There’s a lot of uncertainty in the markets right now. Rising interest rates are about to put major pressure on the economy… making the path ahead hazy for investors.

The biggest fear is a potential recession—where the economy slows down and growth turns negative.

Recessions are scary for investors. But fret not! We’ve been through them before… and we’ll face them again.

Today, we’ll take a look at past recessions to see how they affected the market—both during and after. And I’ll highlight one sector that tends to thrive during these periods of uncertainty.

Stock performance during past recessions

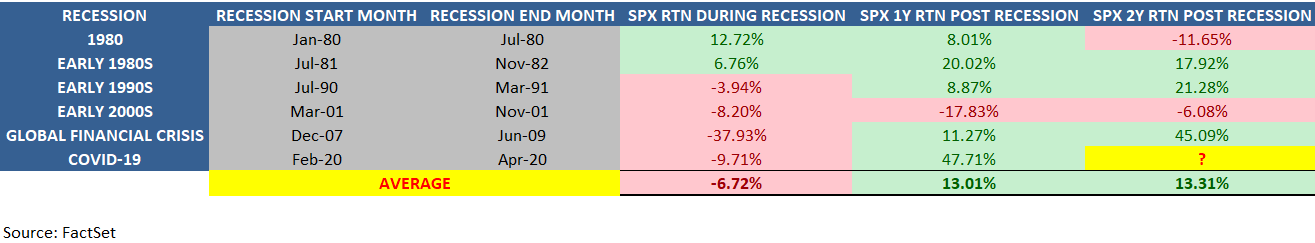

Here’s a look at the past six recessions dating back to 1980. I’ve plotted the performance for the S&P 500 during each period (the middle column). To the right, you can also see how the index did in the one- and two-year periods after each recession ended:

The average length of these recessions was 10.5 months, and the average return was -6.7%. The major outlier was the global financial crisis in 2008–09, with a drawdown of -37.9%. Somewhat surprisingly, the S&P 500 didn’t lose more than 10% during the five other recessions.

You should also notice the one- and two-year performance for stocks once the recessions ended… Investors who stayed the course during an economic contraction were rewarded with double-digit gains on average.

And, as you’ll see, a handful of sectors tend to hold up quite well during a recession… including one that’s seeing a lot of Big Money buying lately.

A bellwether sector during a recession

Most stocks are tied to the economy and its cycle of ups and downs. These cyclical stocks tend to move along with the economy in good times and bad.

Consumer discretionary stocks—like travel companies—are a great example. When the economy is booming, people have extra income to spend on “non-essentials” like vacations.

On the other hand, vacations are one of the first things folks cut back on when times are tough. During a recession, their money goes to essential goods like food and electricity.

The companies that focus on providing these essentials—like consumer staples and utilities—are more “defensive” than their cyclical counterparts. Their sales don’t grow much during the boom times… but they don’t fall much during a recession. And their stocks tend to perform well in just about any environment.

The healthcare sector falls into this category, as well. People get sick and need treatments all the time, regardless of how the economy is doing. And during a recession, this steady demand makes healthcare stocks one of the best areas for investors.

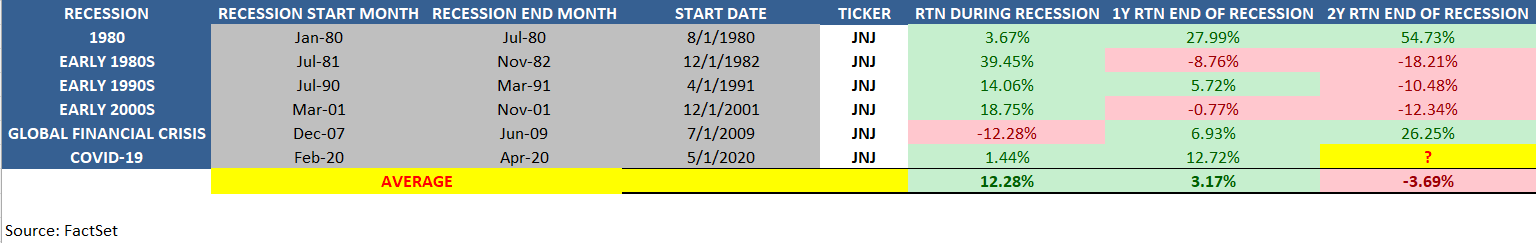

To illustrate the point, let’s look at Johnson & Johnson (JNJ), the global healthcare giant. It makes a wide range of healthcare products, from prescription drugs and medical devices to consumer products like Tylenol, Listerine, and its familiar line of baby products.

Here’s how shares of JNJ performed during the six recessions we looked at earlier:

JNJ generated gains during five of the last six recessions… with an impressive 12.3% average rise (including the double-digit loss during the global financial crisis).

In short, Johnson & Johnson’s history of steady cash flow and stable dividends makes it an excellent stock to own during a recession.

And as investors worry about a potential recession in the coming months, this type of profile is starting to attract a lot of money from the biggest players in the market.

