The 2020 COVID-19 crash came like a thief in the night.

And when prices start to cascade lower, big-time investors quickly face hard decisions…

Many professional investors use leverage, which involves borrowing capital or taking on debt to increase a potential investment return… And when you face small losses on leverage, they can become very big, very fast.

When the choice is made to liquidate these heavily leveraged positions, it can lead to a crash. The recent COVID-19 crash was due in part to this forced selling… but the selling was a green light for investors—the perfect time to go fishing for bargains in the market.

You want to leap in when it feels uncomfortable, and you want to cast a wide net… because bottoms don’t last long.

Looking back to March, we can see that now. After the epic crash, markets rallied in a big way… Just like when a rubber band stretches too far, an oversold market invariably snaps back.

The recent market snapback has been so strong, in fact, that we’re now nearly overbought…

A red light for investors… for now

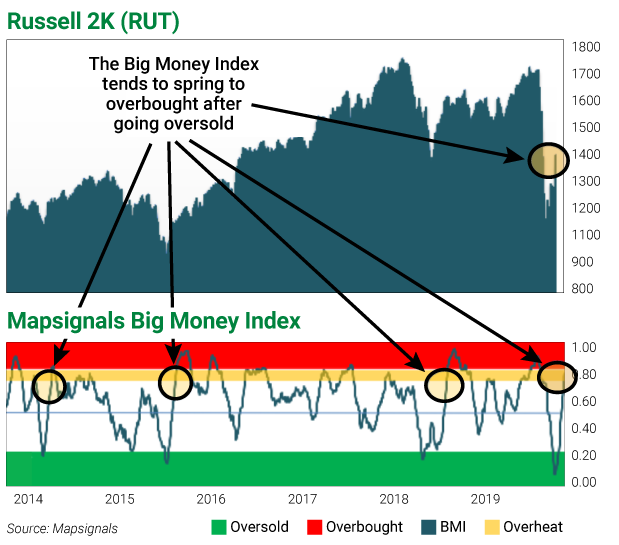

On the chart below, you can see the Mapsignals Big Money Index (BMI) benchmarked vs. the Russell 2000. (The BMI measures supply and demand on 1,400 stocks, and there’s a high correlation between it and the 2,000 stocks tracked on the Russell 2000.)

The BMI is like a traffic light for investing…

When money is flowing out of stocks and the market is oversold, the BMI falls into the green… a GO signal for investors to start shopping for bargains.

And when the BMI is rallying to the red, like now… the market is overbought and sellers are nowhere to be found. It’s our signal to STOP buying and wait for better deals.

Instead of scratching their heads trying to understand the “why” and the “how” of this rally, followers of the BMI know that the recent price action is typical after an oversold period. (On the chart, you can see these huge relief rallies after things got oversold.)

It’s not feeling or emotion… It’s based on years of data.

Like I said before, markets ebb and flow, constantly readjusting to new information… but things still get extended on the upside or downside.

Right now, the market is stretched to overbought—a red light for investors. It means the level of buying today is nearly unsustainable.

But this doesn’t mean another crash is coming… just that we should expect a modest pullback, based on history and the BMI.

And that’s good news, because it also means we’ll likely see cheaper prices on great stocks when things become oversold again—our green light to start buying.

The market has rallied 18% since I told you about this index in March, and the BMI is now approaching red…

Instead of buying more stocks and hoping the market chugs higher, hold off… Wait for our green light when the market readjusts and settles into its right level.

As I’ve said before, emotions are the enemy, and headlines can cause us to make mistakes.

Data and the BMI make things clear. When things are this overbought, it’s probably time to slow down and pump the brakes… But just like waiting in traffic, red lights don’t last forever.

Editor’s note: Last week, more than 2,000 online viewers turned out for our first-ever livestream event, “Navigating the New World Order: A Curzio Research Townhall.”

Frank shared what the experts are missing about the COVID-19 market… answered questions live… and walked viewers through a simple strategy designed for volatile markets like these.

In March alone, this strategy returned triple-digit gains five times… we’re talking 100%, 300%, even 500%!

You can watch a FREE replay of this incredible event… but only for a limited time.