When you first start out, it’s a lot of fun to invest.

There’s so much excitement… so much promise… so much to learn from the market.

Inevitably, there are setbacks—but it’s what we do with them that makes all the difference. We can either embrace the pain and learn from our emotions and mistakes… or we can pretend they never happened.

When it comes to investing, this kind of denial can be devastating.

Let me tell you about my first major setback… and why it was the best thing that could have ever happened…

Let’s say you’re an investor with a struggling portfolio… A sea of losses has led you to finally throw in the towel and say, “I’ve had enough.” You simply want the pain to stop.

The real danger in this scenario isn’t taking the loss. The true enemy is your emotions. Fear and dread cause investors to think with their hearts and not their heads.

Think of it like this: When we buy something like a dishwasher, we do it rationally…

We spend time researching and agonizing over features, brands, models. We study YouTube videos. We go to stores, talk to salespeople, and hunt for the best prices.

And when the one we want gets its price slashed, we pounce and feel great about getting a deal.

The average investor does way more research when shopping for a dishwasher than portfolio stock.

How many of you are guilty of hearing a “hot tip,” getting excited, and opening up your online broker right then and there to buy shares of a company you know nothing about?

Look, I’ve talked to plenty of investors and traders during volatile markets. The most common thing I hear is, “I need to see things stabilize before getting involved.”

That’s a mistake.

Some of the best times to get involved in the market are when the world is on fire.

When the coast clears, and it’s safe to jump in again… the big moves already happened.

That’s why emotion is the enemy of rational investing.

I know it well… On my very first investment, I let my emotions guide me. The story got me excited—a company that was supposed to replace eBay.

I bet around $5000 on the idea—a ton of money to a kid like me—without any actual analysis… all because it felt like the right trade.

And I lost 99% of my money.

Looking back, I consider that huge loss to be the tuition for my investment education.

After investing—and losing—because of an investment driven by emotion, I decided to buy my stocks like I would a dishwasher… And I started winning.

I began to rank stocks by their fundamentals—like sales growth, earnings growth, etc.

And when the market is in freefall and oversold, I revisit these stocks—the ones with solid footing that are likely to bounce high and hard.

Years later, it led me to create a data-driven system (i.e., emotion-free).

It’s a system that prepared me for the problems we saw in March. When markets reach a pain point like that, it’s usually time to place a statistical bet. Like Warren Buffett says, “Be fearful when others are greedy and greedy when others are fearful.”

So, how do we know when the market has reached its breaking point?

Data drives the markets, not emotions

This may sound crazy, but news doesn’t move prices.

Stocks shift because of one reason only: supply and demand.

When I was on Wall Street, I feel like I received a second education just trading stocks…

I handled billion-dollar trades, sometimes in a single day, and I traded for the largest big-money accounts on the planet.

I also sat on the front lines in 2008-09, and had an insider’s look at how monster stock liquidations really happen…

The biggest lesson was that the pain point for some investors provided incredible buy opportunities for others.

Opportunism may not always be pretty, but markets usually rocket higher after liquidations… and often when things feel the worst.

Luckily, it’s something we can actually see in the market…

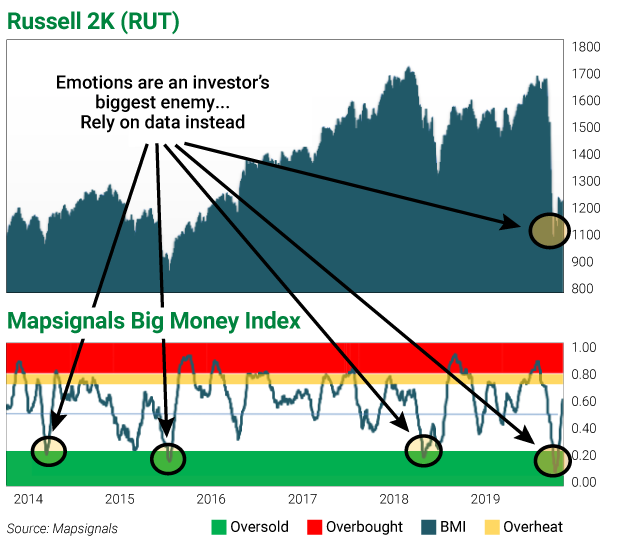

See the chart below of the Mapsignals Big Money Index (BMI). It measures supply and demand on thousands of stocks. (I like to use the Russell 2000 as a benchmark, because this index holds 2000 stocks, and the BMI is measuring big money activity on 1400 stocks. In sum, there’s a high correlation between the Russell stocks and those we’re tracking on the BMI.)

When selling gets extreme, it means opportunity:

As you can see, when the BMI goes green, it aligns with market troughs. That’s the point of peak fear, but history says it’s also the best opportunity…

That’s because the historical data points to amazing forward gains for the markets… and even better gains for the best-quality stocks.

I helped create the BMI—it was built upon all the lessons I’ve learned over my career. And it allowed me to jump in near the March 23 pandemic lows.

The BMI flashed green on March 19… telling me the markets were oversold, and the bottom was drawing near. So I took out my list of stocks and bought big on those I knew were likely to rebound strong.

It was scary and uncomfortable—my heart said “no” while my mind said “yes.”

Now that headlines are starting to improve and the coast seems clearer… the lows from a month ago are long gone.

Had I waited until now, I would have missed out on some fantastic opportunities.

A systematic approach gave me the insights I needed to navigate the last couple of months with icy calm.

With this volatile market, there are likely more troughs—and big opportunities—ahead… so keep an eye on these pages for what the data says.

Keep this in mind the next time the market gets out of whack and things get scary:

Emotional investing creates opportunities for other investors.

Focusing on data creates opportunities for you.

Editor’s note: On April 30 at 8 p.m. ET, Frank is hosting our first-ever webinar—Navigating the New World Order: A Curzio Research Town Hall.

During this FREE event, Frank will cover the COVID-19 outlook you’re not hearing from the mainstream media… the sectors to avoid even when the crisis is over… and how you should invest NOW for the months and years ahead.

Plus, he’ll be answering questions from subscribers like you during the broadcast.

The event is free to attend, but you must reserve your spot now.