even though these bonds aren’t issued by the U.S. government (the lowest-risk bonds you can own), their credit risk is minimal compared to other corporate bonds.

And it currently yields 3.5%, which means you’ll boost your yield by more than 1% vs. SHY. It’s also worth noting that IGSB will pay you more than double the yield of the S&P 500 (1.7%).

IGSB’s top holdings include bonds issued by major, “too-big-to-fail” U.S. banks (the leading destination of the money flowing out of the regional banks right now… and the eventual beneficiaries of the banking crisis). They also include industrial giants Boeing and Honeywell… pharma leaders Amgen and AbbVie… and tech giants including Dell and Microsoft. And because the fund owns thousands of positions, it’s incredibly well-diversified, reducing the potential negative impact of a (unlikely) single-company default.

But here’s the most important part: The average maturity of this fund’s holdings is about three years.

This shorter timeframe means IGSB can reinvest the proceeds (from its maturing bonds) into new positions at today’s higher yields. In other words, the portfolio is constantly changing as some bonds mature and others are issued. And, as the ETF invests in newer, higher-yielding corporate bonds, its income will grow.

The fund already yields 3.5% based on the latest payment (IGSB pays its income monthly). And its payout is likely to keep rising in the near term.

Plus, as I mentioned above, short-term bond ETFs like IGSB are less vulnerable to rising interest rates than their longer-dated peers—and likely to outperform them.

In this dangerous market, shorter-dated bond funds like SHY and IGSB offer a much better income alternative to stocks and long-dated bonds… while providing shelter from the market storm.

P.S. For more of my favorite income-generating assets for this dangerous market, make sure to join us at Unlimited Income—risk-free!