The S&P 500 is near all-time highs. That means all is well in the investing world, right?

Not quite.

Something concerning is happening under the market’s surface. As I’ll show you, breadth is thin. That means fewer stocks are keeping the market afloat. For a strong, healthy bull market to flourish, we need to see lots of stocks participating.

But the good news is there’s one group of stocks leading the pack: high-dividend payers.

In a world of ultra-low interest rates, dividend stocks are a great investment. I’ll show you how to play the theme in a bit.

But first, let’s take a peek under the hood of the market.

Big Money support for stocks is waning

If you’ve read my commentary before, you know I’m a data guy. A few weeks ago, I wrote about 3 charts pointing to lower stock prices ahead.

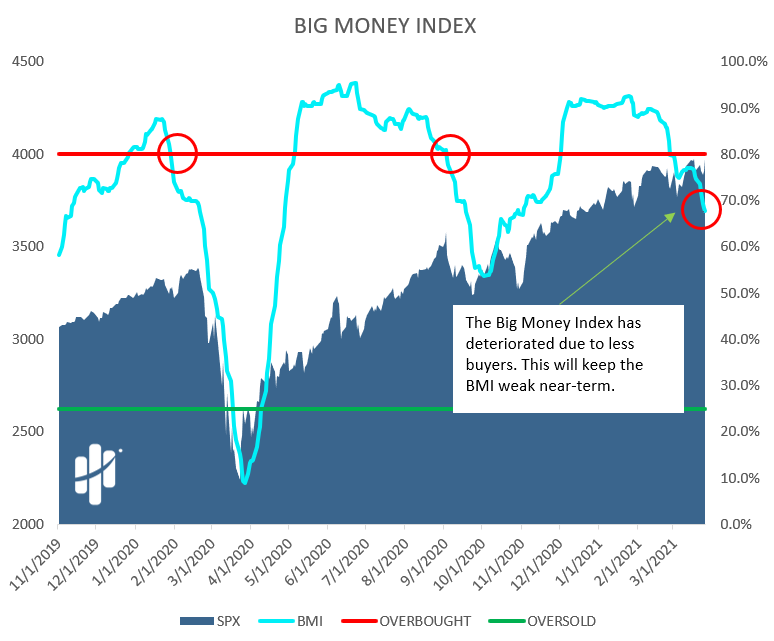

Since then, markets have bobbed and weaved. But my trusty Big Money Index (BMI) is flashing a caution sign. It’s been on a one-way train lower since the end of February.

As a reminder, the BMI measures the amount of buying and selling coming from big institutions. If the line is decreasing, it means buying is drying up and selling is picking up.

Clearly, that’s what’s going on now. Just look at how the blue line sank over the past month or so…

A sinking blue line means fewer stocks are ramping higher compared to a few months ago. It’s not a huge surprise if you consider the epic level of buying we saw two months ago. In January, I noted the buying in stocks had reached unprecedented levels.

Today, the situation has shifted. My data points to more near-term downside for stocks. If things get out of hand, it’ll be another great dip to buy.

But it’s not all bad news. As I mentioned earlier, we’re seeing strong performance from dividend plays…

High-dividend stocks are taking the lead

Most people think of me as a growth stock guy only. But I always keep a close eye on dividend stocks, too.

In fact, stocks that pay a high dividend are among the market’s best performers lately. These high-dividend stocks are pulling ahead while growth sectors—like technology stocks—have taken it on the chin.

Just look at the relative performance of these different groups in 2021. The S&P 500 ETF (SPY) is up 6.26% year-to-date (YTD). High-dividend stocks—measured by the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)—are up 15.9% in 2021. Put simply, high-dividend stocks generated more than twice the gain of the overall market.

Meanwhile, growth stocks have become laggards in 2021. The iShares S&P 500 Growth ETF (IVW) is up a measly 1.35% YTD.

The evidence is clear: Dividend stocks are the new leaders.

This kind of situation happens from time to time. Big institutions take profits in one group of stocks and “rotate” into another sector.

In this case, the stocks that benefited from a work-from-home economy are no longer exciting to investors. Most of those stocks are high-growth technology names that pay a little to no dividend.

In short, big institutions are now rotating into value stocks that pay dividends. Sectors like energy, industrials, and materials have all seen double digit gains in 2021.

Energy stocks like Exxon Mobil (XOM) and Chevron (CVX) have seen YTD gains of 29.03% and 42.41%, respectively. Again, this shows that last year’s losers are this year’s winners.

An easy way to benefit from this theme is via the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) that I mentioned earlier. This fund includes dozens of high-dividend names that can add some ballast to your portfolio whenever market volatility increases.

The bottom line is this: the stock market isn’t out of the woods yet. Leadership is thinning out. Signs point to a coming pullback for stocks.

Remember, pullbacks are normal in the stock market. Make sure you have a buy list ready… and be ready to load up.

And if you have trouble stomaching volatility, consider buying SPHD… it’s a great way to stay invested while reducing the volatility of your portfolio.

What will I be doing? I’m not dumping my stocks. I’ll be looking to pick up high-quality, unloved names that are likely to soar later this year. Once the pullback is over and the Big Money starts buying… stocks usually skyrocket.

If you’re curious about which stocks I’m watching, keep an eye out for Curzio Research’s newest newsletter, The Big Money Report.

Editor’s note:

Every month, Unlimited Income members receive Genia Turanova’s favorite dividend idea on the market.

In the latest issue, she over-delivered—giving members two recommendations: a unique ETF designed to benefit from higher inflation… and a high-yielding stock set to soar on higher commodity prices.

Sign up here for immediate access to these names—along with the rest of Genia’s favorite income-bearing stocks to create long-term wealth.