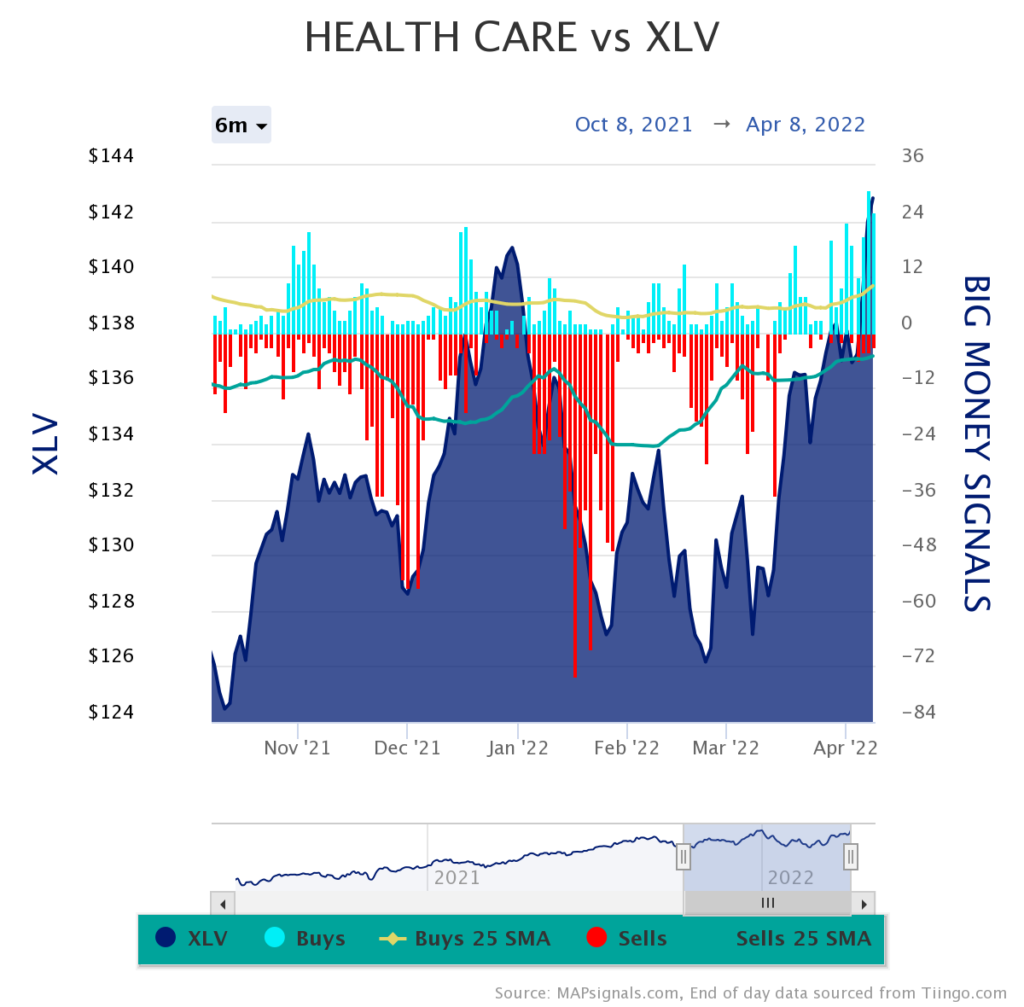

Put simply, the Big Money data shows lots of buying in the healthcare sector. Below is a six-month chart that shows all the buy and sell signals for healthcare companies:

There’s a lot going on in this chart… but look at the rising blue bars on the right side. Each blue bar indicates the number of healthcare stocks ramping higher on big trading volume (which indicates Big Money was buying).

As I mentioned above, healthcare companies offer a stable business outlook… especially when economic uncertainty is rising.

That’s why big institutions are starting to pile into these stocks. And as the economic picture gets murkier… healthcare could be one of the best-performing sectors in the market.

If you’re looking to play this theme, check out the Health Care Select Sector SPDR ETF (XLV). This fund gives exposure to a broad array of healthcare companies, including pharmaceuticals, insurance, medical equipment, and plenty of related businesses.

Its largest holding is JNJ at 9.19%. It also holds UnitedHealth Group (UNH) and Pfizer (PFE) at 8.01% and 4.64%, respectively. These companies have long track records of stable growth in good and bad economies… and my bet is they’ll be great for decades to come.

The bottom line

Recession fears are spreading. But a look back at the past six recessions tells us stock market declines will be modest… and we’ll likely see double-digit returns once the downturn passes.

In the meantime, healthcare stocks tend to do well regardless of the economy. And XLV offers a simple way to buy a basket of healthcare stocks, including plenty of household names that are proven bellwethers during a recession.

Note: I hold long positions in UNH in managed accounts at the time of this writing.

Editor’s note:

Many of you are nervous about where this market is headed… and rightly so.

In this month’s issue of Curzio Research Advisory, out Wednesday, Frank will break down the state of the economy… what’s ahead for the markets… and the smartest ways to position yourself.

Join Curzio Research Advisory today to receive this critical update as soon as it’s released.