Most investors have heard the metaphor “helicopter money.”

It goes back to a 1969 essay by Nobel Prize-winning economist Milton Friedman:

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.

Behind this indelible image, there’s a relatively simple theory: If a government controls the printing press, it can finance an increase in spending (or a tax cut) by simply increasing the amount of money in circulation.

The first major revival of the helicopter money concept was in a 2002 speech by then-Fed Chairman Ben Bernanke:

The U.S. government has a technology called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost… A money-financed tax cut is essentially equivalent to Milton Friedman’s famous ‘helicopter drop’ of money.

The question is, does helicopter money help a failing economy… or is it an overreaction?

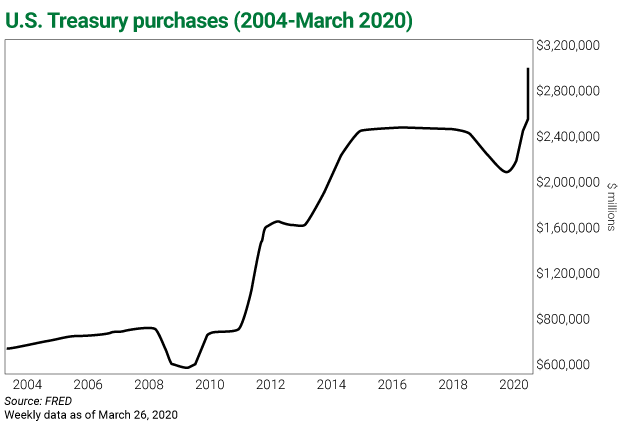

Let’s compare the Fed’s actions in the month of March to its response during the 2008/09 financial crisis.

To fight the Great Recession, central bankers all around the world used a number of unconventional tools, all of them stimulatory. The U.S. implemented quantitative easing (QE) and zero interest rates, while other central banks employed negative interest rates.

Thanks to these measures, the economy was able to avoid further financial crisis contagion. Growth was restored, and as a direct result, the stock market launched a strong recovery that ultimately translated into the longest bull run in U.S. history.

That bull market, as you well know, ended in March—brought to a sudden stop by the dangerous and highly contagious COVID-19… and the subsequent economic pause from attempts to flatten the curve.

In the midst of COVID-19, the Fed has moved aggressively—first cutting interest rates by 0.5% on March 3… and then to nearly zero just 12 days later, on March 15.

Almost daily, new actions are being implemented—all designed to help money move through the economy.

In addition to a dramatic near-zero rate cut—executed faster than ever before—the Fed has implemented other important measures—both traditional and nontraditional.

Here are just a few measures designed to help investors, commercial banks, and the economy:

- Quantitative easing is back, and it’s larger than ever.

First used in 2008, QE is designed to keep longer-term interest rates low via targeted buys of Treasury and mortgage-backed bonds. Unlike in the past, though, this time the Fed is going all out… with a pledge to spend as much as needed.

In November 2008, when the Fed began its QE1 program, it pledged to buy $600 billion in mortgage-backed bonds… That was just a start—by March 2009, the amount of Fed-owned securities grew more than 2.3 times (2.3x)… and 2.8x by summer 2010.

Today, the Fed doesn’t even want to indicate where and when its open-market purchases will end. This means it’s willing to spend whatever it takes… it’s as close to helicopter money as it has ever come.

- To guarantee the banking system works as usual, the Fed has been offering cash via repurchase (repo) agreements that allow banks to borrow cash more easily.

Moreover, at the end of March, the Fed said it would now allow foreign central banks to exchange U.S. Treasurys for overnight dollar loans.

Commercial banks are also encouraged to borrow through the Fed’s “discount window,” with the rate lowered to 0.25% and the length of the loans extended.

These measures aren’t exactly new, but they’re important. Our financial system is an integral part of the overall economy, and it’s more vital than ever that banks stay solvent and operational.

Don’t mistake this action for a government bailout like what happened during the financial crisis.

Today’s crisis isn’t caused by any specific industry, let alone banks’ excessive risk-taking. It’s a public health crisis, and banks are urgently needed today as an important part of the functioning economy.

- As another crisis-fighting measure, the Fed has relaxed the Dodd-Frank act, one of the post-financial crisis banking rules.

Banks will be allowed to take on more leverage—again, to keep the money moving through the economy.

- The Fed has established a new facility called the Money Market Mutual Fund Liquidity Facility (or MMFLF).

This measure is designed to help money market mutual funds (funds where investors park money) withstand withdrawals. Thanks to this, it’s now less likely money market funds will have to sell assets—which would further stress the market. That’s good news for all investors who can now worry less about their money market assets losing value.

- As I discussed last week, for the first time ever, the Fed is allowed to buy corporate bonds and bond exchange-traded funds (ETFs).

But are these measures enough?

Experts and Fed watchers suggest that central bank stock buying (via a liquid index ETF) might be next.

Our central bank has never taken this measure… but it’s not unprecedented.

The Bank of Japan has been able to buy stocks for years… with the most recent amount set as high as 12 trillion yen (over $112 billion) per year.

And while the Fed would most likely need special permission from Congress, we’ve already seen lawmakers are ready to do whatever it takes to save the economy.

The measures set in motion in March have already helped the market, which is now up 12.6% from its 2020 low. Their long-term impact on the market, and the net economic results, will take longer to become apparent… too many factors are currently in play.

But between the mounting death toll and economic carnage, one thing is crystal clear: Without these urgent measures, the market would be even more treacherous than it is now… and the economy would be in even worse shape.

During the Great Recession, there was a limit to how much the Fed was willing to spend. I don’t think unlimited helicopter money was even considered—fiscal conservatism and moral hazard issues were front and center back then.

But the Fed’s measures helped nevertheless.

Today, unlimited QE is clearly the way to go. The looming recession (or even depression) won’t be the result of bad economic and moral decisions.

It’s worth noting policymakers are also on the case. As we all know by now, on March 25, Congress passed a massive $2 trillion economic rescue package called the CARES Act. And there’s already talk of the next phase of the economic stimulus.

The unprecedented amount of stimulus and the measures taken by the Fed are positive—for consumers, for the banking system, for the economy as a whole… and for us investors.

These policies are designed to fight this crisis… and they’re a must for the economy we’re in.

When this is all over, the discussion will inevitably turn to whether zero-rate policies or helicopter money are good for a healthy economy… and how to unravel these measures when the crisis is over. But today it’s clear: The economy could use all the help it can get, and it’s better to err on the side of overdoing it than to be overly cautious.

Editor’s Note: Over the past two months—even with the market crash—Genia’s helped her Moneyflow Trader subscribers lock in gains like 125%… 150%… and even 508%.

Now, she’s developing a new advisory focused on helping investors generate income in this zero-rate environment.

In this short video, Frank explains why he’s personally following Genia’s advice… why every one of you should, too… and how you can get her Unlimited Income advisory (launching soon)—FREE.