Last month, I explained how hydraulic fracturing is fueling an industrial renaissance in America. Industries like pipeline infrastructure, petrochemicals, steel, paper, and fertilizer are adding capacity due to the abundant supply of cheap natural gas.

This month, I focus on a niche industry with soaring demand, directly tied to natural gas production—liquefied petroleum gas (LPG) shipping. I also discuss one company benefiting from stricter industry regulations. Its stock price is already on a tear, and it still has room to run. But first, here’s what you need to know about the industry…

From ground to grill

When natural gas is collected through fracking or drilling, it’s not the same stuff you find under your backyard grill… Raw natural gas contains excess propane and butane, which must be removed to prevent condensation in high-pressure gas pipelines. This excess is what becomes LPG. Natural gas production is the primary source of obtaining LPG, although some is collected during petroleum refinement.

Once collected, LPG is transferred to a pressurized container and “squeezed” into liquid form. Releasing this pressure transforms LPG into a flammable gas. You can safely (and cheaply) store LPG in any size container—from small tanks for barbecue grills to very large tanks for homes and businesses.

Urban America relies on natural gas for heating and cooking fuel. Rural America relies on liquefied propane, since it can be distributed without any expensive pipeline infrastructure. For the same reason, emerging economies like India and China are moving from coal and wood to clean-burning propane fuel.

U.S. LPG production and exports soar

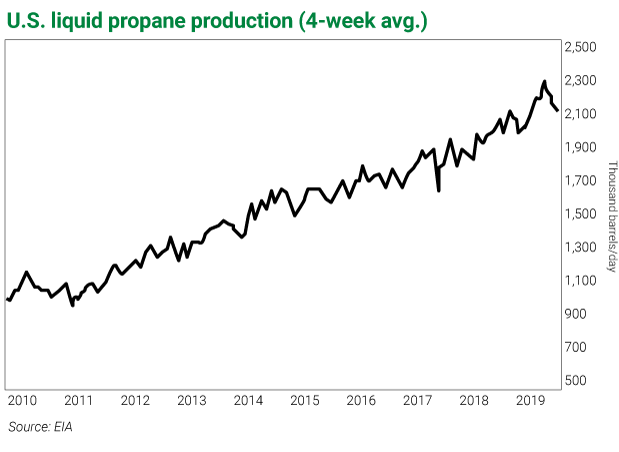

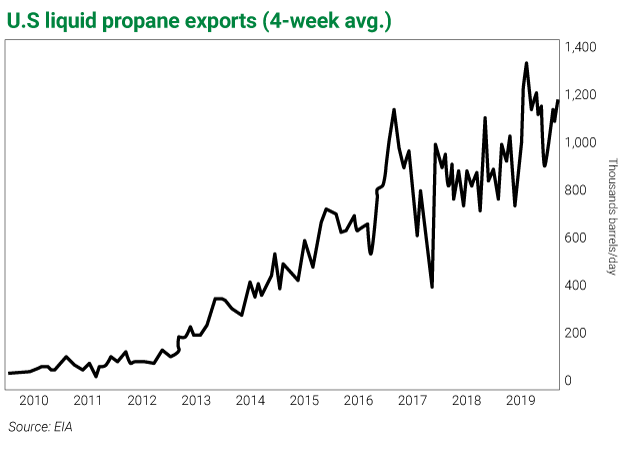

Over the last decade, America’s LPG production has climbed steadily while exceeding demand. Thus, soaring LPG production has created permanent glut conditions… and very low prices.

And since U.S. propane (called Mont Belvieu) now trades at a substantial discount to global prices, the discount has stimulated demand for American LPG. Exports are soaring…

Clean-burning LPG improves the quality of life in emerging economies. By converting from wood or coal to propane, emerging economies are cutting harmful air pollution while increasing the comfort of citizens. And this is being accomplished without big infrastructure investments. Gas companies need nothing more than delivery trucks and pressurized holding tanks.

Asian demand for LPG is growing relentlessly—for use as both fuel and as a petrochemical feedstock. America produces massive quantities of LPG, and America is selling it cheap…

The trick here is transporting massive quantities of LPG from America across the oceans. To accomplish this, you need a big fleet of very large gas carriers.

Demand for long-haul gas shipping soars

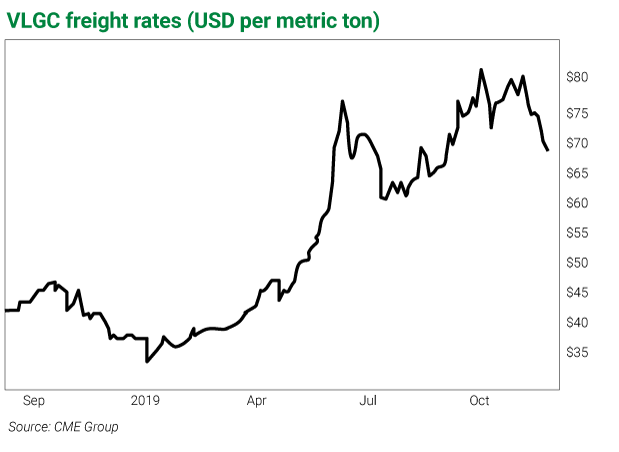

Because of a 2017 oversupply of large gas-carrying ships, orders for new ships have declined. As older ships were scrapped, capacity moderated. But demand for the largest of these ships—called very large gas carriers (VLGCs)—has grown along with Asian demand for cheap American LPG.

