What can a sports-themed romantic comedy from the 1990s teach us about investing?

In the case of Jerry Maguire, a lot.

Anyone who’s ever seen the movie is sure to remember its famous “Show me the money!” scene. (If you’re not familiar, you can watch it here.)

Just as football star Rod Tidwell (played by Cuba Gooding Jr.) makes this demand from beleaguered sports agent Jerry Maguire (played by Tom Cruise)… investors are now demanding that high-flying tech companies show them the money.

As markets kept rallying in 2020 and 2021, these highly valued, unprofitable companies were getting by on strong growth (and on the Fed’s free money policies).

But now that the central bankers have removed the easy money punchbowl, growth has deteriorated… and investors have become much more conservative.

Even those willing to commit to high valuations in exchange for future growth are quickly adjusting their calculations…

They’re now demanding to see cash flows and, if not earnings, at least a clear road to profitability. And the sooner, the better.

Put simply, the market is going through a revaluation process… triggering a mass exodus from expensive stocks.

And once this process starts, it rarely stops until valuations come back to Earth… the market shifts again… or both.

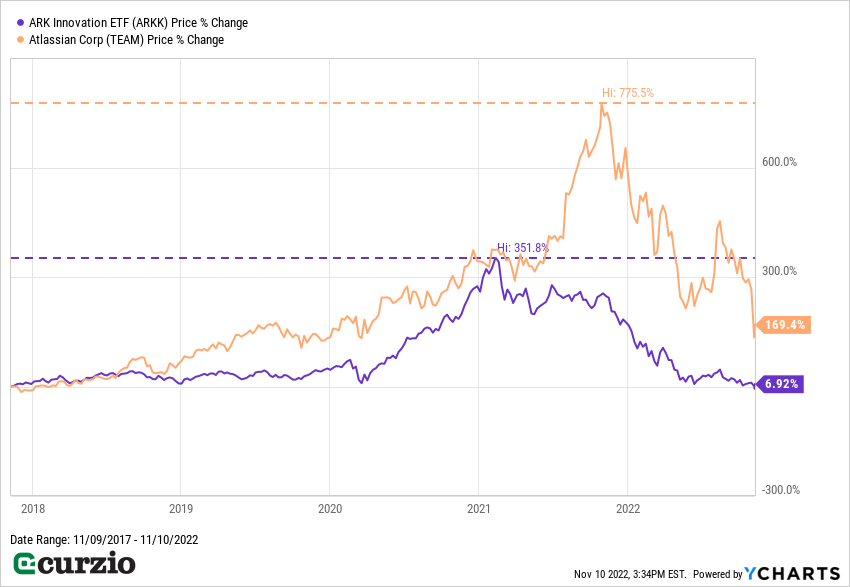

We can already see it in the performance of the pandemic market darlings: high-growth tech stocks.

In what seems to be a repeat of the dot-com bubble bust of 2000, the tech-heavy Nasdaq has sharply underperformed the market this year. It’s down 29% vs. a 17% decline for the S&P 500.

The unprofitable subsector of the market is down even more… with the infamous ARK Innovation ETF (SARK)—an actively-managed fund known for its penchant for money-losing, fast-growing companies—hit a fresh five-year low on Wednesday. It’s down about 60% year to date despite yesterday’s rally.

In other words, the golden era for growth-at-any-price stocks is over as investors demand to be “shown the money.”

Many tech high-flyers are learning the hard way that high valuations don’t last forever… promises can only take you so far… and investors will demand profits in the end.

Take, for example, Australian software company Atlassian (TEAM), maker of a popular collaboration tool called Jira.

Last Thursday, TEAM cut its revenue forecast for Q2 by about 4% (to $835–855 million vs. the expected $879.3 million)… and it warned that customers are hesitant to move from its free service to its paid subscription model. The company is also seeing a slowdown in the number of paid customers it’s adding to its roster.

Moreover, the company expects higher amounts of stock-based compensation going forward (stock given to employees in lieu of salaries). These costs increase as the share price falls and TEAM needs to issue more stock to pay the same amount in salaries.

Making matters worse, TEAM remains one of the most expensive software stocks in the market.

Before the recent decline, TEAM was down 63% off its highs… but still valued at 15.7 times (15.7x) annual revenue…

Even after the stock lost 18% over the past week, it remains super-expensive, trading at more than 12x revenue.

For comparison, Microsoft (MSFT), a highly profitable company, currently trades at 8.9x revenue. It’s still quite expensive… but about 25% cheaper than Atlassian.

Many other expensive tech names remain vulnerable in this market.

In short, higher interest rates have triggered a big change in the market. These former high-fliers are losing their growth edge… and as their growth rates shrink, the market keeps lowering their valuation.

The result: sharp share price declines.

You can see this in the chart below, which shows the past five years of price action for both TEAM and ARKK…

Meanwhile, the AXS Short Innovation ETF (SARK)—an inverse ETF designed to deliver the opposite returns to ARKK—is up almost 60% year to date.

In our Moneyflow Trader portfolio, we booked gains of around 40% and 57% on this ETF in recent months.

And Moneyflow Trader members have made even bigger profits on the decline of Atlassian. We’ve closed three trades on TEAM this year… booking gains of 83.1%, 62.9%, and 271% on put-based bets against this overvalued tech company. (And right now, you can join us at Moneyflow Trader for a limited-time discount.)

The bottom line: It doesn’t matter where a stock is trading relative to its previous highs. What matters is where it trades relative to today’s outlook.

If it’s cheap, buyers will emerge. But if it’s still expensive (even after falling sharply from its highs)… sellers will continue to press it down.

Be careful with overpriced stocks in today’s market… especially those that haven’t been able to show profits. These stocks are vulnerable to more declines as their growth decelerates.