You’ve probably heard of Paul Allen…

The Microsoft cofounder was the 44th-wealthiest person in the world at the time of his death in 2018… with a net worth of over $20 billion.

He was one of Time Magazine’s 100 most influential people in 2007 and 2008…

He gifted billions to his favorite causes, from education to healthcare to wildlife conservation…

He owned the Seattle Seahawks and the Portland Trailblazers…

And as an avid art collector, he was (posthumously) behind the biggest art sale in history.

Last November, at auction house Christie’s New York, bidders sparred over more than 150 masterpieces from Allen’s extensive collection, which included works by Vincent van Gogh, Pablo Picasso, Georgia O’Keefe, Salvador Dali, Rene Magritte, and many others. Bidding began at $100 million… and many pieces easily exceeded their estimates.

By the end of the night, Allen’s collection sold for more than $1.6 billion. (The previous record art auction was “only” $922 million.)

The total was especially impressive considering how much the works had appreciated in value since Allen originally purchased them.

For instance, in 2001, he paid $38.5 million for Paul Cézanne’s “La Montagne Sainte-Victoire,” which sold for $137.8 million.

The sale couldn’t have come at a better time for Allen’s estate, as demand for artwork and other alternative assets soared amid the recent stock market volatility.

Of course, Allen’s collection included top-tier works that most investors don’t have access to… It’s unlikely the average collector would ever be able to replicate these prodigious returns.

So it might shock you to learn that Allen’s estate would have actually earned a better return if Allen had simply invested in an S&P 500 index fund.

For the works with public entry prices, the average annualized gain (over an average of 18 years) was 6.2%… while the S&P 500 returned 8.9% over the same timeframe—through bear and bull markets alike.

There’s a simple lesson here: Staying invested in the market is the surest way to grow your wealth over the long term.

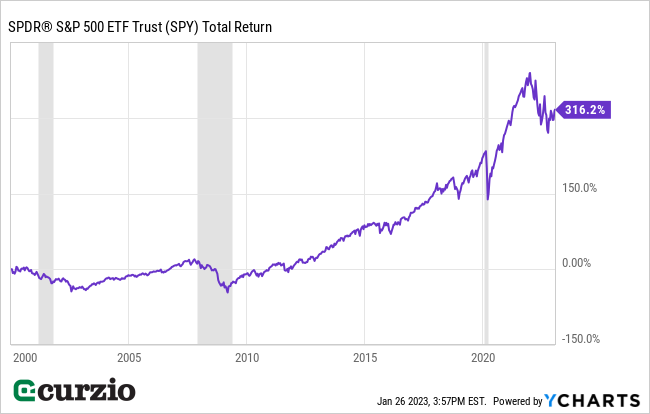

As you can see below, the S&P 500 has more than quadrupled over the past 22 years… despite three recessions and four major bear markets.

Of course, staying invested is hard… especially when the market hits a rough patch like it did in 2022. Through year-end, the S&P 500 lost 18.2%.

Double-digit declines like this can test the dedication of even the most committed investor…

But ultimately, bear markets and market bottoms are the best times to invest: Investors buying at generational lows position themselves for massive gains when the tide turns.

This is where strategies like the one we use in our Moneyflow Trader service can help…

Market insurance helps you ride out the tough times

By buying put options designed to move up when individual assets (or the entire market) fall, you set yourself up to profit from the market’s declines.

And while buying a put will cost you money upfront, that’s the maximum you can lose if the market rises and the trade goes against you. Think of it as paying an insurance premium: You might not need coverage when you’re healthy… but you’ll be glad you paid for it when your health takes a turn for the worse. In fact, the small premium can pay off many, many times over in the event of a catastrophe.

The same is true when it comes to the stock market…

In a bear market, put options—as well as their relatives, inverse ETFs—can make you money as the market plunges.

And because of that fact, it’s easier to hold onto your best stocks… buy more on a downswing… and ultimately profit from the eventual market recovery.

After all, few asset classes can compete with the stock market’s profit potential… not even the well-curated art collections of the rich.

P.S. During the bear market of 2022, Moneyflow Trader members had the chance to lock in 18 winners for gains as high as 271%. With many stocks set to get crushed again… this is the perfect strategy for 2023.

And the best part: I take out all the guesswork—and walk you through each trade every step of the way.