Consequently, VLGC freight rates—the prices LPG companies pay to ship their gas—are soaring; they’ve doubled in the past year…

Because of this increased LPG demand, many shipping companies are turning a huge profit… But for some shippers, the cost to fuel their ships will soon double.

New year, new regulations

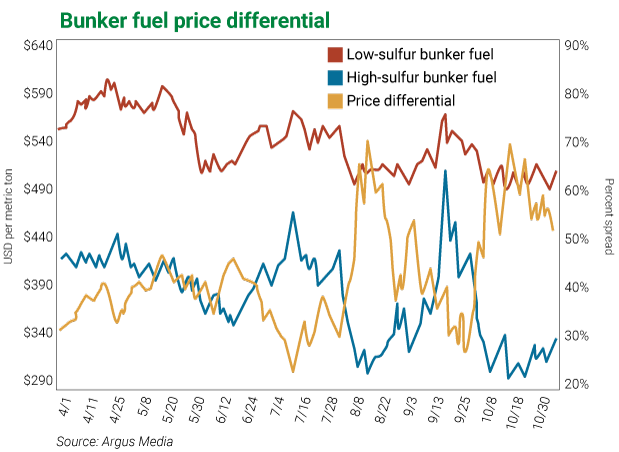

Starting January 1, 2020, the International Marine Organization (IMO) imposed a strict new standard to curb the sulfur emissions of the international shipping industry. The new IMO standard limits the sulfur content of “bunker fuel” oil for powering ships (named after the bunkers that hold the fuel for a ship’s engine) to 0.5%… a huge cut from the prior 3.5% standard.

According to the IMO, most ships use heavy fuel derived as a residue from crude oil distillation. Crude oil contains sulfur, which, after combusting in the engine, ends up in ship emissions as sulfur oxide. This can cause health and environmental problems.

Going forward, oil and gas refiners must remove the excess sulfur or blend large quantities of low-sulfur diesel fuel into bunker fuel for powering ships. Either option will substantially raise the cost of shipping.

Oil and gas refiners are not equipped to meet the high demand for low-sulfur bunker fuel. The market is rationing scarce supply by raising the price. Right now, low-sulfur bunker fuel costs about double that of high-sulfur fuel.

Another way to comply with IMO 2020

The new IMO fuel standard seeks to reduce sulfur oxide emissions… But it doesn’t require that shipping companies only use low-sulfur fuel. By installing scrubbers that remove sulfur from emissions, ships can burn high-sulfur bunker fuel and avoid the added cost.

But that’s not good news for everyone. Scrubbers can’t be installed on most older ships. Only the newest ships are built with the necessary structural support to accommodate scrubber equipment.

A tale of two ships

Because of their structural deficiencies, older ships must use low-sulfur fuel. When these costs start to burn profits, shipping companies will accelerate the scrapping of older ships as they order new ones.

In contrast, the newest fleet operators have an advantage… They’re installing scrubbers, which enable compliance with IMO 2020 while burning high-sulfur, low-cost bunker fuel. New ships will earn very healthy profits, even as the accelerated scrapping of older ships limits capacity and possibly boosts freight rates even higher.

Losers

Older, structurally deficient ships can earn a profit only when freight rates spike much higher. These fleet operators cannot expect to earn consistent profits on their older ships… They also can’t afford to ride the storm in hopes of sky-high rates.

Operators of small and medium gas carriers may also struggle. They can’t afford to participate in the fastest-growing part of the business—America-to-Asia LPG transport.

Winners

The operators of new shipping fleets can look forward to booming profit growth for the foreseeable future.

Fleets of new VLGCs will perform particularly well. VLGCs can efficiently ship gas in high volumes from America to Asia. Their large volume also allows them to absorb the cost of installing scrubbers.

VLGCs will extract huge margins for a long time to come… and one company’s fleet is set to do just that.

Dorian LPG, Ltd. (LPG)

The Dorian LPG fleet is comprised exclusively of VLGCs, most of which are very new. Consequently, Dorian is running at 100% shipping capacity with very high margins.

And Dorian will continue to earn high returns, despite the IMO 2020 fuel standard. By installing scrubbers on its newer ships, Dorian avoids the fuel price hikes afflicting its competitors.

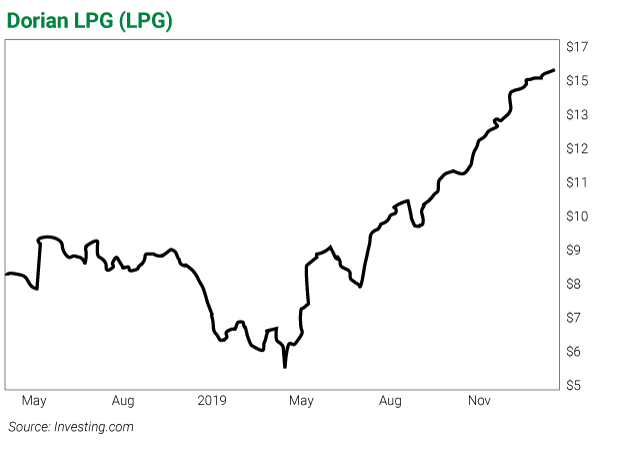

For good reason, the stock has catapulted in the past few months… and it should continue to trade higher.

Dorian’s fundamental picture is still improving… and the stock remains very cheap despite recent gains. Dorian currently trades below book value of $17.46. Also, the forward price-to-earnings multiple of 6.9 is less than half the 15% expected earnings growth rate… making the stock look extremely cheap from an earnings growth perspective.

Recommendation: Buy Dorian LPG (LPG) at current prices. To manage downside risk, sell if the closing price declines below $10 per share for three consecutive days.