The oil “landgrab” is underway…

Just as I anticipated back in April, oil majors are starting to snatch up the best independent exploration & production (E&P) companies.

Less than two weeks ago, ExxonMobil (XOM) officially announced that it was acquiring Pioneer Natural Resources (PXD), a leading shale oil player.

And today, we learned that Chevron (CVX) is buying Hess Corp. (HES), a smaller rival in the oil patch.

Today, I’ll explain why these two deals are proof that oil prices have a long way to run from here… and why the oil landgrab is far from over. I’ll also share two ways to cash in on this trend.

Let’s start with why these acquisitions signal higher oil prices ahead.

A bullish signal for the oil market

As I explained back in April, Big Oil is flush with cash right now… and looking to expand its production footprint without taking on a ton of risk.

I wrote:

Finding new oil has always been an uncertain endeavor. And that’s especially true today, when new reserves are harder and more expensive to find. In fact, it’s not uncommon for major oil companies to call it quits on a big exploration project, even after spending billions of dollars over many years…

In short, the simplest way for Big Oil to grow is by buying smaller, established companies with already-discovered assets.

That’s why mid-tier producers with quality assets are becoming attractive targets…

Pioneer and Hess are two such targets.

Pioneer owns some prime assets in the Permian Basin—the country’s richest shale field. And Hess owns 30% of a massive oilfield in Guyana (the world’s largest crude discovery of the past decade)… plus thousands of acres in the Bakken Formation in North Dakota… and offshore assets in the Gulf of Mexico.

Put simply, these acquisitions are a sign that Big Oil believes oil prices are heading even higher.

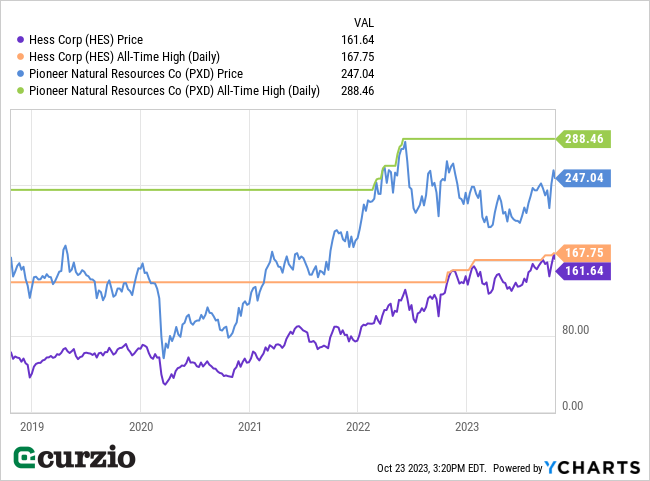

In both cases, Chevron and Exxon were willing to pay premium prices for their new reserves. That’s why PXD and HES are both trading near their all-time highs, as you can see below.

Keep in mind, the only reason oil companies are willing to pay these high prices is because they believe the new assets will pay for themselves many times over. In other words, they’re expecting oil prices to head higher over the long term.

And there’s another major bullish indicator that many investors haven’t noticed…

Big Oil isn’t hedging. Let me explain…

Oil companies often use options to lock in prices for the oil they’ll sell in the future. These “hedges” are a way of protecting their bottom line. They ensure the company will remain profitable even if oil prices decline.

But here’s the thing: While the downside is capped… so is the upside. While these hedges allow companies to stay profitable in a declining-price environment… they mean profits won’t be as high as they could be in a rising-price environment.

So when a company expects higher prices ahead, it will close out its hedges.

And that’s exactly what we’re seeing…

Pioneer closed out its hedges last year… And as part of its Hess acquisition, Chevron said it plans to discontinue Hess’ hedging program.

On today’s conference call, Chevron CEO Michael Wirth said, “We plan to discontinue the use of put options… [because] as a company of our size, we’ve got a balance sheet that is in a position where we can be fully exposed.”

In short, this lack of hedging is a clear signal that oil executives believe oil prices are going higher. They see the multiple catalysts ahead, including geopolitical risk… as well as the dwindling supply combined with record-high demand.

And we’ll likely see even more acquisitions over the coming months…

These two recent acquisitions were made using stock. In other words, Chevron and Exxon used their own shares to pay for the deals. That means neither giant will see a drop in their cash position.

In short, both companies are keeping their powder dry… so they can scoop up more businesses in the near future.

Put simply, the Big Oil landgrab is far from over… which means smaller oil and gas companies with prime reserves remain extremely attractive investments.

How to profit

The simplest way to profit from this trend is by buying the entire E&P sector via an exchange-traded fund (ETF).

There are two major ETFs to choose from: the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and the iShares U.S. Oil & Gas Exploration & Production ETF (IEO).

Both funds are heavily invested in energy E&P companies (75% for XOP and 79% for EIO)… and both also own a healthy stake in refining and marketing companies (18% and 21%, respectively). Plus, XOP owns a small stake in Big Oil (7%).

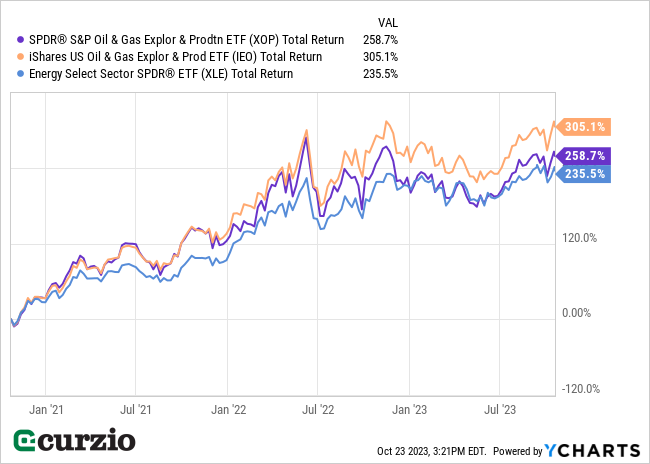

As you can see below, both ETFs have outperformed the supermajor-heavy Energy Select Sector ETF (XLE) over the past three years. This strong performance is a result of their large positions in the stocks of smaller E&P companies (which have more leverage to oil prices than their mega-cap counterparts).

As you can see above, IEO has performed particularly over the past three years (returning 305%, vs. 259% for XOP).

That’s because, unlike XOP, IEO is market-cap-weighted. So, while the top 10 holdings of XOP account for about a quarter of its total portfolio, the top 10 holdings of IEO dominate the ETF at more than 70% of its total value.

This also means that IEO will rally more sharply if one (or more) of its top holdings gets acquired.

On the other hand, XOP will do better than IEO if one of the smaller companies gets a takeover bid… simply because they have a much bigger weight in the ETF.

But you can’t go wrong with either. Both ETFs give you direct exposure to the E&P sector…. its acquisition potential… and its strong leverage to rallying oil prices.