Last year, college football had its greatest season in history…

But the story to get there was years in the making.

You see, just four years earlier, after years of underperforming, the Louisiana State University (LSU) Tigers replaced their coach, hiring Ed Orgeron to lead the team.

Orgeron was a risky decision at the time; many fans and pundits were calling for a better-known name to fill the position.

But Coach O surprised them all…

He ended up overhauling the team’s staff, players, and schema… assembling arguably the best quarterback and coaching duo ever—Joe Burrow and Joe Brady. He took a massive risk… and by the 2019 season, it was paying off in a huge way.

The outlier season represented a phenomenal comeback story for the team. That year, the Tigers beat seven of the top 10 teams… finished the season 15-0… and beat five of the final top 10 ranked teams by an average of 19.6 points.

It was such a ridiculous season that my business partner and I had to see the national championship game in person:

My point is this: Success tends to follow patience. Greatness takes time…

The same goes for the stock market. The most impressive stories, like the Apples and Amazons, take years to develop.

Now, we’re seeing the same thing play out again with Tesla (TSLA).

Patient Tesla investors scored huge

Elon Musk rewrote the automobile history book—battery-powered vehicles are gaining share at a rapid pace. But it hasn’t always been an easy ride holding Tesla shares. Trust me—I’ve owned it since 2014.

Prior to 2019, shares were sidelined for years. Headline after headline would declare the unprofitable carmaker would head lower and eventually face bankruptcy. In fact, TSLA is one of the most shorted companies in history—including by many big-name hedge funds…

Those were not good trades.

News and headlines don’t determine the trajectory of a stock. Supply and demand do.

As you probably know by now, I follow the Big Money. After trading billions of dollars’ worth of stocks on Wall Street, I’ve learned that the best stocks out there have Big Money investors buying shares.

At my firm, Mapsignals, our mission has been to track that data.

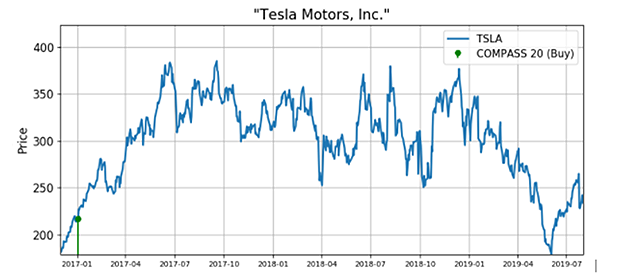

There wasn’t a ton to show for TSLA from 2017–2019. The green signal below is the only time that TSLA appeared as a top name for us:

But, just like with LSU, 2019 changed the game for the stock. Patience began to pay off. Tesla started to become profitable and media headlines began to shift. People began praising the carmaker; Elon Musk just needed time to put the wheels of greatness in motion.

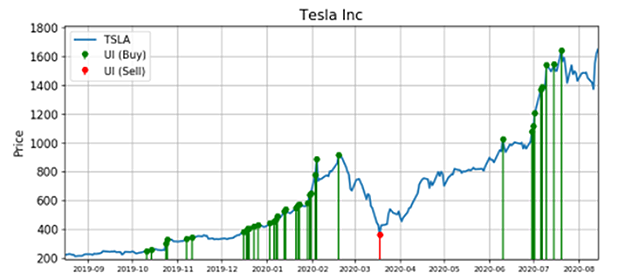

Below, you can see the Big Money buying in TSLA starting in 2019. That, folks, is a lot of green:

The lone sell signal came during the pandemic lows… along with the rest of the stock market. But the Big Money theme quickly returned and ramped shares even higher.

As I said earlier, greatness takes time. Had LSU quit on Coach O, the record books wouldn’t have been rewritten. Had I quit on TSLA, I wouldn’t be able to tell this story.

So often, new investors look for the quick thrill and miss out on the big picture. The truth is this: If you want the best, be patient. There is no overnight success in anything worth doing.

Editor’s note: In the last few months, Big Money billionaires like Buffett and Dalio have quietly poured a collective $1 billion into a small pool of income-generating assets… and if history’s any indicator, this little-known asset class could EXPLODE as much as 1,217% in the coming months.

In a new presentation, Frank explains how fast-moving Main Street investors can cash in on this massive opportunity… Watch here.