On October 23, 2014, I bought two outlier stocks…

And they made a life-changing impact.

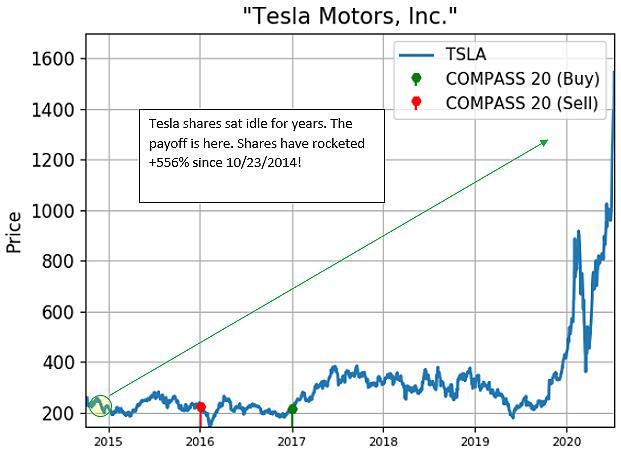

I’d been watching a renegade car company called Tesla (TSLA). In 2008, it gained attention following the release of the Tesla Roadster, retailing for about $100,000. The Roadster was the first electric sports car. Over time, the electric battery would add up to significant fuel cost savings. But the battery’s limited life meant the car could only go so far without a recharging station.

This inconvenience, not to mention the price, made many investors skeptical of the company’s ability to take its cars mainstream.

But on October 23, 2014, I saw Big Money moving into TSLA…

I’d recently visited a Tesla showroom with my business partner and sat in a Model S. Once I did that, it was all over. I now knew this company had an amazing product. And once I saw the Big Money signal… I jumped.

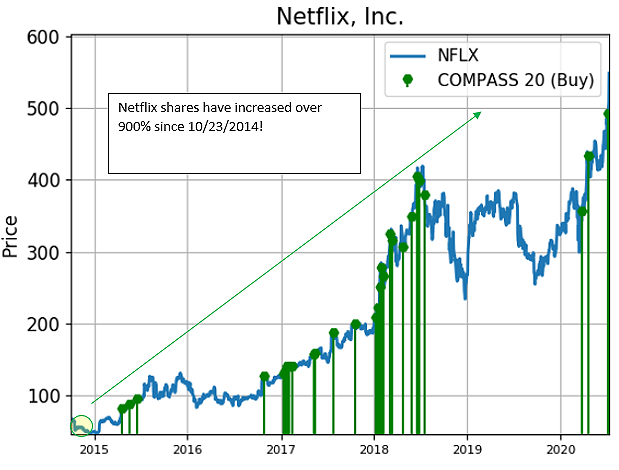

The same day, I saw Big Money moving into another outlier stock—Netflix (NFLX).

Netflix’s mail order DVD service had been around for some time, but I felt the shift to full on-demand streaming was very near. Plus, the company would consistently beat sales and revise its guidance higher.

On October 23, I made a bet on NFLX too.

You can guess what happened next. But instinct wasn’t the only reason I bought these stocks when I did…

Netflix is a 10-bagger

Over the course of my Wall Street career, when I was handling billions of dollars worth of shares (sometimes in a single day!), I came away with one simple—but huge—lesson:

Big Money only chases a few stocks.

In other words, institutions tend to be choosy with their investments… and for good reason.

Over the years, I noticed that only a small percentage of stocks made the most gains in the market. (Please don’t take my word for it. Here’s an awesome white paper that looks at stock returns since 1926.)

Great stocks have great traits: They have amazing products and great management… They grow sales year after year, and—most importantly—they continue to attract the Big Money.

Netflix has been a Big Money magnet.

At Mapsignals, we track Big Money movement, as seen by the green bars.

More green usually means greater gains.

It’s one thing to catch an outlier like this back in October 2014… but it’s another to do it twice in the same day!

Tesla shares have rocketed higher

You’d be hard-pressed to find a stock that’s blasted higher and faster than Tesla… Shares are up 269% year to date.

But the payoff took years to play out. Tesla was controversial back then; heck, it’s controversial to this day.

Some outlier stocks get a lot of praise, while others get a lot of hate. And the TSLA ride has been nauseating. But, the juice was worth the squeeze.

You’ll notice that TSLA didn’t have a lot of green signals. That’s because the fundamentals have been lacking all these years.

What’s been there, though, are amazing products, solid management, and an asymmetric payoff.

Long story short: In October 2014, I placed a bet… and was dealt two aces.

Then, I did what I always do: I held. That’s how you make big money in stocks. Had I sold them on their first rip or dip, I wouldn’t be able to share this experience with you.

Know when to hold ’em… And when you do catch a couple outliers, you’ll have an unforgettable story to tell.

Editor’s Note: The market’s rebound has a lot of investors letting their guards down… and Curzio’s Genia Turanova believes they could lose their shirts as a result.

She’s put together a FREE report explaining the surprising forces that are really driving the rebound… why it could reverse just as quickly as it started… and what you need to do NOW to prepare for the worst.