Last week, market volatility erupted over the possibility that easy money will end sooner than expected…

On November 30, Fed Chair Jerome Powell warned the Fed would start tapering its bond purchases, sending the market down 1.9%.

But so far, the proverbial printing press is still running at a near-full capacity.

Loose money is typically good for stocks—it helped the markets set new records in 2021.

Major indices, led by the tech-heavy Nasdaq, are all up big for the year… The Dow, up “just” 19% with dividends, is the worst performer of the bunch.

The market has recovered from most of last week’s losses, but a surprise or two might be in the cards at next week’s Fed meeting… especially considering persistent inflation and a strong jobs market. The Fed has a dual mandate: incentivize jobs and fight inflation… And low unemployment alone might prompt it to accelerate the taper.

Even if the Fed does proceed with unwinding its bond purchases earlier than the market expected… and even if it moves to hike its benchmark interest rate a couple of times in 2022… the case for dividend stocks will remain as strong as ever.

That’s because, while bond rates might move up a notch or two, dividend stocks will continue to out-yield bonds… and remain your best bet for sustainable income.

Better yet, there are companies that can grow dividends at a pace that exceeds the rate of inflation… and can create a stream of income that grows faster than it loses its purchasing power.

Plus, the best of the dividend-paying stocks are financially strong… and a good bet in a more volatile market.

Today, I’ll tell you how to access 65 of these companies… with just one trade.

But first, let’s talk about dividends… why they exist… and why strong companies raise them over time.

Dividends are how a company shares profits with its shareholders—the ultimate owners of the business.

But a company doesn’t pay dividends out of the goodness of its corporate heart…

A decent-sized dividend can differentiate it from its peers, and help it attract and retain investors.

This, in turn, helps the company’s share price… which can be very rewarding to C-suite executives.

Better yet, dividends—which are typically paid out of company profits—help the business spend the cash on its balance sheet. Too much cash makes it an easy takeover target… which threatens jobs—especially executive jobs.

In other words, dividend investors have powerful allies in upper management.

But this dynamic can sometimes lead to unsustainable dividends…

When a company wants to avoid signaling financial weakness, it might even borrow to pay a dividend. (In future articles, I’ll talk about some easy ways to spot—and avoid—these situations.)

High-quality dividend stocks—those that can easily pay and grow dividends out of the profits their businesses generate—will remain extremely valuable as long as the yields offered on alternative investments (like bonds or savings accounts) remain low.

Such companies will boost their dividends over time…. and shares will likely appreciate as a result.

By contrast, interest income on a bond will never increase (regardless of inflation). Plus, the only real way to make profit on a bond you currently hold is when interest rates decline (and you sell before maturity at a higher price).

But, based on the latest announcement from the Fed, the market doesn’t expect interest rates to decline.

And dividends will remain a must-have for many investors.

An easy way to own a dividend-growing stock is by buying “dividend aristocrats”—a group of S&P 500 members that have raised their payouts for 25 consecutive years.

These may not be the fastest-growing companies in the index, but they tend to be steady… financially strong… and ultimately rewarding.

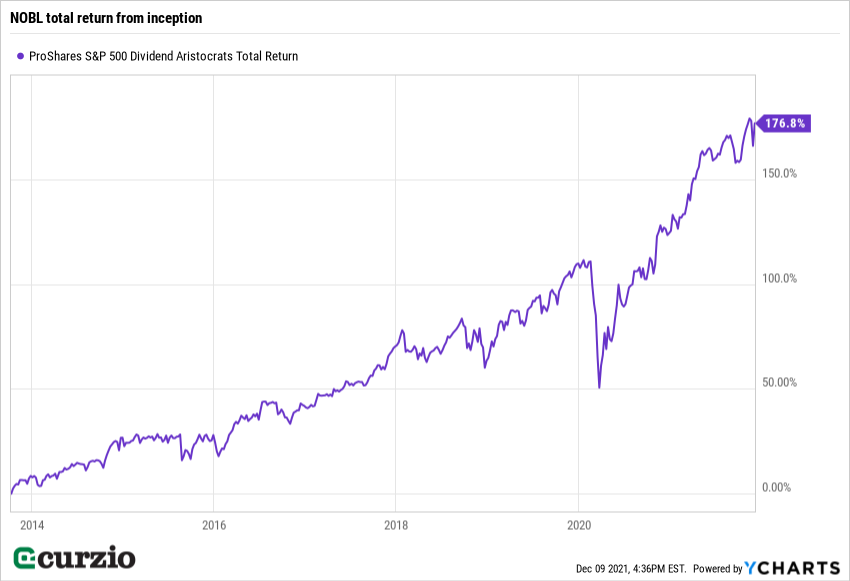

A simple way to own the entire group is the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

The fund’s average forward price-to-earnings ratio (P/E) of just 17.7x (vs. the market’s 21.4x) puts it in value territory… and so does its 1.8% yield (vs. the market’s 1.3%).

With this unique ETF, you can own all of the dividend aristocrats—as many as 65 at the last count… each with a long history of dividend increases… with just one trade. The list ranges from energy majors Chevron (CVX) and Exxon (XOM)… to consumer giants Procter & Gamble (PG) and Clorox (CLX)… to this year’s additions: IBM (IBM), NextEra Energy (NEE), and West Pharmaceutical Services (WST).

Alternatively, you can use the most up-to-date composition of NOBL as a source of income ideas.

Quality dividend-growth stocks will pay you higher income year after year… and help you outrun inflation.

P.S. My Unlimited Income portfolio proves you don’t have to sacrifice growth for income.

Earlier this week, members had a chance to invest in two more of my favorite ways to fight inflation… and book 76% gains on another dividend growth stock in under a year.

If you’re worried about income as inflation ramps up… Unlimited Income will help you build a steady stream of strong, growing dividends.