Editor’s note: In celebration of her two-year anniversary with Curzio Research, Genia brings you a special Q&A edition of her weekly commentary. The three questions below are all from you, her readers… and address topics essential to today’s market. After reading it, we felt a lot smarter…

If you’re a regular reader, you know I love unpacking headlines and explaining what really matters to your portfolio.

And to celebrate my Curzio anniversary, we’ll talk about some of the issues you’ve told me you wanted to hear more about…

I selected the three questions below based on their relevance to today’s market. They touch on topics ranging from bonds and the Fed… to aggressive growth and ETFs… to income and dividend reinvestment.

We’ll start with one about the growing trend for thematic ETFs, and whether to invest…

Q: Do you have any input on Simplify products?

Simplify exchange-traded funds (ETFs), together with peers Amplify and Ark, represent a new and growing set of ETFs based on “thematic” investing.

Thematic investing is focused on big, identifiable macro trends, such as robotics… nuclear energy… or fintech. Until the advent of ETFs, these concentrated strategies were only available to qualified investors via private banks or money management firms.

Some of these funds are based on a specially designed index (and are therefore passively managed), but some can be actively managed, making a buy or sell decision outside of a preset rule.

This is where a fund’s experience counts… and the best way to measure it is by its track record.

The longer it’s been in business, the easier it is to review the fund’s returns, compare them to peers or market performance, and determine whether the past few quarters’ returns (good or bad) are a fluke.

Because these funds depend on a proprietary selection process, which can be difficult to assess, and on a longer-term set of goals, it takes time to get a clear sense of performance.

This is why it’s hard to give a wholehearted recommendation to any of the Simplify funds. They’re too young. Simplify’s oldest ETFs were launched just a year ago… and the popular Simplify Volt Fintech Disruption ETF (VFIN) launched in December 2020.

By itself, though, the young age of a fund shouldn’t prevent you from checking it out… or even taking a position.

This simple set of rules I use should help make a decision:

- Know your investment. Review the prospectus, with a focus on stock selection, overall strategy, and position weightings.

- Make sure you like the fund’s largest positions.

- Pay special attention to costs (management fees). All equal, a fund with lower costs will outperform. An aggressive fund might be worth 0.5% or a bit more in fees—but remember: Most passive funds charge you 0.1% or even less.

- Look at the fund’s turnover. While ETFs are generally more tax efficient than their mutual fund peers, this new crop of actively managed or thematic ETFs trade more… which can result in them taking gains/losses with less tax efficiency than their passively managed peers. This shouldn’t disqualify the fund in question—but it might better serve you in tax-sheltered accounts like IRAs.

- Make sure a fund you’re considering is liquid (easy to buy or sell at short notice). If the portfolio is holding too many small or micro-cap stocks (based on market cap), the average daily volume could make this fund difficult to trade. Also, a fund with too many volatile options or micro-cap stocks might act accordingly.

Q: What are your thoughts on the Fed’s reverse repo facility?

The Federal Bank’s reverse repurchase amounts (“reverse repo” or RRP) have been setting records lately. And investors are wondering if they’re getting too big.

A reverse repo is a Fed instrument that lets financial companies park their money with the Fed overnight in order to regulate interest rates.

Typically, it doesn’t get much use… but post-COVID, everything is different.

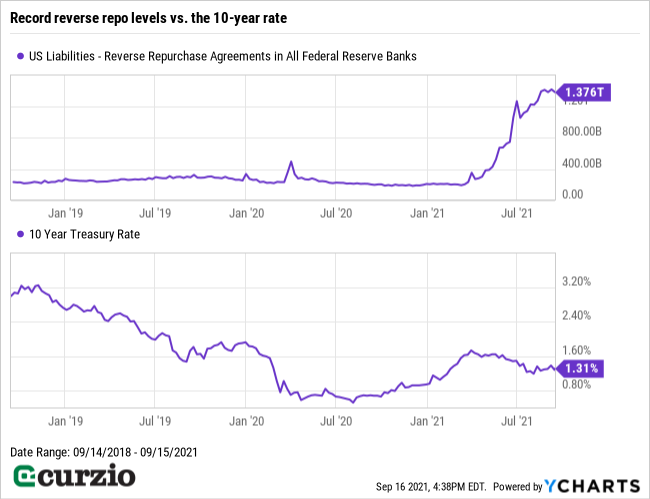

The record amounts this year (RRP exceeded $1 trillion for the first time ever) help explain why longer-term Treasury rates (the basis for mortgage rates) have recently reversed their ascent.

And this action can help bond investors to plan their next step.

If you’ve never heard about reverse repo, you’re not alone.

While it’s often used to help banks deal with excess liquidity (too much in deposits vs. profitable lending opportunities), in the past it also helped to stabilize the entire money market industry.

How does this “cash parking” work?

A RRP is just a standing arrangement for the Fed to sell treasury bonds or other securities to a bank with a goal of buying it back the next day.

By selling—albeit temporarily—some of its Treasuries of mortgage-backed securities, the Fed helps banks take the excess cash off their balance sheets.

This removes some pressure to lend—and helps banks deal with a deluge of cash.

The Fed’s reverse repo gives banks and money market funds a place to earn money… keeping interest rates stable.

And this spring, the Fed lowered the amount needed to “invest” with it… and hiked interest rates on RRP to 0.05% (from zero). That caused more and more money to flow into the RRP… from about $200 billion in March to more than $1.4 billion in September.

I mentioned above that as a side effect of more cash in the system, important rates—such as longer-term Treasury yields on the graph above—reversed their recent increase.

Treasury bond demand increased, the prices for 10-year bonds started to rise again, and interest rates declined (bond prices and rates move in opposite directions).

This lower rate, together with a safer market, might have been what the Fed wanted all along.

But this action also tells us the recent decline in long-term interest rates is largely caused by the Fed… which means it might be short-lived.

If rates were to rise, bond prices would fall…

And the end of the 40-year bull market in bonds might be close.

Q: Do you like dividend reinvestments?

Dividend income is one important reason we invest.

And historically, it’s been a significant component of stock market returns.

The 22-year S&P 500 chart below shows an overall return of 235%… and it includes three massive bear markets: The aftermath of the dot-com boom, the Great Recession, and the COVID-related decline of 2020.

But had you reinvested all dividends back into the S&P, you’d have earned a massive 410% return over the same time period.

Dividend reinvestment works with individual stocks as well.

Let’s take Pfizer (PFE).

Over the past 22 years, it’s returned about 30%.

But with dividends reinvested back into the stock, you could’ve earned 183% over the same period.

Reinvesting dividends is a form of dollar cost averaging. You buy a bit more stock with these dividends every three months (for U.S.-listed companies, which typically pay quarterly dividends). When the stock price is higher, you buy less with the dividends… and more if the price is lower.

Because it takes advantage of price movements automatically, the strategy can even be set on autopilot.

The most important thing here is to make sure you still want to own a certain stock. Again, if you’re reinvesting dividends, you’re buying more of it.

If you do like the stock—and don’t need dividend income today—it’s wise to reinvest dividends. It’s a solid way to grow your portfolio over time and to make use of the power of compounding.

Dividend reinvestment method works until your investment goals change… and you need dividends for supplementing your income.

P.S. Have a question you’d like me to answer in these pages? Let me know here. I’ll address as many of your concerns as I can in a future issue.