Gold prices are one of the biggest puzzles of today’s market.

Normally, you’d expect higher inflation to go hand in hand with rising gold prices.

But this year, even as inflation spiked to its highest level since 2008, gold has gone nowhere.

One possible answer: The markets bought into the “transitory inflation” narrative…

But that myth has been largely debunked by economic realities… and the market is finally recognizing that inflation isn’t going anywhere any time soon.

As Frank also highlighted this week… gold—a go-to asset during inflationary times—is set to rally.

Today, I’ll show you why a surge in gold prices is going to happen (soon)… and which investments will get the biggest boost.

To understand gold and its role in modern economies, we need to go back to 1971, when President Nixon announced the U.S. dollar would no longer be backed by gold.

Known as the “Nixon shock,” this event marked the end of the gold standard (the longstanding system in which the value of a currency is based on the value of the gold a country owns).

But the end of the gold standard was nearing anyway…

While a gold-backed monetary system offers significant stability, it also comes with drawbacks. Since every currency owner has a claim on the country’s gold, the gold reserves are vulnerable to redemptions—citizens or, worse, entire governments exchanging fiat currency for gold, thereby reducing the country’s gold reserves.

In other words, a gold-backed currency is prone to something like a “bank run”… where everyone tries to get their assets out at once. Except in this case, everyone wants the country’s gold.

When Nixon spoke to the nation on August 15, 1971, a run was already in progress… England and France had requested to redeem their gold, held in the vault of the New York Federal Reserve Bank. (France—which had always liked gold and was reluctant to accept the dollar as a dominant currency—even sent a battleship to New York to retrieve its gold stores.)

The incident was a sign the system was already broken… and the price of gold was about to get a huge boost.

Under the gold standard, the price of gold was fixed at $35 per ounce—a cheap price, as it turned out.

Thanks to the Nixon shock, the artificial hold on the price of gold was removed… and the price of gold exploded. By the end of the decade, gold had risen to $512 per ounce—making it the best-performing asset of the 1970s.

Of course, the 1970s weren’t the only time in history when gold soared…

After languishing for two decades, gold prices bottomed out near $250 per ounce in 1999.

Since then, it’s up more than sixfold.

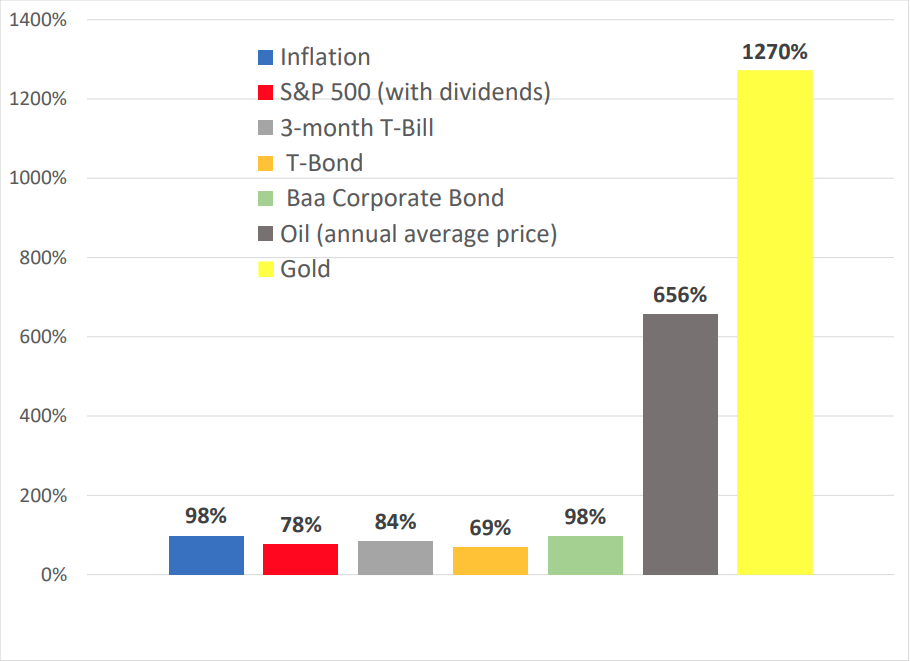

You may be surprised to learn that over the past two decades, gold—an old school, non-dividend-paying, unproductive asset—outperformed the S&P 500… by a large margin.

After setting a new all-time high in August 2020, gold declined—just as it’s done in the past after hitting a major milestone. But the drop has been relatively small (about 13%).

It looks like this correction is now over… and the precious metal is gearing up for another leg up.

