The Federal Reserve is finally signaling that it’s (likely) done hiking interest rates.

At its most recent meeting last week, the Fed left rates unchanged.

While Fed officials left the door open for more rate increases, many market experts don’t foresee that happening. In fact, futures traders are now predicting a rate cut by June 2024.

And that’s great news for gold…

Today, I’ll explain why the end of the Fed’s rate-hiking cycle is just one of many tailwinds for gold… why gold prices are ready to break out from current levels… and two stocks that offer a smarter way to play the yellow metal’s upside.

Why gold is poised to soar

Three weeks ago, I explained why geopolitical tensions would drive investors to safer investments like gold.

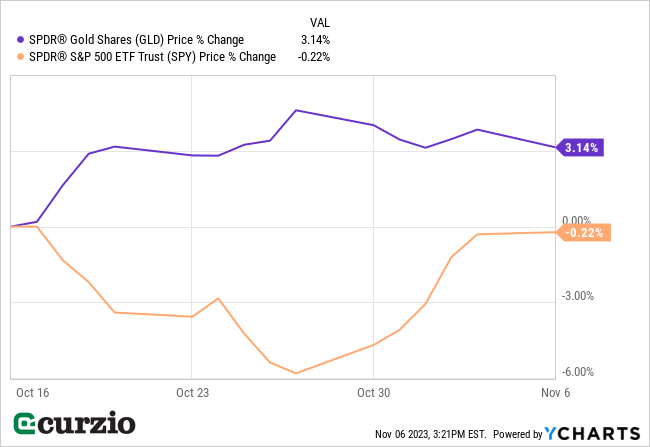

And we can already see the situation playing out. Since mid-October, gold has rallied more than 3%… while the S&P 500 is in negative territory (as you can see below).

And the wars in Ukraine and the Middle East are hardly the only tailwinds for gold right now…

The Fed is also giving us several reasons to like the yellow metal.

First, as I mentioned above, the Fed’s rate hikes are likely over… and we can start looking ahead to possible rate cuts by next summer.

As a non-income-producing asset, gold typically struggles when interest rates are rising (since investors move money to high-yielding assets). Now that rates are set to start falling, gold prices have a major new tailwind.

What’s more, the Fed believes it has raised rates enough to significantly cool the economy. But the full effects haven’t been felt yet, so there’s a good chance we’ll see a major slowdown in the economy over the coming months.

This kind of uncertain environment is great for gold, which acts as a safe haven during times of economic turmoil.

As I wrote three weeks ago:

During the 1970s … the world was struggling with high inflation, economic stagnation, and the effects of another conflict in the Middle East.

From the start of 1970 through the end of 1979, gold prices skyrocketed by more than 1,200%. By comparison, the S&P 500 gained less than 80% during the decade.

More recently, gold was the only major asset class to avoid a double-digit drop during the 2022 bear market.

The bottom line: Gold prices are going higher.

And there’s a simple way to profit…

The smarter way to play gold’s upside

A lot of investors make a big mistake when they try to play a rise in gold prices…

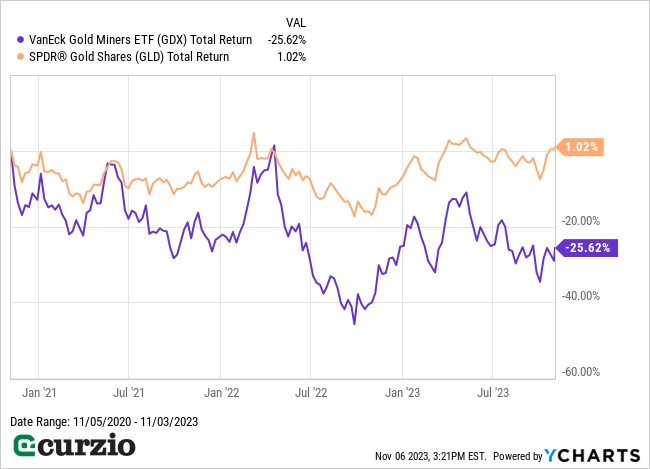

They think the obvious winners will be gold miners. But the truth is these companies have been a terrible investment for years…

As you can see below, gold-mining stocks—represented by the VanEck Gold Miners ETF (GDX)—have lagged the price of gold by about 26% over the past three years.

There are a few reasons for this awful performance…

Producers have been plagued by rising mining costs, from labor to equipment. Meanwhile, much of the world’s best gold deposits have already been mined. The remaining reserves are lower quality… and are more expensive (and less efficient) to extract.

In short, mining is an expensive and unpredictable business. And with fewer high-quality reserves available… the risks involved in developing and operating a mine are as high as ever.

These negatives are a major obstacle to profitability in the gold-mining space.

That’s why I prefer “royalty streaming” companies.

Royalty streamers are like banks—they help mining companies finance their operations. In short, streamers give miners the money needed to build their mines. In exchange, they get a share of future profits—typically a predetermined amount of the mine’s production.

The situation is a win-win for both parties. Miners benefit by offsetting a portion of the mine’s costs (effectively reducing their risk before production starts).

Meanwhile, streamers get a portion of a mine’s future production… which becomes more valuable as gold prices rise. Even better, they don’t have to worry about cost overruns, construction delays, labor disputes, or any of the other headaches involved in mining.

Put simply, streaming companies profit from rising gold prices… while avoiding many of the risks (and expenses) that come with operating a mine.

Plus, they can diversify their investments across dozens of projects, which makes them less vulnerable to problems at any single mine (or country).

It’s also worth noting that this business has significant barriers to entry. Streaming companies must understand each prospective mining partner’s business (including the geology of the mine, the grade of its ore, and its potential lifespan)—and they must have a strong balance sheet to finance promising operations.

Put simply, it’s hard for new players to break into the space… which means less competition for the current industry leaders.

In short, royalty streamers are the smarter way to play the uptrend in gold. Thanks to their business model, they profit directly from higher gold prices… while avoiding many of the risks faced by miners.

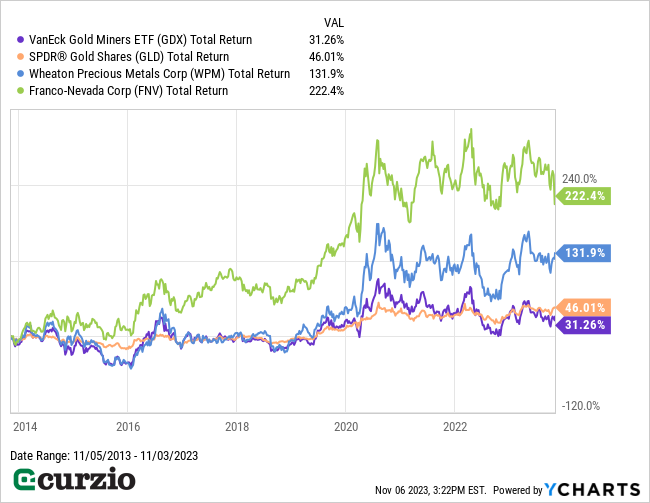

My favorite names in the streaming industry are Wheaton Precious Metals (WPM) and Franco-Nevada (FNV). As you can see below, they tend to outperform miners both in good times and bad, thanks to their combination of lower business risks and exposure to gold’s upside.

The bottom line: With gold poised for a breakout, gold streamers like WPM and FNV are a great way to ride the uptrend.