I expect this next uptrend to look much more like the 1970s than the 2010s.

That’s because the current environment has a lot in common with the ’70s. Back then, the U.S. government was spending a ton on social programs and the Vietnam War—a major contributing factor to the decade’s high inflation… And that’s in addition to the OPEC oil embargo and a sharply higher crude price.

Historically, high inflation is the most important catalyst for gold prices. And that’s exactly what we’re seeing today—except that COVID (rather than Nixon) has shocked our economy.

Plus, there’s another factor working in gold’s favor: the enormous debt governments around the world have taken on. These governments will benefit from weaker domestic currencies (which give a boost to domestic businesses). This means we’re likely to see a “race to the bottom” as every country’s money declines in value.

Gold is the natural beneficiary of this process… and savvy investors have a few ways to benefit from the coming rally.

No 1: Invest in the metal itself

There are several ways to own physical gold, from coins to bars to jewelry.

But if you want to easily trade the metal… with minimal commissions and without having to insure your treasure… consider a gold exchange-traded fund (ETF).

A popular one is SPDR Gold Shares (GLD).

Backed by physical gold, GLD has a long history of tracking the price of metal… minus the small cost of managing the ETF.

GLD is easy to buy, and easy to own.

But since its moves replicate the action in gold prices, it doesn’t offer any additional upside (called leverage) to the gold rally.

No. 2: Own large-cap gold stocks

To get more upside when gold rallies—i.e., to see your investment move up even more than the price of gold—you want to own shares of gold miners… either directly or through an ETF like the VanEck Gold Miners Equity ETF (GDX).

The leading gold miners in this ETF—from Newmont Mining (NEM) to Barrick Gold (GOLD)—are historically cheap… and their profits are set to skyrocket as the price of gold rises.

Better yet, they’ve been reducing their debt and even paying dividends… Barrick has a 1.8% dividend yield right now, while Newmont’s dividends yield around 3.8%.

No. 3: Buy a collection of junior miners

For maximum leverage, you can buy into the junior miners group.

These smaller companies are in early stages of a mine development, from exploration to building out the mine. Some juniors won’t see any gold output for a while yet (if ever)… while others are close to striking it big.

It’s the latter part of the group that makes the juniors so attractive… but it’s the former that makes them risky.

Also, many of these smaller players only own a single mine… another factor that makes them riskier than multi-mine operators like Newmont.

As we know, ETFs are a great way to diversify… which reduces the risk of owning a single miner… while keeping you fully exposed to higher gold prices and rising profits across the mining industry.

The easiest way to invest in junior miners is to buy the VanEck Junior Gold Miners ETF (GDXJ), which owns exactly 100 small mining stocks.

But remember: You can’t diversify away the risks of the entire junior mining group… and if the price of gold declines, so will GDXJ (leverage works both ways).

But junior miners still give you the most upside potential… With their singular focus on precious metals, junior miner margins (and profits) get the maximum boost when gold rallies. (In the chart below, you can see how GDXJ has performed vs. the price of gold and its large-cap peers.)

No. 4: Invest in gold royalty businesses

One good choice here is Wheaton Precious Metals (WPM).

Streaming companies like WPM don’t operate any mines. Instead, they provide financing to mining companies in exchange for a share of the future profits from various mines.

In business since 2004, Canada-based WPM has the benefit of experience and industry knowledge. Today, it has interest in 24 working mines and 8 development projects. Its partners—including large miners like Vale (VALE) to gold majors like Barrick—pre-sell some of a specific mine’s output (often its byproduct, gold or silver) at a discount before it’s even produced. The upfront payment is negotiated for each mine. And typically, it will help offset the mine’s production costs.

This business model makes WPM less risky than either GDX or GDXJ… and a better asset to own when gold is steady or weak. And WPM does great when gold prices rise. As you can see from the chart below, WPM surged last year as gold rallied during the early months of the pandemic… and it outperformed gold and gold-miner ETFs over the past decade.

To recap, you can invest directly in the metal through GLD; in gold large caps with GDX; in junior miners with GDXJ; and in royalty streaming with WPM.

Of course, the list of ways to profit from the upcoming gold rally doesn’t end here… but these four assets are a great place to get started.

Editor’s note:

Last week, Genia told Moneyflow Trader members her favorite way to double your money on gold’s bull run. It’s the kind of super-smart trade Wall Street professionals make… and it’s surprisingly simple.

When you become a Moneyflow Trader member, you’ll not only have immediate access to this trade… but a portfolio full of the best ways to capitalize on this market—and any market.